Insight Focus

- India bans use of cane juice to make ethanol.

- Mills can only make ethanol from molasses.

- This frees up more sucrose for sugar production.

Introduction

India, the world’s second-largest producer of sugar, aims to blend 20% ethanol in gasoline by 2025.

This ethanol will be derived from sugar cane and various grain feedstocks, offering Indian mills the flexibility to choose how they utilize the sucrose in the cane. However, this year India is facing a cane shortfall, and so the government has taken action to preserve sugar supply in 2023/24.

It has banned the use of sugar cane juice to make ethanol; molasses is the only cane feedstock which can now be used to make ethanol. This frees up sucrose for sugar production, our estimate that 4.1m tonnes would be diverted to ethanol production is now too high and we will revise lower shortly.

In this report we assess what the recent changes mean for Indian mills and the world sugar market.

Maharashtra Sugar Imports/Exports

The Indian government hasn’t approved any sugar exports for the coming 2023/24 cane season, meaning mills cannot ship sugar. This is unlikely to change until at least after India’s general election finishes in May 2024, by which time the size of the cane crop will be known.

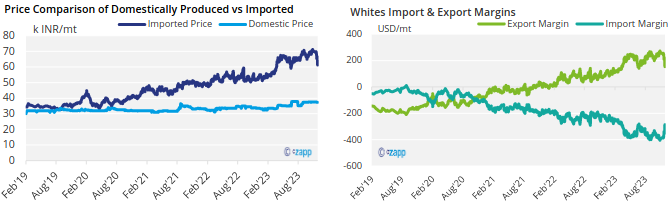

Today, Indian mills could theoretically earn large margins over domestic sales if they exported sugar. However, the lack of a government-approved export quota means that mills are unable to capitalise on the higher global prices.

If this year’s cane crop is much worse than expected, it’s possible India may seek to import sugar. Following the last week’s decline in No.11 raw sugar prices, the cost of importing raw sugar has decreased since our last update. However, imports remain economically unviable and would only become feasible if the local sugar price reaches INR 54.9/kg.

The story is similar for white sugar – mills could theoretically earn a higher margin over domestic sales if an export quota was set for the season.

Ethanol vs Sugar

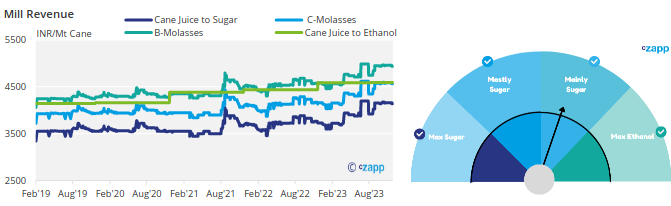

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies.

This choice has just become more limited. India has directed all domestic sugar mills and distilleries to discontinue the use of sugar cane juice to produce ethanol for the 2023/24 season.

However, the food ministry has stated that the supply of ethanol made from B-heavy molasses will continue to meet existing offers from oil marketing companies. B molasses to ethanol remains the best-returning option for sugar mills.

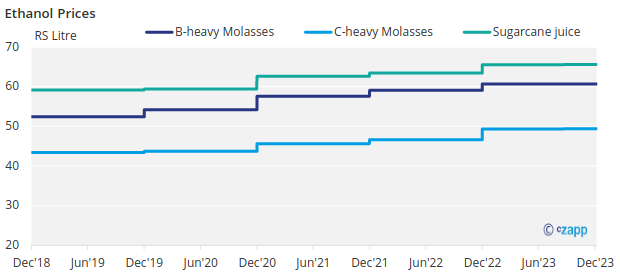

Given the poor outlook for this year’s cane crop, the government can change the ethanol prices paid to incentivize mills to use C-molasses thereby reducing ethanol diversion. Here are the current feedstock prices for ethanol:

Appendix

If you have any questions, please get in touch with us at Jack@czapp.com.