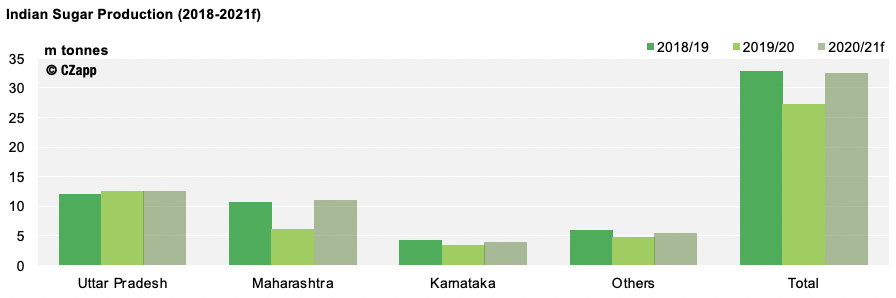

The cane molasses market has turned full circle on India in the last 12 months, from one of the largest exporters of cane molasses, to a ban on exports from the key state of Maharashtra, and then back to being a pivotal supplier to the world market.

The unexpected ban on cane molasses exports from Maharashtra in December 2019 effectively removed over 300k tonnes of cane supply from the international market (8% – 9% of the total global export supply). The impact was seen on CIF prices in Asia and Europe with prices rising in the early part of 2020 reacting to the tighter supply situation.

The impact was multiplied by the reduction in cane molasses exports from Thailand and Australia due to the poor sugar crops in both countries.

The effect of the tight supply would have had a larger inflationary effect on cane molasses prices if it wasn’t for the impact of COVID-19. The disruption to the global economy, crude oil prices, consumer demand and commodity prices was unprecedented. In terms of the molasses market, the main impact was the reduction in ethanol demand and therefore demand for cane molasses.

The reduction in ethanol demand is extremely important to the molasses market as cane molasses is an important feedstock for ethanol production from Brazil, to Thailand and the Philippines. With the fall in crude oil prices, the WTI briefly went into negative territory and combined with the impact of COVID-19 lockdowns, demand for cane molasses in Asia fell due to lower ethanol demand.

We have now turned full circle. The Maharashtra molasses export ban has expired early and we are forecasting larger sugar crops from India and Pakistan. We now think India will have at least 700k tonnes of cane molasses available for the export market.

Thailand – Still Dry with a Small Crop Forecast

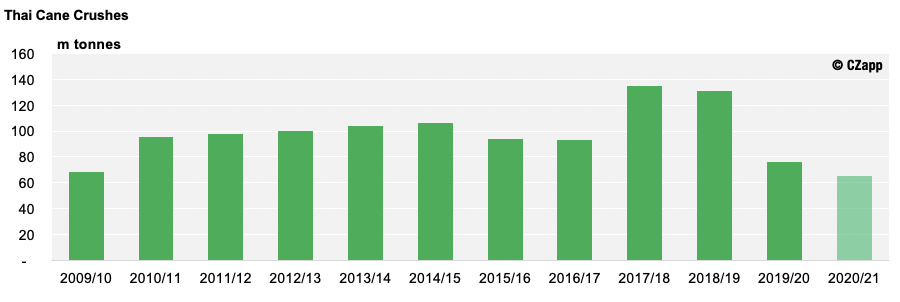

The main area of disappointment in terms of the molasses market is Thailand. Last year, the sugar crop was very poor and struggled to get above 80m tonnes of cane crushed. We had hoped to see a rebound back towards 100m tonnes in 2020/21 (although still short of the record 130 million tonnes a few years ago). However, it appears that is not going to happen and the Thai crop will be below even last years level.

This will result in Thailand likely being a net-importer of cane molasses in 2021. This trend has already begun with Thailand expected to import at least 200k tonnes in the second half of 2020. In many ways, this has balanced out a lot of the fall in demand in Asia from the ethanol and the fermentation sector. Thailand has replaced some of the more traditional import markets. The market for molasses imports into the Philippines should be very quiet for the rest of the year.

India vs. Thailand – Can India Make Up For the Shortfall in Thailand?

We think India will export more molasses in 2021 and industrial demand (mainly ethanol demand) is lower, which should all be indicating that molasses prices are likely to fall. On the other side of the equation, we have a very poor Thai sugar crop forecast, which will result in Thailand becoming a net-importer of molasses. This is compared to three years ago when Thailand exported 600k tonnes of cane molasses. It marks a net-change of at least 900k tonnes of molasses, which is significant in a global cane molasses export market of around 3m tonnes.

