Insight Focus

- Recent strength in the No.11 and No.5 slowed in the last week.

- Raw sugar speculators are net long raw sugar for the first time since July.

- Raw sugar producers, added a considerable volume of hedges.

New York No.11 (Raw Sugar)

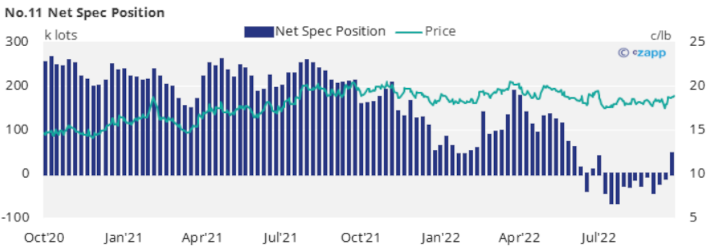

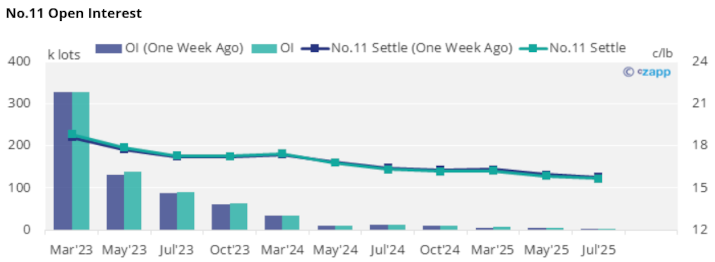

No.11 prices continued to track slowly higher over last week, closing near to 18.9c/lb by Friday. This leaves the market 1c/lb higher than at the start of October.

