Insight Focus

- Sugar futures prices have collapsed in the last week.

- Speculators for both raw and refined sugar have closed a number of their long positions.

- The H/H white premium has weakened, now standing at 138USD/mt.

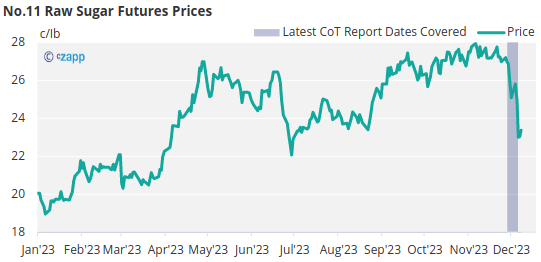

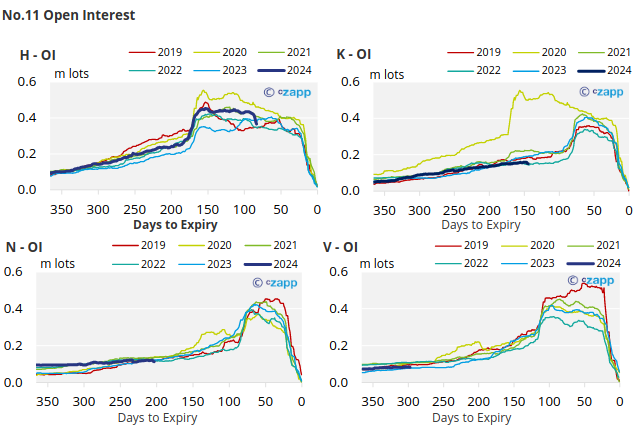

New York No.11 Raw Sugar Futures

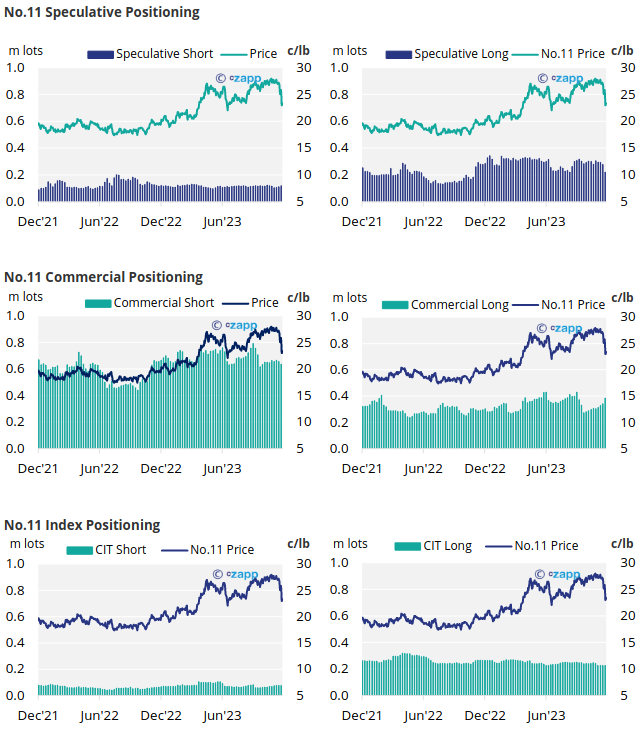

The No.11 raw sugar futures have continued to collapse over the past week, currently trading below 22c/Ib.

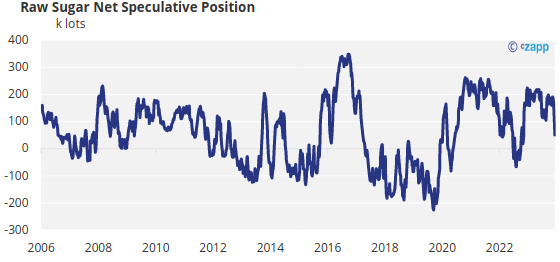

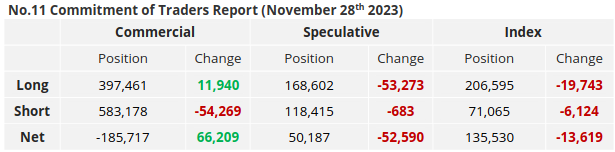

The price weakness has been led by aggressive speculative liquidation. For the second week running they’ve closed more than 50k lots of longs. However, they’ve not meaningfully added to short positions. This means the net speculative position is only 50k lots long, the lowest it’s been since October 2022.

