Insight Focus

- Brazil’s mills may not need to maximise sugar production this season.

- The raw sugar market is well supplied, Indian exports are workable.

- The refined sugar market is undersupplied in the short term.

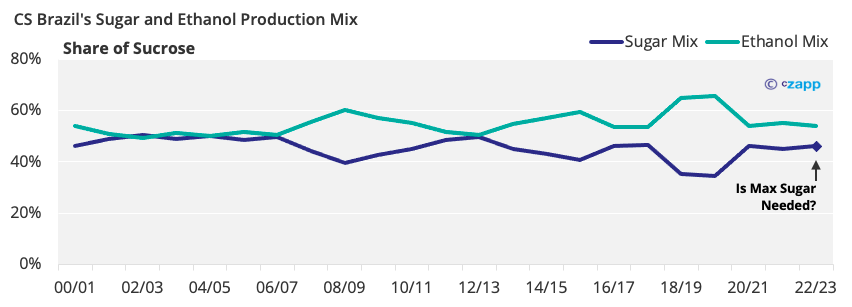

High Oil Prices Encourage Brazil to Maximise Sugar Production

- Everyone’s talking about higher oil prices and what they mean for CS Brazil’s sugar and ethanol mix.

- The mills should still maximise sugar productionthis season, with spot ethanol parity at 19.7 c/lb.

- We’re not sure they need to do so, though.

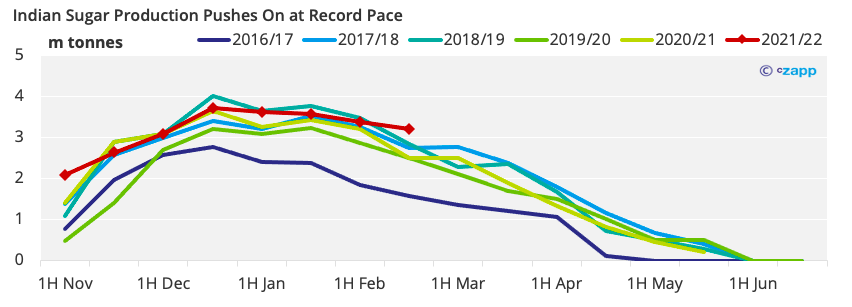

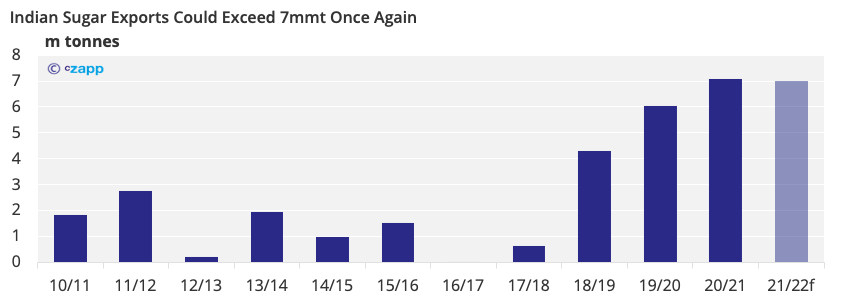

- India’s Record Production Pace Could Boost Export Availability

- Strong raw sugar prices are giving India’s millsan excellent opportunity to sign more export contracts.

- They also have more available to export as production pushes on at record pace.

- India should now produce 32.5m tonnes in 2021/22,up 1m tonnes from our previous estimate.

- This means it could export upwards of 7m tonnes of sugar this season.

