Insight Focus

- No.11 and No.5 prices strengthened last week.

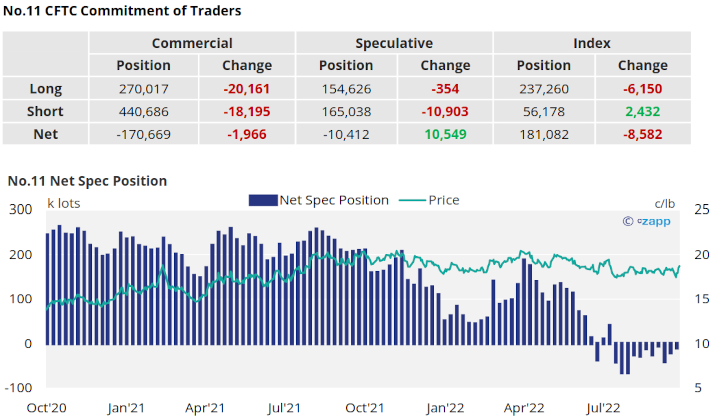

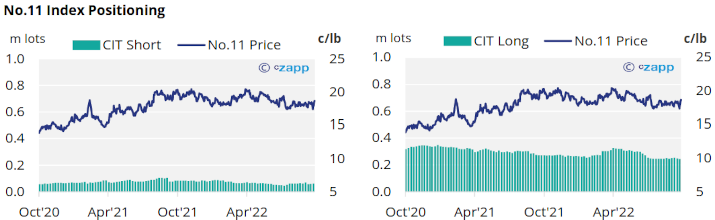

- Raw sugar speculators drift closer towards a neutral position as future price direction is less clear.

- The sugar white premium has fallen below 100USD/mt, the first time since February.

New York No.11 (Raw Sugar)

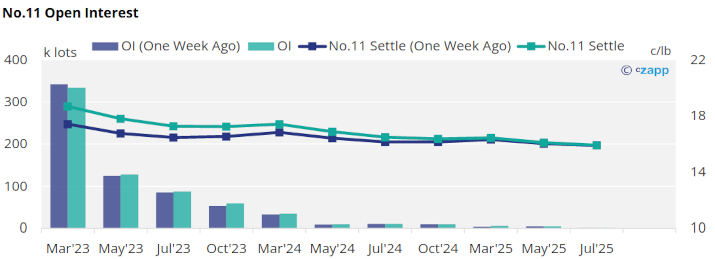

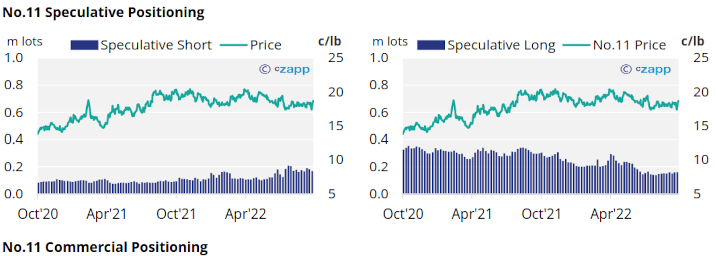

The No.11 strengthened by almost 1c/lb over the last week, closing at 18.7c/lb by the 7th October. This represents a much faster pace of weekly price movement than has been observed for much of the last two months.

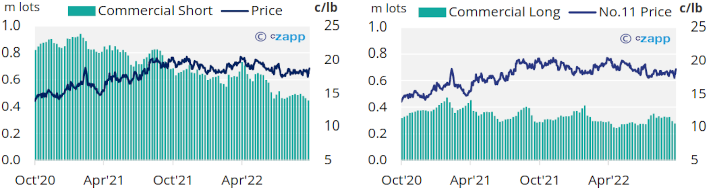

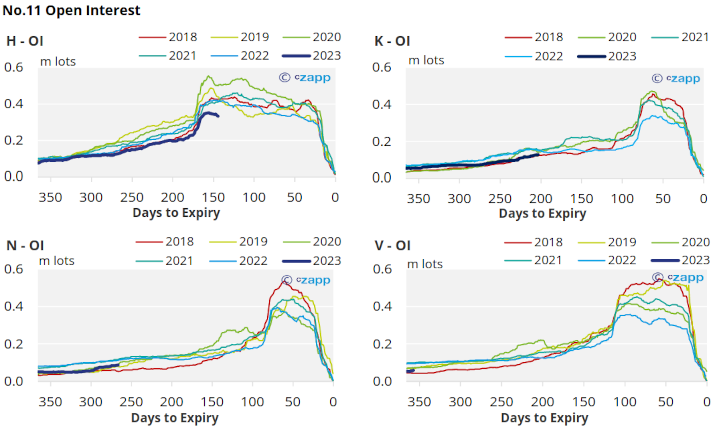

Prior to this, as of the COT report from the 4th of October, the Oct’22 expiry saw over 40k lots of commercial positions close, split evenly between raw sugar producers and consumers.

