Insight Focus

- Can raw sugar keep rallying while other commodities retreat?

- In the short term sugar supply seems to be constrained.

- There’s also almost no investment in sugar production for the long term either.

Hello everyone, it’s Stephen from Czapp with an update on the sugar markets in March 2023.

Last month I was in Dubai for a sugar conference and it was noticeable how bullish everyone was. A month is a long time and today if you read the business news it looks like most markets are in crisis.

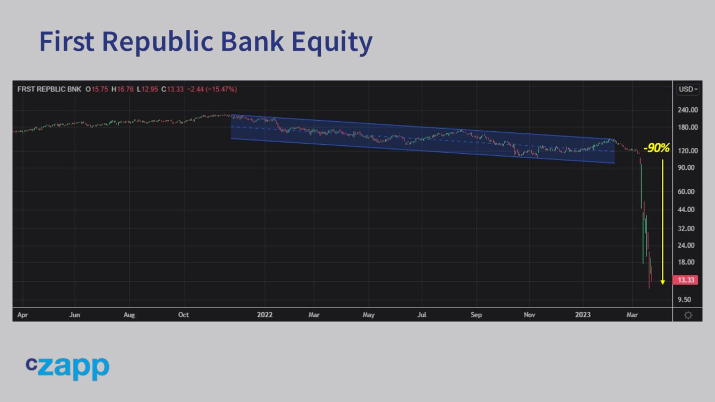

Higher interest rates have led to problems in a number of American banks and this has spread to other parts of the financial system with Credit Suisse being forcibly acquired by UBS. I rather naively thought that higher rates were meant to be good for the banking sector.

Source: Refinitiv Eikon

This is the strangest market panic I can recall. Some individual banks have been hit hard; here’s First Republic Bank whose equity is down 90% in 2 weeks.

Source: Refinitiv Eikon

But look at the broader financial institution equity ETF and although prices are down 20%, it also remains in the range of the past 12 months. It’s only the enormous volume of the past 2 weeks that gives the game away.

Source: Refinitiv Eikon

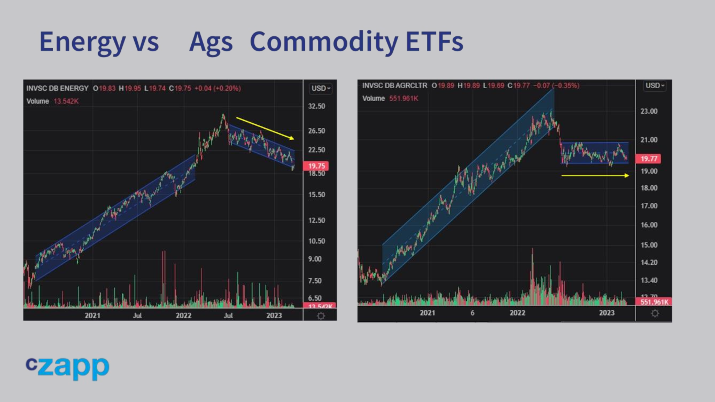

Headlines have also been screaming about the collapse in crude oil, but the decline in crude oil has been an orderly continuation of its year-long downtrend.

