Insight Focus

- This weekend’s Argentine election outcomes have roiled the global protein meal markets.

- There is a deep misconception about the risks this result presents to global food markets.

- The US soybean processing industry plays a role in offsetting the risk.

With this weekend’s election completed, the Argentine people have preliminarily decided to carry on with the economic and tax policies that have proved restrictive for the farm sector and the agricultural processing sector of their economy.

The current Peronist economy minister Sergio Massa – the winner in the first round – is a proponent of those policies. His opponent, libertarian Javier Milei, has previously said he would eliminate state intervention from farming and agricultural exports.

(It is worth noting that under Argentine election rules, Massa did not obtain the necessary votes to win the election outright. This means a run-off vote will be held next month between Massa and Milei, so the tables could still turn).

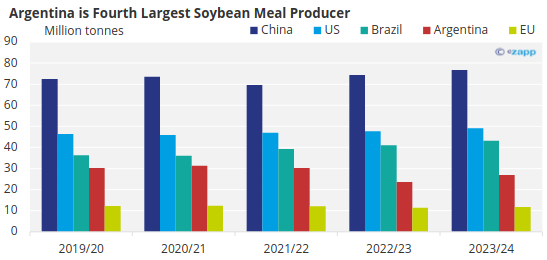

So, what does that have to do with soybean meal? Well, Argentina is historically the global leader in soybean meal and soybean oil exports.

Source: USDA Oilseeds: World Markets and Trade October 2023

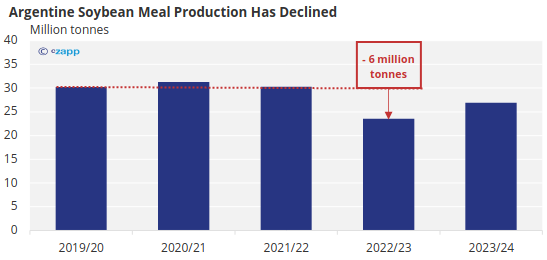

For the purposes of forecasting global soybean crush and the available soybean meal and soybean oil supplies, let’s take a look at what Argentine tax policies have achieved. We’ll pay close attention to the tons produced primarily for export.

Here are the USDA’s most recent soybean meal production numbers.

Source: USDA Oilseeds: World Markets and Trade October 2023

The key takeaways are:

- Soybean meal production is down 6 million tonnes from 30.24 million tonnes four years ago to 23.59 million tonnes this year.

- There is a somewhat rosy recovery forecast predicted by USDA economists to 26.91 million tonnes for the coming year.

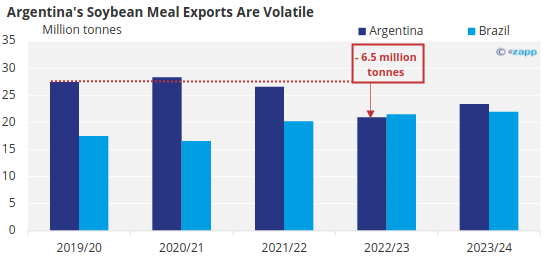

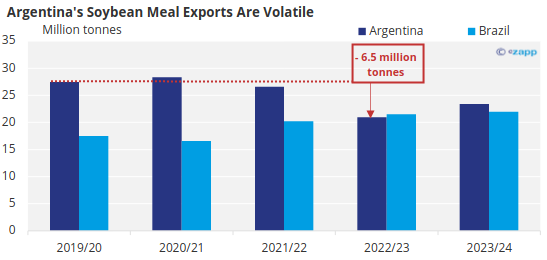

And here are the latest soybean meal export numbers.

Source: USDA Oilseeds: World Markets and Trade October 2023

From this, we can conclude that:

- Soybean meal exports are down 6.5 million tonnes from 27.46 million tonnes four years ago to 20.95 million tonnes this year.

- There is another rosy forecast for recovery to 23.40 million tonnes in the coming year.

- Argentina lost its crown to Brazil for global leadership of soybean meal exports this year.

- There are sequential declines in Argentina’s percent share of an expanding global trade in soybean meal.

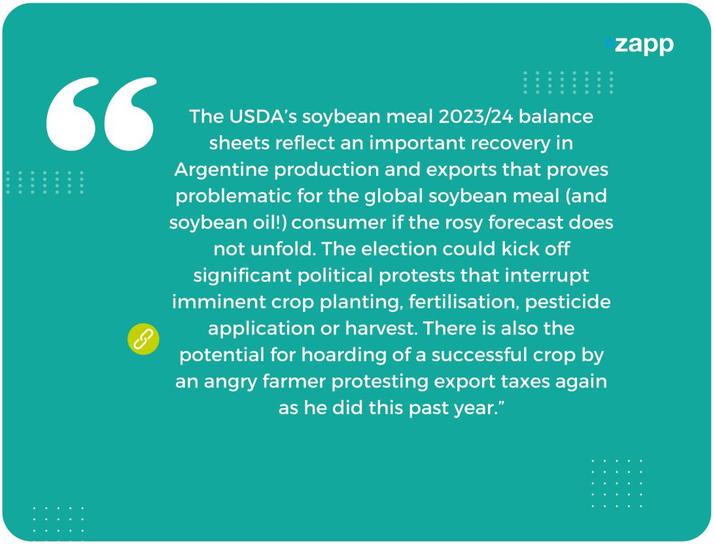

Rabobank’s Owen Wagner succinctly summarised the Argentine farmers’ response to policy below.

