Insight Focus

- Crazy volatility in markets can be a headache for buyers.

- Making the right decisions for an individual business is key to maintaining margin.

- Here are some ways buyers could use logic and data to predict market direction.

A question often posed by buyers from throughout the food supply chain is: ‘How much should I buy and when?’ Unfortunately, there is no right or wrong answer to the question. Every enterprise has its own needs, with its own margin parameters and complications.

Although sometimes a complex issue, there are nonetheless a few simple considerations to help buyers through the volatile and often treacherous world of wheat markets.

Market Moves and Price Drivers

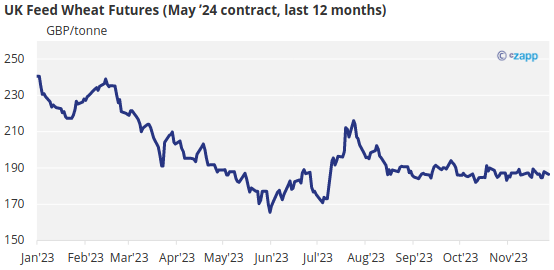

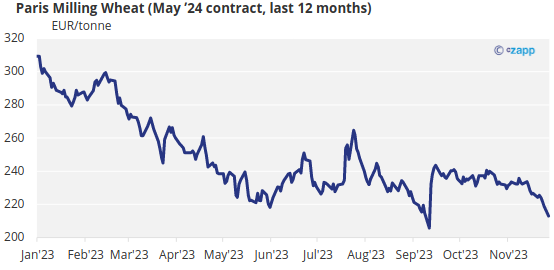

Understanding markets and what drives them is a useful place to start as a wheat buyer. The below charts show prices of London feed wheat and Paris Matif milling wheat over the last year.

Data source: Barchart

Data source: Barchart

The charts above show the downward “bear” trend over the last year, as wheat has moved on from the extraordinary highs of 2022. Prices are driven by the economics of supply and demand.

2022 was a year of extreme volatility with worries over global wheat supply. It’s no great surprise that supply was the concern, given that Russia, the largest exporting country in the world, invaded Ukraine, the fourth largest exporting country globally.

Up until now, 2023 has seen the continued decline of prices due to more stable supply. The mid-year price rally was driven by supply anxiety with a focus on the Black Sea Grain Corridor. Notably, Russia withdrew from the agreement on July 17.

As is often the case, the rally was exaggerated. The world did not see major disruption to wheat supply, nerves calmed and a return to the downward trend resumed.

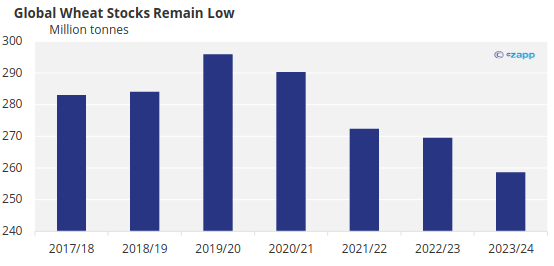

Although low, global stocks of 258.7 million tonnes according to the USDA, appear sufficient to have kept the bears in the driving seat thus far.

Source: USDA

Buying Strategy

Hindsight

Using the last 12 months, with the benefit of hindsight, the lessons appear reasonably straightforward. A falling market, where wheat growers are making good returns, should allow for buyers to remain relaxed and act as spot buyers as needed.

The rally in the middle of the year may have been difficult, but it was temporary, so a spot buyer should not have suffered too badly overall. It is clear to see, when faced with a bearish trend, that spot buying is a good option.

The Present

Considering the market picture today, there is an air of stability. Supply currently appears adequate for a world struggling with cost-of-living pressures. Prices have been falling and buyers seem willing to wait – a strategy that has proven wise over recent months.

After all, ‘if it is not broken, do not try to fix it’. Does that mean carry on buying spot and simply price when needed?

Is it ‘broken’?

World ending stocks are some of the lowest over the last eight to 10 years, with demand looking to outstrip all recent harvests. This demand, based upon a financially struggling world, could increase if there is more money to spend in 12 months’ time.

Perhaps we should ask how the wheat growing farmer feels. Prices for wheat are low with high costs of production. The current weather has potential to diminish the 2024 harvest. Wheat growers are reluctant sellers at these prices, which are unlikely to generate them big profits in 2024.

Concluding Thoughts

Looking back at recent years, demand is outstripping supply in the longer-term. But weather is not a stabilising influence on prices. The market can always go lower, but markets do not go down forever. And wheat growers may argue that they need higher prices.

A buyer assessing the overall picture of wheat today and looking forward for the next 12 months may be wise to consider buying forward as any price rise begins. If it locks in a margin, it is surely not the wrong thing to do!

The downward price risk is likely to be limited but the upward price risk has potential to move significantly larger amounts and for a longer period of time. We can consider February 2022 as an extreme case in point. We do not know what tomorrow’s news will be.

Beware of trying to buy at the bottom of the market. After all, tops and bottoms are for fools.