Source: Refinitiv Eikon

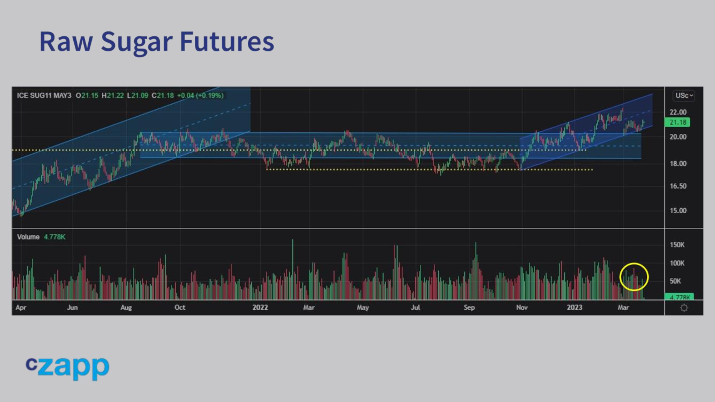

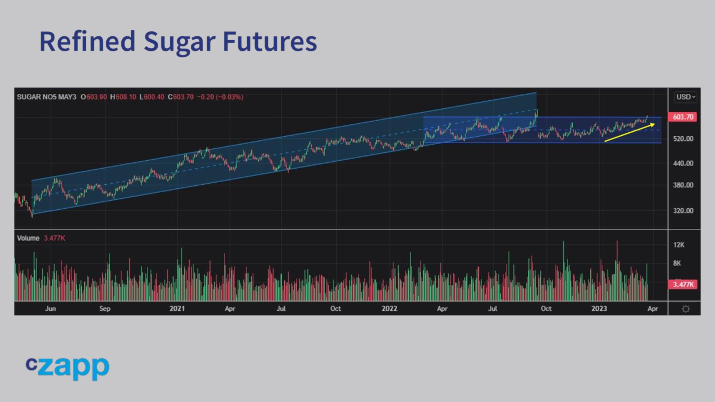

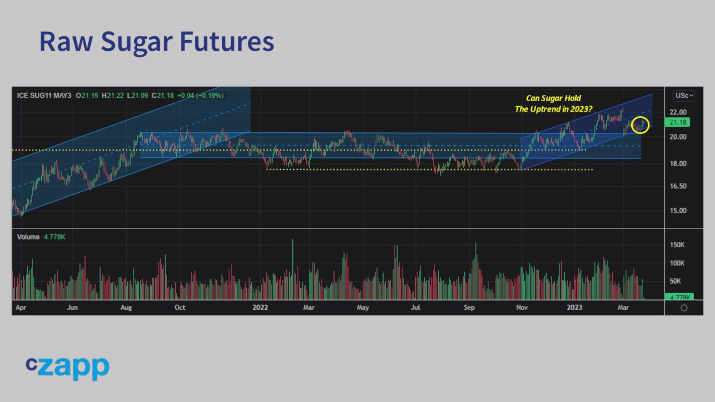

For sugar the impact has been even more muted. No abnormal volume, no wild price movements. It remains in its uptrend. So ignore the news headlines and the talking heads and social media influencers and you can see things look quite normal.

Source: Refinitiv Eikon

One thing that’s been fascinating this year is the divergence in commodities. Many investors conveniently lump all commodities together as one class, to be thought about once a decade. In 2020 and 2021 most commodities rallied. In 2022 most traded sideways.

Source: Refinitiv Eikon

This year, energy markets have finally started to decline. But agricultural commodities have kept going sideways. Sugar can be both – you can use cane and beet to make sucrose for food or for ethanol as a road fuel.

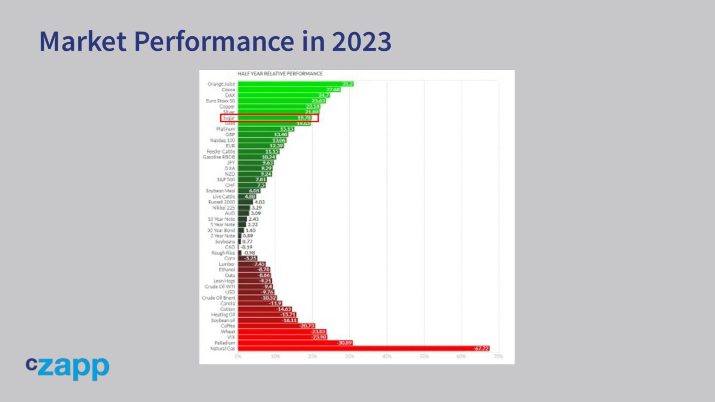

Today, sugar is trying to identify as food, not energy. In fact, its one of the top performing markets in the past 6 months. What’s so special about sugar?

