- It’s possible sugar prices strengthen short term as spec shorts may come under pressure.

- However, the macro environment remains negative for sugar.

- European beet crops at risk from prolonged heatwave.

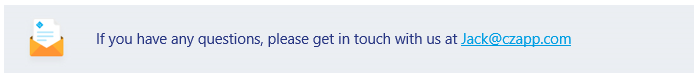

New Spec Shorts Feel The Pressure

- A sizeable speculator net short position in raw sugar has built in recent weeks;

- Their short position now makes up nearly 22% of open interest, the largest since December 2019.

- Many of the fresh spec shorts were opened when the market was trading at 17.50c or below, in an attempt to push the market lower.

- These shorts will have come under pressure in Monday’s move above 18c, leaving stronger longs and the potential for prices to rally back towards 19c.

Source: Refinitiv Eikon

- This is especially true if Chinese refiners continue to buy around 17.50c level, as we have seen on multiple occasions so far this year.

- However, there is also the chance that speculators look to have another attempt at pushing the market lower, especially given weaker macro environment which isn’t very constructive for sugar.

Wider Markets Still Not Constructive For Sugar

- Both ag and energy markets are not looking too constructive with ags trading sideways after dropping below a 2 year upward trend.

- With sugar part of both the agriculture and energy markets, this may limit sugar’s ability to rally or sustain any price increases.

Source: Refinitiv Eikon

- Gasoline is the major link for sugar between the ag side and the energy side as ethanol is blended into gasoline.

- As we have flagged in our sugar market videos, we believe the Biden administration will do what they can to get this back below 2.50, which would be negative for sugar.

Source: Refinitiv Eikon

- It’s also worth remembering that USD still appears to be strengthening which is also negative for commodities.

Source: Refinitiv Eikon

What Do The Fundamentals Show?

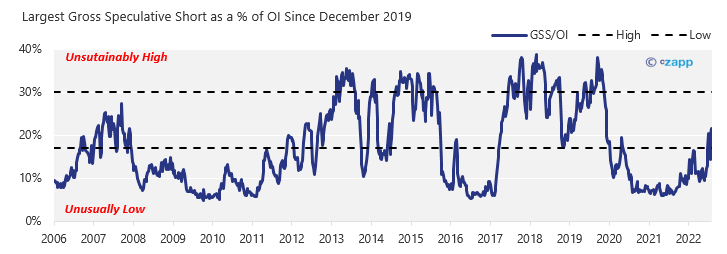

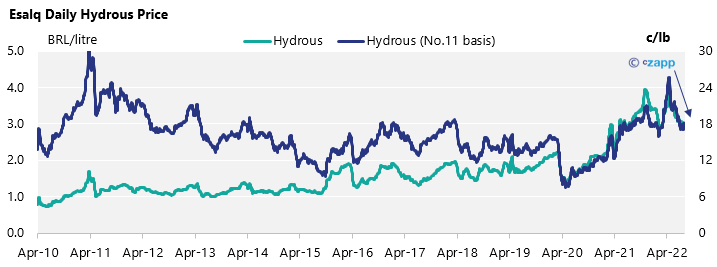

- Continuing the energy theme, ethanol prices in CS Brazil remain under pressure and fell again last week.

- We also believe that as domestic gasoline prices are above international parity they could be lowered again.

- This would make gasoline more competitive than ethanol and add more pressure on ethanol prices.

- This should be negative for sugar, but for now the BRL has strengthened in recent weeks meaning ethanol parity has increased by 50 points to 17.85 c/lb since last week.

- With sugar’s climb back to 18c, it still pays millers about 120 points more than ethanol meaning they should continue to focus on maximising sugar production rather than ethanol.

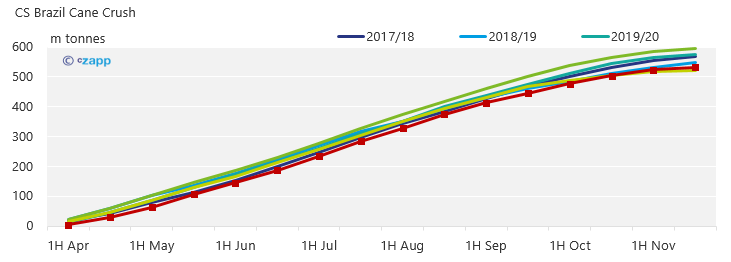

- Turning our attention to the cane, rain has finally arrived in CS Brazil which should be very helpful for cane yields, despite causing a few days of delay to harvesting.

- It’s worth mentioning that some frosts are forecast for later in the week but we don’t expect this to have any noticeable impact on the cane.

- We are more concerned that if it starts to rain in November, mills may shut down as usual, without harvesting all the cane, due to this season’s delayed start.

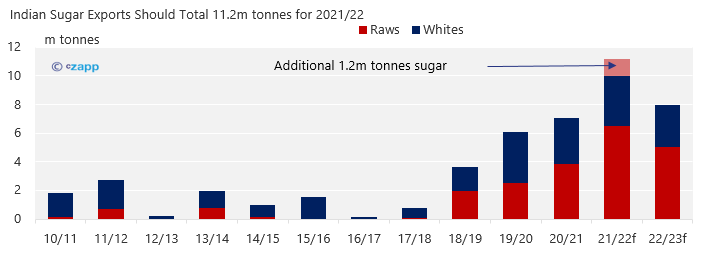

- The other major story from this week is that the Indian government has approved the export of an extra 1.2m tonnes of sugar.