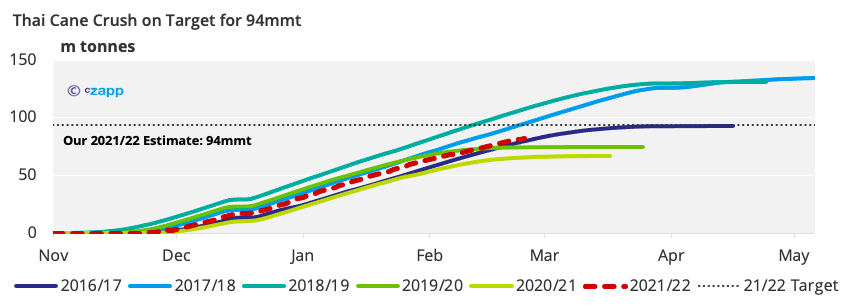

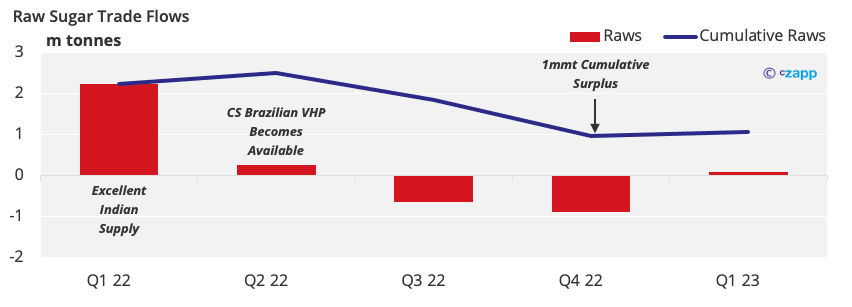

Strong Thai Cane Crop Helps Erode Global Raws Deficit

- Thailand’s cane crush is progressing well.

- The mills have crushed 84m tonnes so far andproduction could surpass our 94m tonne estimate.

- The raw sugar deficit we wrote about last time has therefore disappeared.

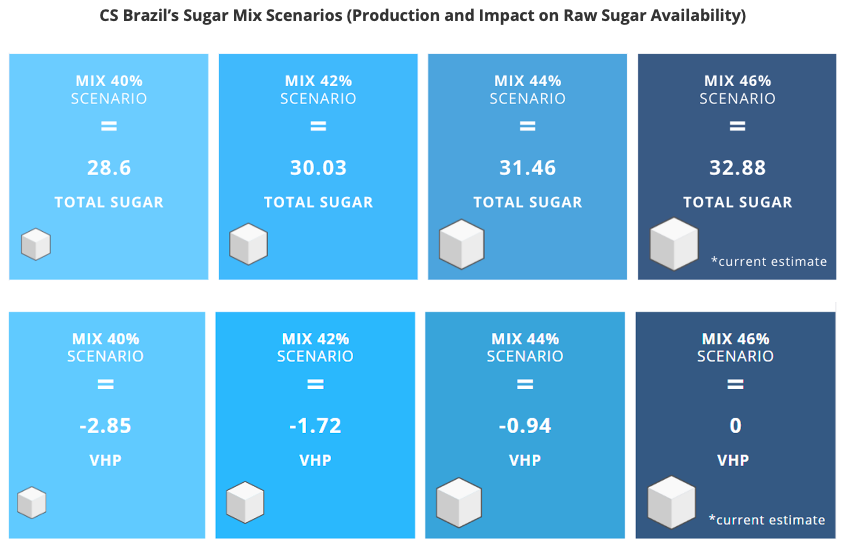

- However, prices must remain high enough to ensure CS Brazil’s mix leans heavily towards sugar.

- The mix only needs drop by 2% (to 44%) before there’s not enough raw sugar to satisfy demand.

- And if rains are poor between now and when the cane crop starts in April/May, production could drop, pushing the required mix back towards maximum.

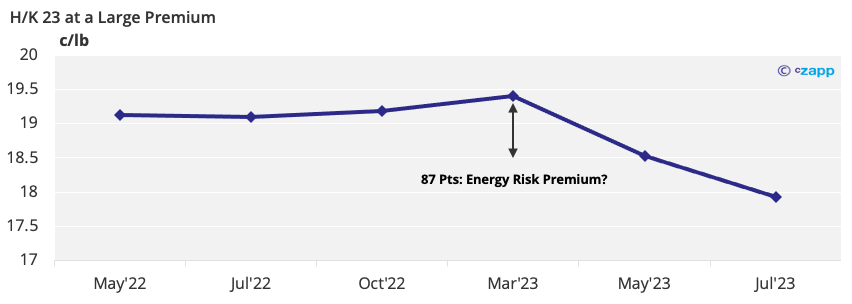

- The large >80-point premium of the No.11 H/K 23 spread may also reflect energy risk and the need for CS Brazil’s mills toprioritise sugar until the end of the season.

