Insight Focus

- German production has risen and continues to show strength.

- Dry conditions in New Zealand have impacted Fonterra’s North Island.

- China’s domestic milk production is expected to keep growing, impacting WMP imports.

Europe Records Healthy Milk Collections

France, Germany and the UK together account for almost half of all milk production across the EU/UK. So, it is important that we watch them as a guide for milk production in Europe as a whole. The European peak is now less than two months away and if things continue on the current trajectory, it could be a big one!

German milk production rebounded strongly in week five of 2024 and has continued showing strength since. This is the major driver of the bloc now, since it is 0.65% higher for week seven versus the same week last year.

Meanwhile, UK milk production continues to track 2023 very closely. French milk production is improved on 2023 but is below 2022 levels. 2024 is tracking quite consistently at weekly collections right between 2023 and 2022.

New Zealand Dries Up

The latest milk collection figures for the month of January have been reported by all dairy processors. After underpredicting the December collections by circa 5 million kgMS, I now find myself having gone the other way and over predicted for January by 6 million kgMS. The actual DCANZ print for January New Zealand Milk Production came in at 201.8 million kgMS. The substantial drying out of most regions seems to be offsetting the decent conditions still observed in Waikato and Southland.

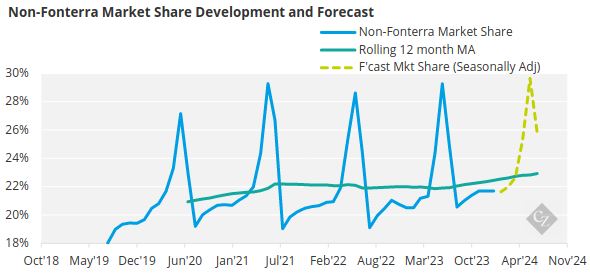

Our predictions for the non-Fonterra group are still on point at 43.4 million kgMS for the group in January and a stable 21.3% market share through this Fonterra FY. The relative growth due to milk won from Fonterra is consistently evident.

It is the volatility in the Fonterra numbers which are generating the surprises. While the South Island is still strong, Fonterra’s North Island farmers were down a lot. Hot and dry conditions were to blame for this.

However, reading between the lines, given that Waikato has not experienced quite the same dryness as the rest of the north, Fonterra’s market share losses have been significant in the Waikato. This makes total sense as it is also where the new non-Fonterra assets have come online.

New Zealand weather in February was very dry and unusually sunny but with relatively normal temperatures. The soil moisture continues to be largely the same as it was a month ago, with everywhere dryer than usual except for Waikato and Southland. With the plentiful sunshine, pasture growth should be ample in these two regions with soil in good condition for growth. Everywhere else is browning off quickly.

February collections are hard to call, but we should see a continuation of non-Fonterra outperformance year over year and the wider country being down year on year once the leap year is adjusted for. We expect the Non-Fonterra bloc to come in a touch under 35 million kgMS.

It is clear that the EU peak is looking like it could be strong while NZ is drying out and milk production there could potentially drop quickly.

All Eyes on Southeast Asia

The two big questions aside from these topics are: “How much milk is China going to produce?” and “What is going to happen to SMP prices?” It’s fair to assume that we will see a continuation of the impressive growth in Chinese domestic production and that this will continue to substitute a growing amount of WMP imports.

SMP is the more interesting one in my mind. The MENA region has surprised the market by continuing to buy decent volumes for much longer than most observers anticipated. The most recent GDT event is the first time we have seen a decent crack appear in the SMP market. A large portion of the Southeast Asian buyers have been buying hand-to-mouth in the spot market, with many believing that price levels for the past four months have been “too high”.

Southeast Asia as a region has a reputation for being the best at picking the bottom for dairy. Their share of purchases on GDT are often higher than usual around localized bottoms in pricing. Thus, the Southeast Asia share is certainly something to watch! This is especially true since MENA has stepped back for the first time in a while, and Ramadan begins very soon.

The milk growth is likely to be in Europe though, and without the Red Sea open at present this product has a much longer (and more expensive) voyage to Southeast Asia. A lot of US milk seems to be flowing to cheese so US SMP is unlikely to be as present in the Southeast Asia battleground this year.

Red Sea Issues May Generate NZ Premium

If the Red Sea remains closed when Europe hits its peak in May then we may see New Zealand SMP pricing attract a statistical premium over EU at a FOB level. CIF prices might be similar but there may even be a New Zealand premium on this basis due to supply security benefits of the 25-day transit from New Zealand versus one approaching two months from Europe if goods go around Africa.

A cautionary note is that while it might seem intuitive for New Zealand processors to swing as hard as possible to the SMP/fat, observers must remember that Fonterra’s milk price is largely driven by WMP pricing, and that Fonterra is structurally short WMP due to its Milk Price construct.

This means that Fonterra will always make a little more WMP than most commentators expect, to help sell into rallies – or risk having its EBIT squeezed quickly. This effect is most heightened in the shoulder period of the season, i.e. now.

Beef prices in the US are strong and we are hearing that culling rates remain elevated. Many farmers are even breeding their dairy cows with Angus or other beef bulls to begin the cows’ lactation cycle while creating offspring with better beef yields. We are told that beef’s contribution to the overall dairy’s revenue has tripled in recent years.