- The market outlook is binary.

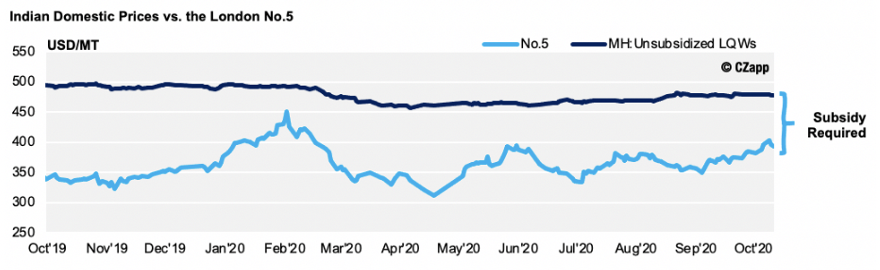

- If India subsidises sugar exports for 2020/21, there will be enough sugar in the world to meet demand at today’s prices.

- If India doesn’t subsidise sugar exports, higher prices are likely.

Raw Sugar Supply in 2021

- We are assuming 2.6m tonnes of Indian raws supply for the world market in H1’21.

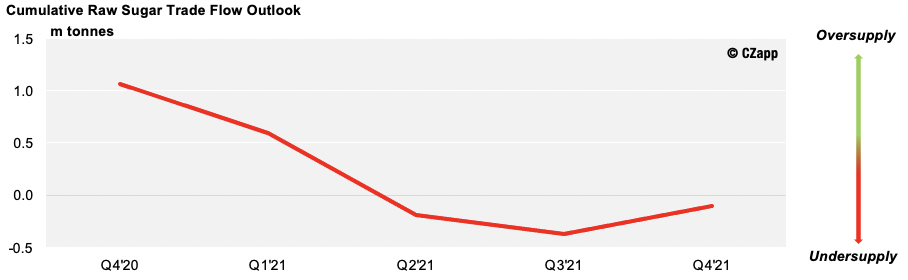

- The world market would barely be adequately supplied if this happens.

- However, if India doesn’t export raw sugar in 2021, the world market would be undersupplied.

- Centre-South Brazil and Australia will have finished their cane harvests and will be exporting the last of their old crop sugars.

- Thai raw sugar availability will be low.

- Central American raws will largely flow to East Asian refiners under trade deals.

Raw Sugar Demand in 2021

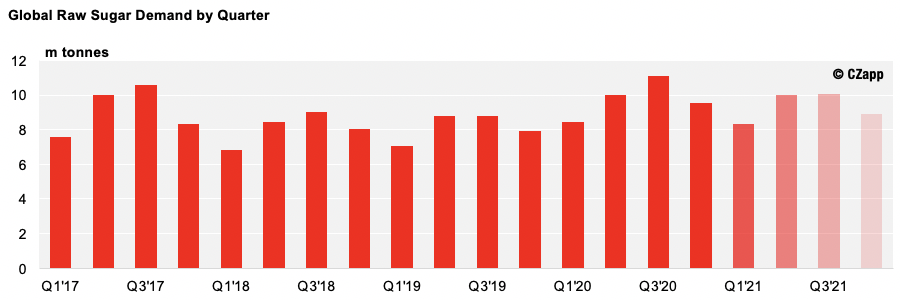

- We’ve been wondering what may happen to global sugar demand now prices are more than 60% above this year’s lows.

- The commercial long position in raw sugar has been falling, which shows that physical buyers haven’t been chasing the market higher.

