Insight Focus

- China’s sugar arrivals in first half 2023 are low.

- Chinese refiners have begun to buy amid the No.11 correction.

- China may not have to fully use its AIL allocation in 2023.

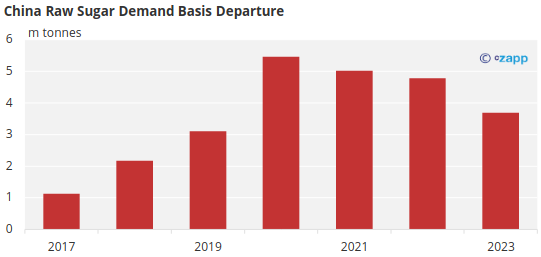

China is one of the largest sugar buyers in the world, importing 6m tonnes to fill its production shortfall.

It’s no news that China delayed its raws demand in 2023 due to skyrocketing sugar prices. With a sharp and rapid No.11 price correction, have they begun to fill their pockets with sugar?

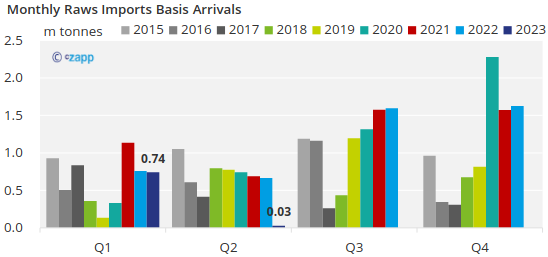

Zero Raws Imports in May

In May, China customs reported zero tonnes of raw sugar were imported, same as March’23. This confirms that in 2023 China made almost no new purchases.

The Q1 imports were purchased and shipped in 2022.

Source: Czapp, China Customs

Q3 arrivals are also expected to fall far short of the levels seen in the past four years.

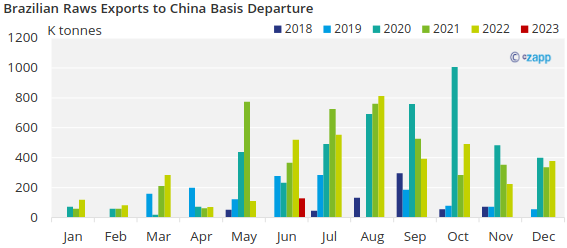

After five months of waiting, we finally saw two vessels bound for China in June. The arrival in China may be in September with 45 days of shipping and customs clearance.

Has China Acted Amid No.11 Correction?

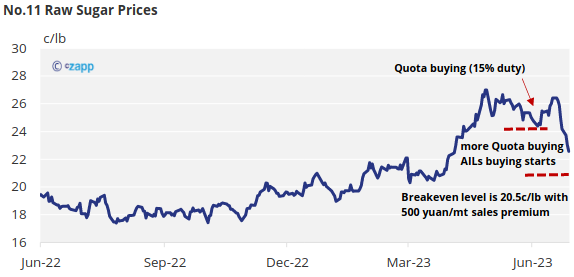

As Chinese raws demand is so low, some quota buyers rushed to make purchases when No.11 retracted near 24c in early June. Quota sugar pays 15% import duty.

But that is just quota demand. After that it was quiet again until the rapid decline, attracting some Chinese quota and out of quota (AIL) demand again. Out of quota sugar pays 50% import duty.

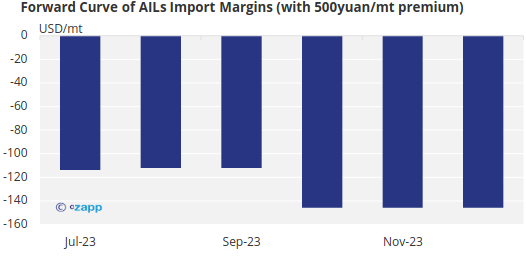

Today’s AIL breakeven level is 19.60c, or 20.50c/lb taking a 500 yuan/mt sales premium into consideration. Unless the market gets this low, we are unlikely to see a full release of 3.3 million tonnes of AILs demand.

The silver lining is that import margins are starting to improve, as compared to a low of -$234 / tonne in mid-May, import margins today have improved to -$114 / tonne.

As mentioned above, imports may not be high until end of Q3. Therefore, the domestic supply is tight, which is conducive to the improvement of import margins, thus stimulating new supply.

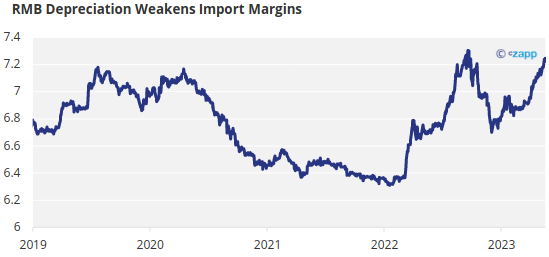

It would have been better had it not been for the yuan devaluation. Yuan has depreciated by as much as 8% this year. That makes imports more expensive.

Source: Czapp

2023 AILs Allowed to Be Idle?

Another reason Chinese sugar refiners can be more patient may be because they don’t have to fully use AILs this year.

Refiners have made several requests to the Ministry of Commerce, and the following picture may be a fair point. For nearly two years, import margins have struggled in the negative zone.

Finally, for China’s raw sugar demand in 2023, we can see a significant decline from 5.5m tonnes in 2020 to 3.7m tonnes. However, there are still variables.

- Will there be additional imports for the rotation of sugar reserves?

- Could import margins improved enough to enable more AIL demand?