732 words / 4.5 minute reading time

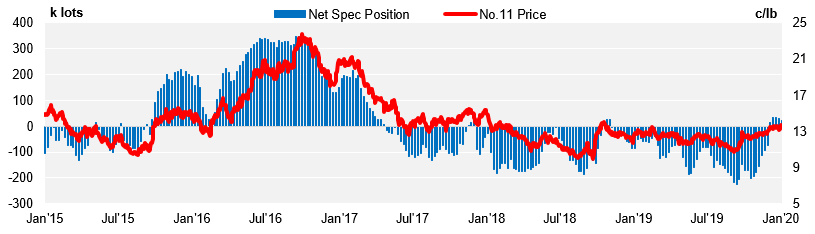

- Speculators have moved from a large short position to a small long in sugar in the past couple of months.

- In 2015 we saw the same trend, and specs then continued to buy until they had a record net long.

- Will they be able to do this in 2020?

Speculators Could Push Market Higher

- The specs have moved from a 200k lot short to a long position in the space of two months after almost a year of being short.

- Similarly, back in 2015, the specs held a then record net short of 132k lots after a prolonged period in which they were short.

- Later that year, they reached close to a record net long positioning and later in 2016 increased the record by over 50%.

- This move pushed the market from lows of 10c/lb to highs of 24c/lb in a little over a year. Could the same thing happen this time?

Historic Spec Position and No.11

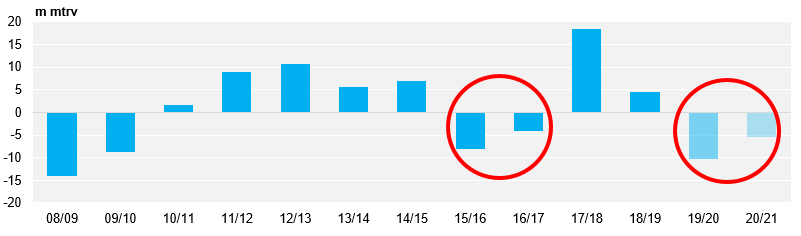

- In 2015, the sugar market was moving from a prolonged period of stock build into a deficit, which gave the market the bullish sentiment that allowed the specs to push higher.

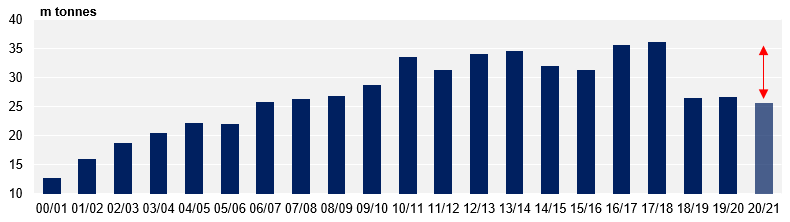

Global Stock Change

- While this season we are again expecting a deficit even larger than 2015/16, there are four main reasons why we do not expect the specs to have the same appetite/ability to push the market much higher.

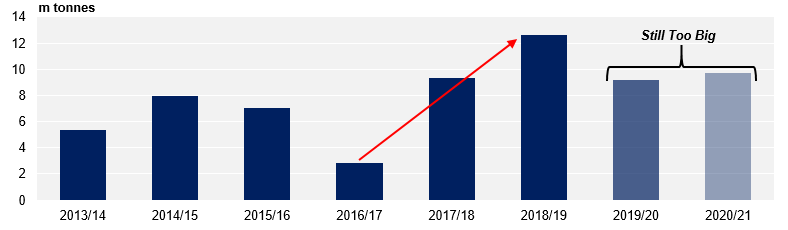

Price can Unlock Sugar from India

- India has huge sugar stocks after two years with huge production.

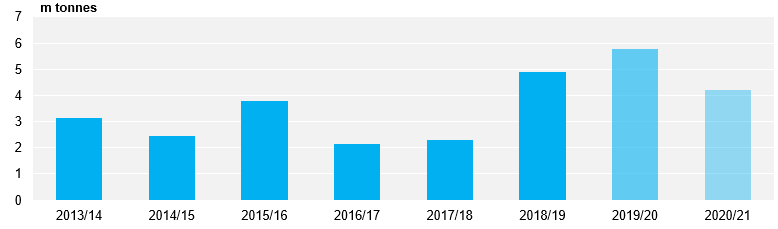

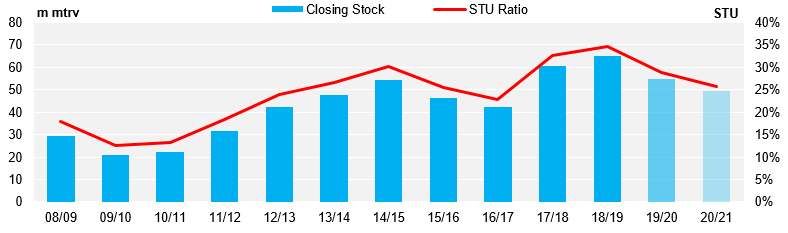

Indian Closing Stocks

- This season’s production looks set to reduce, but we still expect a surplus.

- Export subsidies were required last season but stocks remained high and subsidies have been given for exports this season.

- We expect 5m tonnes of sugar to be exported from India, but up to 7m tonnes could be exported if prices continue to incentivise it.

Indian Exports

- On top of this, production next season could rebound back to 33m tonnes since cane prices still incentivise plantings, and with a large ethanol program unlikely to be established, sugar could need to be exported again.