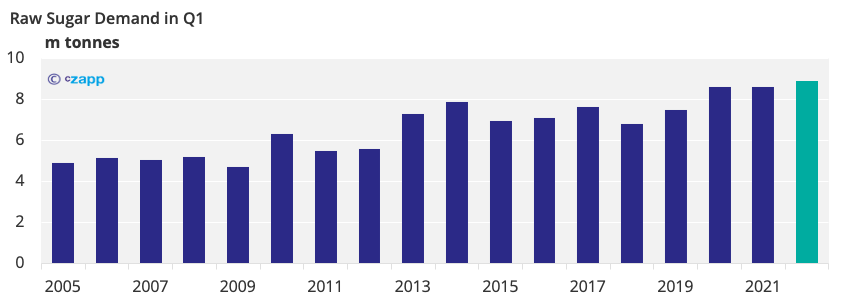

Raw Sugar Demand in 2022

- Q1 raw sugar demand has been better than ever in Q1’22.

- However, if higher prices persist, physical demand could begin to struggle.

- Any fall in demand will reduce the pressure on CS Brazil’s sugar mix.

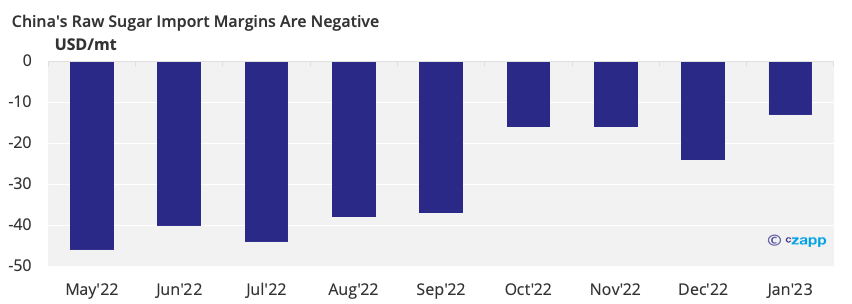

- Chinese refiners can’t profitably import raws at current prices; their breakeven level is around 17.5 c/lb.

- Either raw sugar prices need to fall, or Chinese prices need to strengthen.

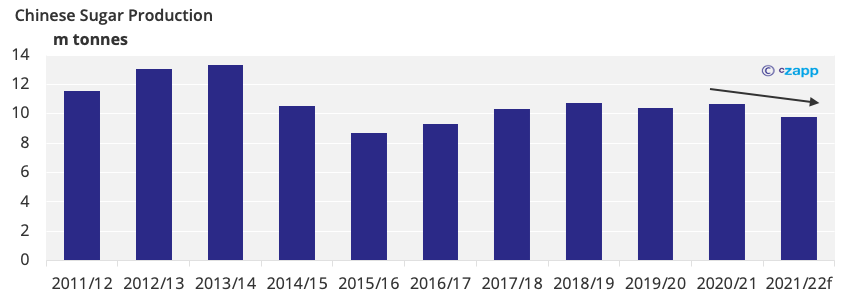

- The latter seems more likely with Chinese production struggling as cold and wet conditions hit sucrose development in southern cane fields.

- Other large buyers, such as Indonesia and Bangladesh, have imported plenty of raws in so far in Q1, mostly from India.

- Bangladesh should import more than 800k tonnes this quarter, well above average.

- This could give it the flexibility to delay a few cargoes if prices are too high.

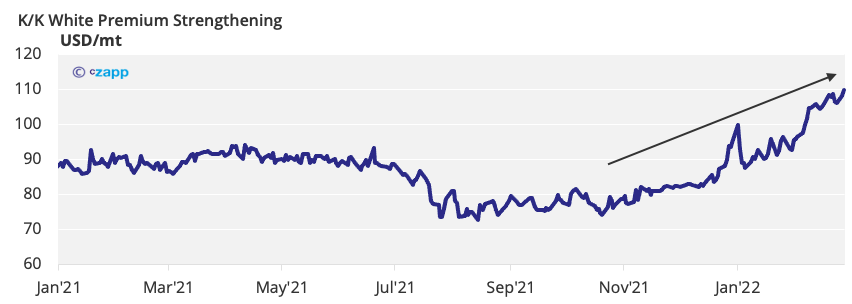

- Some of the world’s toll refiners may also struggle in the coming months.

