Insight Focus

- European milk production stable; UK poised to surpass last year’s output if trend continues.

- MENA region’s milk powder purchases buoy market; South East Asian buyers cautious.

- US dairy hit by bird flu outbreak; human transmission feared.

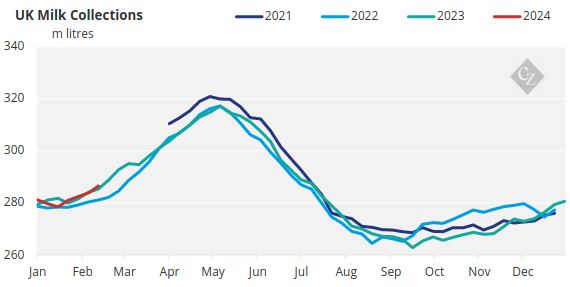

French, German and UK Weekly Milk Collections:

- German milk production has continued its strength through to mid-March, with weekly collections now above the same week of 2023.

- UK milk production continues to track 2023 very closely. At this same point last year the UK had a down week, so if the current trajectory continues then UK collections could quickly streak ahead YoY and is the origin I will be watching most closely over the coming weeks.

- From about the 20th of February French milk production increases have stalled and we have seen a flat-lining in the weekly collections. This is similar to what occurred in France last year.

- The overall group is still up 0.46% for the week beginning 11th March 2024 vs. the same week in 2023.

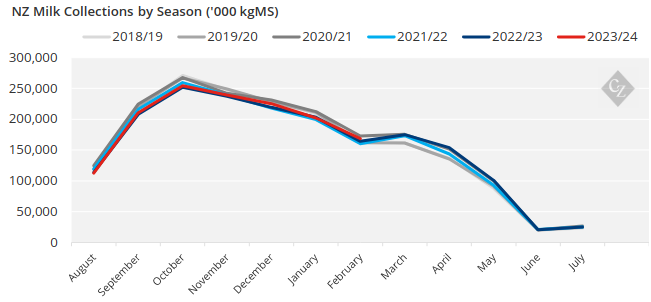

New Zealand Milk Collections:

- It is key to note that February 2024 was a leap year month so has one extra day, this important point seems to have been brushed over in several key reports on NZ Milk Production.

- The latest milk collection figures for the month of February have been reported by all dairy processors. The actual DCANZ print for February New Zealand Milk Production came in at 168.7 million kgMS adjusting for leap year. This is the strongest February in New Zealand since 2021; the 2020-21 season being New Zealand’s record production season. New Zealand milk production is now up 1.06% through this Fonterra Financial Year with all processors reporting very good February production.

- The non-Fonterra group continues to out-perform, 36.5 million kgMS for the group in February once leap year is adjusted for. The group’s market share through this Fonterra FY is inching higher at 21% YTD.

- The strong February appears to be nationwide, with even North Island numbers paring back some of the losses earlier this season.

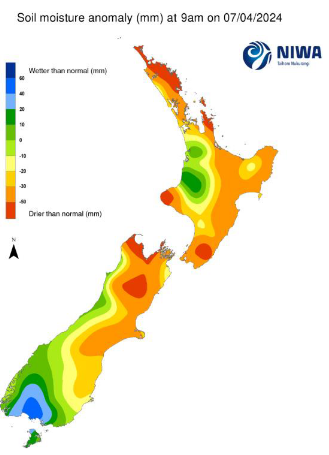

- New Zealand weather in March was unusually cold and drier for most of the country. The important exceptions to this were decent rainfall being observed in key dairy regions of Waikato and Southland.

- The soil moisture continues to be largely the same as it has been all of this year: everywhere drier than usual except for Waikato and Southland.

- Colder temperatures and dry weather will be impacting pasture growth negatively for much of the country but should be ample in Waikato and Southland with soil in good condition for growth. The positive setting in these two regions (combined with parts of Eastern Taranaki) seem to be enough to more than prop up New Zealand’s milk production at present!

Source: NIWA

- Supplementary feed sales have ticked up substantially across the country in the past few weeks. The key exception being in Waikato which has “amazing feed cover”.

- Taranaki is being described as being in a “green drought” and we are hearing that some farmers in this region will be drying their cows off early. We suspect that this will only be the minority as most will continue to maximize their revenue in light of a circa $8 NZ/kgMS payout.

Market Intel:

- We are hearing that two of New Zealand’s larger producers are all but sold out until July/August ETD.

- The SMP/fat stream return continues to significantly outperform that of WMP.

- I made the point in my last article that the MENA region had surprised the market by continuing to buy decent volumes for much longer than most observers anticipated. We saw a decent crack appear in the SMP market after the first GDT in March, this was quickly followed by yet another ONIL (Algeria) tender. This is very important to note, as again we see the MENA region step in and give a level of confidence to the market. ONIL covered their SMP a level higher than most market participants would have expected, particularly in light of strong milk production in Europe as we approach the northern-hemisphere peak.

- Again I want to flag that a large portion of the Southeast Asian (SEA) buyers have been buying hand-to-mouth in the spot market, with many believing that price levels for the past four months have been “too high”. MENA stepping back into the market certainly lends strength to the case that we are near a current “floor” price for SMP.

- We are hearing that one NZ-based processor has been fined heftily (anecdotally circa $1,000,000 USD!) due to goods being over a month late to arrive in Algeria from a recent tender. This highlights the risk-reward balance of participating in these tenders, and such a late arrival would certainly give the government buying agency increased impetus (and ability) to cover larger volume sooner and avoid such gaps appearing again.

H5N1 Bird Flu Outbreak in US Dairy Herds:

- The New York Times have reported on the bird flu virus which is believed to have been passed from a cow to a human.

- At least 16 herds across 6 states are believed to be infected.

- This situation is worth monitoring closely in case a large number of US dairy cows are forced to be culled.

- Infected cows are believed to exhibit reduced milk production and decreased feed consumption. Farms with infected animals have been instructed to destroy milk as the milk has been found to contain H5N1 viruses.

- Pasteurization of milk does destroy the virus according to the US Food and Drug Administration (FDA). Consumption of raw milk or products made from unpasteurized milk from infected cows could pose a health risk.