The speculative selling has been absorbed by end-user buying and some producer buy-backs. The net commercial position is now 186k lots short, the least short it’s been since September 2022.

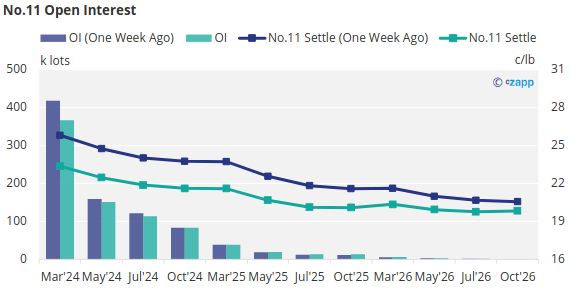

The No.11 forward curve has flattened significantly since last week.

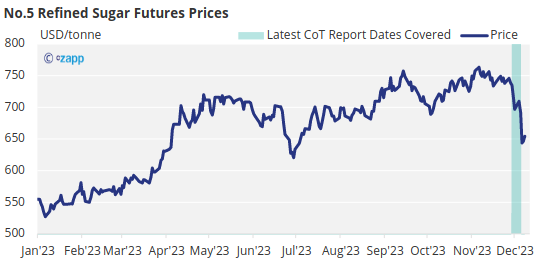

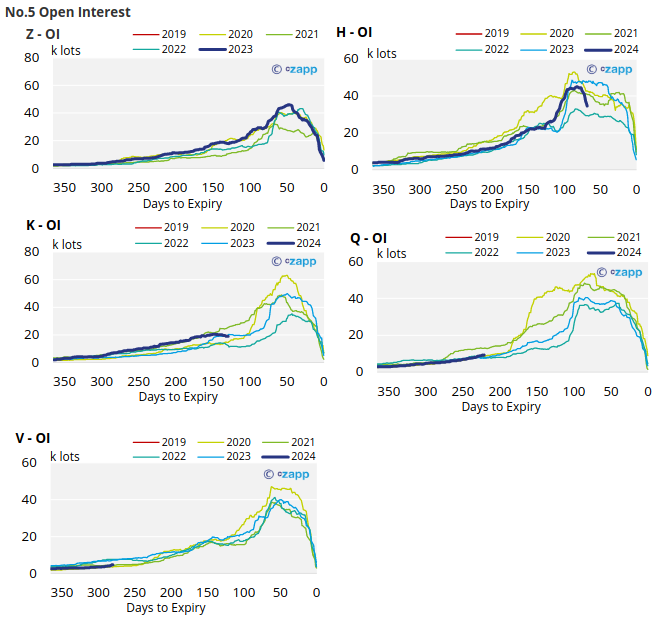

London No.5 Refined Sugar Futures

The move lower in refined sugar futures has broken the year-long upward trend, with prices now trading around 654 USD/mt.

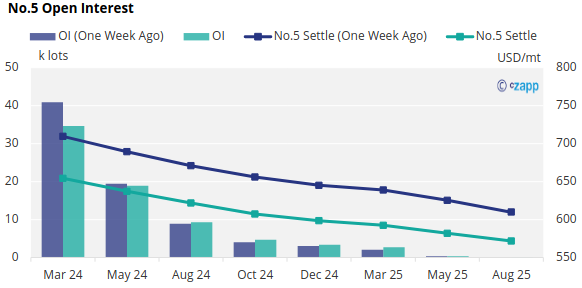

The refined sugar futures curve remains heavily backwardated.

