Insight Focus

- The carbon market has dropped as much as 24% since end of 2023.

- Traders are reacting to drop of more than 20% in power sector emissions.

- But investors are rebuilding bearish bets for 2024.

Low Natural Gas Prices Disincentivise EUAs

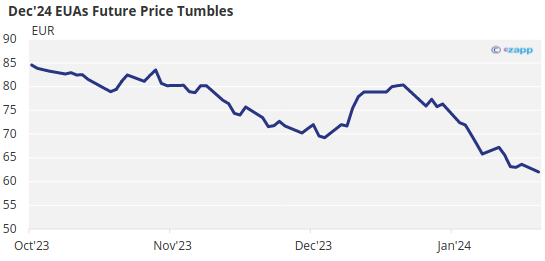

European carbon prices have started 2024 on a very weak note, falling to their lowest in almost 18 months as traders see no let-up in the declining demand for carbon permits from EU industry.

Prices for the December 2024 futures contract on ICE Index tumbled from EUR 80.37 on December 29 to a low of EUR 62.04 on Monday, a drop of 23%, as investors increased their bearish bets on the market this year, while some power generators also sold off unwanted surplus EUAs.

Source: ICE

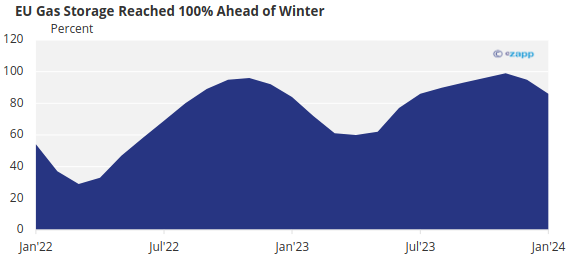

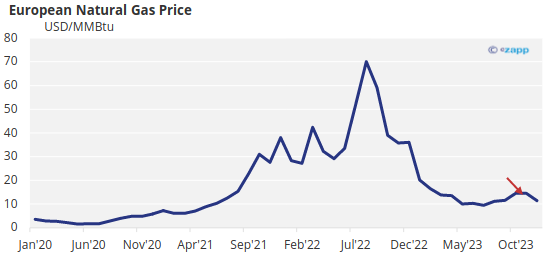

The decline has been largely driven by weak demand for coal. Prices for natural gas, which generates around half as much CO2 as coal, have fallen 64% in the last year as Europe built high stocks of the fuel ahead of the current winter.

Source: AGSI

The falling cost of gas also means that the fuel has become much cheaper to use for power generation than coal, and this drove a more than 20% drop in the amount of CO2 emitted by European power plants in 2023.

Source: World Bank

At the same time, the continuing economic downturn has cut industrial production from energy intensive sectors like iron and steel, aluminium and fertilisers. Analysts say industrial emissions likely fell by more than 5% last year.

Specs Bet on Further Declines

The upshot is that the balance of surplus emission allowances in the EU ETS market probably grew in 2023, and with the outlook for 2024 not showing much improvement until late in the year, prices for EU Allowances are likely to remain depressed for the next few months.

Speculative traders were already betting on price declines as early as last autumn and built up a short position in futures contracts that swelled to more than 40 million EUAs at one point. While a number of these positions were closed out before the end of the year, the last three weeks have seen these bearish bets re-opened.

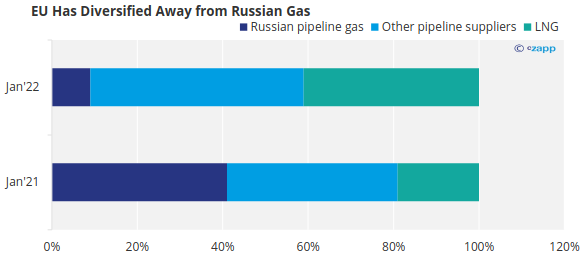

The growing market surplus comes at a time when the EU is auctioning more than 250 million extra EUAs to fund its energy transition away from fossil fuels and Russian gas in particular. The REPowerEU initiative began selling additional permits last summer and is scheduled to sell EUR 20 billion worth by 2026.

Source: REPowerEU

The falling price of EUAs means the European Commission may be forced to sell even more than the roughly 250 million allowances that were initially forecast, adding to the bearish pressure on prices.

The EU ETS was set up in 2005, with the goal of driving emissions lower in line with the bloc’s international climate commitments. It was set up with specific volumetric goals rather than with a price target. As a result, there is no mechanism to maintain the EUA price above a minimum floor.

The market regulator employs a formula that will trigger the sale of additional allowances if prices rise too high too quickly, but the main intervention lever addresses supply and demand.

The Market Stability Reserve withdraws 24% of the calculated market surplus each year and can also inject up to 100 million EUAs into the market if available supply drops below a threshold level of 400 million tonnes of CO2.