Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

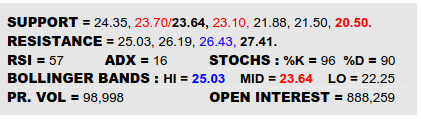

NEW YORK SUGAR #11 OCTOBER 2023

Resilience proven at the 23.70 pennant prop, NY has cruised on up to nip at the 25’s Friday, steadily smoothing over the scar left by a Jly contract delivery delve. This is now pushing up against the upper Bollinger band (25.03) but that band is showing initial signs of swerving higher itself so not instantly concerned by its presence and still eying passage on into the 26’s. Only an overt flinch that saw the market double back to close under 24.35 would mark a stumble to take notice of, in that case having to place 23.70 back on the endangered list.

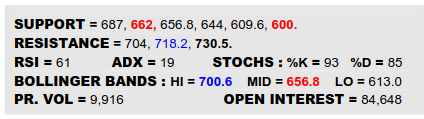

LONDON WHITES #5 OCTOBER 2023

London punched home the 688 escape Friday and, with a brief flaggish correction duly completed, it was back in the saddle to reenter the 700’s. Given the generally encouraging macro backdrop for commodities meantime, this looks increasingly encouraging and the Oct high at 718.2 and a continuation high at 730.5 are both beckoning overhead. Only if the Dollar came surging back over its 101.60’s gap would there be niggling concern to warrant an eye on 687 as the tripwire back to 662, that lower ledge now the key turning point underfoot.

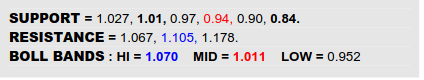

B-BERG / US DOLLAR RATIO

Brent completing its mid year base by popping the $78’s helped the B-Berg shed its downtrend and the same happened here on the Ratio while also phrasing ’23 into a slightly skewed inverse H&S. Encouraging events therefore that heighten suggestion of a commodity resurgence and the road to 1.105 beckons as the upper Bollinger band pushes ahead to 1.07. Nonetheless, there is still the concern associated with the Dollar swerving back up from a 99.65 ‘measuring’ gap target and so the corresponding 101.60’s gap needs watching alongside the span between 1.027 and the oncoming mid band (1.01) here, a gouge back down through it all clearly taking the wind from the wings.

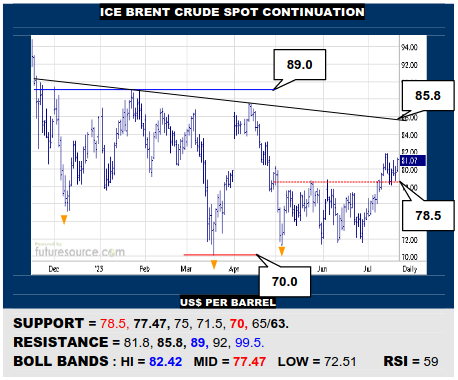

ICE BRENT CRUDE OIL SPOT

Brent preserved its getaway across the 78’s this week and so nearby action is acquiring a flaggy feel and 81.8 would duly be watched as a trigger from this pattern to reach on towards the 85.8 exit from a major inverse H&S. Only reeling back through the 78’s and the oncoming mid band (77.47) would disrupt the new Q3 applied improvements.

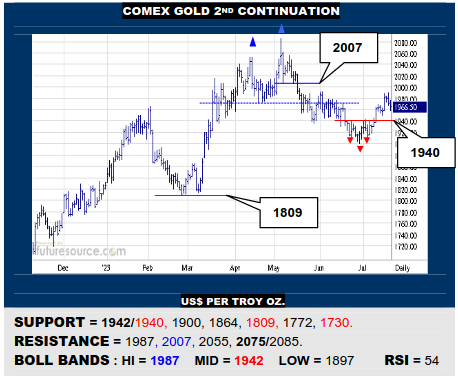

COMEX GOLD 2ND CONTINUATION

Gold managed a mid year upturn from a small inverse H&S but has cooled at its upper Bollinger (1987) this week as the Dollar fights back. Would cater for a dip towards the mid band and base (1942/1940) then but only breaking through there would douse the flame completely. Hold the 1940’s and a further leg into the 2K’s could still subsequently ensue.

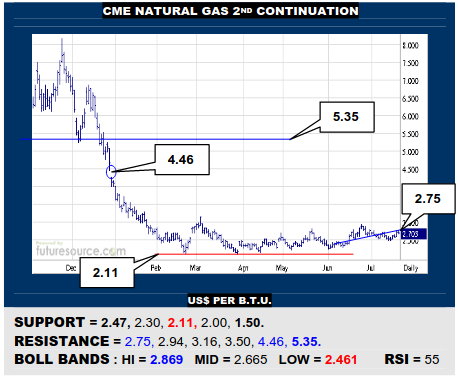

NYMEX NATURAL GAS 2ND CONTINUATION

Try, try again for Nat Gas as it attempts another foray north. This must make a decisive impression beyond the 2.75 neckline to the small late Jun H&S in order to convince of greater buying fuel reserves that might finally allow declaration of a larger saucer shaped base. If foiled in the 2.70’s though, keep eying 2.47 as the trapdoor towards 2.11.

S&P 500 STOCK INDEX

The S&P has pulled up out of a summer ’22 to summer ’23 basing event under 4200 and is riding the high road back up towards the 4819 Jan ’22 peak. Must cater for some bumpiness on that journey but for the time being only a backlash through the 4440’s would mark a concerning stumble where focus would swivel onto the mid term uptrend (4330).

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.