Last week, I wrote the below paragraph prior to this weekend’s election:

The volatility for soybean meal calendar spreads and soybean board crush margins at the end of last week, before the election, and then over the last two days after the election, has been significant. Market participants are now grappling with lots of concerns about the Argentine November runoff election as well another immediate round of government incentives.

These export incentives were announced on Monday and are designed to draw hoarded soybeans from the Argentine producer to shore up the government’s foreign currency reserves.

Here are two snapshots of the Chicago Mercantile Exchange’s (CME’s) soybean meal futures curve:

This shows the front part of the curve — the December 2023 versus the March 2024 spread:

Source: Refinitiv Eikon

And this shows the middle part of the curve — the March 2024 verse the July 2024 spread (which coincides with the new crop Argentine period):

Source: Refinitiv Eikon

For both calendar spreads, the rally going into the weekend election featured significant upside volatility and expanding daily trading ranges. The subsequent Monday/Tuesday sell-off (profit taking, relief selling, “buy the rumour, sell the fact” trades) featured downside volatility but this was muted relative to the upside volatility.

Yesterday’s huge trading range and explosive upside move from the lows of the day in the December/March spread pushed a lot of traders back in their seats and displayed the great gaps between buy orders and sell orders. This is a function of real uncertainty, engendered in large part from the weekend’s Argentine election results.

So, is there anything else that’s going on to drive volatility in soybean meal spreads? Yes!

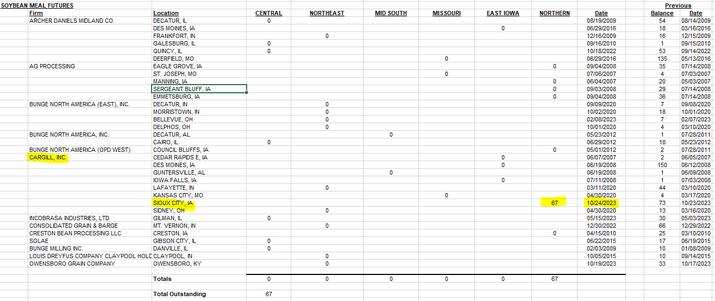

I am afraid that the soybean meal trade desk at Cargill has once again upped the year-end bonus pool for the soybean meal trade desk at Archer Daniels Midland. After placing a large slug of soybean meal into the closely watched CME delivery window via the October contract, the Cargill traders have had to endure another round of ADM traders using the soybean meal for immediate purposes to satisfy their own sales (instead of producing the meal). Note that the same ADM traders stopped the October deliveries by keeping their long futures position into expiration and taking delivery. This has yielded a very profitable outcome as physical prices continue to rally in the US.

It is a déjà vu replay of an event earlier this summer with Cargill expressing a negative opinion about demand by delivering and ADM expressing an expansive view of demand by taking delivery.

Per prior posts, agricultural behemoths approach the delivery window to proudly proclaim their market opinion to the public (and bend prices in their direction) via the very open and detailed delivery process and dare others to challenge them.

A brief aside on global protein demand. I listened to yesterday’s third-quarter Archer Daniels Midland earnings call on which analysts peppered management with multiple questions about the potential for the US soy processing industry to overbuild soybean meal production capacity in the coming years. (Funnily enough, there was zero recognition of the Argentine doom loop noted above!)

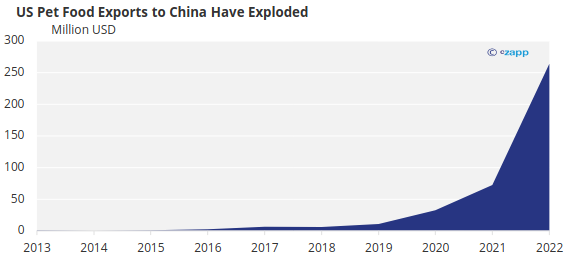

This brings me to my current favourite USDA chart, published in July this year, that starkly puts vegetable protein meal demand into focus.

Source: USDA

Consider the following statistics detailed by the USDA and then ponder the implications for global pet food demand as other countries follow the same “pet” path.

There is a very clear evolution of global consumer appetites as they climb the GDP steps to higher incomes and greater wealth. When global citizens have higher disposable income, they:

1. Consume more protein (eat two chickens per week instead of one)

2. After satisfying the demand for more protein they eat more fresh fruits and vegetables

3. Now consume more convenience foods (think ramen noodles)

4. Now consume more confection (sodas, ice-cream, candies)

I believe I need to add a 5th step (but I wonder if there are enough academic studies to support this theory):

5. Adopt a pet (which will consume vegetable protein meals).

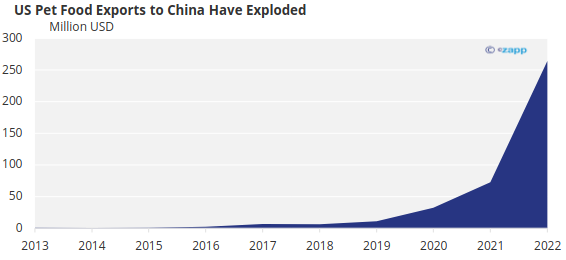

Again, look at the one-year change and seven-year trend in pet food exports to China. Are analysts thinking about the US build out of soybean meal production capacity the right way?

Source: USDA