Insight Focus

- The shipping industry currently uses about 300 million tonnes of fossil fuels.

- Something must change if the industry is to meet its strict environmental targets.

- Could hydrogen be the marine fuel of the future?

Technology Lacks Adoption, Scale

Much like ammonia, there are various production pathways for hydrogen. In the same way, gray and brown hydrogen is produced using fossil fuels natural gas and coal, while green hydrogen is produced using renewable energy sources. Blue hydrogen is produced using fossil fuels, but it incorporates carbon capture technology.

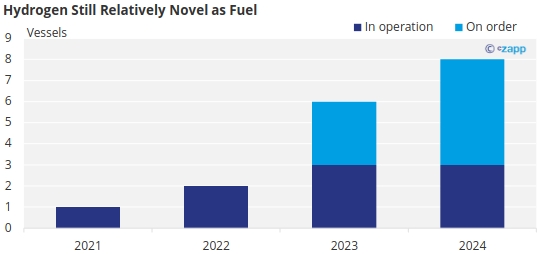

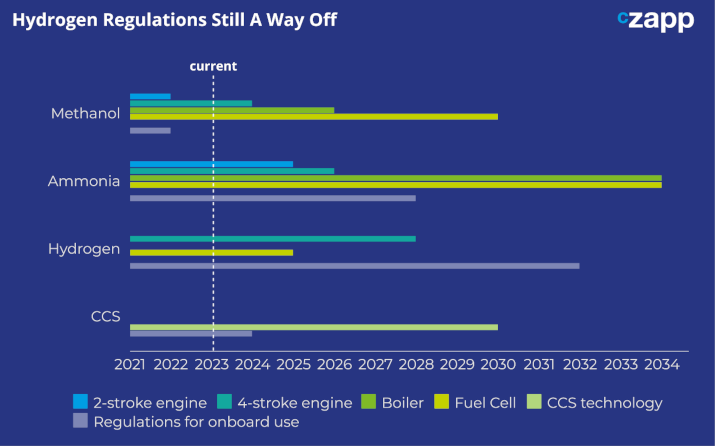

Hydrogen is not yet a mature technology, particularly in the maritime industry. DNV expects uptake to remain low, reaching 0.5% of the global energy mix in 2030 and 5% by 2050.

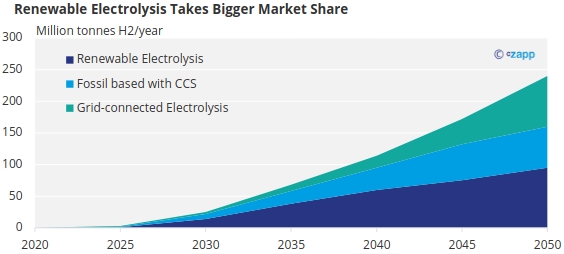

Right now, hydrogen bunkering infrastructure for ships doesn’t exist due to low demand. However, the electrolysis pathway is relatively mature, meaning it could be easily adopted by ports provided there is a readily available supply of electricity. The majority of hydrogen production is still based on fossil fuel pathways though.

Source: DNV Hydrogen Forecast to 2050

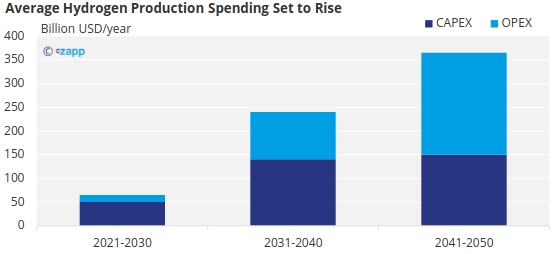

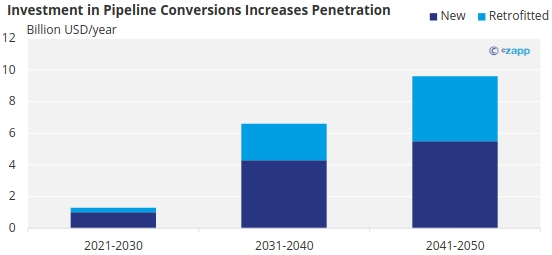

Currently there is little investment in the technology, but this is expected to pick up.