Source: Refinitiv Eikon

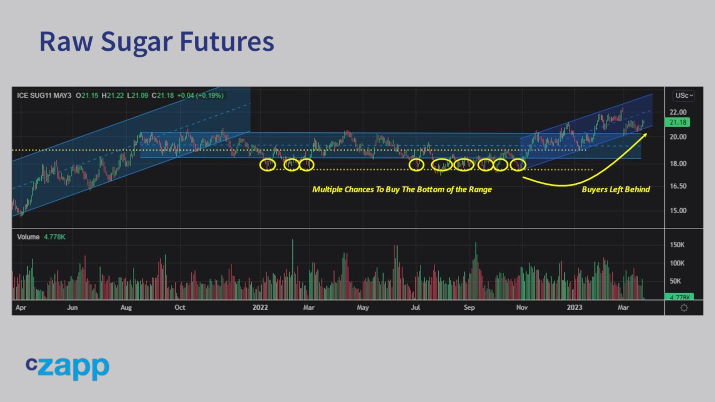

For a start, the sudden strength of sugar has completely sidelined buyers. In 2022, consumers had repeated opportunities to buy raw sugar below 18c/lb. This was still more expensive than prices had been for much of the previous 6 years, but at least the price range was well-defined. Those with a disciplined risk management plan could keep picking off the lows in the market. But the raw sugar futures haven’t been below 18c since November.

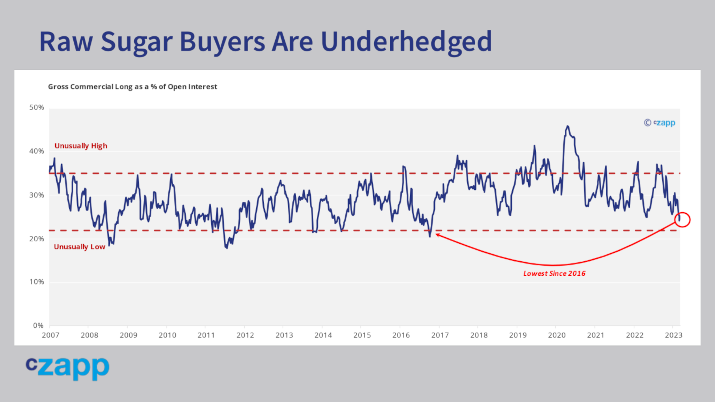

Buyers are under-hedged and so are being forced to buy sugar hand-to-mouth. This chart shows the commercial long position as a proportion of open interest: in other words, how much of the futures market is made up of buyers hedges. It’s at the lowest level since 2016, which was the last time the market rallied aggressively over 20c. Clearly if the market retreats back towards 2022’s range then consumers will buy again.

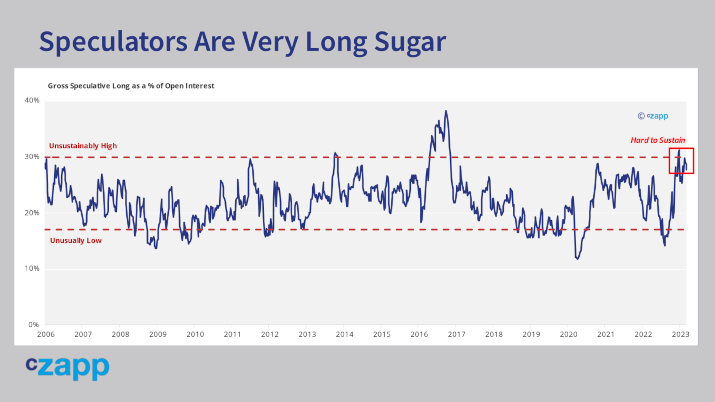

Meanwhile, speculators remain very long the sugar market. They’re the ones who’ve bid the market higher in recent weeks. Their long is now approaching 30% of raw sugar futures open interest, and in the past it’s been difficult to sustain above these levels. Nevertheless, speculators are still in control and forcing buyers to nibble at increasingly high levels. A bull market, in other words, climbing up a wall of macro worry.

