Insight Focus

- Both raw and refined sugar prices continued to strengthen over the last week.

- This offered raw sugar producers’ good opportunity to advance their hedging regime.

- Sugar speculators also bought into this strength, extending their long positions.

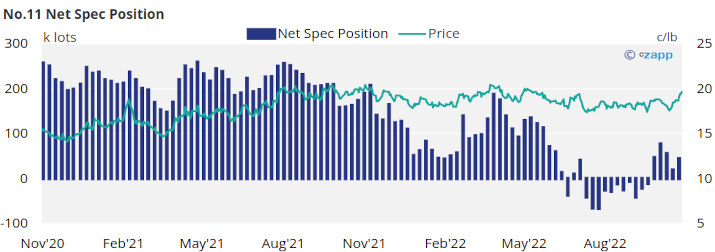

New York No.11 (Raw Sugar)

No.11 raw sugar futures have rallied for the last 11 trading sessions, the first time this has happened since 2015. The Mar’23 contract now sits above 19.8c/lb, much closer to the top of the long held sideways range.

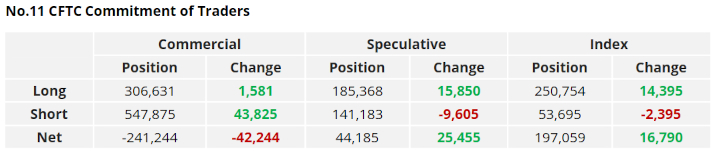

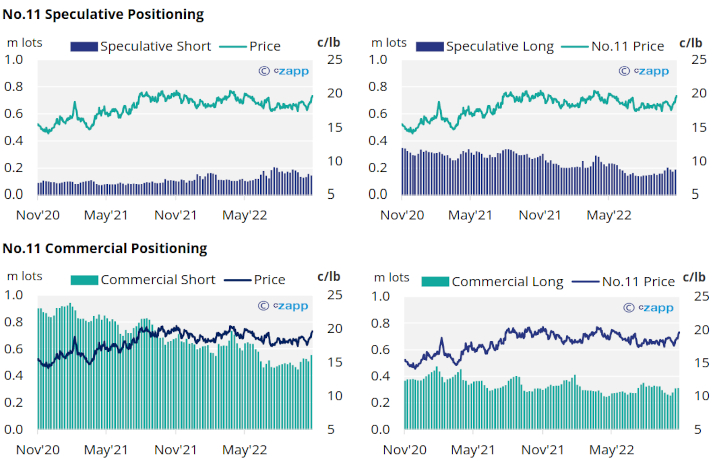

With this rally underway by the 8th of November (latest CFTC CoT report) raw sugar producers have added almost 44k lots of new hedges, selling into this recent price strength.

Consumers were also able to add a small amount of additional cover (1.5k lots), likely when prices were closer to 18.5c/lb.

Raw sugar speculators, buying into upwards momentum have opened 16k lots of fresh long positions, and closed almost 10k short positions which had likely come under pressure as prices begun to rise.

As such the net spec position now extends to 44k lots long, over 25k lots higher than the week before.

