Insight Focus

At the beginning of the year, we identified the four key food supply issues to watch in 2024. Now, almost six months later, let’s take a look at which trends have eased off and which have become more pronounced.

1. Food Affordability

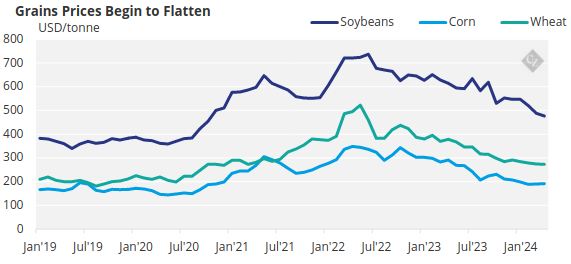

Food affordability has remained a key talking point through 2024, although price rises seem to be levelling out across food staples.

Source: World Bank

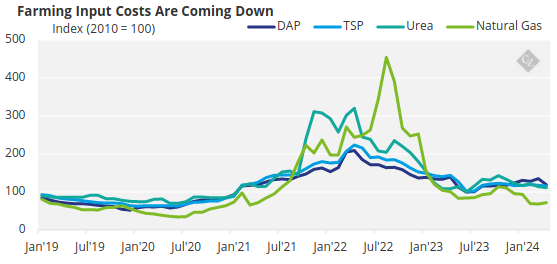

One of the primary reasons for the rise in food prices was the increase in the cost of inputs for food producers. Fertiliser prices for instance rose considerably from 2020, as did the price of natural gas, which is important for food production.

Source: World Bank

But as of April 2024, the cost of these inputs has dropped close to 2010 levels. The cost of natural gas has gone from its peak in August 2022 to slightly above pre-Covid levels as industrial demand wanes.

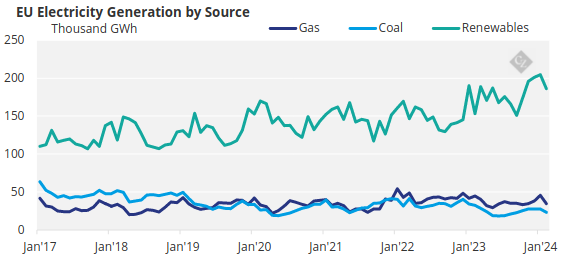

This is due to a number of factors, including an increase in the penetration of renewable energy into energy systems. This is how European energy generation looks, according to Eurostat data.

Source: Eurostat

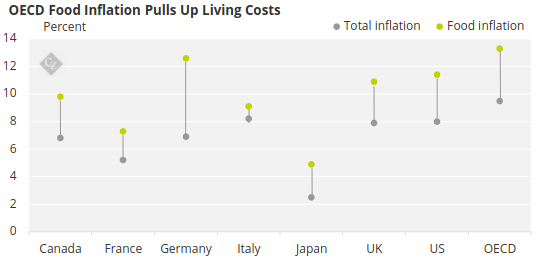

All of this means that input costs for farmers in certain regions is now decreasing. However, this is not strictly true across the board. Inflation varies greatly across different countries, and in almost all locations, food inflation is still putting upward pressure on prices.

Source: OECD

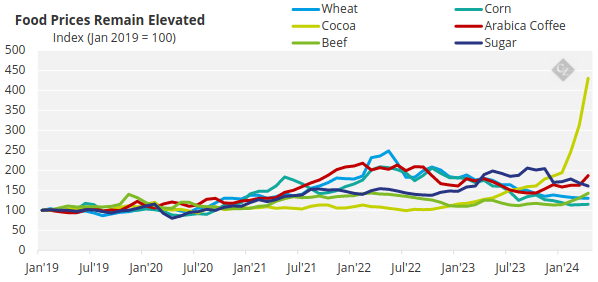

While this may no longer be due to higher input costs, other factors are creating circumstances that mean food costs more. There are also other issues to consider across different food commodities. The price of cocoa, for instance, has shot up this year due to structural issues in the supply chain.

Source: World Bank

2. Weather

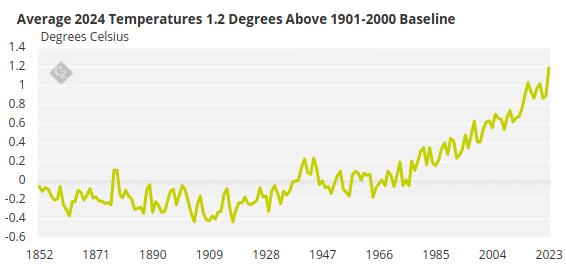

Weather has become perhaps the most influential theme of 2024. El Nino has created extreme weather events in several parts of the world that has disrupted food production, sending costs up.

But as global temperatures rise, these weather events are no longer just a symptom of El Nino and should instead be expected year-round. This is a phenomenon known as “heatflation”.

Source: Met Office

Agriculture is perhaps the most vulnerable economic sector to extreme weather events due to its reliance on natural resources. There have been reports of many extreme weather events that have impacted food production in the first half of 2024.

