1,054 words / 5 minute reading time

- The world is oversupplied with sugar; we think the market could weaken further.

- COVID-19 is hitting sugar consumption, which limits the ability of buyers to use low prices to increase offtake.

- Logistical disruption in Brazil is the major bullish risk, and could lead to a savage rally in the middle of this bear market.

Long Term View: From >30c to <10c in a Decade

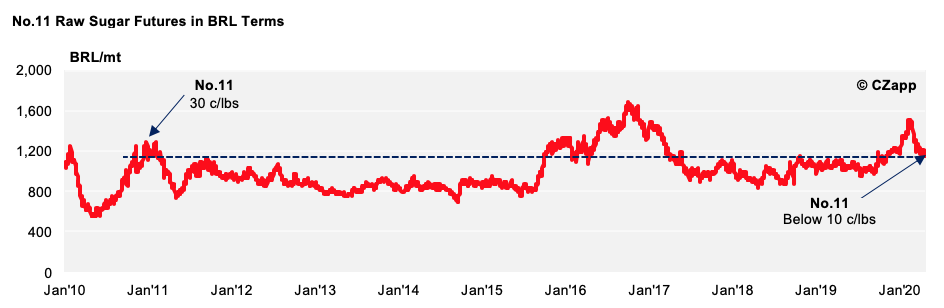

The raw sugar market has finally fallen below 10c.

It’s now the cheapest it’s been in more than a decade. This is good news for buyers.

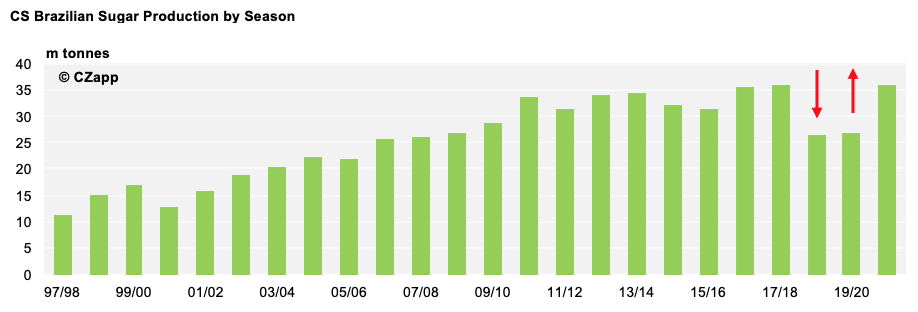

But what’s scary is that most producers have not reduced the amount of sugar they make even though prices have been falling for years.

Sugar mills in Centre-South Brazil (the world’s largest cane region) have been insulated by the extreme weakness in the Brazilian Real.

In fact, sugar prices today in BRL terms are as good as they were during the 30c market of 2010 & 2011.

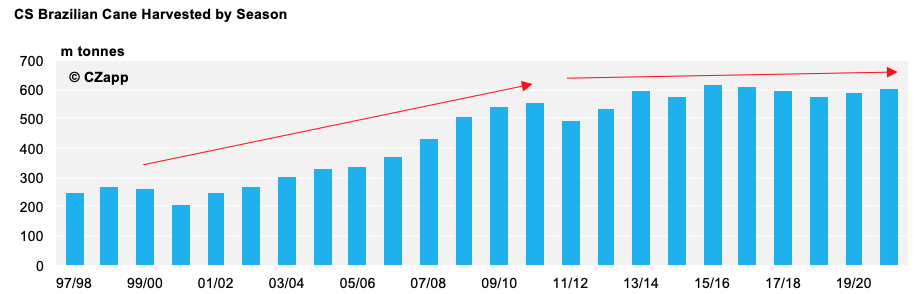

Cane acreage in CS Brazil has therefore been static around 600m tonnes for the last seven years.

India was the world’s largest sugar producer in 2019. Mills make 80% of their sales in the domestic market, which has been fixed by the Government at $410/mt. Their exports are subsidised. Producers in India don’t see the price signal the sugar market is giving because the Indian taxpayer and consumer absorb the losses.

It’s a similar story in North America, where the US sugar programme ensures the American taxpayer and consumer pays a premium for sugar.

Only in Thailand might we have seen a meaningful contraction in sugar production, and perhaps cane acreage. But even this hasn’t been solely due to price. 2019 saw the worst drought in 40 years, leaving some farmers physically unable to plant cane.

We shall have to see whether European farmers reduce beet plantings in 2021 as they come off three-year beet contracts made when the world sugar market was significantly higher.

Until we see some of the world’s major sugar cane and beet regions reduce acreage in the face of low sugar prices, our default position will be bearish on sugar prices in the long term.

Shorter Term Prices: Up or Down?

The collapse in global energy prices means Brazilian sugar mills will lose money on every drop of ethanol they make this year. They’ve hedged almost all of their sugar production for 2020 at close to record levels. Mills will therefore maximise raw sugar production.

This means the raw sugar market will be heavily oversupplied in 2020.

