This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Harvesting pace of sugar beet crops is below five-year average in Idaho, Michigan and Colorado.

- Spot and forward cash beet and cane sugar prices are unchanged.

- Annual contracting of corn sweeteners for 2024 is progressing slowly.

The sugar beet harvest was in full swing near the end of September. Spot and forward cash beet and cane sugar prices were unchanged.

The harvesting pace of sugar beet crops was below the five-year average in Idaho, Michigan and Colorado, but progress was outpacing the average in Minnesota and North Dakota. Full harvest typically is underway by 1 October.

While state sugar beet crop ratings as of 24 September were mostly higher compared with a year ago, several declined from a week earlier. Wyoming had the largest decline, falling to 78% good-to-excellent from 87% the previous week and 86% a year ago. Michigan had the lowest current crop rating compared to its year-ago status at 52% good-to-excellent, down from 56% a week earlier and well below 73% at the same time last year.

Trade sources indicated sugar content from early harvested beets in Michigan was lower than expected. The crop still had capacity to meet targeted sugar levels, but it required favourable weather and a delayed harvest to allow the beets to deposit more sugar.

It was also hoped that beets in parts of the Western Sugar Cooperative’s region could be kept in the ground a little longer to boost sugar content. But recent recollections of early freezes impacting some states’ overall production and yields have narrowed the delayed harvest window.

Without significant harvest progress, some beet sellers still were not booking additional sales for calendar 2024, hoping to get the majority of their beets harvested and into piles before selling the remainder of the crop.

Spot beet sugar prices for 2022-2023 were offered at 62¢ to 64¢ a lb f.o.b. Midwest, unchanged. Beet sugar for 2023-24 was offered at 56¢ to 59¢ a lb f.o.b. Midwest, unchanged.

There were no indications domestic sugar cane harvest had begun in earnest as state offices have not yet reported any updates on harvest progress.

Recent rains along the Gulf Coast provided some much-needed moisture, helping the good-to-excellent rating for the Louisiana sugar cane crop to rise three percentage points to 24% (all good). While welcomed, the rains may ultimately be too little too late for the drought-depleted crop this close to harvest.

Refined cane sugar continued to be offered through calendar 2023 by one refiner at 68¢ a lb f.o.b. nationwide, unchanged. Cane sugar for calendar 2024 was offered by one refiner at 62¢ a lb f.o.b. Northeast and West Coast, unchanged. Prices ranged from 57¢ to 60¢ a lb f.o.b. Gulf and Southeast, also unchanged.

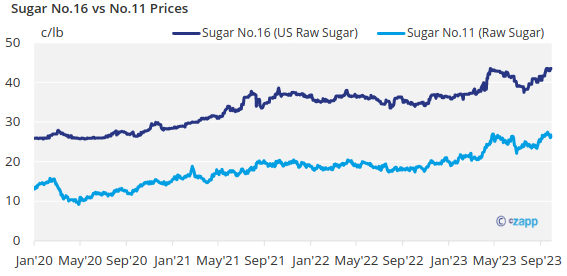

Annual contracting of corn sweeteners for 2024 was progressing slowly. Buyers were still hoping for lower 2024 prices compared with 2023, but the trade pointed toward steady corn demand from Mexico as well as rising global sugar prices, which are supportive to corn sweetener values, to justify their initial offers that appeared to be flat to slightly higher.