Opinion Focus

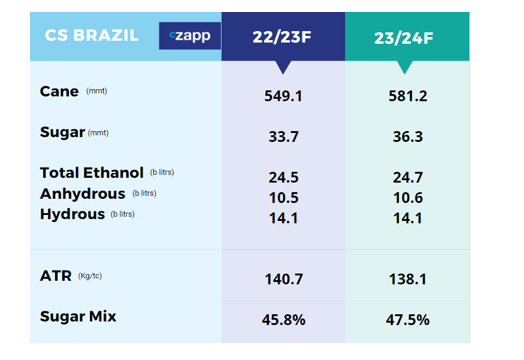

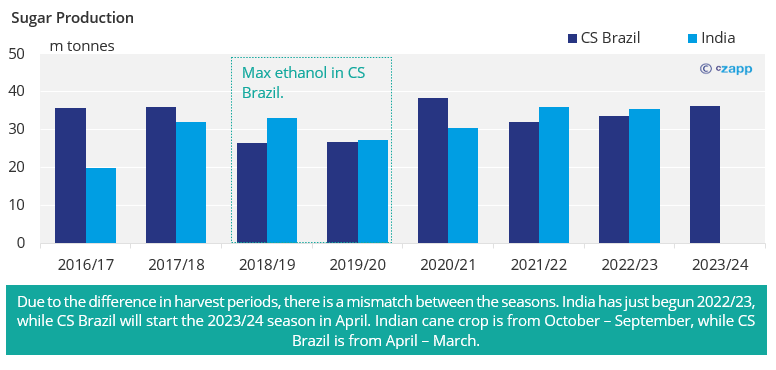

- We think Centre-South (CS) Brazil will make 36.3m tonnes of sugar in 2023.

- This would be the second highest on record.

- CS Brazil will become the world’s largest sugar producer once more.

After 2 years, Centre-South (CS) Brazil will once again take over the title of largest sugar producer from India. We think CS Brazil could make 36.3m tonnes of sugar in 2023, while India should produce 35.5m tonnes.

With a raw sugar availability tight throughout 2023 and futures close to 20c, Brazil’s performance will be followed closely this year.

A Stronger Start to Sugar Production

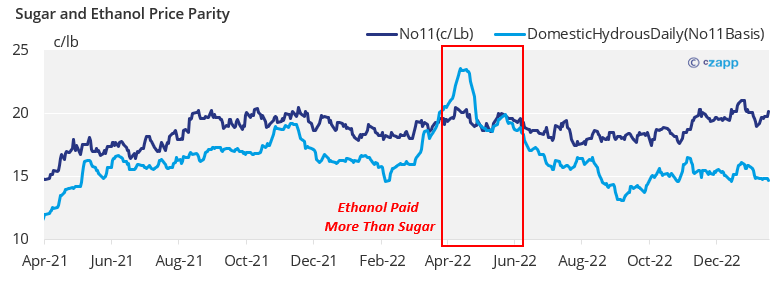

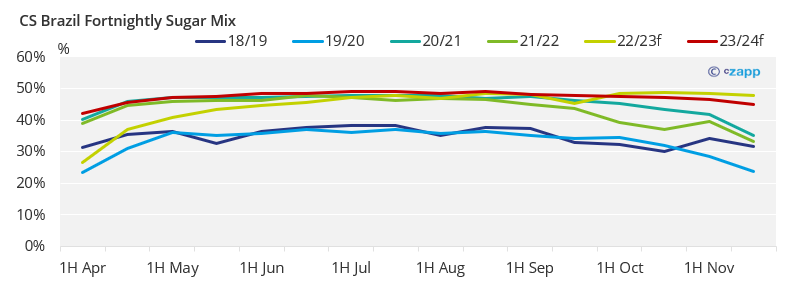

Unlike last season, sugar is expected to continue to offer better returns than ethanol when the season starts in April.

In 2022, ethanol prices were above/close to sugar until mid-June. As a result, cane mills prioritised ethanol production over sugar for the first time since 2019. In 2023 we expect mills to prioritise sugar, meaning 2.2m tonnes more sugar should be made in Q2’23 compared to Q2’22.