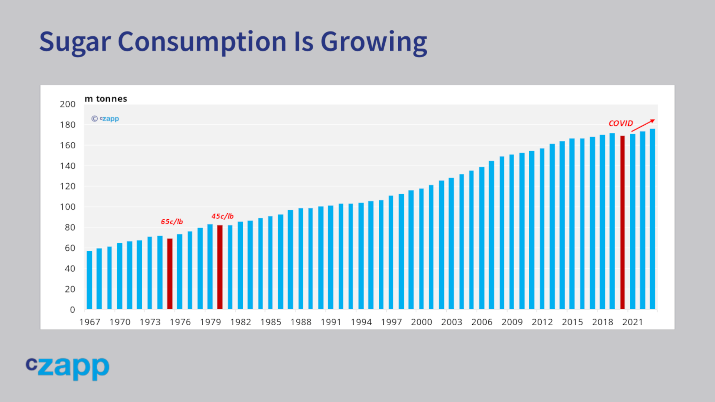

Let’s go right to the end of the sugar supply chain. So far we’ve not seen any signs of people eating less sugar thanks to higher prices.

Source: Refinitiv Eikon

Nor have we seen any evidence of a slowdown in refined sugar shipments thanks to low US Dollar availability or difficulty financing trades. The gradual strength in refined sugar futures if anything is helping pull the raw sugar market higher.

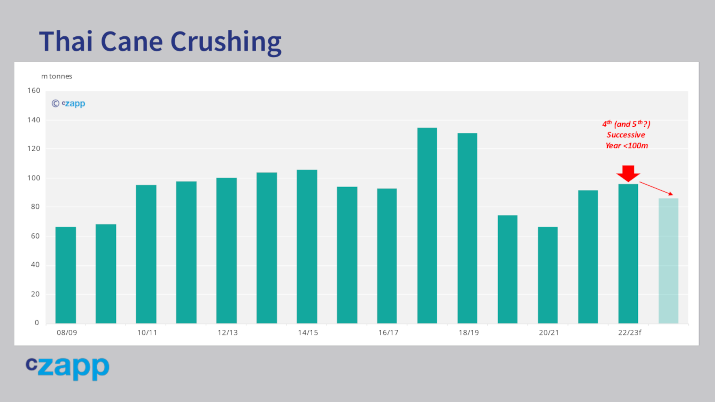

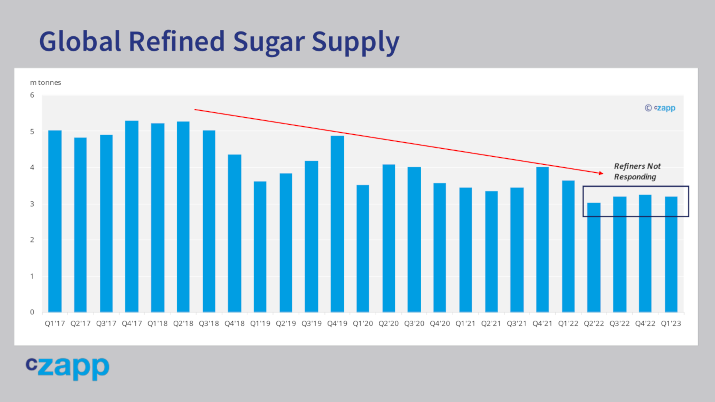

Refined sugar supply, however, is constrained. This year’s Thai cane crop has underperformed, meaning less supply.

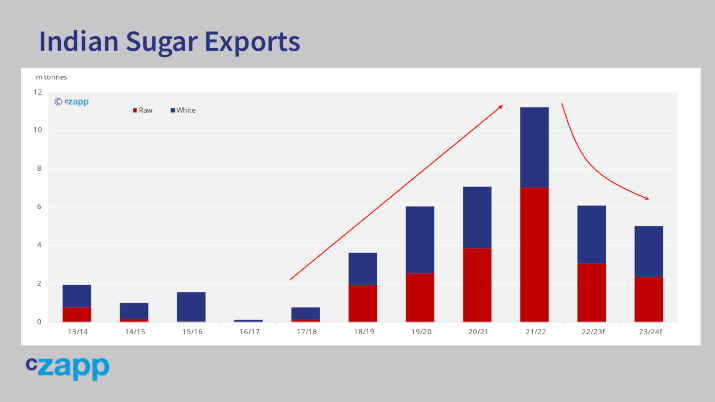

It’s a similar story in India.