- Soaring energy costs will up processing costs and the white premium required to operate profitably.

- The white premium may therefore need to strengthen until it finds this level as the market is still heavily reliant on supply from these refineries.

Raw Sugar Supply Beyond 2022

- Raw sugar supply could tighten next year and be more reliant on CS Brazil, lifting prices.

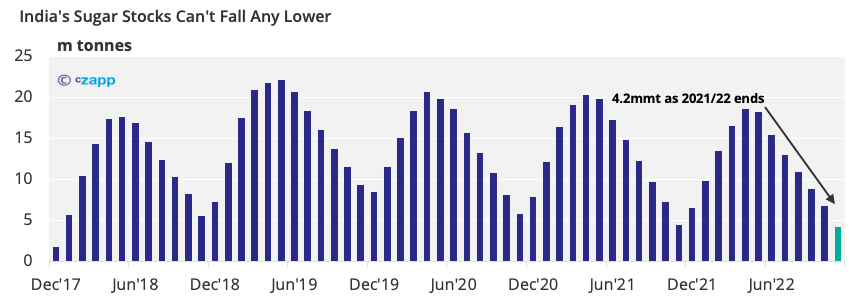

- India’s export availability could be poorer as it should end this season with limited stocks.

- Its sugar production should also fall as moresucrose is diverted to ethanol.

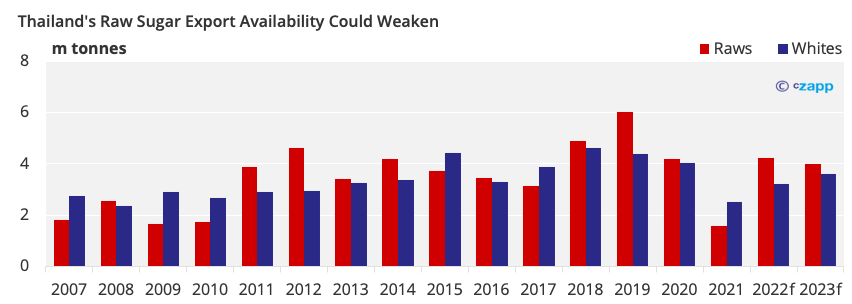

- Thailand’s raws availability could fall too, as the mills favour white sugar production with today’s stronger white premium.

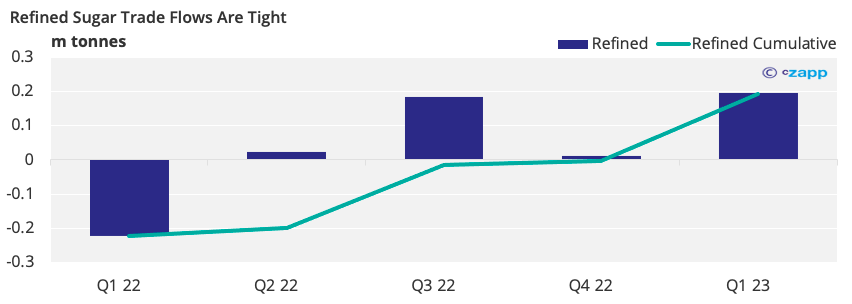

The Refined Sugar Market is Tight

- The refined sugar market looks tight through2022, which is positive for white sugar prices and the white premium

- Refined availability from key producers, such as Europe and Thailand, has been poor this year, prompting increased reliance ontoll refiners.