Source: DNV Hydrogen Forecast to 2050

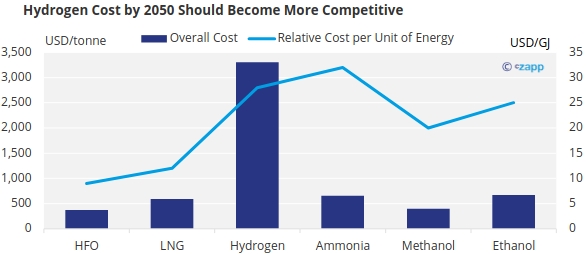

Cost of Fuel Competitive on Energy Basis

Hydrogen’s energy density is approximately three times that of heavy fuel oil so, despite a high cost per tonne, the cost per measure of energy is relatively competitive with ammonia, methanol and ethanol.

Source: IMO

According to DNV, the cost of grid-based electrolysis will drop to around USD 1.50/kg by 2050. Green hydrogen costs are expected to reach parity with blue hydrogen by about 2030 at around USD 2.50/kg. In fact, most regions will see the cost of green hydrogen dip below grey and brown hydrogen by 2050. Depending on natural gas availability, some regions may see higher penetration of blue hydrogen.

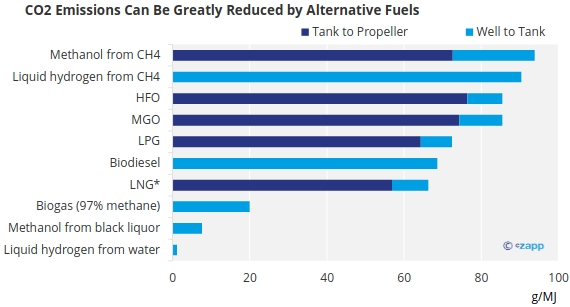

Ultra Low Emissions Big Selling Point

Hydrogen is an attractive fuel for the shipping industry because its emissions are negligible. However, like ammonia, the production process needs to be considered. Green hydrogen made with renewable energy has a carbon footprint as low as 4.6g CO2 equivalent/MJ of energy. However, the footprint of grey hydrogen is as high as 155g CO2 equivalent/MJ – higher even than fuel oil.

Source: DNV

As it stands, global hydrogen production that is generated by fossil fuels generates 830 million tonnes of CO2 equivalents per year.

Storage Concerns Hold Back Hydrogen

Hydrogen is three times as energy dense as heavy fuel oil, but it has a significantly lower volumetric density. This means that hydrogen takes up about five times more space than the equivalent heavy fuel oil when stored in liquid form and 15 times as much when stored in gas form.

As a result, significantly more storage space or more bunkering would be needed for hydrogen powered vessels. These bunkering facilities would likely have a significant Capex requirement.

And this is not the only storage concern. As the smallest molecule in the universe, hydrogen can leak very easily through the tiniest of spaces.

This may be concerning on a ship because hydrogen is extremely combustible when mixed with air. This is a major limitation for its use in shipping. And when it is stored, liquid nitrogen has a temperature of -253 degrees Celsius – which is a huge stressor for equipment.

Due to these safety issues, hydrogen is largely used within the production region, although natural gas pipelines can be repurposed to transport hydrogen at a fraction of the cost of a new pipeline.

Source: DNV Hydrogen Forecast to 2050

There have been some advances in the use of liquid hydrogen for shipping. In 2020, MAN announced that it has developed a liquid hydrogen marine fuel gas system that can be installed on different types of ships.

Concluding Thoughts

- Hydrogen is possibly the least developed marine fuel.

- There has been very little interest in using the element as a marine fuel except from a handful of early adopters.

- Hydrogen’s status as a clean burning fuel and its relative cost efficiency are both big advantages.

- The cost of building up bunkering infrastructure could be partially offset by repurposing natural gas pipelines.

- The biggest drawback for hydrogen is its stability and safety.

- Until these concerns can be addressed, the fuel is unlikely to be adopted by the maritime industry.