Insight Focus

- Mexican cane yields have been hit by poor weather.

- We lower our forecast from 6.05m tonnes to 5.6m tonnes.

- The US to increase their TRQ allocation for Brazil and the Dominican Republic

Mexico is a major cane growing country. It’s also co-joined to the American sugar market under the US, Mexico, Canada Agreement (USMCA), which facilitates trade between the nations. This means that most of Mexico’s surplus sugar flows into the US duty-free, with American corn syrups going the other way.

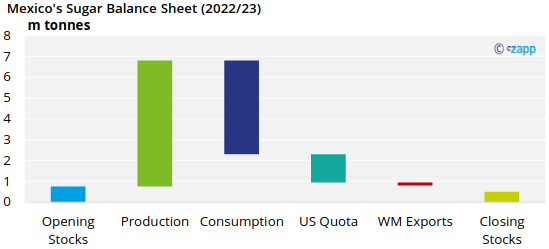

In 2022/23, America believes it will need 1.26m tonnes of Mexican sugar to arrive. However, this year’s Mexican cane harvest is proving tricky.

Problems With Mexico’s Cane Harvest

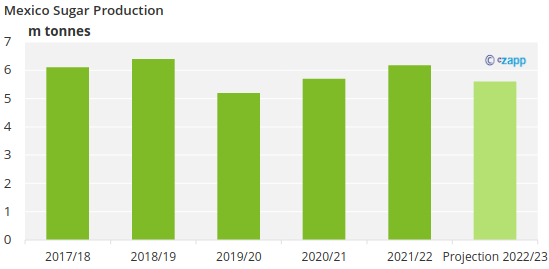

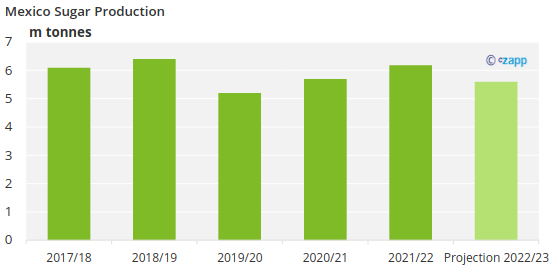

Last month we estimated Mexico to produce around 6.05m tonnes of sugar this year. Optimism behind this figure has dwindled. We now project Mexico to produce around 5.6m tonnes of sugar. This would be the second smallest harvest in the past six seasons.

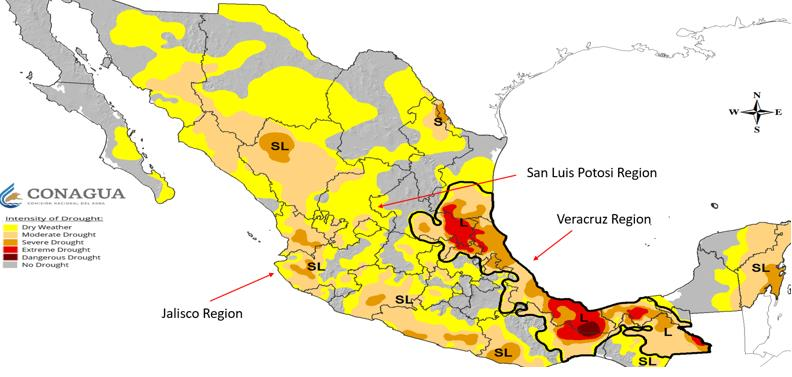

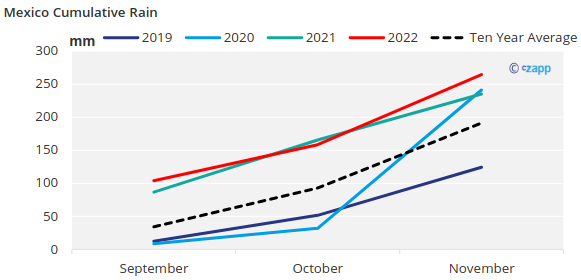

Weather was dry in the Mexican cane regions of Veracruz and San Luis Potosi through the middle of 2022, which limited cane development.

Source: CONAGUA

Around 60% of the cane isn’t irrigated and so was exposed to the full force of the dry weather.

The last time this happened was in 2019/20, when sugar production fell from 6.4m tonnes the year before to just 5.2m tonnes.

Flowering of Cane

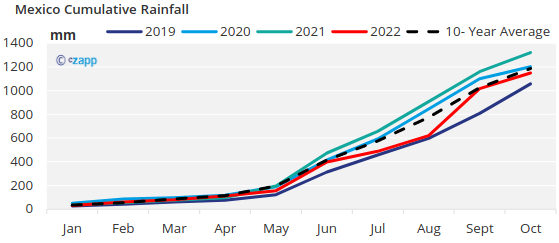

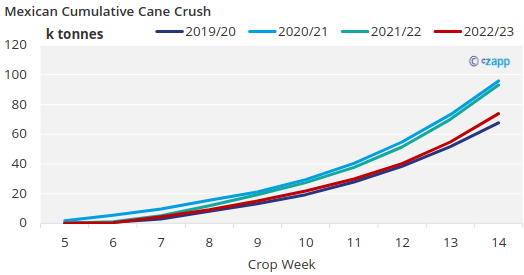

During the first 14 weeks of the cane harvest, less cane has been crushed at mills than usual. Ironically, this is partly because of wet weather in September, October, and November which delayed the start of the harvest.

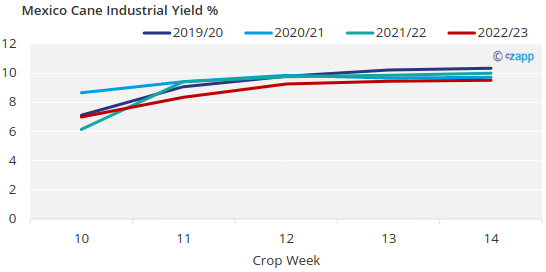

This abnormal rain decreased the exposure of the sugar cane to the sun causing flowering, which usually decreases sucrose yields.

If Mexico makes 5.6m tonnes of sugar this year, we expect 4.5m tonnes to be used domestically and 1m tonnes to be exported to the USA. This would leave around 100k tonnes surplus sugar which could be exported to the world market.

This harvest’s shortfall in Mexican sugar production has led the US to increase raw sugar quotas from other trading partners. The US announced a total reallocation of 220k tonnes. Brazil and the Dominican Republic are the countries most benefiting from the reallocation. Both countries were allocated an additional 40 k tonnes of raw sugar.