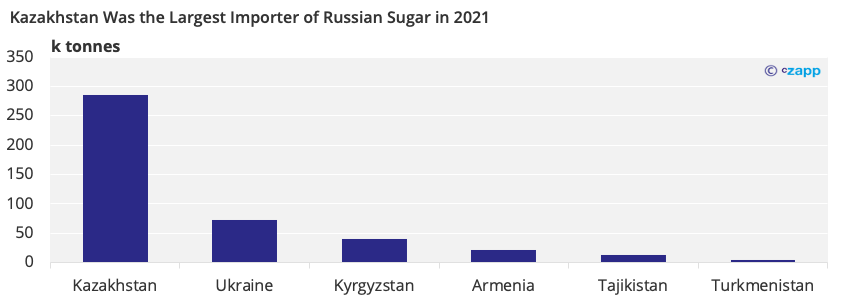

- Exports from Russia to the Eurasian Economic Union have also been banned until the summer.

- This will predominantly impact Kazakhstan, which may need to look elsewhere over the coming months.

- Beyond this, container availability could worsenagain as port congestion builds around China with COVID lockdowns reimplemented.

- This means differences in regional cash values will still be required to ensure supply in surplus regions like East Asia can meet demand in deficit regions such as Africa.

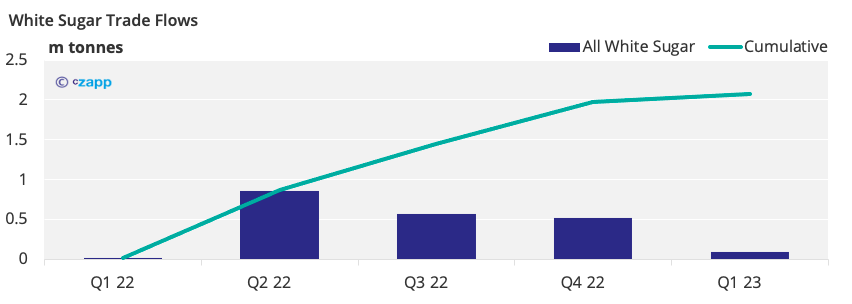

- Aside from these issues, the wider white sugar market is well supplied.

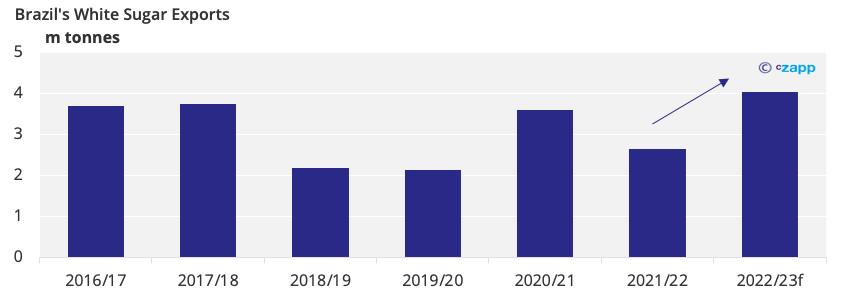

- Brazil’s white sugar availability should jump significantly in 2022/23 (Centre-South and North-Northeast).

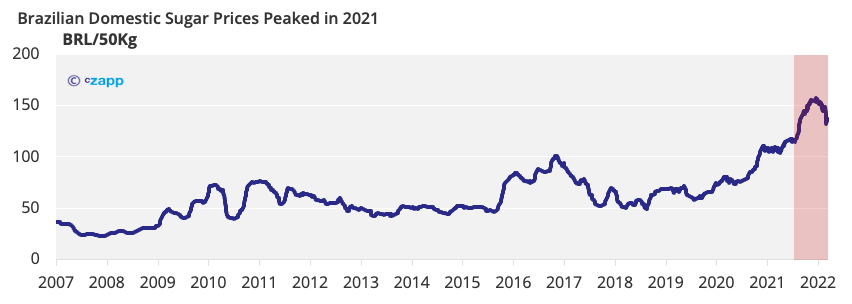

- Last season, domestic sugar prices were much higher as domestic sugar stocks dipped.

- Whites demand was also poor as buyers had stocked when prices were much lower in 2020.

- This stock build also helped mitigate anypotential supply chain disruption.

If you have any questions, please get in touch with us at Will@czapp.com

Other Insights That May Be of Interest…

How the Brazilian Fuel Price Adjustment Hits Sugar & Ethanol

Russia Sanctions Weigh on Agri Trade Flows

Market View: Specs Bet On Higher Ethanol Parity

Explainers That May Be of Interest…