Insight Focus

- The current Black Sea grains deal expires on 19th November.

- It’s not clear if it will be extended or not.

- 100 vessels are currently waiting outside Ukrainian ports to load.

Forecast

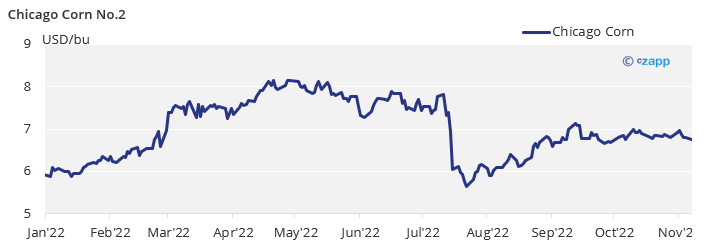

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu. The average price since Sep 1 is running at 6,8 USD/bu.

Market Commentary

Corn closed the week flat after Russia rejoined the grain corridor out of the Black Sea and no serious supply disruptions occurred. Wheat closed positive on fears of lower supply out of Argentina and Australia.

Russia rejoined the agreement for the Black Sea grain corridor just four days after they had pulled out.

Grains rallied at the opening last Monday after Russia pulled out, especially Wheat, but they corrected last Wednesday after the announcement they would rejoin. The question now is if the deal which expires on November 19 will be extended or not. As we mentioned last week Russia’s interest is to facilitate exports of their own agricultural goods which are suffering from international sanctions.

By now, October grain exports out of Ukraine were stable at 4,7 mill ton and the approx. 100 vessels in the line up waiting to enter Ukraine should continue to move towards Odessa and other ports to be loaded with grains.

US Corn is now 76% harvested above last year and 12 points above the five year average. Corn harvesting in Ukraine is 27% complete well below last year’s 61%. The yield is also much lower than last year at 5,5 ton/ha vs. 6,82 last year. Corn planting in Argentina is 22,9% complete vs. 28,4% last year and condition is running at a poor 6% good or excellent.

Wheat was able to close the week positive with the correction after Russia having rejoined the grain corridor not being enough to close the week flat like Corn did. And it was mostly due to a Friday rally after flood damage in the Australian Wheat region and a lower estimate for Argentina’s production.

BAGE in Argentina lowered their Wheat production forecast to 14 mill ton which is 1,2 mill ton below their previous estimate and a sizable 26,3% vs. the five year average and a huge 37,5% below last year’s production. Good to excellent conditions is just 9% of the area.

US winter Wheat is 87% planted, which continue to be very much in par with last year’s and the five year pace.

Russian Wheat planting continues to make progress but there is no clarity on the number of hectares to be planted after the record harvest that just finished.

In the weather front, favorable conditions are expected in Brazil and Argentina while dry conditions are expected across the US Corn belt allowing faster harvesting pace and Wheat planting. Europe is expected to see rains and warmer than normal weather which if positive for germination, is not good for frost protection potentially leaving Wheat vulnerable to the frosts that will come in the winter.

We have the November WASDE this week Wednesday and the only major change we are expecting is an upward revision to Russia’s Wheat production number from the 91 mill ton of the Oct WASDE to around the 105 mill ton Russian authorities have published. But this number is already discounted in the market in our opinion thus the WASDE should be more or less neutral.

Once we have no risk of supply disruptions out of Ukraine, the focus turns again to harvest progress for Corn and planting progress for Wheat which at the same time is depending on weather. The Corn harvest is well advanced and we don’t expect surprises in this week’s WASDE. Also weather is being favorable in the US and Europe for Wheat planting. We expect the market to remain supported with some downside risk from harvest pressure.