- We believe 700k tonnes of this will be raw sugar with the remaining 500k tonnes as low-quality whites.

- With this additional sugar and the expectation that next season’s cane crush gets underway earlier than normal, Indian export availability should be enough to cover any shortfalls from CS Brazil.

- For any sugar not already contracted, mills will need achieve 19.1c/lb (from No.11 and physical premium) to breakeven against the domestic market.

- This may mean the No.11 needs to trade closer to 19c if this Indian sugar is required.

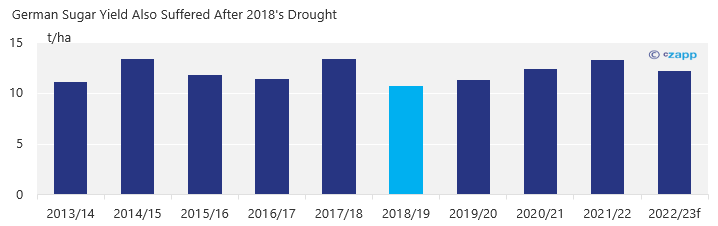

- As we wrote in this month’s statshot, we are becoming increasingly concerned about the condition of the beet crop in Europe, owing to very little rain and extreme heat.

- More farmers across Europe’s beet belt (North West) and the UK are starting to report poor looking beet crops.

- Beet tests from South Germany point to a lower beet yield but much high sugar content – this generally indicates that the beet is under stress.

- The results are like in 2018 when Germany ended the season with very low yields.

- If rain does not come soon, Europe may need to import more sugar to meet domestic demand which would be positive for both the refined sugar and raw sugar market.

- It’s also supportive of the white premium because Europe will have very little sugar available to export.

Long Term Outlook

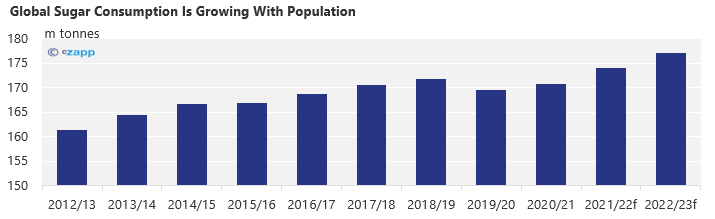

- Sugar consumption around the world continues to grind higher each year, largely driven by population growth.

- This is supplemented by sucrose demand to make ethanol for road fuel.

- While this has happened for decades in Brazil, the fastest growth today is in India.

- In 2022 around 3m tonnes of sugar has been diverted to make ethanol instead.

- In 2023 more than 4m tonnes of sugar might be diverted to ethanol.

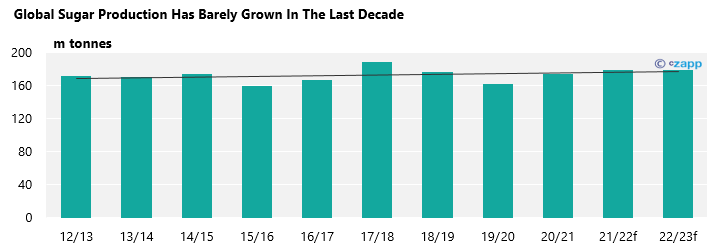

- Set against this, global sugar production has been static for more than a decade.

- A decade of falling sugar prices strongly discouraged investment in cane and beet growing/processing.

- Recent stronger prices might start to reverse this trend, but they need to be sustained for investors to have confidence to allocate capital to the sector.

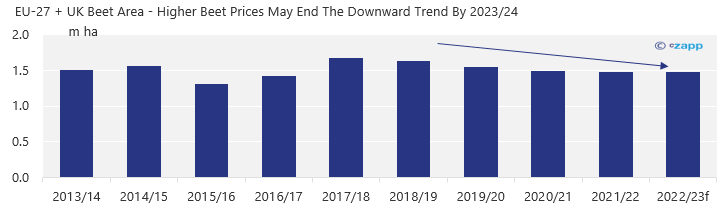

- In India, cane area has been increasing but there has been little change in any of the other main beet or cane regions.

- There is an early indication that that European beet acreage may stop falling and even increase slightly in 2023/24 as beet prices have increased significantly (as much as 48%).

- This should make the crop much more attractive and competitive against other crops for farmers.

- Despite this, we are therefore worried that the world sugar market is approaching the point where global consumption outstrips global production.

- We are one major adverse weather event in Brazil, India, Thailand, the EU or FSU away from another step higher in price.

Managing Your Market Risk

- Producers should continue to add short-term cover above 19c/lb.

- Producers who are braver and looking to hedge for 2023 and beyond could wait for better returns, given our positive long-term view.

- Buyers should look to add longer term cover below 18c and become increasingly aggressive should the market fall close to 17c.

- Given the lack of Thai and European refined supply for 2022, and constraints on some regional refiners, we think the white premium could continue to trade above 130 USD/mt in the short term.