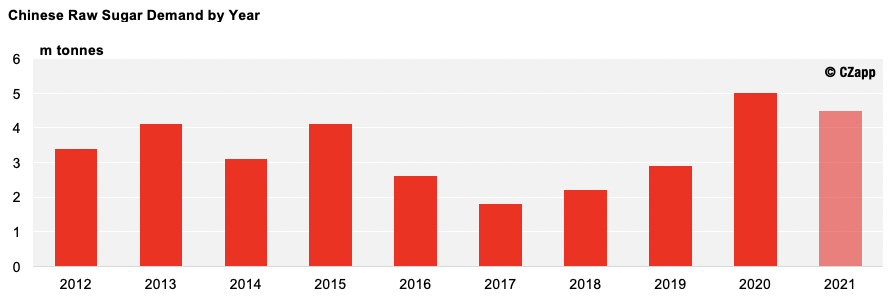

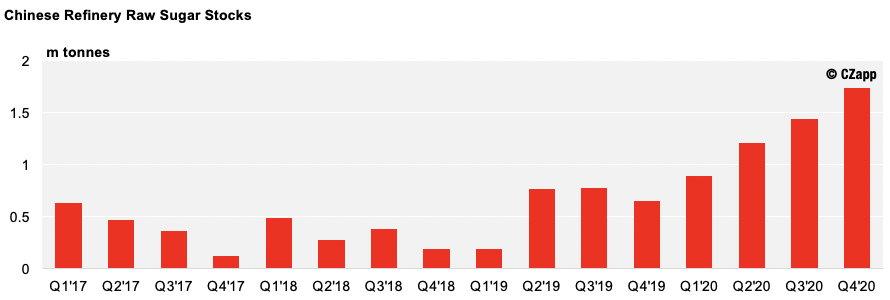

- This year’s major buyer of raw sugar has been China, where imports have been partially deregulated.

- China will import a record 5m tonnes of raw sugar this year, and we think it could import a further 4.5m tonnes next year.

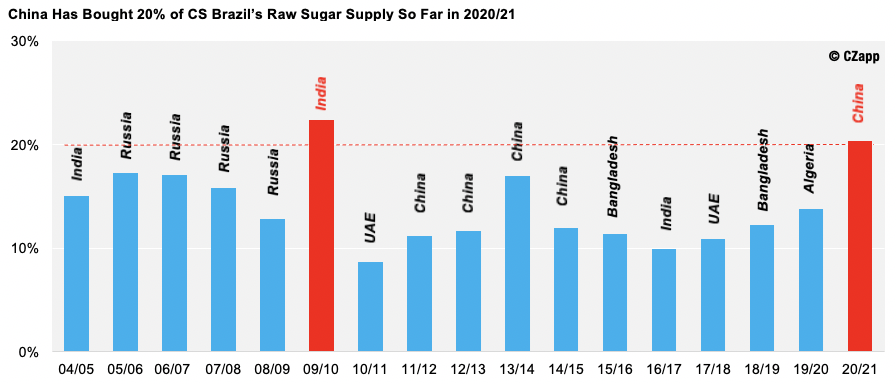

- China has also bought 20% of CS Brazil’s raw sugar so far this season.

- The only other time we’ve seen a single buyer take so much Brazilian supply was in 2009/10, when India pushed the world market towards 30c.

- However, Chinese buying will be price-dependent.

- Chinese refiners were active buyers of raw sugar at around 10c this year, but won’t have made fresh purchases recently.

- We think the raw sugar market would need to fall significantly for Chinese refiners to buy further tonnage for 2021.

- At current prices, they will instead run-down bonded stock for next year’s needs.

- It’s a similar story for destination refiners.

- Many have no flexibility in their operations.

- But some refiners have a large enough raw sugar storage that they can flex their offtake according to the market structure.

- H/N at +155pts makes it hard for these refiners to make an acceptable return, so we’d expect their raws demand to reduce.

The Pressure in CS Brazil in 2021

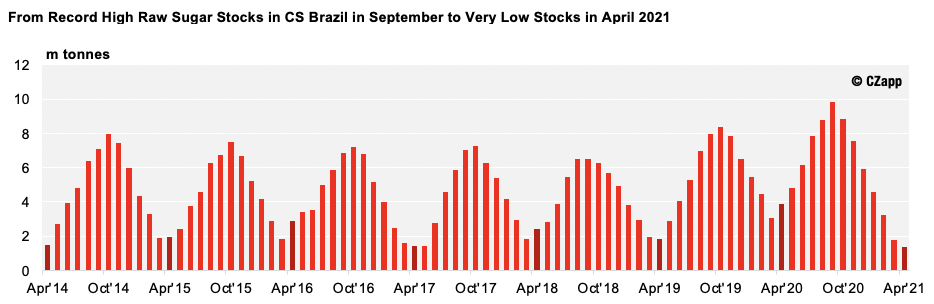

- Nevertheless, if India doesn’t export, the pressure on the start of next year’s CS Brazilian crop in May would be immense.

- This is where the world’s pent-up raw sugar demand would appear.

- We think raw sugar stocks in April 2021 will be among the lowest we’ve ever seen.

- Any delays to cane harvesting in the region could make raw sugar availability even worse.

- Typically, sugar and grains compete for elevation at the ports in May, June and July.

- All of these risks are already being reflected in the K/N spread at 65pts.