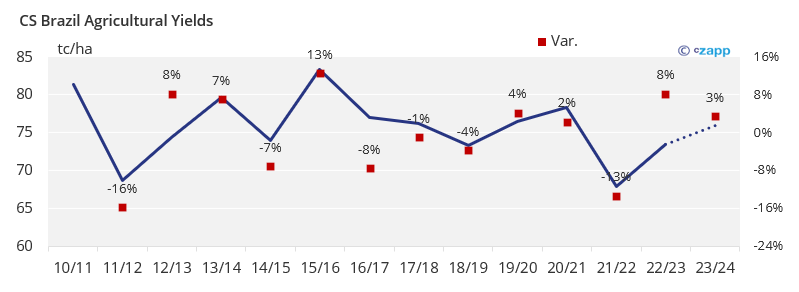

We also think more cane will be available for crushing in 2023/24. After 3 years of below-average rains, cane fields have started to recover. Agricultural yields in 2022/23 rebounded by 8% reaching 73.5 tonnes of cane/hectare. The overall cane crush should reach almost 550m tonnes – a 5% increase year on year.

Rainfall in 2022 was good, and we conservatively expect a 6% increase on cane crushing from 550m tonnes to 581m tonnes this season. There is an upside for this figure, depending on how close to average rains are in this first quarter (which are essential for cane development).

Logistics Will Remain an Issue

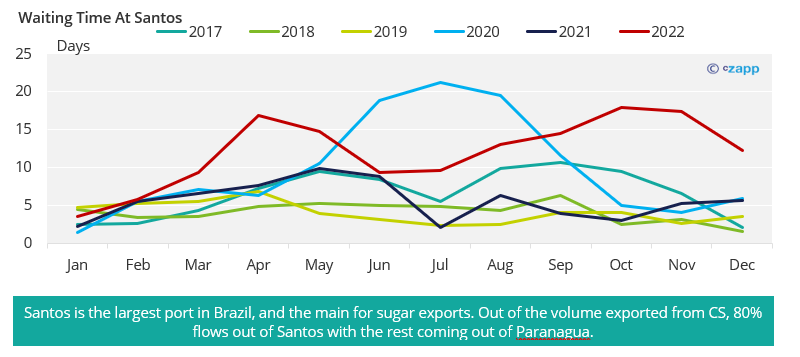

Last year, logistics were a big issue for sugar flow out of Brazil. Massive demand combined with vessel nominations arriving all at once led the waiting time to berth at Santos to start rising in July, reaching almost 20 days in October and November. Additionally, freight rates from the countryside to the port more than doubled.

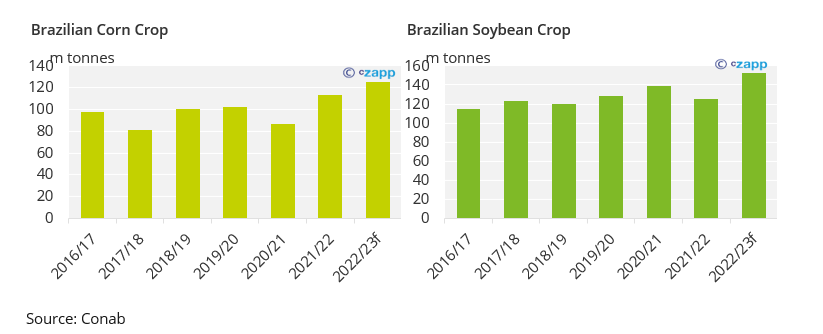

This year, things could be even worse. Conab (National Supply Company) forecasts record corn and soybean crops, with one increasing by 10% and the other by 21%.

Santos has 4 sugar terminals that also operate grains: CLI (ex-Rumo), VLI, Copersucar and Teag. We estimate, considering terminals efficiency, that Brazilian sugar exports are capped at around 2.6mi tonnes per month.

So, this year, remember not to limit your focus around sugar production and UNICA figures. Following logistics in CS will be key to know if the sugar being produced is able to flow out easily from Brazil.

Crop Summary Table