Opinion Focus

- Shipping firms have benefitted from unprecedented rate increases in the past few years due to pent up demand.

- But now the Covid-related momentum has worn off and the world is headed towards recession.

- The maritime industry has a challenging 2023 ahead.

Maritime trade is often seen as a bellwether of economic health. But with a recession creeping up in most countries and other ongoing issues, 2023 looks like it will be a challenging year. We take a look at the main considerations for the industry in the next year.

1. Macroeconomic Conditions

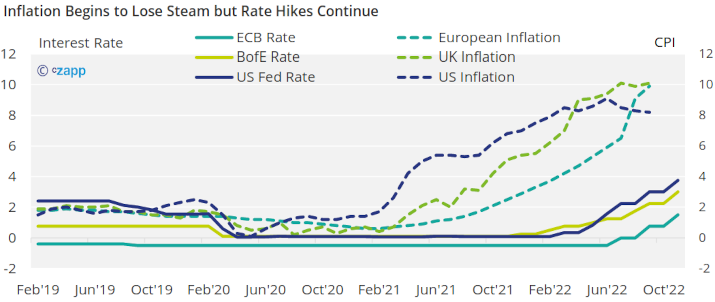

Inflation is expected to remain elevated through 2023, despite Central Banks’ attempts to curb its momentum through interest rate hikes.

Source: US Federal Reserve, European Central Bank, Bank of England, OECD

This means that the cost of goods will remain elevated, cutting into purchasing power. Although this may not necessarily lead to the consumption of fewer goods, it will certainly lead to a shift in the kinds of goods that are in demand.

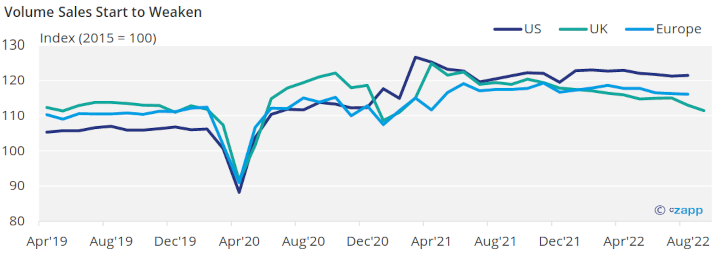

And volume sales are already starting to weaken in countries such as the US and UK.

Source: OECD

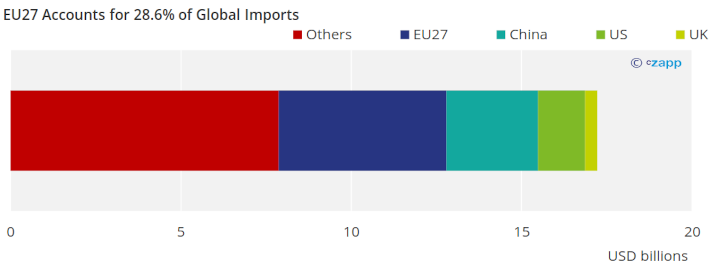

Since the US and EU including the UK account for almost half of all global imports, this is an important signal for maritime trade.

Source: World Bank WITS

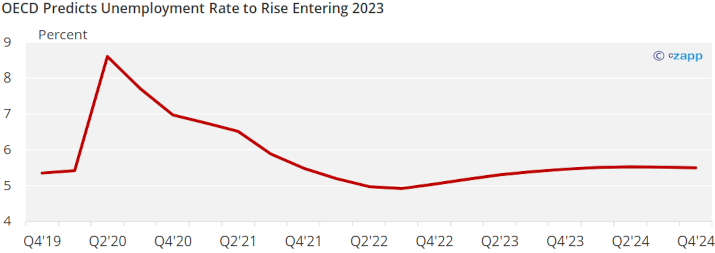

This difficult situation will only be exacerbated as unemployment begins to rise. Already, some industries have begun to implement mass layoffs, including retail and technology.

Source: OECD

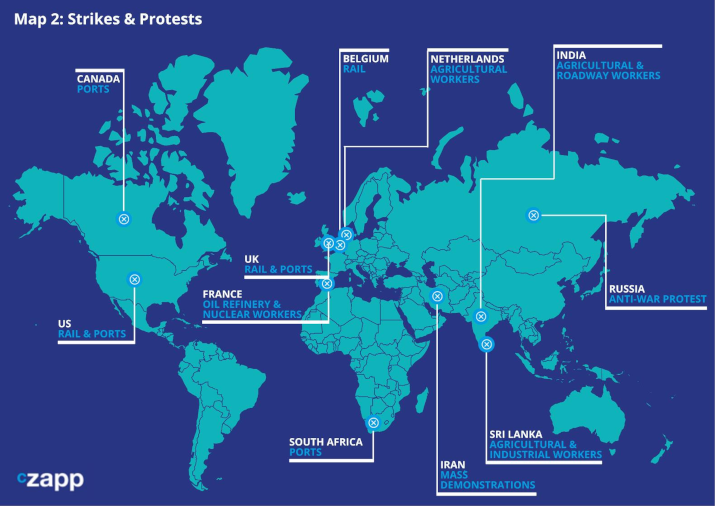

But even without a sharp increase in unemployment, strikes and protests continue to wreak havoc for global trade.

An impending rail strike in the US threatens to “cripple” the US economy.

2. Chinese Demand

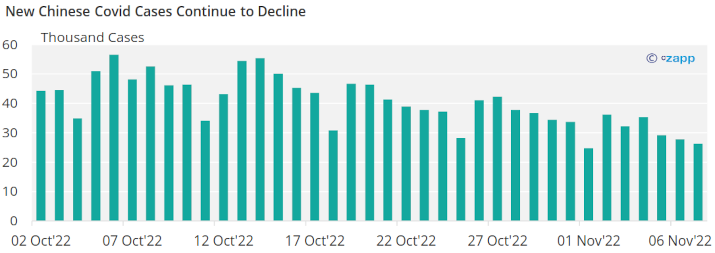

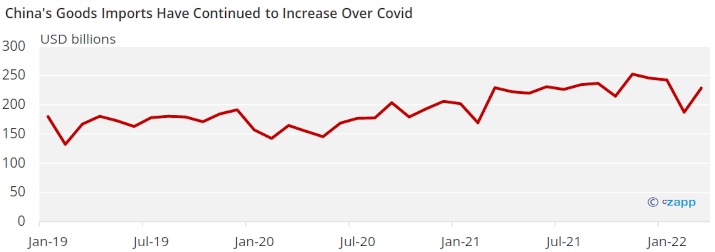

While the EU accounts for about 30% of global imports, China alone is responsible for almost 16%. The government’s zero Covid policy has put a dampener on trade over the past few years.

Source: WHO

Recently, there is speculation that public unrest over mass lockdowns may prompt authorities to change course on the policy. There is a delicate balance to be struck in the potential reopening but keeping the policy in place will ensure a “grim” economic outlook for 2023.

It is unlikely there will be a sudden reopening in China, but looser restrictions would not necessarily be good news for maritime trade. With a reopening of international travel and entertainment venues, goods may be shunned in favour of services.

As well as China-related issues, the global supply chain will also have to contend with more shifting trade patterns amid emerging geopolitical events. The war in Ukraine for example has shifted key grains, energy and fertiliser trade flows. There is now a lack of direct connections to the vital Black Sea area.

3. Congestion Aftermath

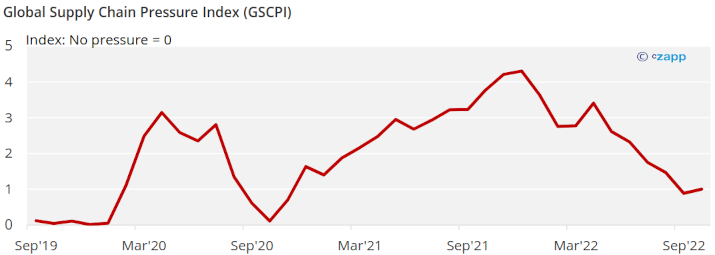

After all the supply chain issues from 2021 and 2022, supply chain pressure is finally beginning to ease. But there are still some lasting complications that logistics firms will have to deal with into 2023.

Source: Federal Reserve Bank of New York

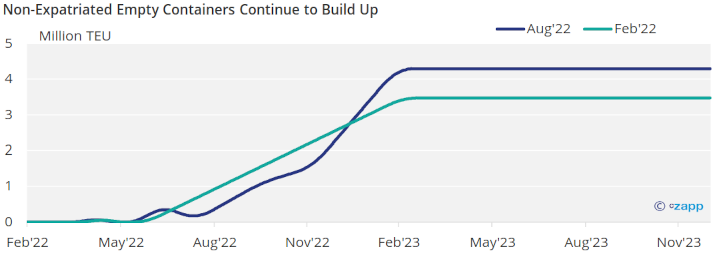

After last year’s scramble for more and more shipping containers, the drop in demand has created a build-up in unused containers that have not been repatriated. In 2023, the amount of empty shipping containers is expected to reach 4.3 million TEU.

In some ports in China, as much as 90% of box spaces are occupied – a stark contrast to last year’s container shortages.