What does this mean for the market? Firstly, it shows that caution must be taken in immediately concluding that the increase in Indian sugar production and cane molasses exports will result in lower molasses prices. We are still in a tight supply situation with the Northern Hemisphere cane crush not beginning until November/December and there is continuing demand for imports of cane molasses into Thailand.

Subdued Demand for Molasses in the Industrial Sector

As noted above, demand from the industrial sector suffered during the first half of 2020, in particular, demand from the ethanol industry. We have witnessed countries begin the process of reopening their economies, although the pace and direction is very uneven as any sign of an increase in the rate of COVID-19 infections can result in further lockdown restrictions. Generally, this should start to support industrial ethanol demand for cane molasses as we move towards reopening.

One area of increased demand has been for ethanol production for antibacterial products, which are now a key part of attempting to control the spread of COVID-19. This is unlikely to be sufficient to offset the falls in the much larger fuel ethanol markets; however, it is an area of growth that is worth noting.

The raw sugar price is still competitive in our fermentation markets with the price struggling around the 12 USc/lb (~$260 per metric tonne) level. On a per sugar basis, raw sugar remains competitive (99.9% sugar vs. ~50% sugar in molasses). Demand may remain subdued in those markets that can access and utilise cheaper raw sugar.

Beet Molasses – Average EU Sugar Crop Supporting Prices

The EU sugar beet crop looks quite close to the five-year average in terms of yield, with the current forecast at 73.5 t/ha compared to the five-year average of 74.5 t/ha.

Beet molasses is still competitive versus cane molasses in Europe and has traded at discount to cane since 2018. This has kept demand across Europe at a good level and the differential between the products will continue at least until the end of 2020.

The demand for beet molasses has not been immune to the impacts of COVID-19; however, the animal feed markets have been fairly resilient, with supply chains quickly adjusting away from restaurants and catering and towards increased supermarket and retail demand.

The demand for beet molasses for ethanol production in Europe has not been as negatively impacted as could have been expected. Europe has a much broader feedstock base for ethanol production compared to somewhere like Brazil, which is nearly all based on sugarcane. Demand has increased for the production of antibacterial agents, which will offset some of the decline in fuel ethanol demand.

The Russian sugar beet crop will be lower than last year, with less than 1 million hectares planted. The price in Russia has been more volatile recently and the smaller crop should see this trend continuing, with the likelihood that we will see higher prices in Q4 2020 and potentially disappointing volumes available in the first half of 2021.

Egyptian beet molasses prices have continued to trade at levels above the other key exporting markets, driven by a combination of increased domestic demand from the fermentation sector and reflecting a key logistical advantage in terms of export quantities and deep-water facilities.

Summary – Indian Molasses Supply is Vital, but is it Sufficient?

Like the majority of markets and the global economies, the world of molasses has been impacted by COVID-19, with demand from the fuel ethanol sector a particularly volatile area. However, some of the largest drivers of price movements this year have nothing to do with COVID-19. We have been hit by a high probability of two consecutive poor cane crops in Thailand, a seven-month ban on molasses exports from Maharashtra and a dry Spring in Europe, which has suppressed sugar beet yields.

Fundamentally, molasses does appear to be a supply-driven market at present. The volatility encountered in the world since the start of 2020 has largely been neutral in terms of demand for molasses, with the exception of fuel ethanol demand. Supply has been the main factor and that has been driven mainly by weather and state Government actions in India.

In the context of supply being key; the question is: Indian cane molasses exports will increase, but is this sufficient to offset falls from elsewhere in Asia and Australia? The answer is likely to be “no”, with the switch of Thailand to being a net-importer in 2021 (they will be importers for the second half of 2020 as well) unbalancing the market and tightening supply.

That being said, demand will have some influence. If we do see the continued recovery and opening up of economies and an increase in transport activity, we should see the demand for cane molasses pick up in the fermentation sector.

Trying to balance out these factors to provide a commentary on price is more difficult. Supply should remain tight for the rest of 2020, so prices are likely to remain at their current levels. The Asian market looks to be the most volatile in terms of pricing as that is where the main reductions in demand and supply have been.

Into 2021, we will need to watch the Indian supply situation closely and see how the world economy and COVID-19 develops. It is very difficult to make any firm predictions at this point as there are too many unknowns to draw together a reliable prediction. If we did, we would have to spend the majority of the next report explaining the reasons why our predictions were wrong!

Other Opinions You Might Be Interested In…

- How Will the EU’s Poor Crops Impact the Molasses Market?

- Thai Molasses Exports to Reduce with Poor Cane Crop