588 words / 3 minute reading time

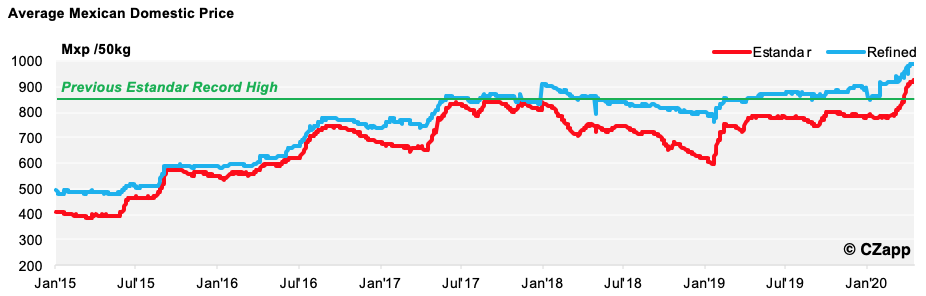

- The average national price for a 50kg bag of Estandar sugar has reached a record high of 986.96mx; over 1,000mx/50kg in some States.

- This is the result of both a further reduction in the domestic crop estimate and the Mx Peso weakening.

- This could impact demand in the short term and lead to a large rebound in production next season.

Mexican Domestic Price Reaches Record High

- The latest WASDE report indicated that the US Department of Agriculture (USDA) expects closing stocks to reach 7.2% of annual demand, based on the current import scenario.

- The price hike is principally due to the Mexican crop ending sooner than usual, due to the impact of the drought seen in the summer of 2019.

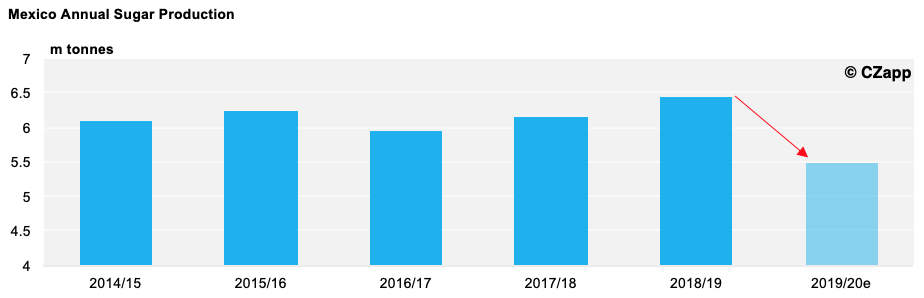

- As mills are beginning to close, the higher ends of the forecasts now seem less likely. We now expect a 5.5m tonne crop, down from our earlier estimate of 5.8m tonnes.

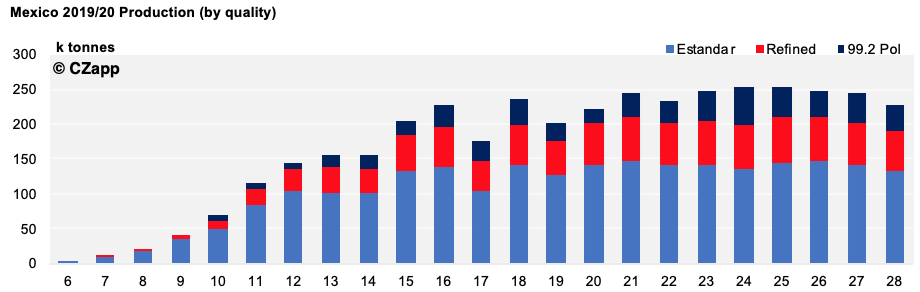

- On top of this, a larger proportion of the sugar currently being produced is sub 99.2 polarity; a spec only for export to the US.

Mexican Crop Downgrade and Quality

- The Mexican Crop now looks like it will end at around 5.5m tonnes; down 0.9m tonnes year-on-year (YoY).

- Whilst this is more than enough to supply the domestic market, Mexico also has quota access to the US.

- This market offers good returns and bears some political importance for the Government.

- It now looks as though the mills are focusing on maximising US exports by producing a higher proportion of sub 99.2 pol sugar.

- This spec is only used for exports to the US as raw sugar (following the trade agreement’s definition of ‘raw sugar’).

