Insight Focus

- Volatility is mean-reverting in the medium to long term.

- It is influenced by factors like cointegration between price with underlying value.

- Volatility trading often focuses on assessing implied volatilities relative to expectations.

Definition of volatility: a statistical measure of the dispersion of returns for a given security or market index.

Definition of implied volatility: the level of volatility at which market participants are willing to swap risk in the future, at a given point in time. It can be thought of as the market’s view of a likely movement in the price of the underlying security.

Definition of cointegration: when two or more time series cannot deviate from equilibrium in the long term.

This article builds on a lot of the concepts which I introduced in the Mean Reversion article last month.

Exploring Volatility:

- Volatility in itself is mean-reverting in the medium to long term. Without going to elaborate detail the reason for this can be conceptualized as follows:

a) If the security has some underlying value then its traded price is cointegrated with that value. The volatility is the uncertainty of the traded price as it tracks the security’s value.

b) Another way of conceptualizing this is that volatility is like the distribution of a cross-commodity spread trade between the traded price and value of a given security.

- A characteristic feature of volatility in the long term is that it sometimes spikes up very fast and then returns down gradually.

- Volatility is generally called “vol” by options traders and we will use this convention for the rest of this article.

Calculating Historic Vol:

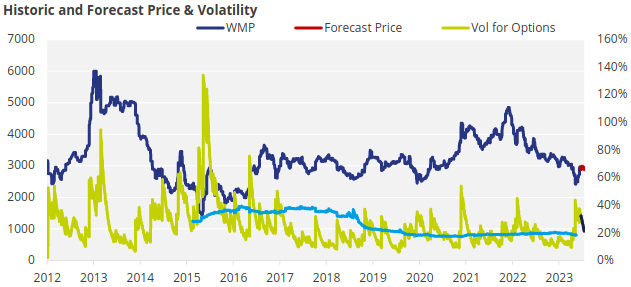

- Utilize daily price data for the commodity under review. I am using daily SGX-NZX Whole Milk Powder (“WMP”) pricing again here.

- It is better to use log price data for vol calculations, like mean-reversion analysis. This is because log returns have more stable variance, handle gains and losses in the underlying symmetrically and are more likely to be normally distributed.

- Smooth daily volatility using an exponentially weighted moving average. Like mean-reversion analysis, the daily observation of vol can in itself be quite volatile and susceptible to market movements. Smoothing has the benefit of including past observations while weighing more on what has happened to the vol more recently. This can then be annualized to a value which is more meaningful.

Vol Trading – Beyond Options:

- Options are the most common and easiest way to trade vol.

- Options are forward-looking instruments. The price of an option is most sensitive to input for vol that the trader is using in their pricing model (like Black-Scholes).

- Trading vol is all about your view on where vol is trading now (implied vol) vs. what you think vol should be trading at. This will help you to uncover relative value. Sure, if you are bullish on price you can buy a call and it may pay you – but understanding vol can help you to determine whether you expect to buy those calls cheaply and can seek to uncover additional value, or if they are expensive.

- Since vol tends to revert to its mean over time, it’s valuable to compare the current calculated historical vol levels, the Long Run Mean (“LRM”) of vol and the implied vol being traded at that point in time. This analysis can aid in deciding whether to take a buying or selling position in vol. For instance, if your calculation indicates that the vol is currently “low” compared to its LRM and implied vol is also trading at this level, then you could reasonably anticipate the potential for a profitable trade by purchasing vol. It is incredibly important to consider market fundamentals when determining your forward view on vol and not just compare it to the LRM.

