Insight Focus

- This year’s Thai cane price could reach a new record high.

- This should encourage farmers to plant more cane for harvesting in 2024/25.

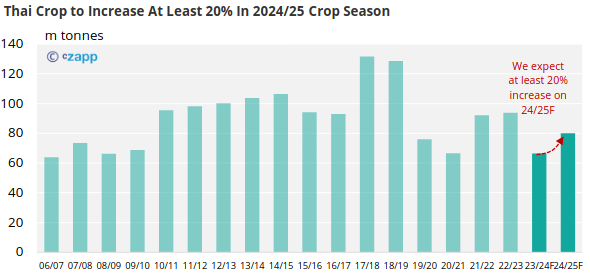

- We think it is possible that Thailand will crush between 80m to 100m tonnes in 2024/25.

Good Rainfall but Why We Expect the Lower Crop?

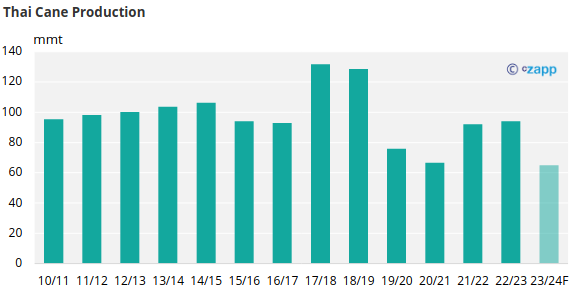

As we mentioned in our previous article on Thailand’s cane, the only factor that could help the 2023/24 crop is more rain. After a prolonged drought in Q1 and Q2, Thailand has now been soaked with rainfall recently. Up to 30% of the 2023 cumulative rainfall occurred in September, mostly from tropical depressions.

We still think that the majority of the crop has been damaged by the low rainfall at the start of the year. This led to lower agricultural yields at 7.96 mt/rai or 48 mt/ha (23% lower YoY), especially in the North and Central regions.

All in all, we maintain our belief that Thailand will crush less than 70m tonnes of cane in 2023/24.

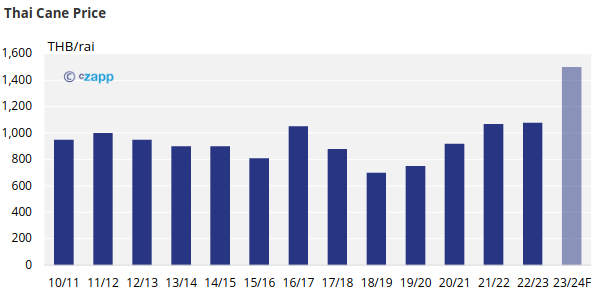

Cane Price Rallies to Incentivize 24/25 Plantings

The higher sugar prices that we have seen this year were too late to incentivize farmers to plant more cane for the 2023/24 season. But it is likely that the cane price for this upcoming season could be in excess of THB 1,500 per tonne, providing the No.11 remains above 24c/lb across the March’24, May’24 and July’24 futures contracts from now until their expiries. The expected cane price is also being helped by the recent weakness of the Thai Baht against the US Dollar.

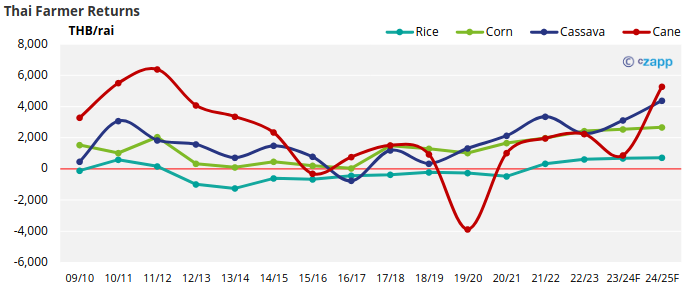

Farmers will make decisions on what to plant for the 2024/25 season starting from October this year. It is likely that cane is going to be paying a significant premium to cassava (as well as rice and corn), which we think could lead to a strong switch back to cane.

In addition, the higher cane price means farmers are more likely to invest more into their cane and try to achieve a higher agricultural yield.

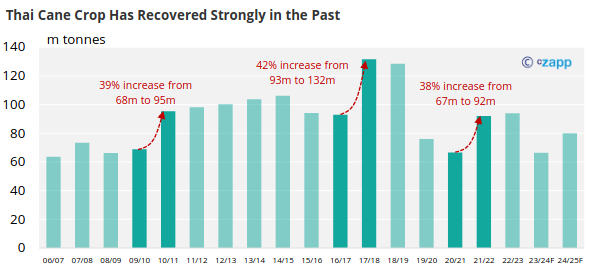

Another Big Jump of Thai Crop

Thailand has a history of big swings in cane production and historically it is not unusual to see recoveries from bad year of 30 to 40 percent.

One concern is that we see a prolonged impact from the El Ninio affect, which causes lower rainfall in 2024 too.

However, weather risk aside, we think that the price signals will be strong enough to see a recovery in the planted area back above 10m rai. Based off a conservative agricultural yield estimate of 8 – 9 mt/rai, could see a 2024/25 cane production number of 80m tonnes, or even up to 100m tonnes if we see weather conditions return to normal.

The weather fluctuation is still a big concern as observed from the previous year where the sugar yield is abnormally high and this year rainfall pattern. We are planning to re-asses our forecast in November.