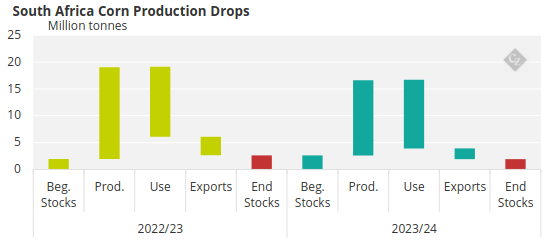

One such impact has been a drop in corn production in southern Africa. Below, South Africa’s corn production profile can be seen for this year and last. While production is down by about 3 million tonnes due to poor weather, demand has remained stable.

Source: USDA

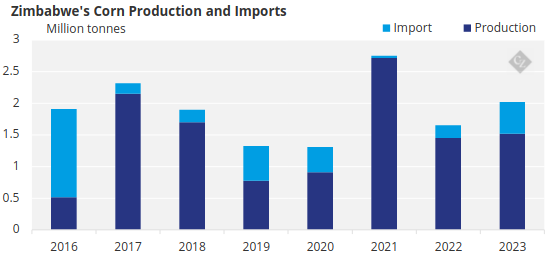

Other countries in the region such as Zimbabwe, Zambia and Malawi have also been impacted by droughts, which has caused their governments to declare a state of emergency.

The situation is so dire that the government of Zimbabwe has now ruled out exports to neighbouring countries this year, which will impact countries that are already food insecure, such as Rwanda and DRC.

Source: FAOSTAT

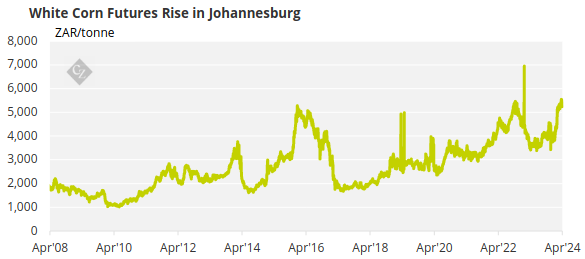

So, even though global average food prices seem to be stabilising, weather in each producing country can change the situation drastically. White corn futures are now becoming more costly on the Johannesburg Stock Exchange despite global corn prices having dropped in recent months.

Source: Johannesburg Stock Exchange

3. Logistics Issues

Another issue keeping food prices high is the logistics issues being faced by the maritime transport industry. Research shows that the vast majority of the world’s food is traded across the water. Only about 41% of food is transported through other methods.

Of course, this means when there is any disruption in shipping, it will have a knock-on effect on food availability and prices.

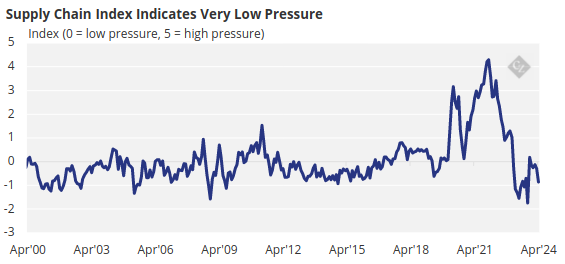

Right now, pressure on the supply chain is extremely low. Compared with the height of the pandemic disruptions, there is very little pressure on the supply chain.

Source: GSCPI

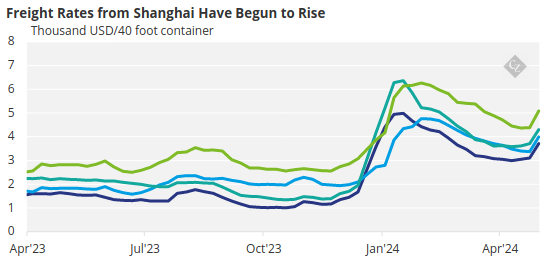

However, container freight rates are starting to rise again, indicating that there may be more demand than supply available.

Source: Drewry Container Index

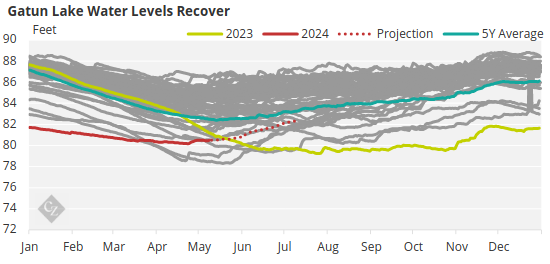

This is more than likely due to an escalation of global conflicts and re-routing caused by low water levels around the Panama Canal. Since mid-2023, water levels at Gatun Lake – the main body of water that feeds the canal – have been at record low levels.