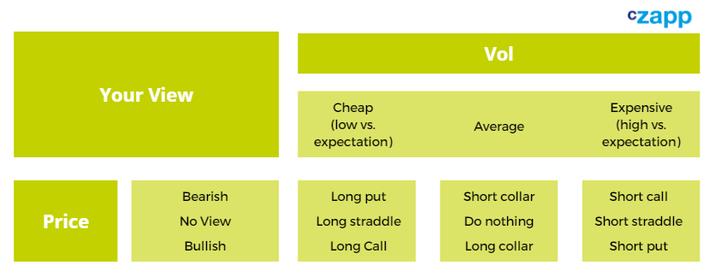

- Options trades themselves can be employed either directionally with respect to price or not. There are many options strategies available, and the below table suggests some of the most basic for given states of the market:

- The best way for a trader to attempt to exploit a mispricing of traded vol in the market is for them to enter what could be an advantageous option position and then Delta Hedge this to expiry. If the trader correctly identified this mispricing of vol then they can lock in a risk-free profit by delta hedging their options position through to expiration using the underlying futures. This topic is the subject of an enormous amount of financial literature so for the purpose of this article please take it as given.

Case Study using SGX-NZX WMP data and Trading Insight:

- Values below are as at 28th September, 2023:

a) Spot price = $2,915 USD/MT

b) Current vol = 33.1%

c) LRM of vol = 18.6%

- We have used the same MRR methodology here for the vol of SGX-NZX WMP that we did for the price of SGX-NZX WMP in the last article.

- Expectation is that vol will decrease (i.e. it is “expensive”) and that price will increase. So the best course of action is to be short puts.

- The trader must determine the optimal strike price and expiry month for their puts based on their knowledge of the fundamental and technical market. If buying options then their budget is a key consideration (as a premium is paid for the purchase of options), however with the sale of options a total premium sought to be collected should be front of mind.

Hedging using options:

- If a user of WMP had an indexed supply agreement linked to GDT, they could use the SGX-NZX futures to lock in pricing when they saw value.

- Alternatively, the hedger could use options to reduce their price risk.

- Options can be used by hedgers like insurance, where a premium is paid and protection is given beyond a chosen price level.

- The added benefit of using options to hedge is that the hedger can benefit from positive movements in price. For example:

a) If a hedger locked in their May 2024 ETD FOB price today at $3,370 USD/MT using futures and price went down $40 USD/MT at expiry then this would be a $40 cost from their margin account.

b) Whereas if a hedger bought a March 2024 $3,400 strike call for $30 USD/MT and price went down by $40 they would be able to buy that price physical $40 cheaper so would be $10 better off than had they bought futures, while still having had protection in place in case of the price taking off over that 6-month period.

- An understanding of the relative value of vol and what this means for the option premium can help the hedger to determine what might be the best course of action to reduce the price risk on their future purchases.

Risks to be aware of when trading in vol:

- Getting out”/liquidity risk: as per the previous articles in this series, the same applies here especially when operating in relatively illiquid markets such as dairy. Options on futures are typically even less liquid than those of the underlying futures so special care must be taken when sizing a position to ensure that you are able to exit if required, especially if the trader is short options.

- “Gamma risk”: that being delta hedging when the price of the underlying is very close to the strike price of the option transacted. When the price of the underlying is near the strike price of the option the delta of the option is at its most sensitive. This can require a lot of transactions to maintain the delta hedge which can be particularly costly in markets with wide spreads (and high implied transaction costs).

- Being short calls has essentially unlimited price risk, this is a very risky strategy and should be considered very carefully before entry.

- Balancing risk/reward and timing when determining your entry and strikes: you want to give yourself the best opportunity to be right at the right time. Being right alone can lead to a trader losing money. For example, if the vol is substantially “cheap” vs. your expectation then you should seek to enter an options position that is far enough into the future to give vol enough time to converge to normal, with a sensible strike, while not increasing the option premium to such a level that the opportunity no longer exists. I.e. balance potential profit with time to options contract expiry. It is key to still “get in”, you should be comfortable paying up a little to get a valuable position on rather than missing out entirely.

Want to understand volatility better and how this might be used to dynamically manage your price risk but can’t do it alone? Call us!

- To transact volatility on your own you need:

- To understand volatility and what products are most appropriate to trade to benefit from your view on vol.

- Access to the associated/appropriate markets.

- Access to physical product and approval to buy physical product linked to an index.

- The ability to fund potentially large values in your derivative margin accounts for several months.

- If you think that this kind of structure could benefit your business but don’t have all of the components in-house, then CZ can help facilitate this for you transparently.

- Get in touch with Tom at TSoutter@czarnikow.com.