Source: Sea-Intelligence

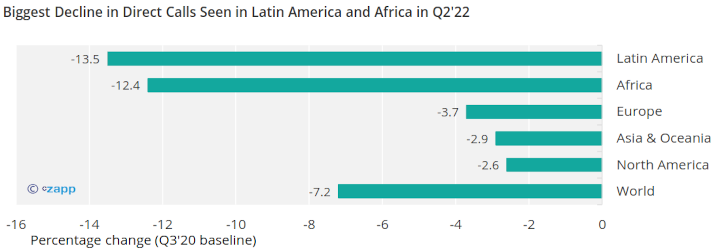

And as shipping companies look to boost efficiency, reductions in port calls are likely to become more prevalent. This was one of the big themes in 2021 and was a major driver of the logjams seen at major ports.

According to UNCTAD, the corresponding drop in schedule reliability was estimated to cost shippers between USD 5 billion and USD 10 billion. It also resulted in a withdrawal of capacity from smaller ports and developing countries.

Source: UNCTAD Review of Maritime Transport 2022

4. Reluctance to Invest

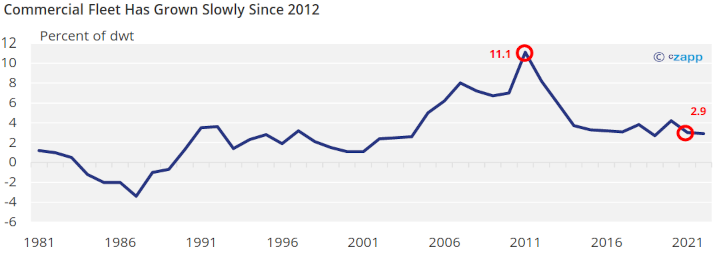

Despite a scramble for additional capacity in 2021, the global commercial fleet did not actually grow very much.

Source: UNCTAD Review of Maritime Transport 2022

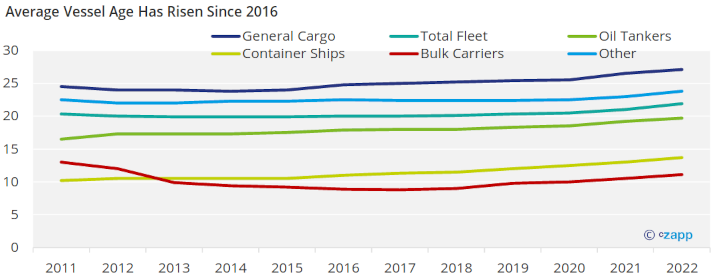

As a result, the fleet has been slowly ageing.

Note: Age is weighted by number of ships and vessel type

Source: UNCTAD Review of Maritime Transport 2022

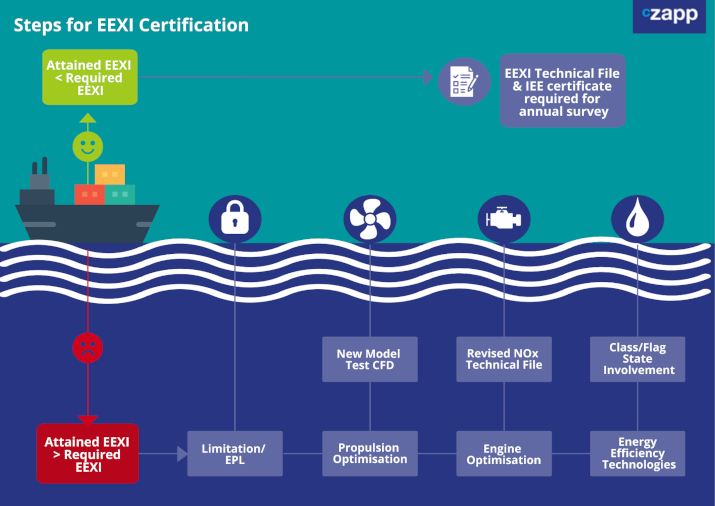

This reluctance to invest is partially a result of new climate legislation coming into force in 2023. The IMO will impose strict emissions regulations, which will force many shipping companies to change the fuel used.

The environment of uncertainty has created a reluctance to invest in new vessels, which will push the average vessel age up further. If the lack of investment continues, going forward capacity will be jeopardised.

Concluding Thoughts

- The environment will only become more challenging for maritime trade in 2023.

- While shipowners are grappling with environmental requirements and new investments, a recession will cause a demand dip.

- The supply chain is still trying to untangle issues created by the huge demand in 2021 and 2022.

- These factors will lead to a decline in capacity and by extension higher rates during the next upturn in global trade.

To view the entire 2022 Review of Maritime Transport Report, click HERE.