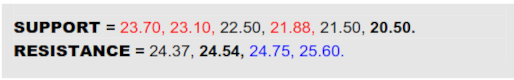

NEW YORK SUGAR #11 OCTOBER 2023

Notwithstanding a good finish Friday that pried open the double top over 24.01, NY promptly relinquished and slipped back to the 23.70 face edge of the prior pennant-like congestion. It needs to stand firm on here or else a fleeting glimpse into the top wouldn’t count for much and indeed the top would appear reconstituted, noting comparable top frontiers in B. Real, T. Baht, I. Rupiah and C. Yuan pricing haven’t been disrupted. Must grit the teeth on 23.70 and go again then whereas falling through could soon lead on to breaking 23.10 and hastier losses once more.

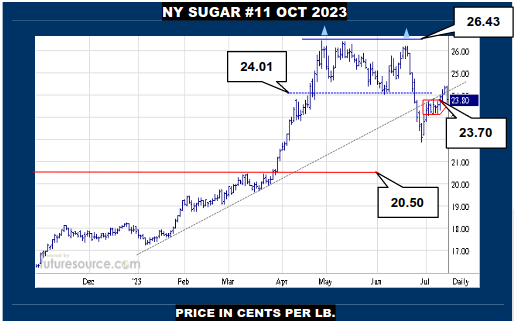

LONDON WHITES #5 OCTOBER 2023

Just as Jly Raws expiring tamed the dive, Aug Whites expiring seemed to dull the recovery and London skewed lower again Monday. No obvious harm done yet by this but it certainly does bring the mid band (657) to 655 perch back into clearer focus again. If a dip was gathered together above it, there should be residual benefit from the recent impression made beyond 661 that could still lead to a further leg higher into the 700’s. If NY ripped back under 23.70 and 655 subsequently snapped here though, beware another dive towards 600.

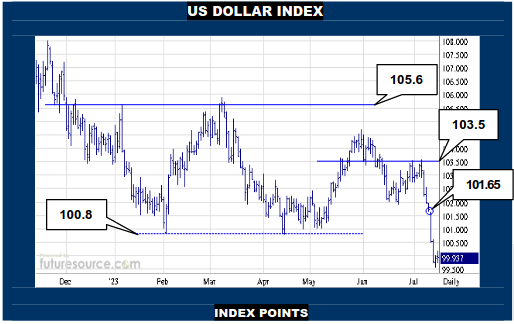

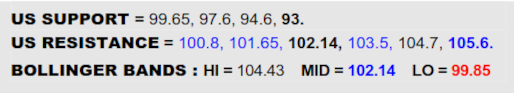

US DOLLAR INDEX

Stumbling in the mid 103’s as Q2 passed off to Q3, the Dollar has taken a sharp swat lower to needle the 99’s. The attention getter during that drop was a tiny 101.60’s gap, trying to ascertain its identity to help decipher what will follow. One initially suspects a ‘breakdown’ gap as values were in the throws of departing a seven month span of action, seemingly headed towards the next main weekly shelf in the 94’s/93’s realm. Wary though because if it were a lesser ‘measuring’ gap, 99.65 met the goal already so the ensuing week or two’s action and if the greenback stays pinned under 100.8 should tell a lot about whether the decline has more to it or if it has played itself out in that one brief dive.

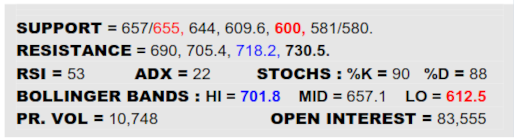

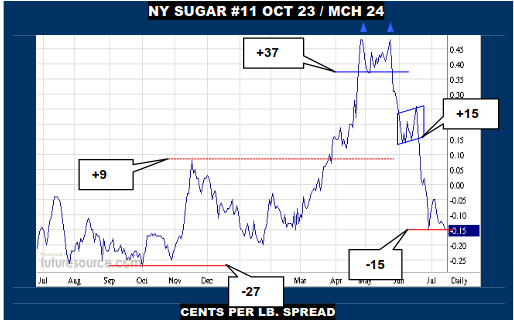

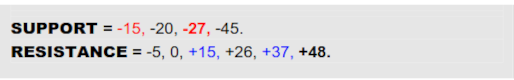

NY SUGAR #11 OCT 23 / MCH 24 SWITCH

VALUE : -15

The recent flat price revival did nothing for the Oct/Mch switch, which has muddled around in negative terrain near the -8 prior bear flag projection, making no effort to mount any sort of reflex back towards the flag itself that sits well overhead above +15. Meantime, though lacking for the definition of the preceding flag, a further slump through -15 would give a new bear flaggish vibe to early Jly and suggest risk of pressing on through -27 to a next projection at -45. Must otherwise do more than just dab the brake, needing to twist back over -5 to imply a small new base that could trigger an effort towards +15.

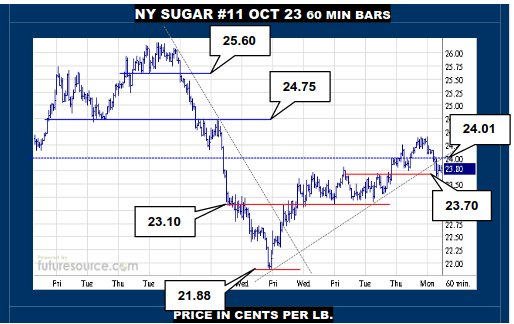

NY SUGAR #11 OCT 23 INTRADAY SNAPSHOT

A disconcerting lack of traction in the aftermath of Fridays’ jab through 24.23 and the slip back out of the 24’s has also broken the hourly chart uptrend. A quick shift from hopeful to hobbling then and the market needs to compose itself aboard that 23.70 ledge to impress more a sense of just a short term twitch rather than actually throwing in the towel on the Jly recovery. If able to gather up at 23.70, so the door would remain ajar topside, although after this wobble one would now want to see the Fib retracement of the previous decline (24.54) overcome to beef up faith in the recovery again. If 23.70 collapsed instead, there could be a growing sense of the Jly swell cresting and loss of 23.10 could henceforth bring a new delve into the 21’s.