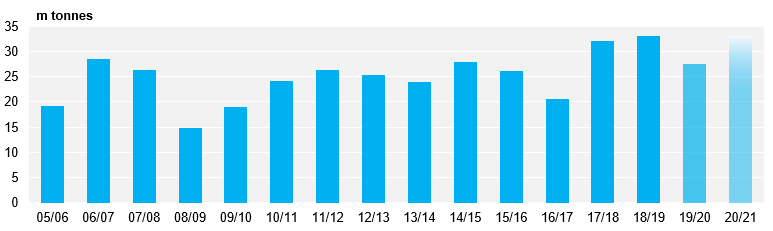

Indian Production

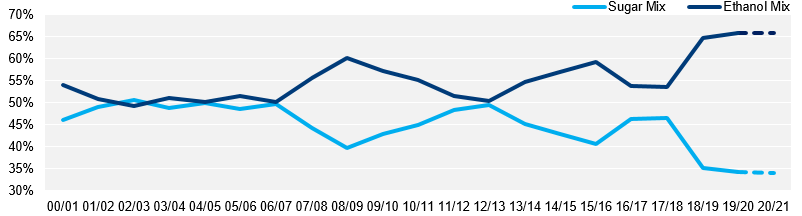

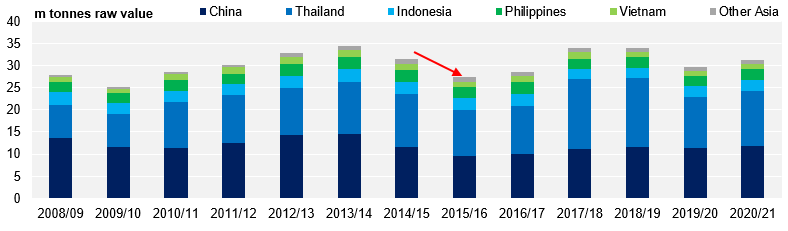

Brazil Can Increase Production

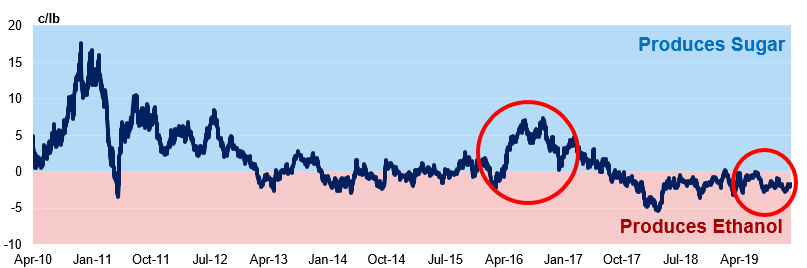

- When prices started to rally in October 2015, CS Brazil’s 2015/16 production was tailing off, and mills therefore had limited scope to increase sugar production.

- By the time the following season’s production had started prices had reached 16c/lb and sugar returns were greater than hydrous.

Hydrous vs. Sugar Returns

- Mills for the 16/17 season therefore increased sugar production, reaching a then record 35.6m tonnes in the season, but this still wasn’t enough to put the world into surplus and reduce spec appetite.

Sugar Mix

- This season, while CS Brazil can increase sugar production by 10m tonnes, this isn’t required. The world has enough sugar in stock and the Trade Flows are not in deficit.

Production

- If prices incentivise it, mills could swing production away from ethanol and back towards sugar.

- At 16c/lb we could see an extra 10m tonnes of production and pricing on the world market, providing a cap to the market and diminishing speculators potential returns.

Larger Worldwide Stocks

- While Brazil and India are poised to provide more sugar for the world market, worldwide stocks are already very high.

- Stocks before the 19/20 season were 10m tonnes raw value larger than in 15/16.

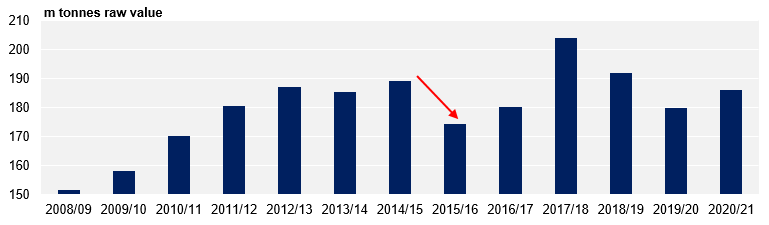

Worldwide Closing Stocks

- At the high point of this year in April, the world will hold over 100m tonnes of total sugar stocks.

- This would take almost seven months for the world to consume even if everyone stopped producing sugar.

- Therefore, as prices rise, consumers could decide to reduce buying, instead eating cheaper stocks, reducing demand.

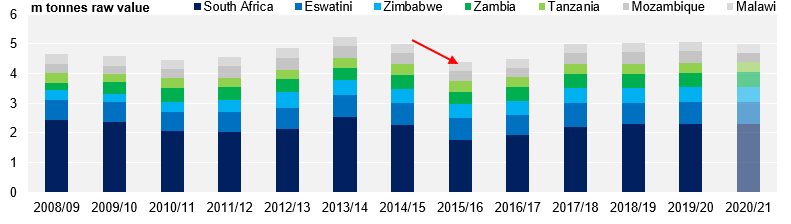

El Nino and Effects on the Balance Sheet

- Back in late 2015, there was one other factor that gave the specs a bullish story to get behind – El Nino – one of the three strongest weather events since 1950.

- This event caused increased rainfall at the end of Brazil’s 15/16 and caused drought in southern Africa, with a number of countries declaring states of emergency, both affecting production.

Southern African Production Decline

- Rainy seasons across South East Asia were also affected and crops struggled. The El Nino coincided with a 4m tonne reduction in South East Asia compared to the previous season and crops struggled to rebound the following season.

South East Asian Production

- All of this contributed to a 15m tonne reduction in production between 14/15 and 15/16 seasons, helping bullish sentiment.

Worldwide Production