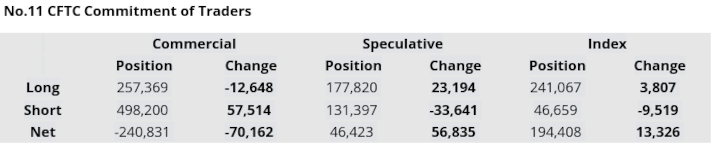

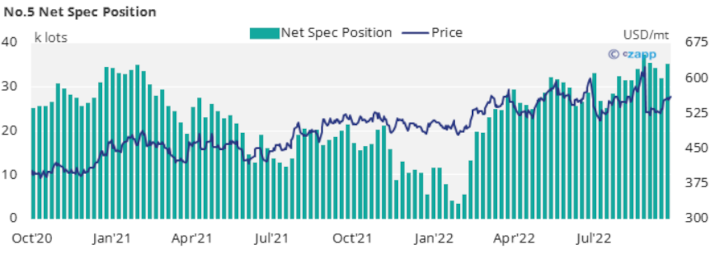

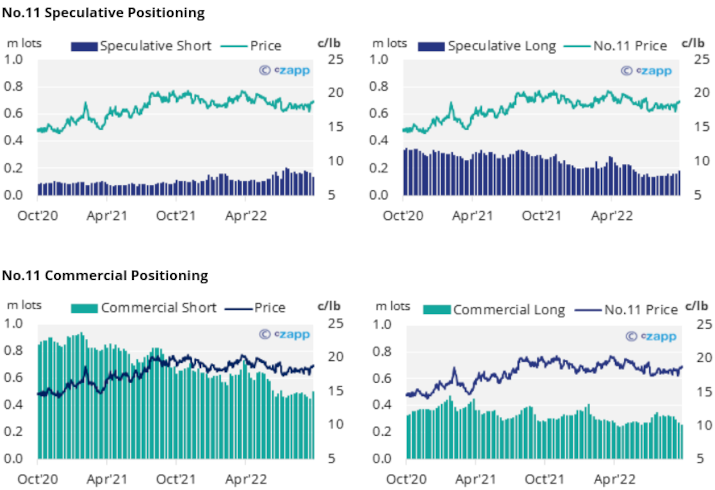

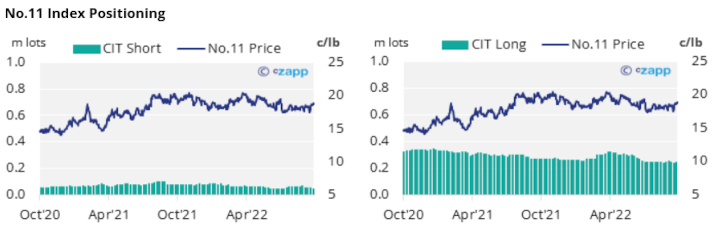

With the latest CFTC CoT report now reflective of the start of this rally, as of the 11th of October raw sugar speculators spurred on by a rebound in energy markets closed almost 34k lots of short positions and opened 23k new long positions.

This is the first time speculators have been net long the sugar market since July. However, the net position remains close to neutral, as it has for most of the last 6 months.

Raw sugar producers added almost 60k lots of fresh hedges as prices rose. This returns the commercial short position to its highest in the last 3 months.

By contrast the commercial long position fell by 13k lots by the 11th of October as consumers were not willing to add new hedges whilst prices strengthened.

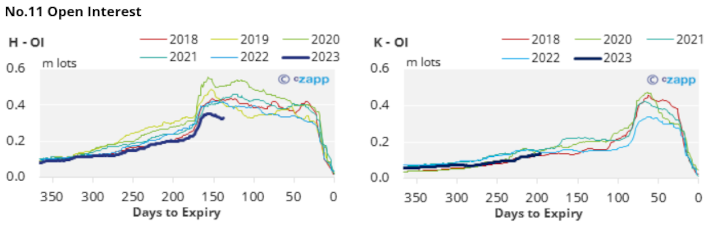

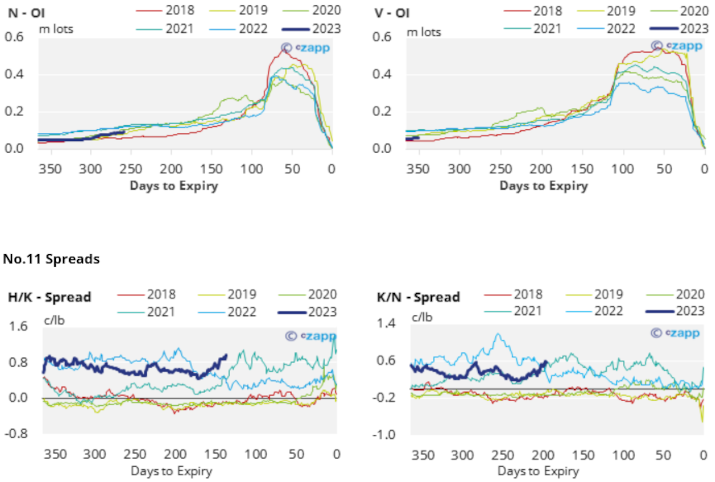

With most of last week’s upward movement focussed on the Mar’23 contract, the forward curve has steepened slightly to the middle of 2023, before turning to a slight carry into the start of 2024. This suggests the current tight supply situation could ease over the next few quarters.

London No.5 (Refined Sugar)

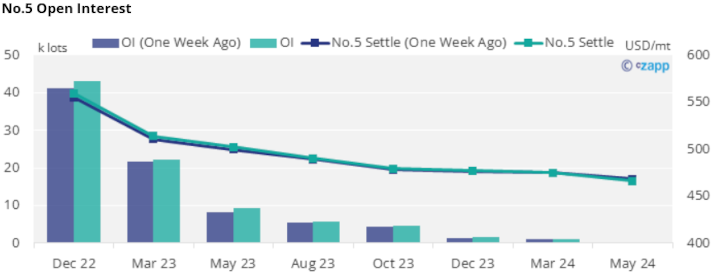

No.5 prices also slowly strengthened over the last week, briefly breaking above 560USD/mt by Friday.

By the 11th of October, speculators renewed faith in their bull position in refined sugar as the net spec position rose by over 3k lots, helping move the market higher. This reverses a net spec position falling towards neutrality observed over the last 4 weeks.

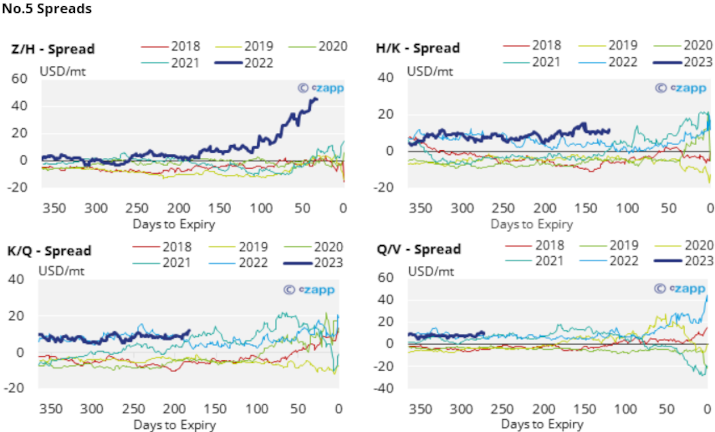

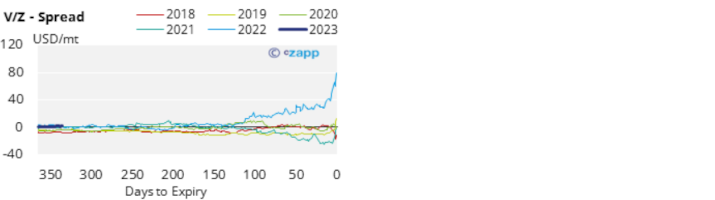

The Dec’22 contract is now at over 45USD/mt premium to the Mar’23, leaving the No.5 forward curve strongly backwardated. This is reflective of the short-term pressure in the refined sugar market.

