Insight Focus

- Agriculture has underperformed many equities in recent months.

- Capital flows don’t seem to be coming to commodities any longer.

- Brazilian warehousing/logistics are still a worry for the grains markets.

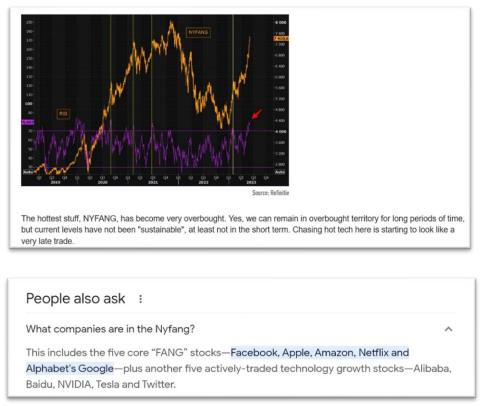

All eyes on the skies right now with a “dryish” pattern from central Nebraska through eastern Ohio mixed with a dab of heat giving the grain bulls a reason to hope for a trend reversal. Perhaps the commodity trading universe is busy trading tech equities (and not commodities) as detailed in this morning’s ZERO HEDGE.

Source: Refinitiv Eikon

Here is QQQ, the NASDAQ 100 etf, v DBA, the agricultural index etf.

And QQQ versus the hottest thing in agriculture, renewable diesel and sustainable aviation fuel as represented by Darling Inc.

And QQQ versus beef, chicken, and pork as represented by Tyson Foods.

Let’s just say that capital flows are distinctly not coming into the commodity space, the commodity indices are trending lower, the Russian/Ukrainian war escalates, the commercials are net long wheat and the funds are short to them, and the renewable diesel community sits and waits for the EPA.

For those of us in the physical trade, our eyes now wander over to the FOB values for soybeans and corn from Brazil and that great straining sound coming from the South suggests the grain warehousing, logistics, and elevation system needs a relief valve usually known as basis collapse.

Friday the USDA updates their views of the world and as many of you might suspect I am going right to the oilseed data tables to check the economists’ views on the Argentine soybean crop, crush rate, and soybean product export forecast. I also want to see if the USDA economists institute a “step down” function for new crop US corn and soybean exports in recognition of the Brazilian (Ukrainian???) need to unload record production into global markets at the expense of US farmers.

“Someone” is accumulating an ethanol to sustainable aviation fuel company. See the A+ green light from Investor’s Business Daily below and the chart below that.

Here is the hottest stock on the planet over the last 60 days versus AMTX.

Yeah AGRICULTURE! Enjoy your beautiful summer weather you Midwesterners, water the tomatoes the heat is coming, keep praying for global peace, and trade well this week.