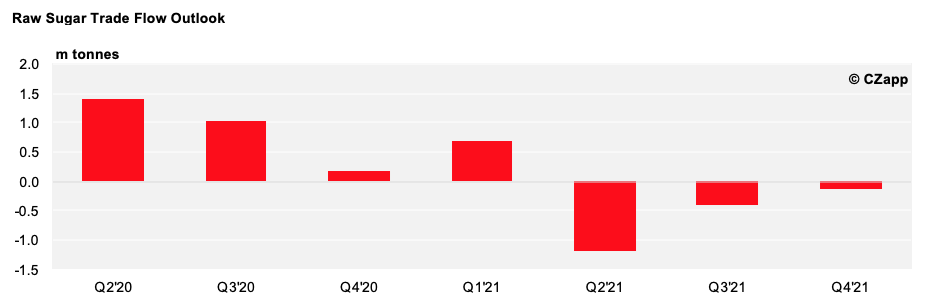

So long as this sugar can be exported without any problems, prices should fall.

Mills in Brazil can make sugar faster than it can be exported. We therefore think that storage in Brazil will rapidly fill up through the middle of this year.

Mills will need to seek third-party storage as their own warehouses fill. These are more expensive to operate. This means the raw sugar spreads are likely to weaken.

We think it is this spread weakness which will lead the market lower. It is possible that the N/V trades to a 40pt discount (full carry for mill storage). V/H could trade significantly weaker still; perhaps past a 120pt discount.

There is one enormous risk with this bearish thesis. It’s no use if mills produce sugar but can’t get it to the port and onto a ship.

There are so many points in the chain which might be vulnerable to a COVID shutdown:

- Can mills operate normally? Look at the problems we are seeing in the American meat packing sector; could they be repeated in the Brazilian cane sector?

- Will truckers or train operatives become sick and unable to work?

- Will roads to Santos and Paranagua port remain open and freely passable?

- Will stevedores be able to elevate sugar for loading onto vessels?

- Will ship movements be normal – will crews be quarantined, will pilots be able to work?

If any one thing goes wrong and impedes the flow of sugar, we could see a severe price reaction higher. Previous logistical disruption in Brazil has led to premium spreads and strongly positive physical values. The sugar market sub-10c doesn’t price in any logistical risk at all.

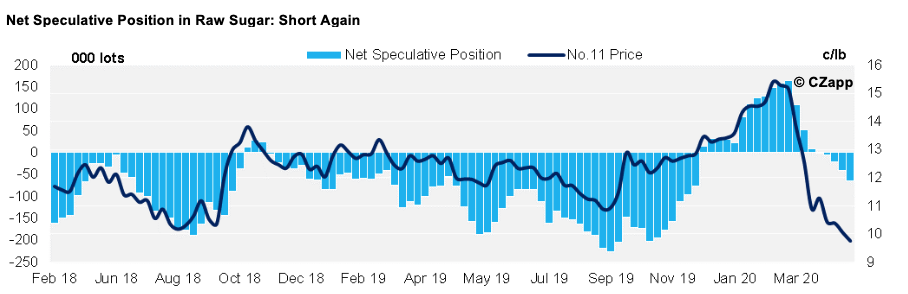

Adding fuel to a possible upside move is the speculative positioning. Speculators hold the smallest position in sugar than they have in the past decade. But they have just started to build a new short position.

Sugar producers are already well-sold. So who will specs buy back from if problems emerge?

The Refined Sugar Market

The one bright spot in the sugar world has been the refined market. White premiums this year have traded close to $100/mt, which is a major contrast to the $50-70 range we saw in 2019.

This means the world’s re-export toll refiners are maximising their throughput, and this means that global demand for raw sugar is decent.

As long as this continues, it’s good news for the sugar market; price weakness in the raw sugar market won’t be as severe as it otherwise might have been.

We think this trend is likely to keep the Q/N white premium above $80, and the Q/V spread at a premium. In the absence of low-cost Thai or European refined sugar being available, the world must pay up for refinery supply.

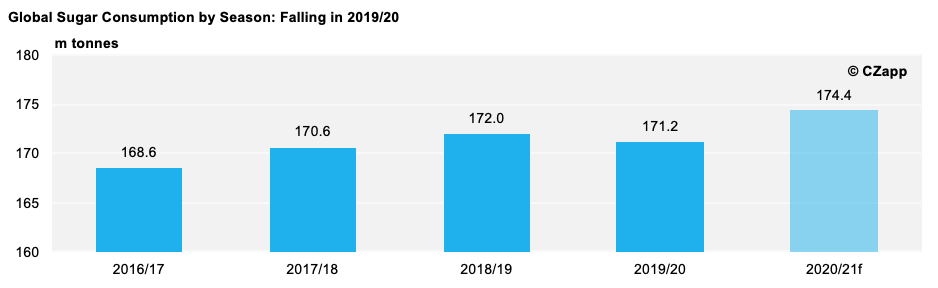

But we are incredibly worried that sugar consumption may fall in 2020, both in per capita and absolute terms. This is because billions of people around the world have had their normal lives turned upside down by coronavirus.

Sugar consumption is extraordinarily hard to estimate properly. We won’t know for months whether sugar consumption has fallen by a little or a lot in 2020. If consumption is falling by more than the market is estimating, at some point we’ll see the world’s food and beverage companies delay their refined sugar offtake. The world’s refiners have very limited refined sugar storage, and so these delays will ripple back through the sugar supply chain.

This means we are concerned the V/V white premium and V/Z spread could unexpectedly collapse in H2’20.