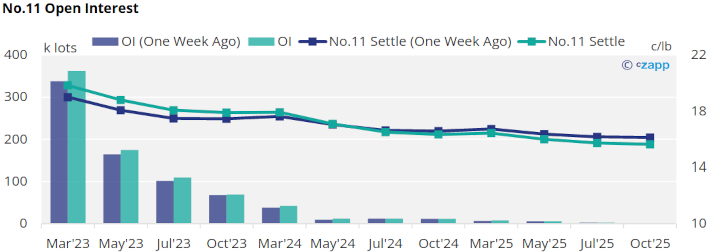

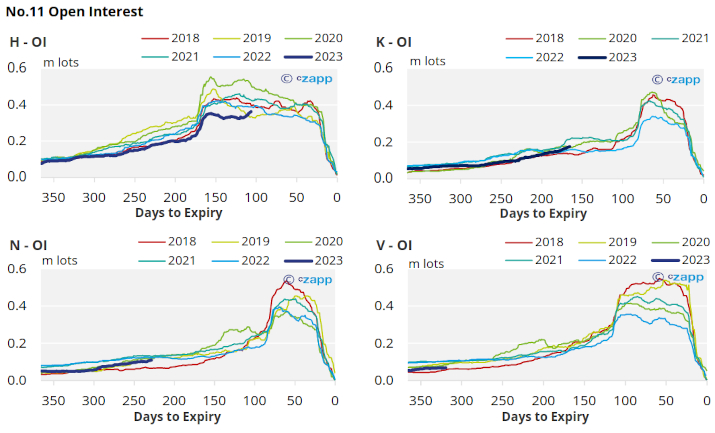

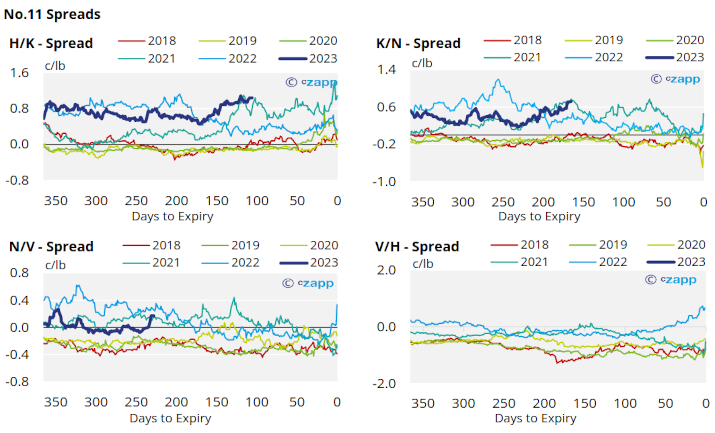

The No.11 forward curve is still backwardated to the middle of next before moving into contango into Mar’24, suggesting potential tightness in the market toward the end of 2023.

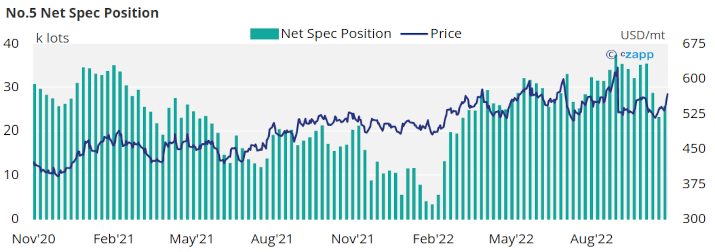

London No.5 (Refined Sugar)

Soon to expire Dec’22 No.5 refined sugar prices maintain their recent upwards momentum, crossing the 565USD/mt threshold by the end of the week. Prices have now risen for 10 of the last 11 trading sessions.

The upcoming Mar’23 contract has strengthened by over 50USD/mt since the start of the month and is now at its highest level since at least June at over 535USD/mt.

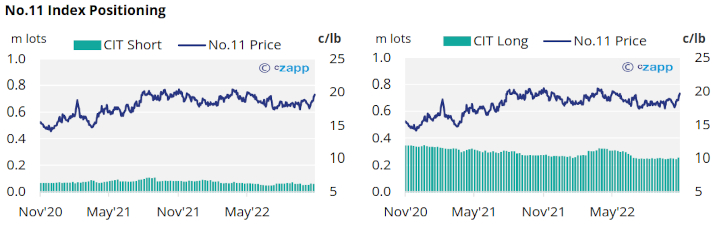

As of the latest CoT data on the 8th of November, refined sugar speculators extended their net long position by 2.5k lots, buying into price strength. This pauses the broader decline in the net spec position seen over the last month.

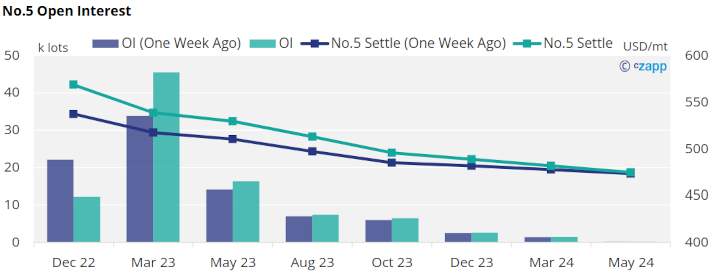

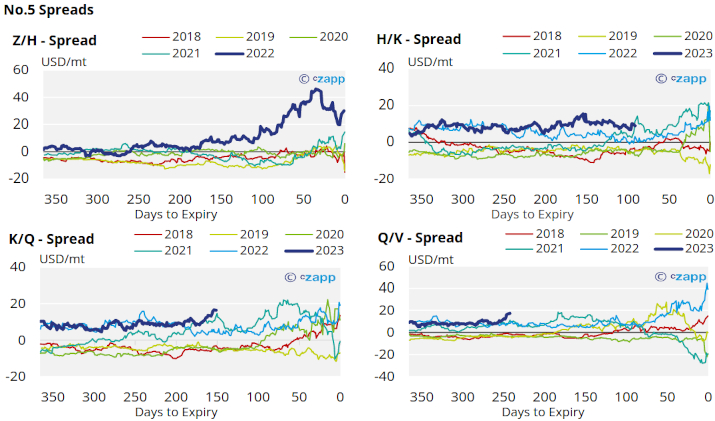

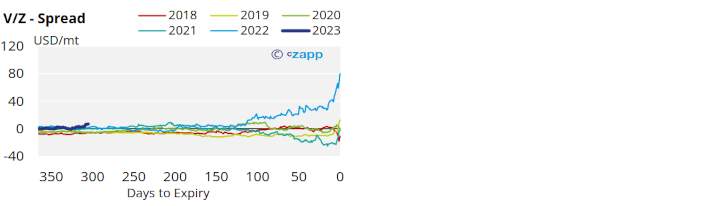

With the majority of Dec’22 positions now closed or rolled to the Mar’23 contract the Z/H spread has grown slightly to 27USD/mt premium. The rest of the refined sugar forward curve is still strongly backwardated until 2024.

