Insight Focus

- Conflict between world’s largest sunflower oil producers, Russia and Ukraine, tightens oilseed supply squeeze.

- Short-term options for import-dependent countries such as India aren’t long-term ones.

- US soybean demand for renewable diesel eating into export availability.

Last week’s USDA Oilseeds World Markets and Trade featured an exposé on the current vegetable oil situation in India, the world’s largest (and most dependent) vegetable oil importer.

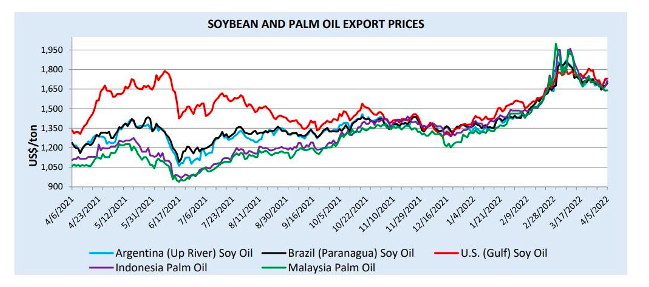

The recent rally in soybean oil prices is undoubtedly very difficult for the Indian consumer facing 20-year highs for palm oil. Palm oil is by far the world’s largest vegetable oil volume that enters global trade, as well soy.

As the chart below details, US soybean oil prices rallied sharply this time last year (red line) as the US market began to deal with the first step function in demand from the renewable diesel industry. A buying panic developed, especially in the refined, bleached, and deodorised category (the vegetable oil refining processes before packaging and distribution to the food industry but also a category now consumed by the renewable diesel industry). The premium of RBD to crude degummed soybean oil hit record highs.

By October, November, and December (peak US soybean harvest), US, Brazilian and Argentinian soybean oil prices moderated, as did palm. The bull market, less panicky, trendier, more global across all oils, resumed during February this year when the global vegetable oil market started to price in steep drops in soybean production in Brazil, Argentina, and Paraguay as well ongoing concerns about Malaysian palm production and Russian tanks.

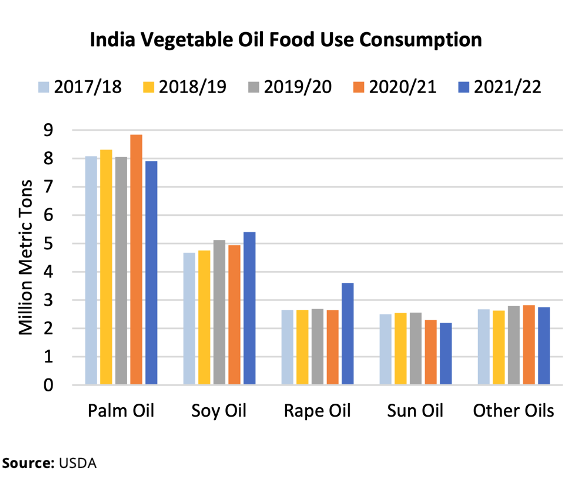

As the below chart details, India has been forced to turn to international soy and rapeseed oil suppliers to replace palm and sun oil, a new problem for India spawned by Russia’s invasion of Ukraine, the number one sunflower oil exporter in the world.

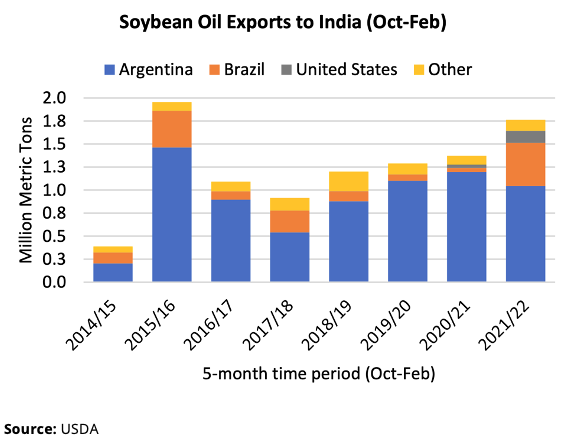

Note India’s dependence on Argentine soybean oil in the chart below with a recent expanding reliance on Brazilian production.

The global vegetable oil market was dealing with three major long-term supplier problems. And now comes another supplier problem; the undetermined duration of the invasion of Ukraine (the world’s largest sunflower exporter), and sanctions on Russia (the second-largest sunflower exporter).

Longer Term Problem #1

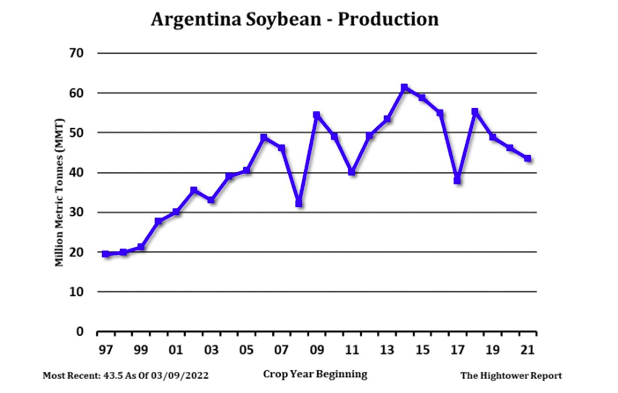

If you rely on Argentina, you have a problem. What is that problem? Lack of growth. When will that trend change? No trend changer to point to on the horizon.

