Opinions Focus

- Sevastopol attacks are cited as Russia suspends participation in grain corridor deal

- Assessing Russia’s interests suggest suspension may be short lived

- Turkey’s President Erdogan remains steadfast in his commitment to the agreement

Introduction

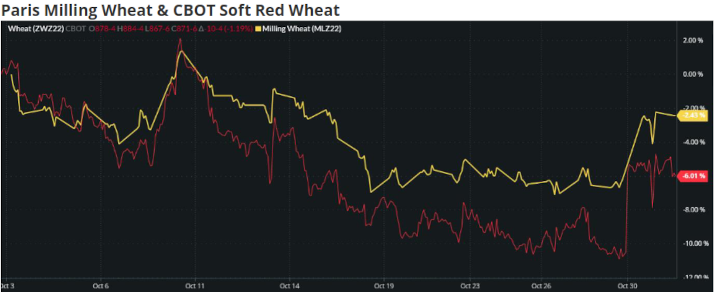

Wheat prices eased throughout the month of October, as seen in the chart below.

However, news that Russian was suspending its participation in the Black Sea Grain Corridor sent wheat markets higher on Monday.

Source Barchart Commodityview

The Black Sea Grain Corridors appeared to be working well with as much as 12mmt of grain being exported by Ukraine since 1st July, down only one third from the same time last year.

Saturday 29th October saw explosions around the Crimean port of Sevastopol, home to the Russia’s Black Sea fleet.

Ukraine has not accepted responsibility, but Russia has blamed their forces.

Damage to a Russian frigate has been broadcast, with a statement from the Russian Defence Ministry suspending their participation in the Turkey & UN brokered Black Sea Grain Corridor.

Shipping Continues with Problems.

In the aftermath of the Russian statement, it appears that ships have continued to leave port in Ukraine.

On Monday, Ukraine’s infrastructure ministry reported 12 ships containing over 350,000mt of grain left Ukraine.

There are numerous issues associated with attempts to maintain shipping without Russia’s engagement.

Safety is an obvious concern, given the Russian blockade of Ukrainian Black Sea ports following their initial land-based invasion.

Vessel insurance is a problem while war rages. Since Saturday various insurers have, for now, withdrawn cover for vessels heading to Ukrainian ports.

Russia’s interests

Russia’s President Putin has been accused by Ukraine and others of ‘weaponizing food’.

Russia is the World’s largest exporter of wheat, with record 2022 production. It seems unlikely that Putin would wish to diminish their ability to export.

There are many countries who have either voted against, abstained or not voted at all in UN motions to condemn Russia’s war in Ukraine. These include countries in need of wheat imports, such as Algeria, Bangladesh, Ethiopia, Morocco and many more.

Perhaps these countries are driven as much to pacify Putin and continue trading relationships with Russia for grain as any desire to counter UN motions.

For Putin, it would appear ill-advised to stoke further price rises for wheat given his need for political support, or even mere indifference from importing governments on the world stage.

External Political Will

Having been the original instigator and broker for the UN grain corridor deal, Turkey’s President Erdogan remains steadfast in his commitment to maintain the flow of vessels.

With his intact relationship with President Putin, Erdogan is well placed to assist the elongation of the agreement.

Conclusions

Despite a hike in prices on Monday morning wheat markets are calming as we write.

Talk of Putin holding the world to ransom over food may appear to have merit for his political aims in the short-term, but it would most likely be an error of judgement on his part longer-term.

Russia has a record wheat crop with 40mmt that needs exporting, much through the Black Sea.

Putin needs to maintain support or indifference politically, with the major wheat buyers around the World. This will allow sales and currency income to aid a struggling Russian economy.

Continued disruption to wheat shipments through the Black Sea may well push prices higher, to the dismay of the poorer nations in most need.

Walking away from the agreement may result in more forceful engagement from wealthier nations to facilitate Ukrainian shipments, while creating greater political isolation for Putin.