Note: March and April’s export stats are preliminary at this stage.

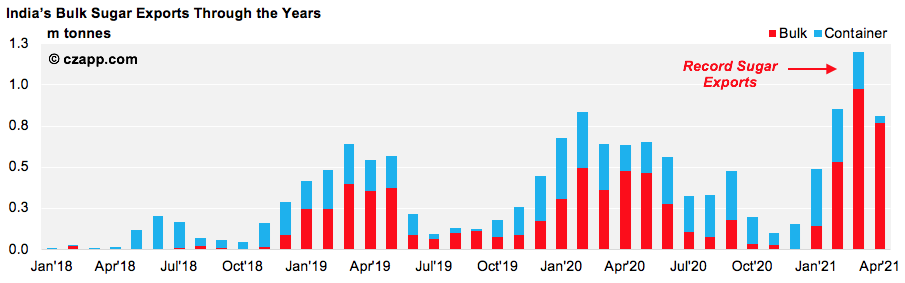

- What container shortage? India’s mills exported a record 1.2m tonnes of sugar last month, up 345k tonnes from the previous highs.

- This was 40% higher than the previous monthly record set in Feb’20, and was driven by nearly 1m tonnes of bulk shipments.

- If India maintains such a strong pace of exports, it should have no trouble fulfilling its 6m tonne sugar export subsidy for 2020/21.

A Record Month for Indian Sugar Exports

- India has exported 3.8m tonnes of sugar so far this season, 1.2m tonnes of which left in March alone.

- The majority of last month’s sugar exports were raw sugar via bulk vessels, as the mills managed to work around the ongoing container shortage.

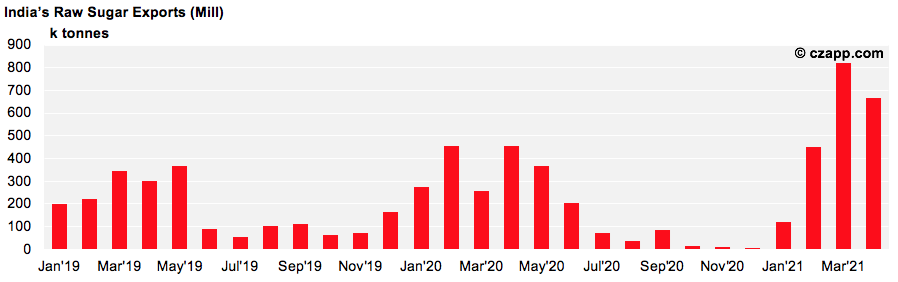

Raws Exports More Than Double February’s Pace

- India exported 820k tonnes of raw sugar in March, up 367k tonnes month-on-month.

- This means by the end of March, India had exported 1.39m tonnes of raw sugar so far this year.

- This strong raw sugar export pace looks set to continue, with a further 669k tonnes already nominated for shipment in April.

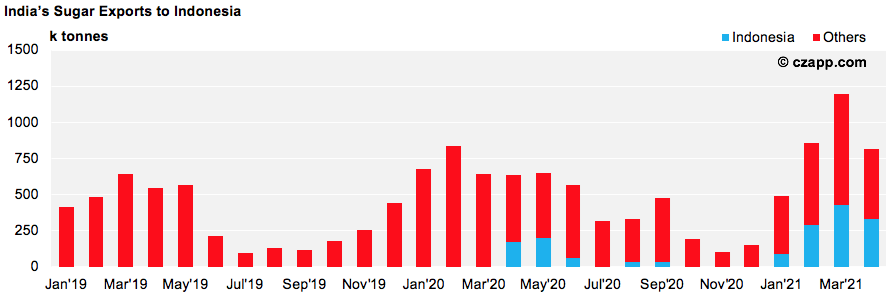

- The main offtakers have been Indonesia (331k tonnes), the UAE (254k tonnes), Bangladesh (166k tonnes) and Yemen (92k tonnes).

- Indonesia was the main factor pushing India’s raw exports pace along with already 1.2m tonnes shipped.

- This includes April’s shipments and 145k tonnes of LQWs shipped as raws.

- Iran, which has shipped close to 1m tonnes last year, is no longer a feature in this year’s India raw exports (as yet).

- This is because the Indian and Iranian Government are still in discussions on executing their bilateral trade deal on the back of financial sanctions.

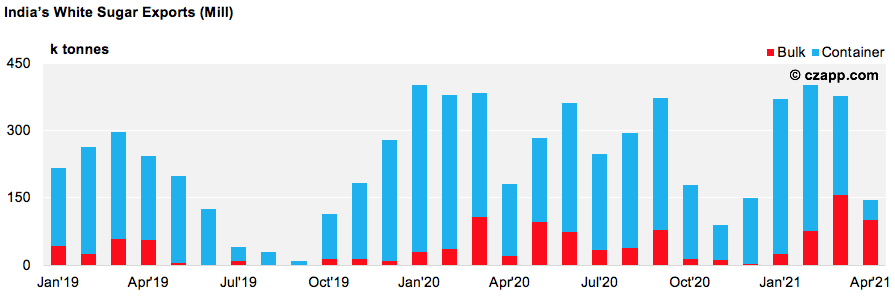

White Sugar Exports Remain Stable

- India exported 378k tonnes of white sugar in March, down 24k tonnes month-on-month.

- With this, India has exported 1.15m tonnes of white sugar so far this year.

- The main off-takers have been Afghanistan (467k tonnes), Somalia (242k tonnes) and Sri Lanka (226k tonnes).

- The proportion of bulk exports have increased marginally by 7% to 22% for Q1’21 compared to Q1’20.

- This is because the white sugar destinations that can accept bulk vessels are limited to mainly the East African destinations such as Sudan and Somalia.

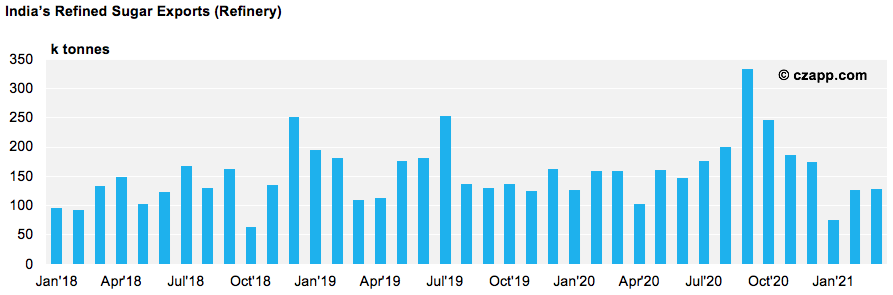

Coastal Refineries Feel the Brunt of Container Shortages

- India’s coastal refineries exported 129k tonnes of refined sugar in March, down 3k tonnes month-on-month.

- Their exports remain slow as they continue to grapple with the ongoing container shortages; around 80% of India’s other sugar is now being shipped in bulk.

- With this, India’s coastal refineries has exported just 276k tonnes of refined sugar so far this year, down 169k tonnes from the year prior.

- A lot of Asian destinations prefer not to buy bulk refined, so the container shortage, plus the poor cane and beet crops from Thailand and the EU, will continue to tighten the refined sugar market.

Here’s Another Opinion You Might Be Interested In…

- Indonesia: The World’s Largest Raw Sugar Importer in 2021

- India Ups Ethanol Production at Sugar’s Expense

Click Here to View the Czapp Explainers