Longer Term Problem #2

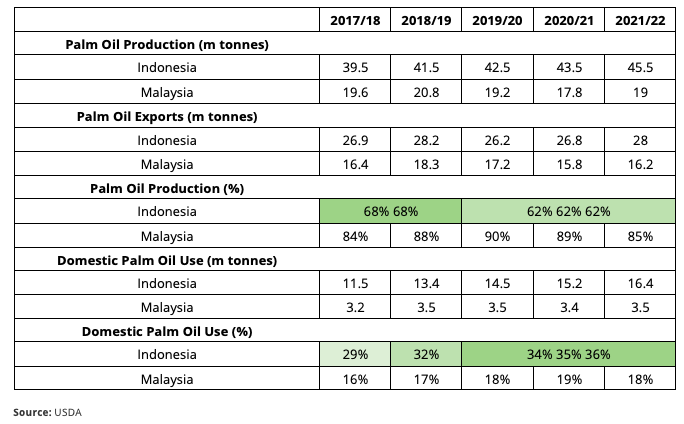

If you rely on Indonesian palm for origination, you have a problem. What is that problem? See the tables below.

For the global importer of palm, the key issue is Indonesian domestic usage going higher as a percentage of production and exports going lower as a percentage of production. Indonesian determination to support domestic biofuels production will, over time, considerably tighten the global palm balance sheet.

To make matters worse, Malaysia, a stagnant number two palm producer, has announced it will follow in the same direction.

Problem #3

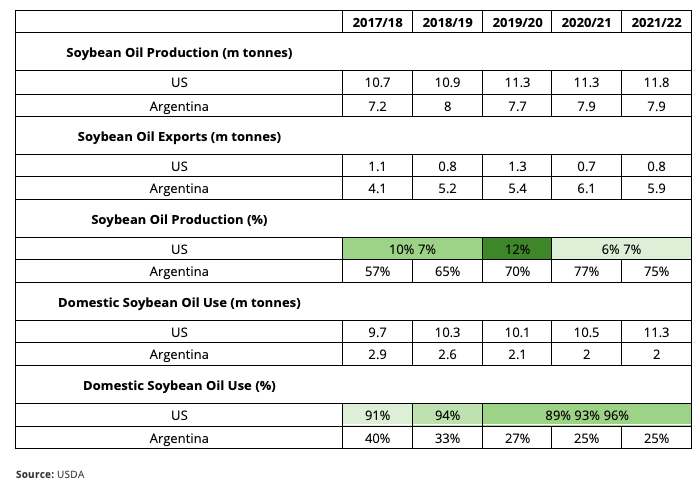

India turning to the US for soybean oil imports is NOT a long-term solution.

The US has embarked on a path supported by Washington DC and California (others coming) policy makers as well as renewable diesel refiners and vegetable oil feedstock providers (the best example is the announced investor/supplier/refiner relationship between Chevron and Bunge Limited).

The table below details the growth in US domestic usage. That trend goes steeply higher in 2023, 2024, and 2025.

Initial renewable diesel feedstock demand increases have been met by declining usage by the biodiesel industry and US soybean oil exports. Once those trade flows head into the renewable diesel streams, they’ll not head back unless economics change dramatically.

The renewable diesel industry now has its sights set on competing with the US domestic food industry for supply whilst also getting help from the US’ record soybean acreage and crushing rate. The chart table details the evolution of US trade flows into domestic streams and out of export streams.

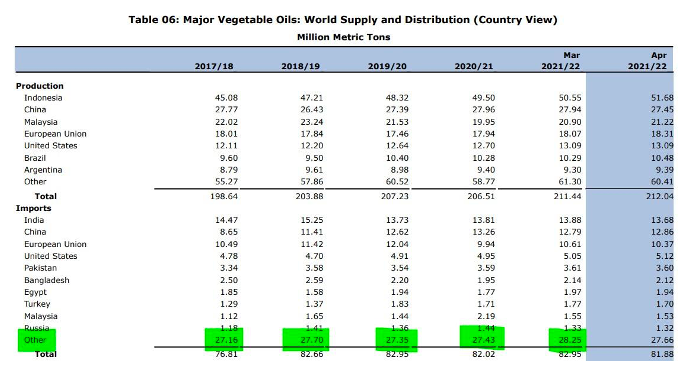

By the way, it’s not just India that faces these three supplier issues. Here’s the league table for world’s largest vegetable oil importers dominated by OTHER (too small for the USDA to showcase).

So, India, China, Pakistan, Bangladesh, Egypt, Turkey and OTHER, probably made up of 20-25 more distinct importing destinations, have real supply problems and they are getting worse (with a big surprise from Russia).

How does the supply problem get reconciled? There are two paths: the demand path and the supply path.

Who controls the demand path?

- Major national and state level policy makers in disparate halls of policy power spread across the world.

- Consumers disturbed by the food to fuel implications of biofuels.

- Bankers, investors, and boards of directors of energy and agro-industrial behemoths with the same concerns as consumers.

Who controls the supply path?

- Global investors, hesitant to place capital in countries like Argentina (and those in Africa).

- Farmers, ready to forego legacy cereal crops and expand oilseed acreage.

- Investors, ready to support feedstock processing capacity in countries like the US (soybean processing).

Is there an intelligent way to reconcile global biofuels policy and global food supply redundancy and security while also preventing countries like India getting squeezed of out vegetable oil supply?

There is. What is it? Stay tuned.

For further information, please email waltercronin@msn.com.

Other Insights That May Be of Interest…

Little Good News for Soybean Importers, Despite Record US Area

Brazil’s Meal and Oil Exports Hit Record Highs Despite Smaller Soy Crop