Opinion Focus

- Central banks are raising Interest rates in response to high inflation.

- Companies that receive extended credit are facing massive cost increases linked to these higher rates.

- Cz offer instruments that can be used to manage interest rate risk.

Central banks around the world have been hiking interest rates through 2022 in an effort to tame high inflation. resulting in eye-watering cost increases for companies that depend on credit lines to do business. However, there are tools available to help food, beverage and packaging producers and consumers navigate this period of economic volatility.

Rate Hikes Used to Tame Inflation

Today’s environment of high inflation has caused several central banks to take action to cool the economy. In the euro zone, inflation is currently at 8.6%, while it has reached 9.1% in the US. In the UK inflation recently rose above 10%. One of the actions being taken by central banks has been hiking interest rates.

Last month, theEuropean Central Bank raised its headline interest rate to zero to combat inflation. This rate had been in negative territory since 2014 to stimulate economic growth. Meanwhile, in the US the Federal Reserve hiked rates by 0.75 points to a range of 2.25-2.5%. Last week, the Bank of England raised rates by 50 basis points – the biggest move in 27 years – to 1.75%.

Companies Feel Financing Squeeze

So, what does this mean? When interest rates rise, lending is encouraged, and borrowing is discouraged. A key reason why the housing markets in the US and UK have been appreciating in value is because very low rates have encouraged people to take out loans in the form of mortgages. In contrast, savings accounts have been paying very low rates of interest in the past few years.

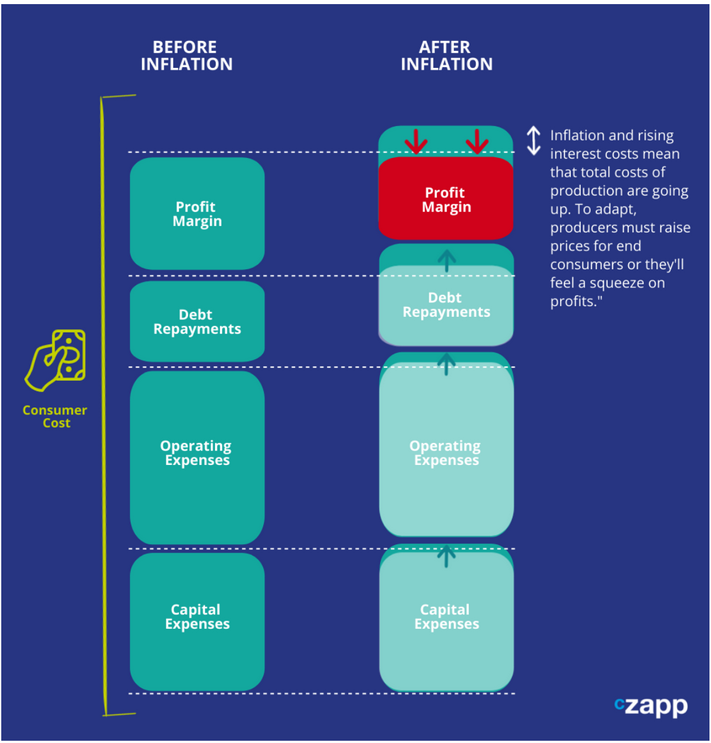

Likewise, as rates rise, savings rates also increase, and it becomes more costly to borrow. This helps to tame inflation with overall market demand reducing in response to the higher cost of funds. For large companieswith significant amounts of debt, this can create cost volatility and prompt a complete reassessment of financing options.

Knock on Effects of Supply Chain

In this high interest rate environment, banks and lenders tend to become more conservative and typically less finance is available. There are strict lending criteria linked to affordability. If rates rise too much, suddenly some companies may be deemed higher risk, so will have to pay more in interest as a form of insurance policy for the bank.

In some cases, companies may not be able to access debt at all because banks think the risk of missed payment or default may be too high.

This is also likely to push up the cost of goods. If suppliers are paying higher interest rates, they need to either pass on these additional costs or absorb them. This will either lead to higher prices or less efficiency within their supply chains.

SOFR Hedging Can Reduce Risk

Cz offers extended payment terms to consumers and prepayment terms to producers through an extensive range of financing partners. This allows companies to push out payments, giving them more breathing space amid tight margins.

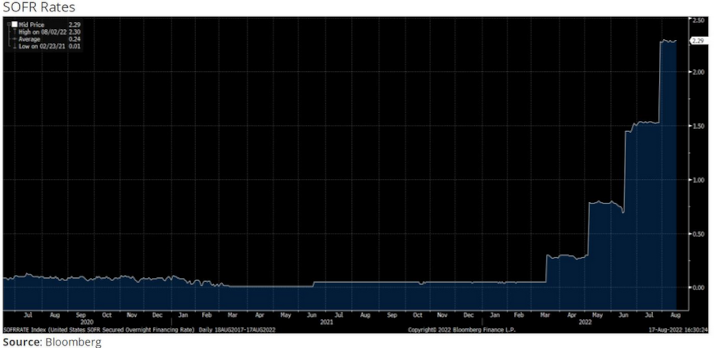

The cost of this financing is linked directly to the Secured Overnight Financing Rate, or SOFR. As we have discussed, SOFR has increased dramatically as central banks try to fight inflation through monetary policy. This has increased the cost of finance, and the forecast is for the cost to continue rising.

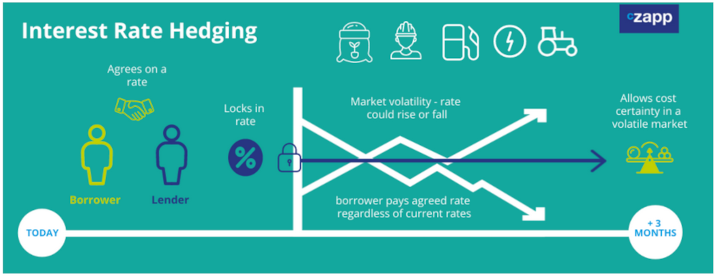

But companies do not necessarily need to swallow these continuously higher rates. One tool offered by Cz gives clients the ability to hedge interest rates. This locks in the SOFR component at a rate that the client deems affordable and removes the risk that the cost of financing continues to trade higher.

This kind of coverage locks down the finance cost component and allows cost certainty in an extremely volatile market.

Concluding Thoughts

- There is a high risk of further interest rate increases in the coming years and months.

- The expectation is that the Fed could increase rates to the high-3% area.

- This means an automatic increase in funding costs.

- Loan and bond issuance is strained and there is a lower ability to access finance.

- There is an increased need for companies to mitigate interest rate risk.

If you’d like to know more about how Czarnikow can help you manage your freight risk, please contact Maximilian Kirby on mkirby@czarnikow.com.

Other Insights that may be of interest

Have the Indicators the Supply Chain Should Monitor Changed?