Back to India

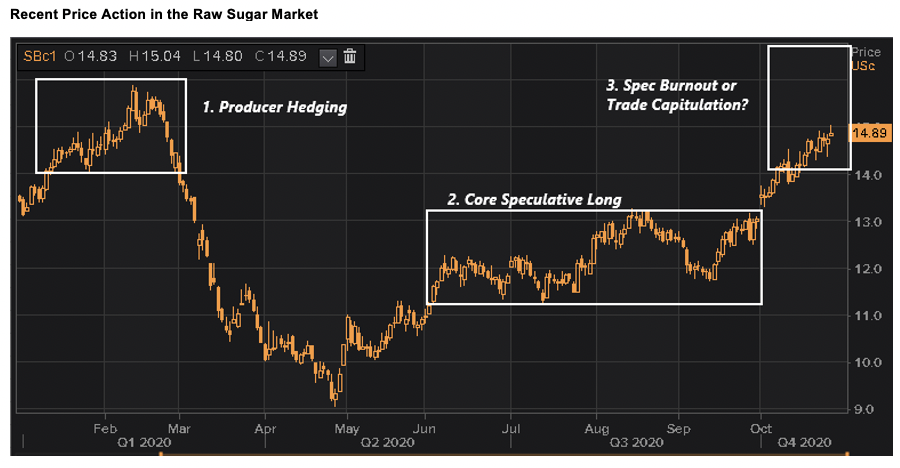

- If India subsidises sugar exports in 2020/21, then today’s sugar prices are probably too high, the speculative momentum would be difficult to sustain, leading to a burnout.

- We would need to see the market fall to a level at which physical buyers re-engage.

- We don’t think the market would fall below 12c because the sugar market cannot afford for Brazilian cane mills to buy back sugar hedges in 2021.

- If India doesn’t export, there is a risk the raw sugar market strengthens towards 19c, which is the level Indian mills could export without an export subsidy.

- The answer to the sugar market is in Narendra Modi’s Cabinet’s hands.

Market Positioning

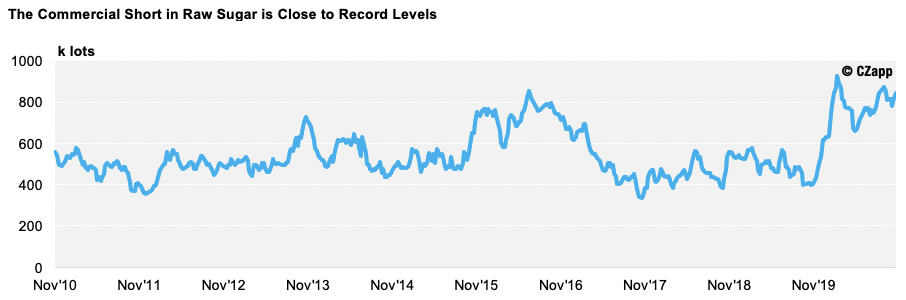

- The prospect of raw sugar heading towards 19c is concerning because of the huge imbalances in market positioning today.

- Brazilian sugar mills have been taking advantage of record high sugar returns to lock in prices for 2021 and 2022.

- This is reflected in the vast commercial short positon in the market.

- These short positions were largely placed between 14 and 15c and are now being held and margined by Trade Houses.

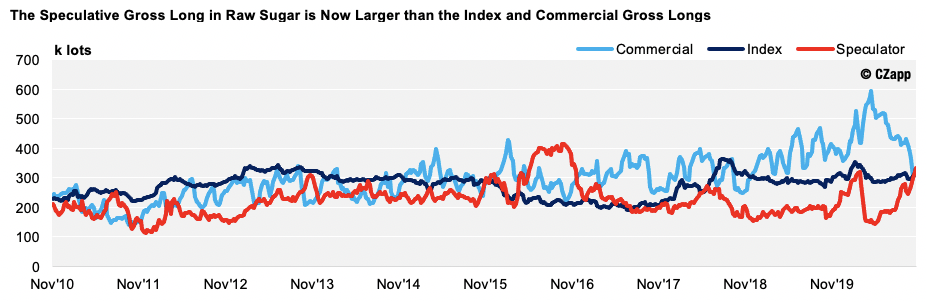

- The other big fish in the raw sugar pond are the speculators.

- Speculators have been buying the sugar market since April, when prices recovered back above 10c.

- Since this time, they’ve aggressively added to their positions.

