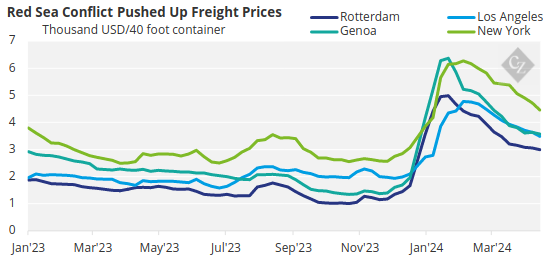

Iran’s missile attack on Israel has intensified the already precarious situation in the region. This adds complexity to an already unstable freight environment. But cargoes are transiting the region with no obvious increase in rates.

Iran’s Israel Attack Engulfs Commercial Container

On April 13, 2024, the Islamic Revolutionary Guards Corps (IRGC), along with the Islamic Resistance in Iraq, Hezbollah in Lebanon, and the Yemeni Houthis, coordinated attacks on Israel using drones, cruise missiles and ballistic missiles.

Iran justified the attack as retaliation for Israel’s bombing of the Iranian embassy in Damascus on April 1, resulting in the deaths of two Iranian generals. The strike was interpreted as an extension of the Israel-Hamas conflict and marked Iran’s first direct attack on Israel since the onset of their proxy conflict.

Hours before Iran launched the attack on Israel, Iranian forces boarded the 15,000 TEU container vessel MSC Aries and forced the ship and its 25 crew members into Iranian waters. MSC Aries is owned by Gortal Shipping Inc, affiliated with Zodiac Maritime Shipping Company, and operated by the Italian/Swiss shipping company MSC.

Iranian Foreign Ministry spokesman Nasser Kanaani stated that the ship had been arrested after violating “international shipping regulations and failing to respond appropriately to Iranian authorities.”

Container Industry Shakes Off Impact

Commenting on the capture of MSC Aries, Xeneta’s chief analyst Peter Sand said, “An already bad situation in the Red Sea and Gulf of Aden has just worsened and could put ocean freight container imports and oil exports in the Middle East at risk.”

He added, “Any widening of the conflict, which has already resulted in huge disruption to ocean freight services in the Red Sea region, would be extremely concerning.” Dubai is a regional hub for imports as well as sea-air corridors. Containers arrive in Dubai by ocean via the Strait of Hormuz for onward travel by air to Europe and North America. “If ships are impacted from sailing into the Arabian Gulf, then the disruption would be considerable,” Sand continued.

The shipping sector has already faced serious challenges, especially in the Middle East, and several industry experts are concerned about the impact of the latest escalation on supply chain and trade flows in the region. However, there has not been any severe effect observed for now. Cargo ships are continuing to sail through the region as before, with no significant increase in rates.

Note: chart shows Shanghai routes

Source: Drewry Container Index

“Whenever there is uncertainty in the market, there is the potential for ocean freight shipping rates to increase – as we have seen most recently following the escalation of conflict in the Red Sea. However, oil prices have not spiked as some feared they may, and ships are seemingly sailing through the Strait of Hormuz without issues, so any direct impact on rates may be limited,” noted Sand.

Despite the conflict, the container logistics market may even be poised for stabilization. “We do not see market volatility causing the container prices to spike significantly yet,” said Container xChange in its latest analysis. “This is also because of the high overcapacity overhang that still exists in the market and acts as a shock absorber for the container market.”

Escalation is Cause for Concern

Despite operations seemingly continuing “normally” in the region, the capture of MSC Aries has alarmed shipping stakeholders.

Guy Platten, secretary-general of the International Chamber of Shipping (ICS), suggested that ships trading in the Gulf region should liaise closely with the military to ensure they are fully protected from Iranian forces.

“Iran’s seizure of MSC Aries is a flagrant breach of international law and an assault on freedom of navigation,” he said. “This reprehensible attack against a merchant ship once again places innocent seafarers on the front lines of geopolitical conflict.” Platten called for the immediate release of the ship and its crew.

Stormy Weather Worsens Middle East Supply Chain Flow

Days of unusually harsh weather across the Persian Gulf region have also heightened concerns among ocean and air freight stakeholders, further complicating supply chains already strained by escalating geopolitical tensions.

Information from cargo agents and shipping industry insiders in Dubai reveals notable delays and backlogs in cargo processing. However, estimates suggest that typical operations are expected to resume by the end of the week.

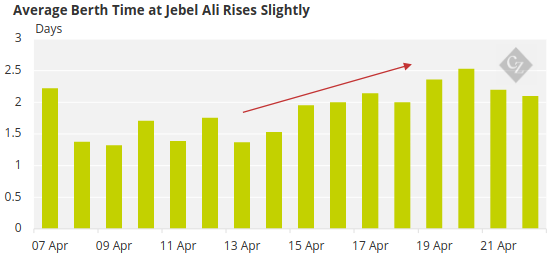

Notably, major ports such as Jebel Ali, a key global container hub, have faced delays in berthing operations due to the adverse weather conditions.

Source: Dubai Trade

Despite reports of main port terminals operating at “near-normal” levels, disruptions persist in road freight movements across various regions, necessitating efforts by authorities to clear affected road networks.

A senior executive at a leading European container shipping company acknowledged that while most port operations are functional, cargo delays persist due to the ongoing flooding.

Looking Ahead: Navigating Uncertainty

As the region – and the whole world – braces for potential escalations, stakeholders in the shipping industry must remain vigilant and adaptable. Close collaboration between maritime and shipping authorities and military forces is crucial to ensuring the safety and security of vessels navigating through volatile waters.

Additionally, contingency planning and risk mitigation strategies are imperative for safeguarding supply chains against unforeseen disruptions.

In this volatile landscape, maintaining open channels of communication, fostering collaboration and prioritizing the safety of seafarers and cargo are paramount. While the full extent of the impact of recent events remains to be seen, proactive measures and resilience will be key in navigating the uncertainties that lie ahead.