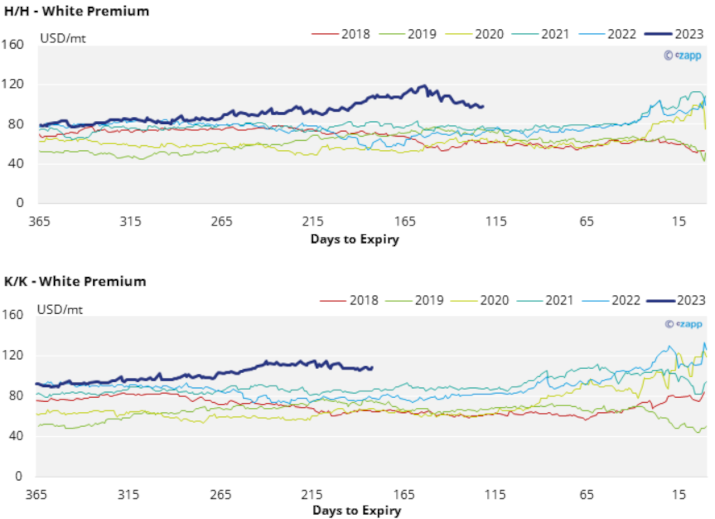

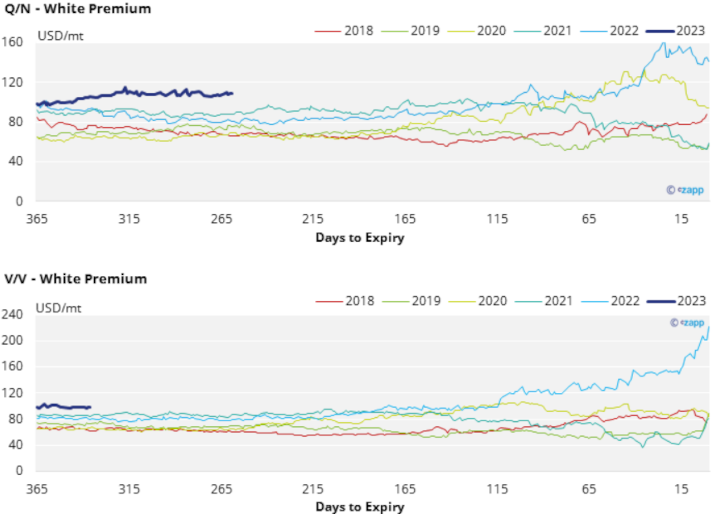

White Premium (Arbitrage)

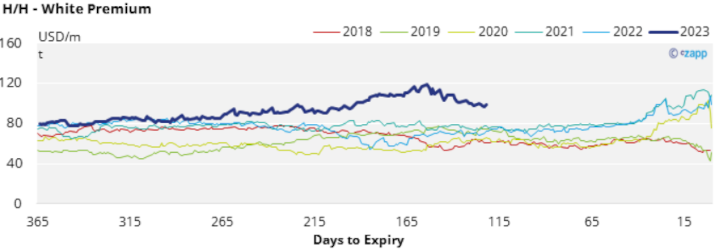

The white premium remains below 100USD/mt though has stopped declining over the last week.

We think this move is driven more by bearish macroeconomic factors than a resolution to the undersupplied market seen throughout Q3.

Many re-exports refiners need around 120-130USD/mt above the No.11 to produce refined sugar, therefore the current white premium is not strong enough to incentivise this.

The proceeding K/K and Q/N white premiums are more stable at the moment, still trading around 105USD/mt, unusually high this far in advance of their expiries.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

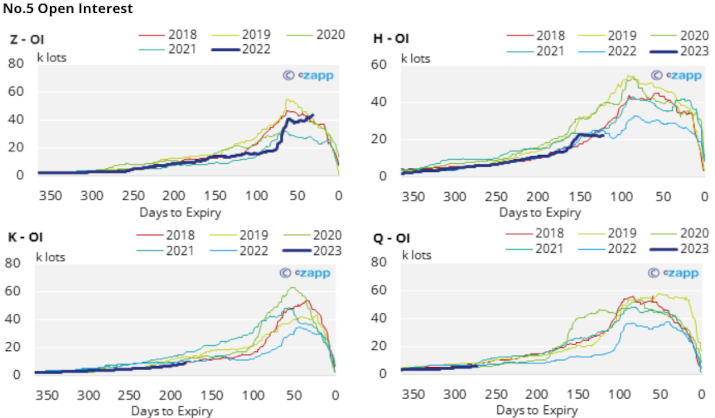

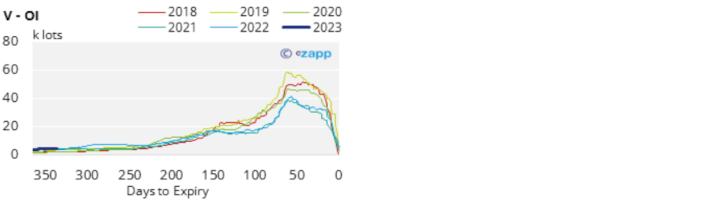

No.5 (White Sugar) Appendix

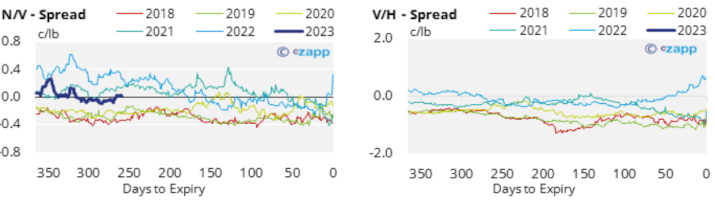

White Premium Appendix