- Whilst production for refined and Estandar quality sugar is falling, sub 99.2 pol production has remained fairly steady.

- This means less of the sugar currently being produced is for the domestic market, putting pressure on domestic supply.

A Weak Peso Makes Imports Expensive

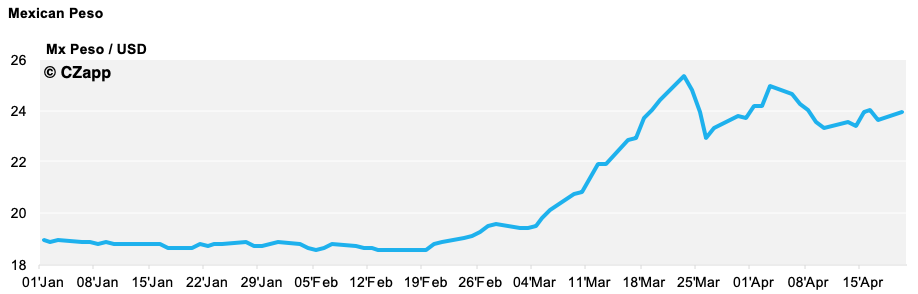

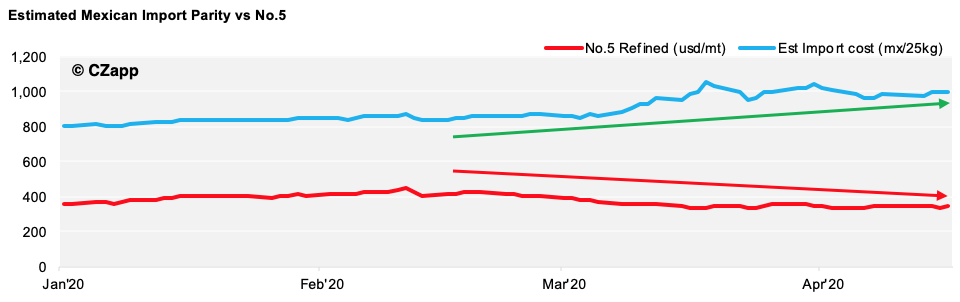

- Mexico’s domestic price is helped by the weakening Mexican Peso, which jumped from 18.7 in the middle of February to 24 by the middle of March.

- This has kept imports from the world market expensive, even as the world market price fell off in 2020 and the domestic price rose.

- This gives domestic suppliers a strong platform from which to negotiate, as they know the only competition into the market is at 1,000mx per 25kg.

- Until we see the import parity fall, we do not expect to see prices fall until the following crop begins in October.

What Impact Will This Have?

- Domestically, the majority of buyers are probably already covered for the year.

- But spot buyers may be dissuaded from buying, due to the high prices and the impact COVID-19 is having on their own production.

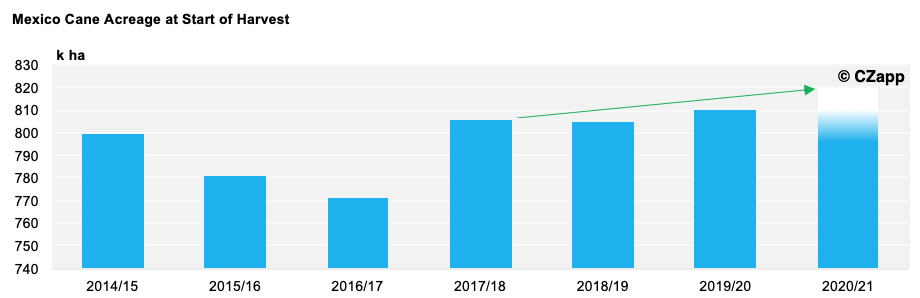

- However, these prices are used to average the returns for cane producers in the country; returns are likely to be at record levels.

- We can expect further plantings this season, hence another record crop in terms of acreage.

- With normal weather conditions, the harvest could rebound to 6.4m tonnes; the same volume as was produced in 2018/19.

- Such a scenario could see Mexico swing from being a 1m tonne world market exporter, to an importer, and then back to a 1m tonne exporter.

- Prices could fall to the 700-800 Peso range, as they did in 2019, leading to the farmer-led warehouse seizures.