Insight Focus

- Brazil soybean harvest 5.2% complete vs 11.6% last year.

- Rains have disrupted harvesting so far.

- This is also delaying the safrinha corn plantings.

Forecast

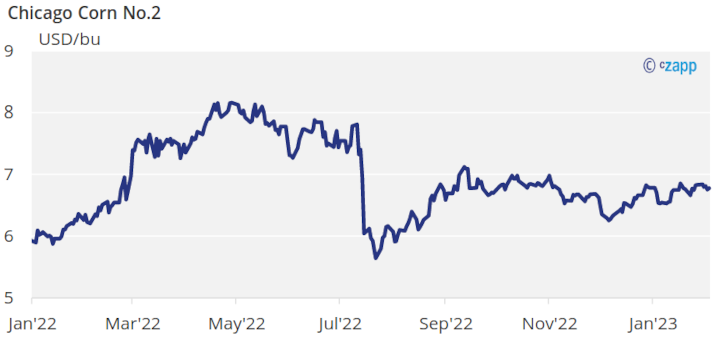

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,7 USD/bu.

Market Commentary

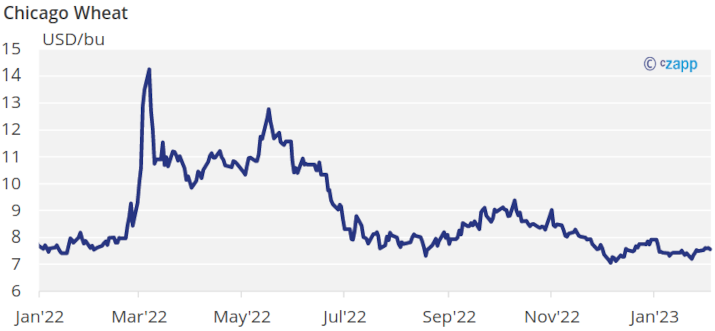

Another lateral week for grains but this time slightly negative with the only weekly gains seen in Chicago Wheat.

The week started with US Corn inspections lower than expected but Wheat inspections were better than expected.

Fob Gulf prices continue to be less competitive than Fob Brazil prices capping Chicago Corn prices.

In Brazil, Corn production forecasts for 22/23 range from 129,1 to 125,1 mill ton and this is vs. 116 last year. Meanwhile, the Soybean harvest continues to run slow with just 5,2% complete vs. 11,6% last year. Key state Mato Grosso has harvested 16,3% of the area vs. 31,7% last year. This starts to be something to watch closely as after Soybeans are harvested safrinha (second corn crop) is planted which has started already and is 3,9% planted vs. 14,5% last year. First Corn crop is 7,8% harvested vs. 11% last year. The problem is that rains continue to be expected in Brazil which could further delay soybean harvesting and safrinha Cron planting.

In the Wheat front, besides the better than expected US export inspections, there was good tender activity. Russian exports are also running well at some 20% higher year on year despite sanctions.

Rains in Argentina are now expected to finish and weather is expected to turn warm and dry. Brazil is expected to have rainy weather. In the US, cold and dry weather is forecast in the north similar to what is expected in Europe.

The export corridor out of Ukraine expires by mid-March and like it happened before the previous expiry, speculation around the extension of the corridor are taking place. This comes on top of increasing waiting times apparently caused by Russian inspectors deliberately delaying the inspections process. As much as 117 vessels are in the queue according to Ukrainian sources.

The focus these days continues to be South American weather and the potential impact to corn production in Brazil and Argentina. Brazil’s weather has been perfect but rains now above average are delaying soybean harvesting and corn planting. Argentina has suffered from dry weather but we had two weeks of rains above average and the question is how much has corn condition recovered.

We think further rains expected in Brazil will give some support to the market. We don’t really see downside risk.