- For only the second time ever, the speculative long now exceeds the index and commercial long positions.

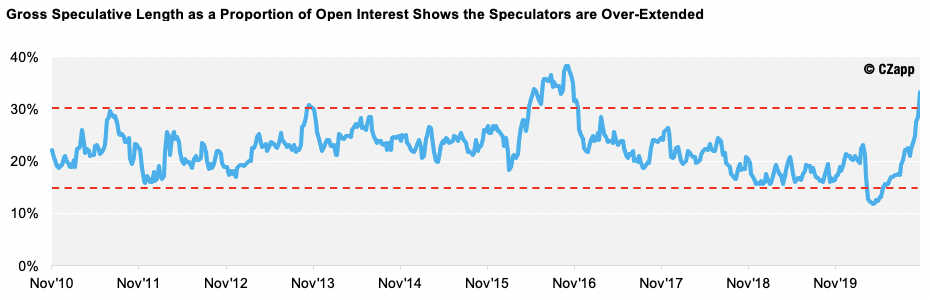

- The gross speculative long position is also above 30% for only the second time ever.

- The only other time this has ever happened was in 2016.

- This suggests that speculators are already over-extended with the market at 15c and a period of consolidation would be healthy.

- However, 2016 tells us to be careful.

- That year, the speculators held an outsized position for 31 weeks, during which time they drove the raw sugar market from 16c to 24c.

Source: Refinitiv Eikon

- There’s no reason they can’t keep their outsized position this year; it’s completely in the money today.

- Every point the market rallies means more margin for the Trade Houses to pay.

Source: Refinitiv Eikon

- Perhaps the ultimate buyer of raw sugar in a blow-off top to 19c would be a Trade House, which is unable to meet its margin calls, leading to a forcible buy-back?

Back to India

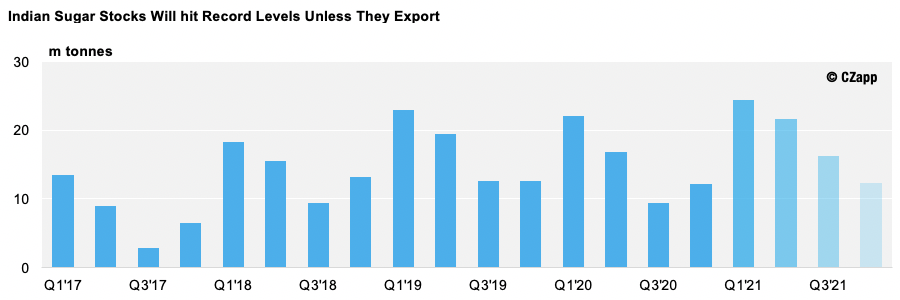

- We think India will subsidise sugar exports in 2020/21.

- Sugar production there will be too large to do anything else.

- The Indian government cannot allow stocks to build to unmanageable levels because this will pressure mills’ cash flows, meaning cane farmers won’t be paid.

- This is politically unacceptable.

- Equally, India’s ethanol programme isn’t large enough to soak up spare sucrose yet.

- India believes WTO rules allow it to continue to subsidise exports until 2023.

- All the Government needs to do to ensure mills have sufficient liquidity is take last year’s export subsidy rules and apply them to this season too.

- We think the notification will be approved in the second half of November, giving cane mills enough time to make raw sugar for export.

Flat Price Outlook

- What does this mean for risk management? Producers with further tonnage to sell for 2021 should continue to sell.

- Current prices should lead to excellent margins and it’s not worth gambling to try to achieve the very top of the market.

- Consumers should seriously consider adding to cover if the market trades back towards 12c.

White Premium Outlook

- A final thought on the white premiums in 2021.

- After all, the bulk of India’s sugar supply will be white sugar if exports are subsidised next year.

- Without cheap Indian white and refined sugar, the white sugar market will be reliant on re-export refiners, and they have a higher cost of conversion than those who make white sugar from cane or beet.

- If there is no subsidised Indian sugar in 2021, we think the white premium will need to trade between $90-110/mt to ensure sufficient supply.

- If India does subsidise sugar exports, the function of the white premium will be to reduce supply from the world’s re-export refiners.

- This suggests the white premiums in 2021 should trade between $60-80/mt.

Other Opinions You Might Be Interested In…

- Thailand Prepares for Worst Sugar Production in 11 Years

- Market View: Speculators Over-Extend Their Position