Insight Focus

- The grains markets are all still very well-supplied, meaning prices look bearish.

- But the floor should be close as the US pulls back on planted areas due to low profits.

- Weather in South America and the northern hemisphere will be the main price drivers.

It was another largely negative week for all grains as ample supply in all regions more than offset fears of lower South American production. Weather in South America and in the northern hemisphere should be the driver for prices in the short term. We could see some correction after the last three consecutive negative weeks, which could trigger some short covering, but ample supply should cap any upside.

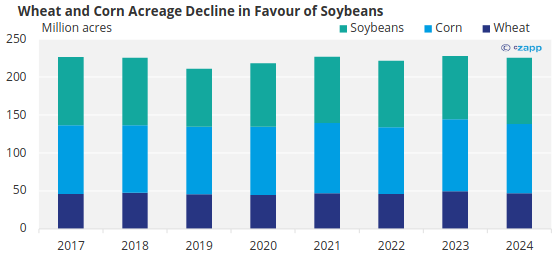

Ample global supply should continue to weigh on the market with the next question being where the floor is. It should be close with major producing regions like the US and Ukraine already projecting lower areas for the new crop given low profitability. The USDA revised its projections for 2024/25 growing areas, lowering corn and wheat acreage in favour of soybeans. Russia also increased its export quota.

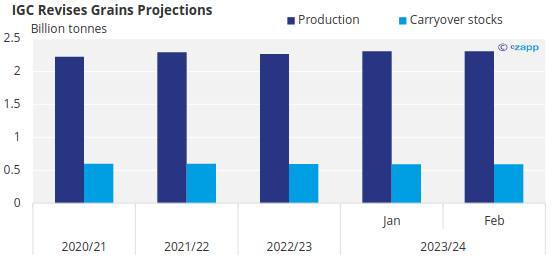

The IGC increased its global grains production forecast by 3 million tonnes to 2.31 billion tonnes. All of this comes from higher corn production, but the figures show all-time high production for all grains with a 43 million tonnes increase year on year.

Source: International Grains Council

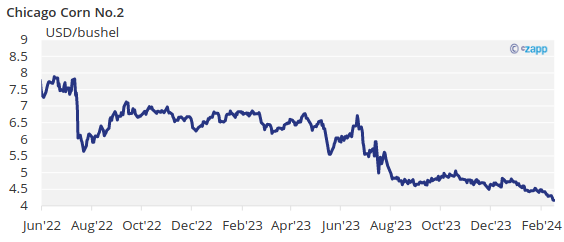

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop to average in a range of USD 4.15/bushel to USD 4.4/bushel. The average price since September 1 is running at USD 4.67/bushel.

USDA Reduces Corn, Wheat Growing Projections

At the Agricultural Outlook Forum last Thursday, the USDA published its first projection for the new crop. The big picture is one of lower corn and wheat acres in favour of soybeans due to higher profitability.

Corn acres are expected to fall to 91 million acres (36 million ha), or a 3.8% year on year drop. The wheat area is expected to fall to 47 million acres (19 million ha), down 5.3% on the year. Soybean planting is expected to increase 4.7% to 87.5 million acres (35.4 million ha). Total acres are projected to be 1% down on the year at 225.5 million acres (91.3 million ha).

Source: USDA

As a result, corn in Chicago started on a positive note last Monday, but it quickly turned into a very negative second half of the week.

Argentinian Corn is now fully planted, and its condition fell to 27% good or excellent versus 31% the previous week and 34% three weeks ago.

In Ukraine, the agriculture ministry published a survey showing farmers intend to plant 9% less corn this spring due to very low profitability at current prices. Conversely, soybean area would grow by 21%.

In South America, the Brazilian and Argentinian soybean crops have suffered from persistent dry weather. In Argentina, BCR said 100,000 ha of soybeans have been lost due to extreme heat for two weeks. But ample rains last week and rains forecast for this week may have triggered some selling last week.

Russia Expects More Wheat Exports

In the wheat front, the Russian agriculture minister has suggested there may be a fresh 4-million-tonne export quota for grains between February 15 and June 30. This is due to wheat stocks in Russia as of January 1 being 1% higher year on year despite lower production.

Analysts in Russia are also increasing their production forecasts to 93.6 million tonnes from 92.8 million tonnes. This is also higher than the 91 million tonnes projected by the latest WASDE report. The reason for the upward revision is the very favourable weather conditions during this winter.

The French agriculture ministry reduced the planted area for the 2023/24 winter cereal crop by 500,000 ha to 6.2 million ha due to excessive rains. The first report on wheat condition showed 68% in good or excellent conditions versus 93% last year due to excess rains during January. The global supply and demand picture continues to show an oversupplied market. Losses in French wheat production are more than offset by higher Russian production.

Argentina and Centre-West and South Brazil are expected to receive ample rains, which is very much needed in both regions. The US and Europe are expected to continue to experience above-average temperatures with some rain.