In the same period raw sugar speculators cut 11k lots of recently opened short positions a small volume of long positions. This has moved the net spec position further toward neutrality, now at only 10k lots short. This could be considered representative of a raw sugar market currently caught between a bearish macro environment and bullish sugar fundamentals.

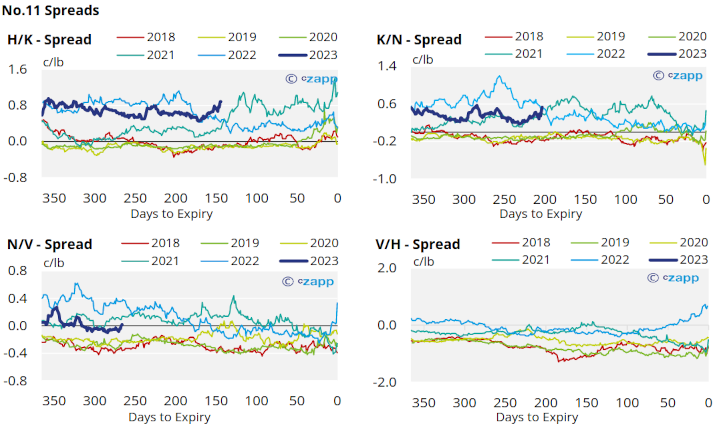

The No.11 forward curve remains backwardated toward the middle of next year, suggesting that the supply tightness could ease in coming months.

London No.5 (Refined Sugar)

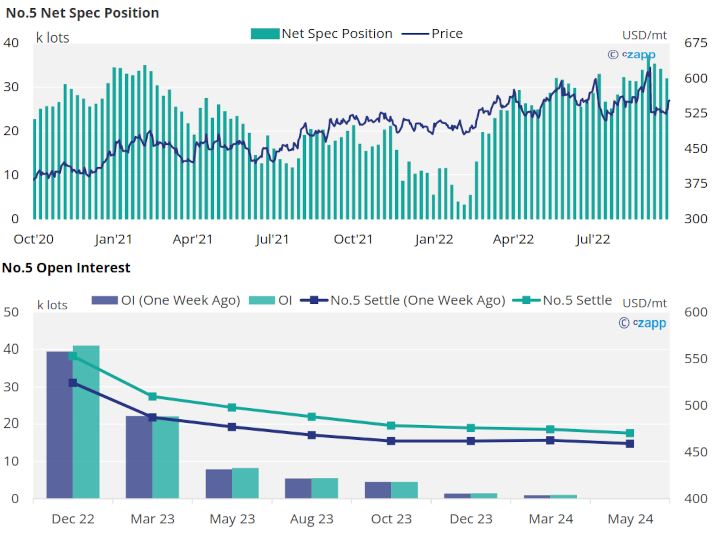

No.5 prices have lifted out of the 520-540USD/mt range held since the Oct’22 expiry, finishing last week around 555USD/mt. This mirrors similar strength in the No.11.

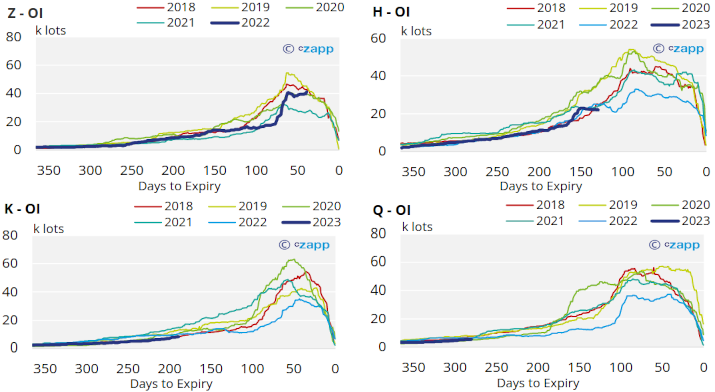

By the 4th of October COT report, refined sugar speculators continue to reduce their large long position, closing almost 2k lots.

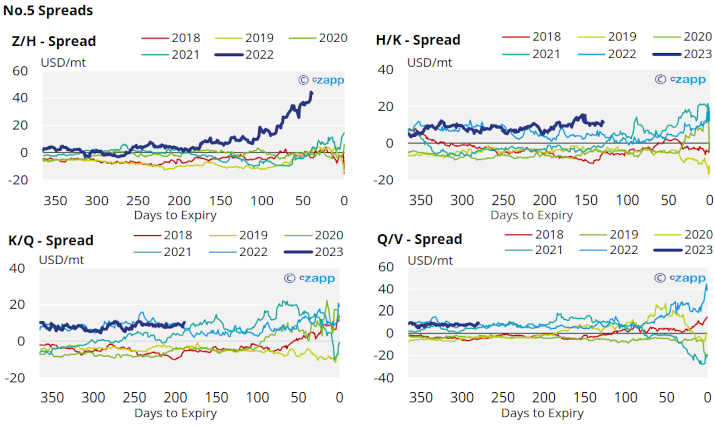

The Dec’22 contract is currently at over a 40USD/mt premium to the next contract, leaving the No.5 forward curve strongly backwardated. This is reflective of the short term pressure in the refined sugar market.