Source: Panama Canal Authority

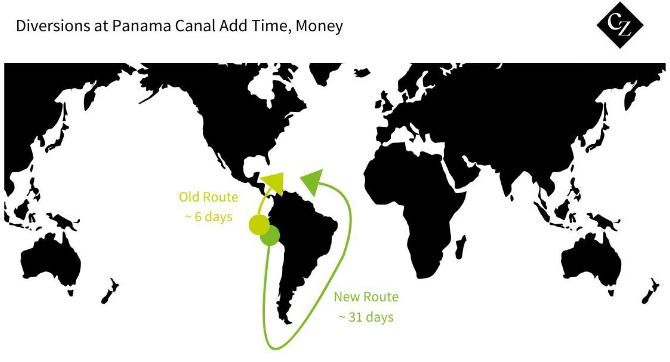

Although water levels are now starting to recover, they remain on the lower side of the historical average. This has caused the Panama Canal Authority to restrict access to the canal, in some instances forcing shipping firms to find alternative options.

For some, this includes re-routing vessels around the southern tip of Argentina and Chile. Others have resorted to a land bridge between Balboa on the Pacific side and Manzanillo on the Atlantic. Of course, both options require additional time and money, which directly impacts on freight prices in the form of surcharges.

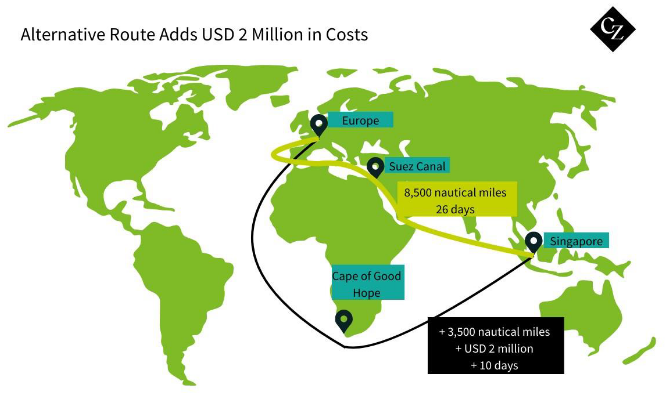

Not only are these diversions happening in the Panama Canal, but there are also conflicts around other key crossings and trade locations such as the Black Sea and Suez Canal.

4. Protectionism

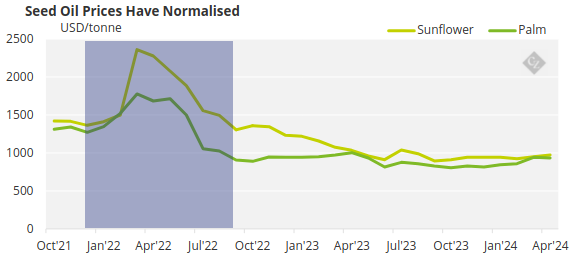

In the first half of 2024, protectionism seems to have declined from peak levels seen over the past few years. In the case of seed oils, 2023 saw a substantial price rise due to protectionism. In the chart below, the shaded area represents a period of protectionism.

Source: World Bank, Food Security Portal

For instance, Kazakhstan – whose sunflower seed exports account for about 11% of global calories from the product – imposed a ban on exports between December 2021 and October 2022. Likewise, Indonesia – responsible for over half of global palm oil exports – imposed a ban between January and May 2022.

Although prices have now normalised, this shows how susceptible these concentrated industries are to price shocks. This is particularly concerning when it comes to staple foods, such as wheat and rice.

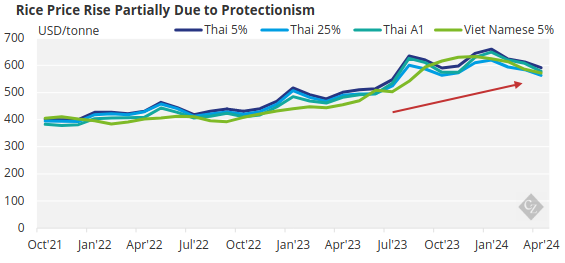

India still has export restrictions on broken rice and non-basmati rice, and these will be in force until at least the end of 2024. Given that India is responsible for about 26% of global rice exports in calorie terms, this ban, combined with weather issues, is continuing to push up rice prices.

Source: World Bank

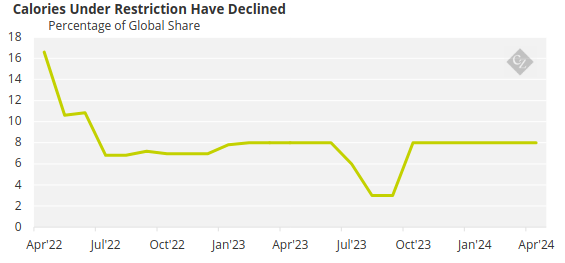

Although the calories under restriction have declined in recent years, it will be worth keeping an eye on industries with very concentrated production, such as cocoa — about 60% of which is produced in Ghana and Ivory Coast.

Source: Food Security Portal

What to Expect

- Through 2024 so far, the most impactful issue for the food supply chain has been weather.

- This has had a knock-on effect in other areas, such as logistics and food inflation.

- While food inflation has eased in many countries, it remains stubbornly present, and food prices continue to rise.

- There has been less impact on food markets from protectionism this year, but there is still a danger that comes from highly concentrated industries.