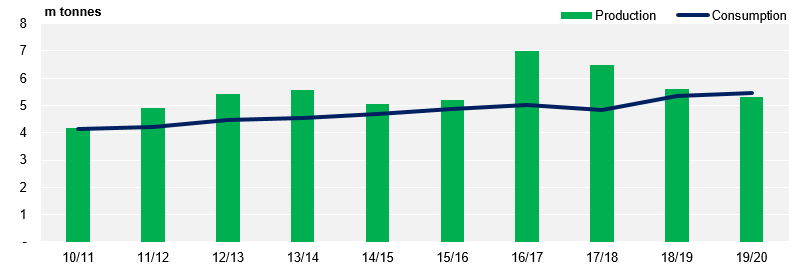

- We think that Pakistan will not export sugar in 2019/20.

- Low stocks mean domestic market sugar returns are currently better than the world market.

- We expect production to fall below consumption for the first time in 10 years.

Exports Stopping

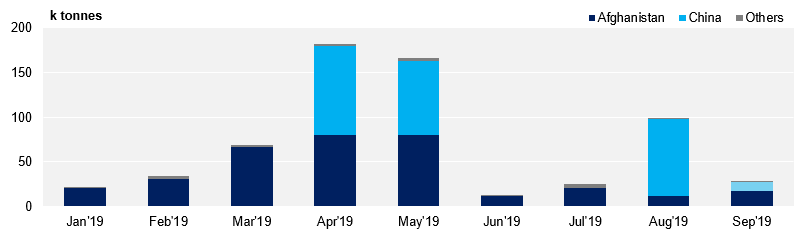

- Since May, Pakistani exports, other than those to China, have slowed significantly as the $35/mt (PKR 5,350/mt) export subsidy was removed.

- With sugar prices in Pakistan remaining well above the world market price we think that this trend will continue as the domestic market offers the best return.

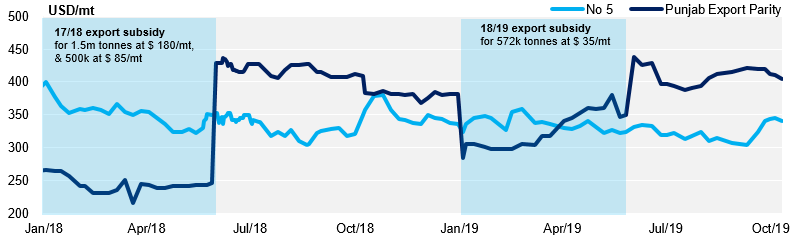

Pakistan Prices Below Export Parity

- The exception to the slowing exports is China, where exports as part of a free trade deal have continued to flow.

- 278k out of 300k tonnes has been shipped as part of the Government to Government deal (GTG).

- It is rumoured that the Chinese paid $416/mt, well above the world market price, to ensure the full quota from this deal was filled.

- Currently, we do not expect Pakistan to be part of another sugar GTG deal this coming year.

Pakistan Exports

- Based on stock levels, there is also little available surplus to ship meaning we do not foresee an export subsidy next season.

- Demand from Afghanistan, as much as 500k tonnes per year in the past, will need to be met by alternate origins.

- We believe that Afghanistan is likely to increase its offtake of Indian whites by around 250k tonnes YoY.

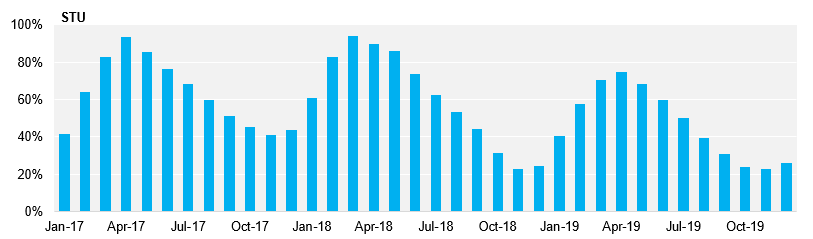

Production Shortfall – Lowest Stocks in Three Years

- We think that stocks in Pakistan will fall to their lowest level in over three years.

- Stocks will be just over 1m tonnes at the end of October or just over 20% Stock to Use, which we think is a comfortable stock level.

Pakistan Stocks

- This is because we expect production to be 5.3m tonnes, the first season in 10 years where production is below consumption.

- This is due to dry weather in Sindh, one of the key cane growing areas in Pakistan.

Domestic Price Softening – No Impact

- Despite the market dynamics, domestic prices have reduced slightly over the past month.

- We think that prices will be supported as mills in Sindh have decided to sell limited quantities of sugar with a minimum price at PKR 67.5/kg, in order to support the domestic market.

Pakistan Domestic Price Coming Under Pressure

- We think prices have come under pressure because demand from Afghanistan has been displace by Indian whites due to the high Pakistani price.

- Additionally mills have tried to boost their cash flow in preparation for cane purchases by increasing their sales rate.

- The government has also introduced a new ID card system of regulation amongst local sugar traders meaning that traders can no longer buy sugar to hoard as part of a speculative move.