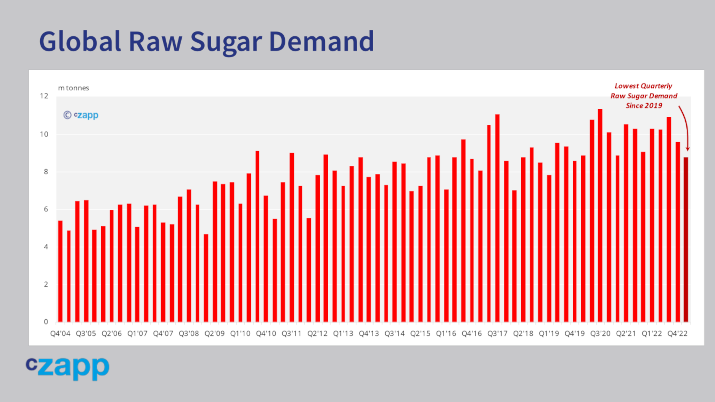

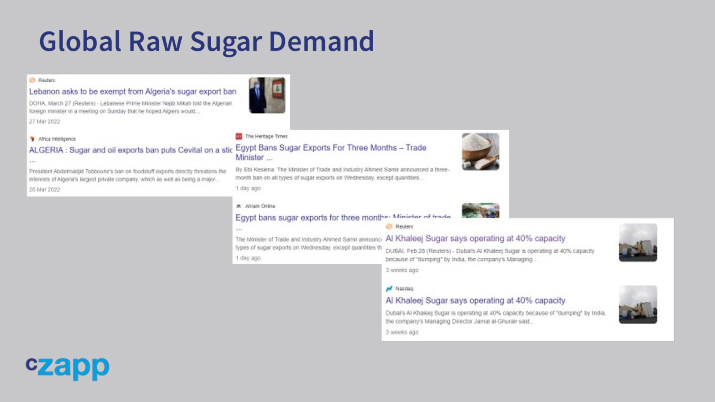

It also feels like the world’s re-export refiners have struggled to take advantage of the higher refined futures. Raw sugar demand around the world has been pretty poor so far in 2023. This is perhaps because the backwardation in the raw sugar market has been difficult for refiners to cope with. But there are other problems.

Refined sugar exports from Algeria have been banned for nearly a year. In recent days Egypt has also banned exports. And the refinery in Dubai hasn’t operated at full capacity for a while now. Many other raw sugar buyers are refiners using the raws to make sugar for domestic consumption. They generally have less flexibility over their buying. However, they could still impact the market.

China is one of the world’s largest buyers of raw sugar, accounting for around 4m tonnes a year. However, even though domestic sugar futures are rising, import margins for out of quota raw sugar are negative. It’s possible that as Chinese sugar prices rise, end-users switch to other sweeteners, maybe corn syrups. Or they may look to import liquid sugar or pre-mixes rather than rely on raw and refined sugar imports.

So let’s put this all together. In the short term, refined sugar supply is constrained. But refiners around the world are struggling to respond, so we’re not seeing large demand for raw sugar for processing into refined. It’s not that sugar demand is being hit by high prices…. It’s operational difficulties which are constraining supply.

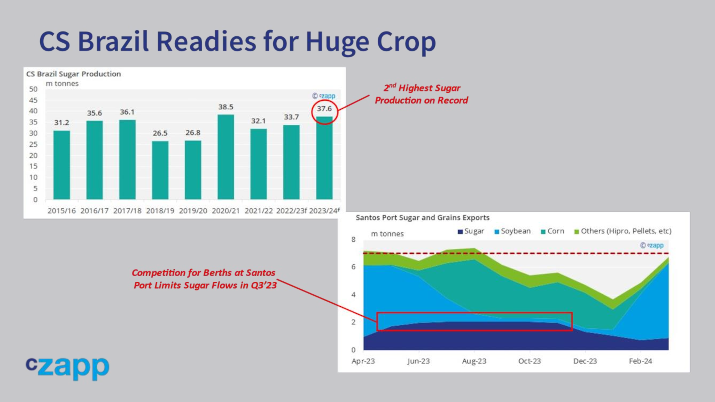

This will continue even as Centre-South Brazil starts harvesting its huge cane crop. Everyone expects problems with getting this sugar from the mills inland to the ports and then onto vessels for export. All of seems to put the speculators in quite a strong position.