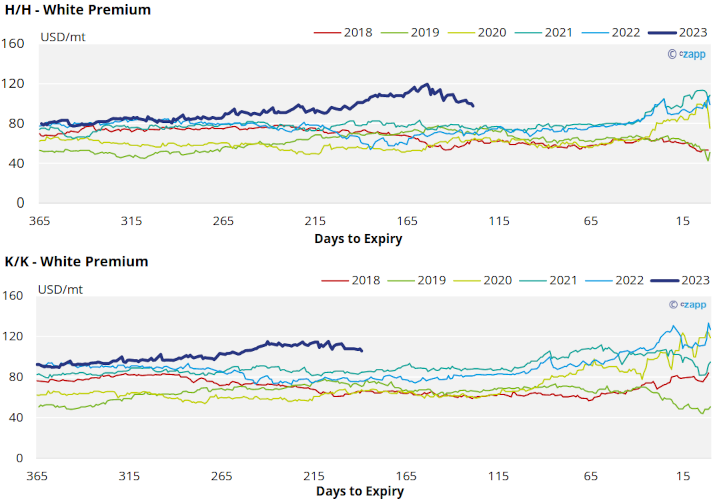

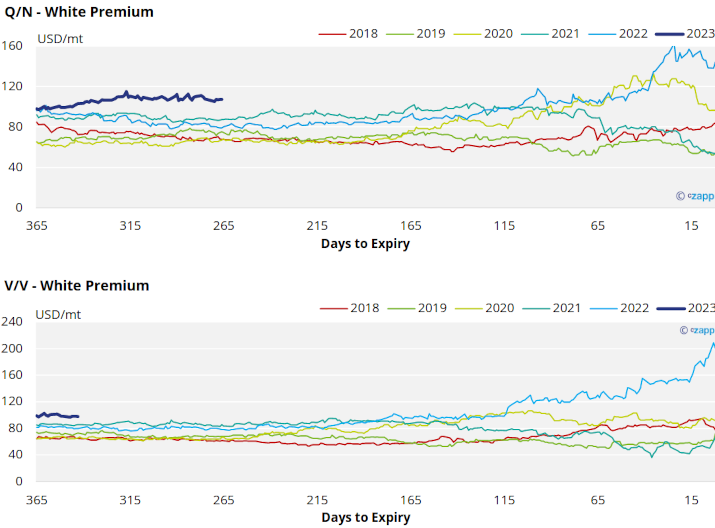

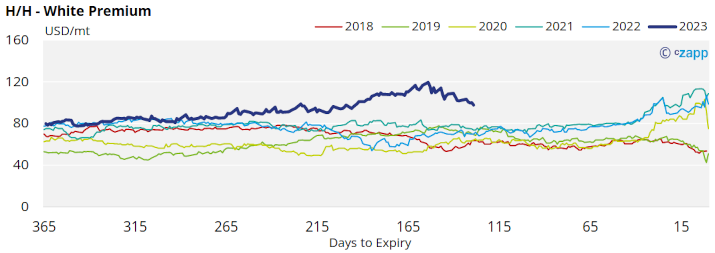

White Premium (Arbitrage)

The sugar white premium has dropped through the symbolic 100USD/mt threshold, closing last week at 97USD/mt, a low not seen in the last 8 months.

We think this move is driven more by bearish macroeconomic factors than a resolution to the undersupplied market seen throughout Q3. As such many re-export refiners could struggle to operate profitably at this level.

The proceeding K/K and Q/N white premiums are more stable at the moment, still trading around 105USD/mt, unusually high this far in advance of their expiries.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

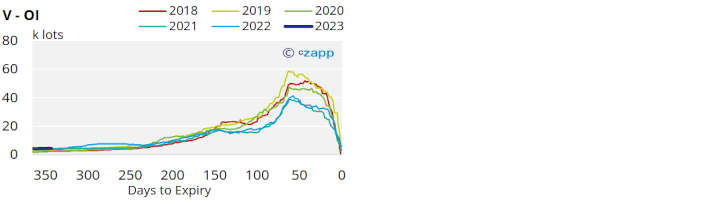

No.5 Open Interest

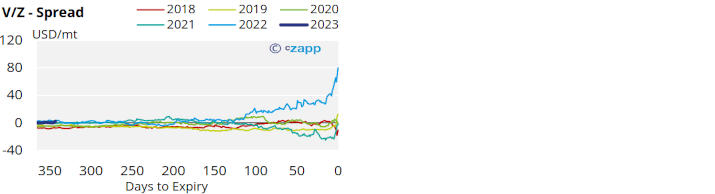

White Premium Appendix