White Premium (Arbitrage)

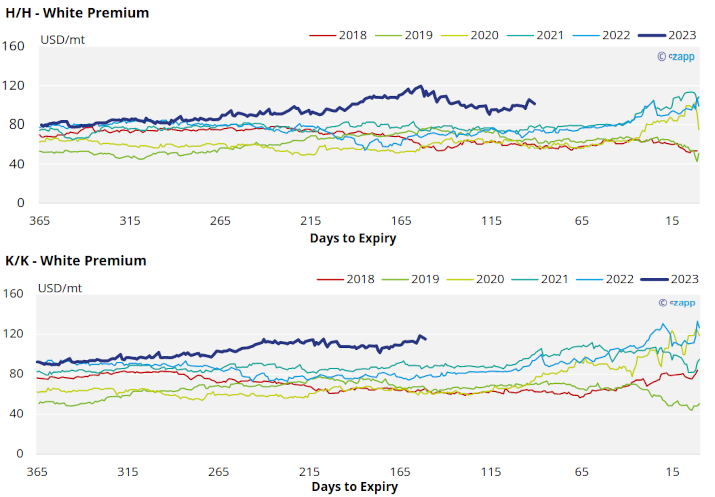

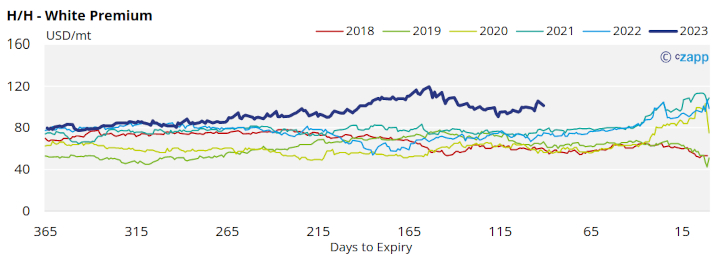

The H/H sugar white premium has pushed back above 100USD/mt over the last week, following No.5 strength.

Many re-exports refiners need around 120-130USD/mt above the No.11 to produce refined sugar, therefore physical values are still necessary to bridge this gap.

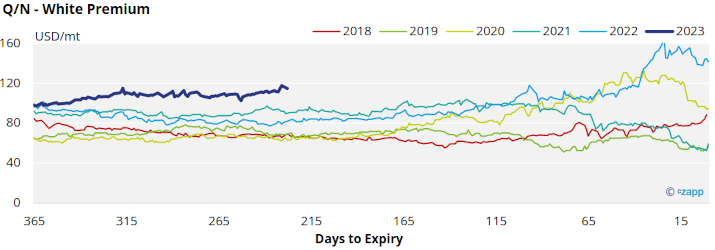

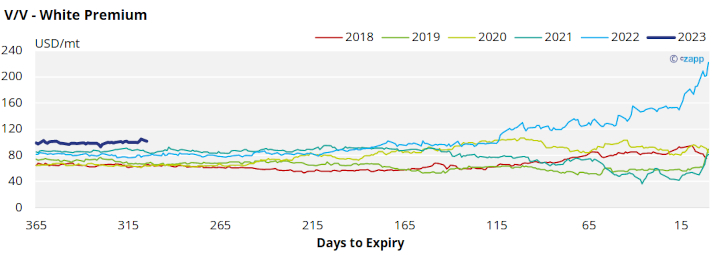

The refined sugar market is a little undersupplied for the majority of 2023 and this is reflected in comparatively strong K/K and Q/N white premiums which are both pushing toward 120USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

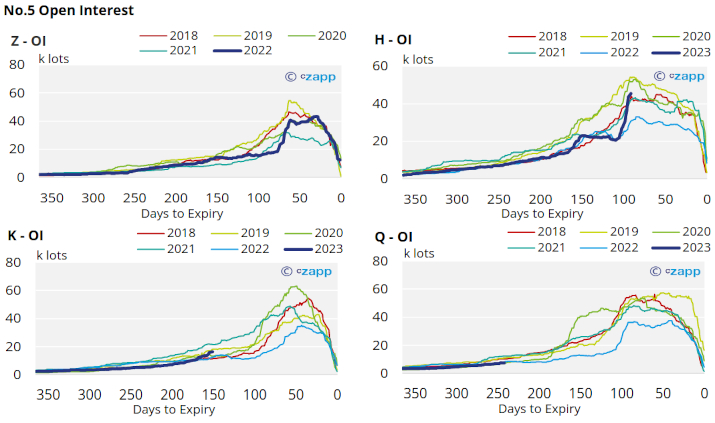

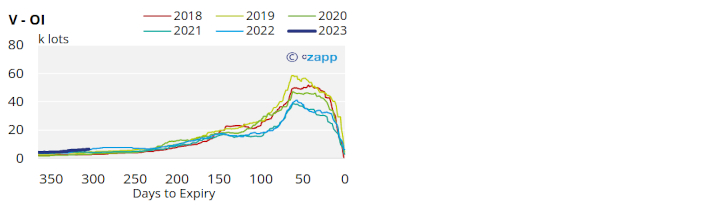

No.5 (White Sugar) Appendix

White Premium Appendix