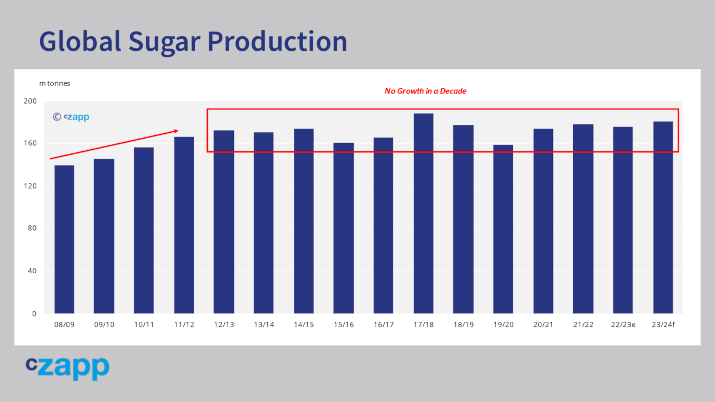

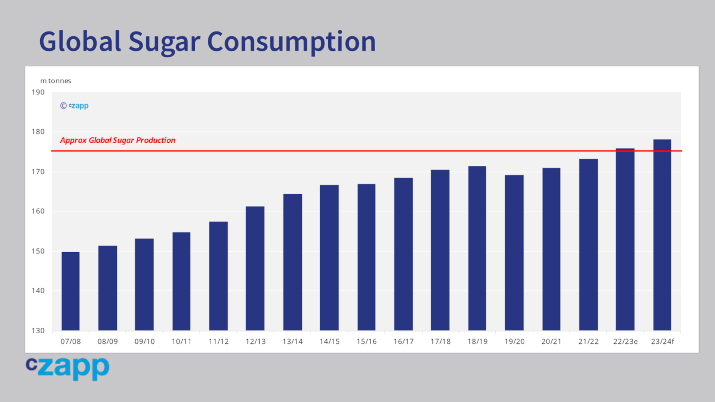

In the longer term supply is constrained too – global sugar production has stagnated at 175m tonnes for more than a decade.

Consumption has finally reached this level. We urgently need new investment in cane and beet growing and processing. But that investment isn’t happening anywhere except India, where the sucrose is being diverted to make ethanol not sugar. We need higher prices at the back of the curve to incentivize investors back to the sector.

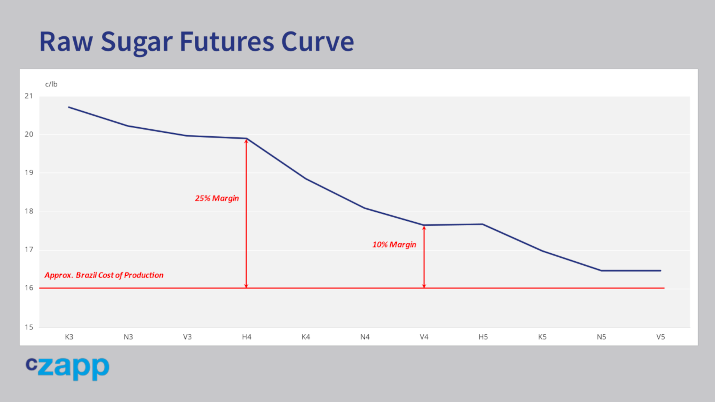

I’ve been highlighting this for at least a year now, and at last we’re seeing the middle of the curve shift above local interest rates in Brazil. While this is welcome, we’re not seeing any new interest in investing in the cane sector yet. Perhaps we also need the 2025 contracts to trade at a larger premium to cost of production too? The risk is that meanwhile the front of the curve responds sharply to any further unexpected supply problems.

Source: Refinitiv Eikon

So sugar is in a funny place. If it can shrug off the malaise in the energy markets the case for sugar’s bull market is still there. Don’t expect huge increases overnight. But a gradual grind higher is very possible.

If you’d like more help with your sugar hedging, please get in touch.

And, as always, thanks for watching.