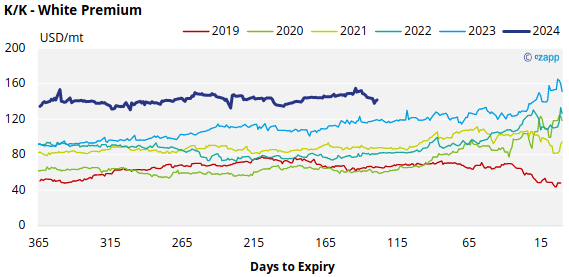

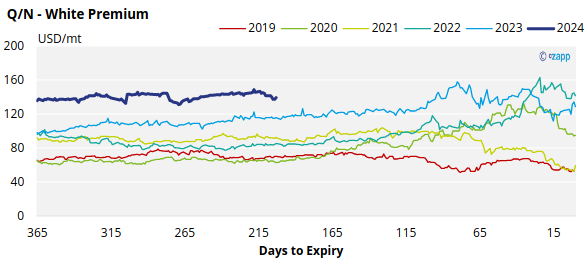

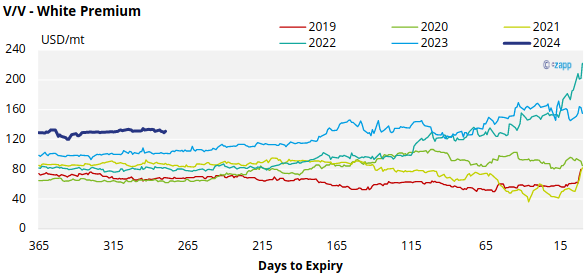

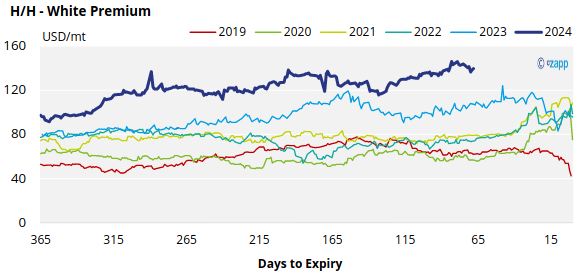

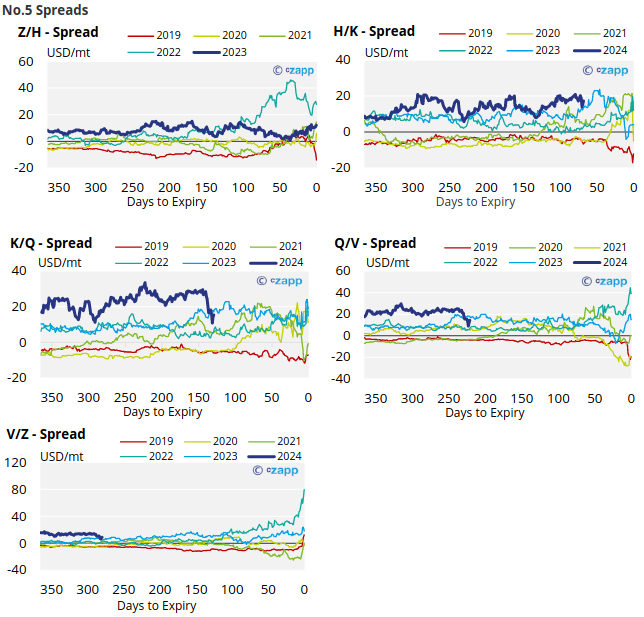

White Premium (Arbitrage)

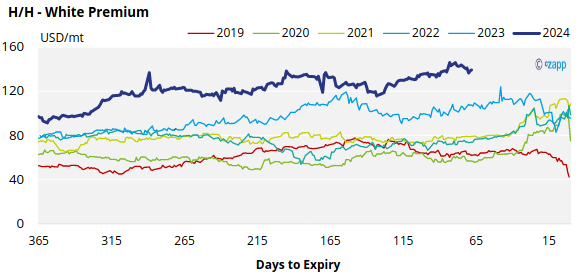

With the No.11 and No.5 sugar futures making similar moves in the past week, the H/H white premium has weakened to 138USD/mt.

The 2024 white premiums remain strong. We’ve not seen this kind of strength in the H/H white premium at this stage in the cycle in at least 5 years.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix