Insight Focus

- No.11 raw sugar futures closed last week at 20.7c/Ib.

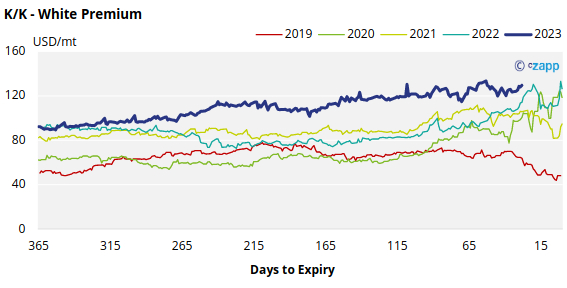

- K/K sugar white premiums stand at 128USD/mt.

- We continue to think that producers are well hedged.

New York No.11 Raw Sugar Futures

The No.11 raw sugar futures weakened slightly over the past week, closing at 20.7c/Ib last Friday.

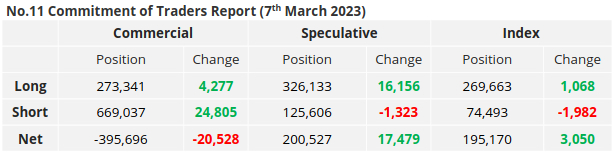

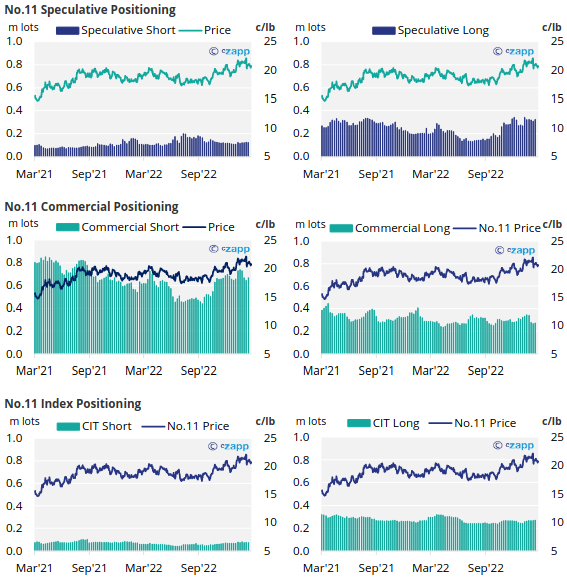

The CFTC is slowly recovering from a cyber-attack earlier in the year, releasing trading data up to the 7th of March, this is a week behind the usual schedule:

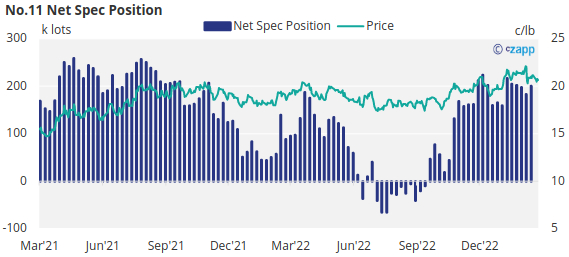

In light of this, even though we lack access to recent data, we believe that raw sugar speculators continue to hold a sizable long position given the market’s continued strength thus far in 2023. As a point of reference, on March 7th, the net spec position had increased by 16k lots, and it was now just over 200k lots long.

On the commercial side, raw sugar producers increased their positions by around 25k, while consumers gained approximately 4k lots of new hedges by the 7th of March. We think that raw sugar producers are likely well hedged at the moment, and consumers are poorly hedged given the relative price strength so far in 2023.

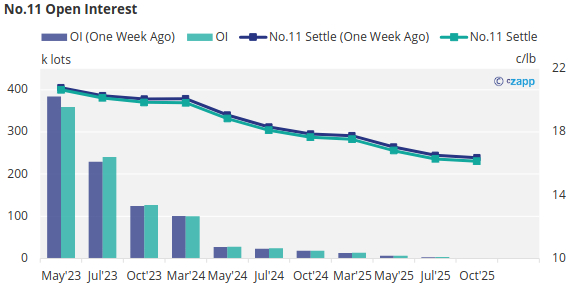

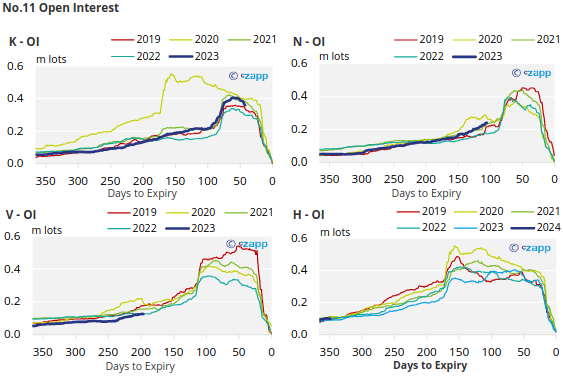

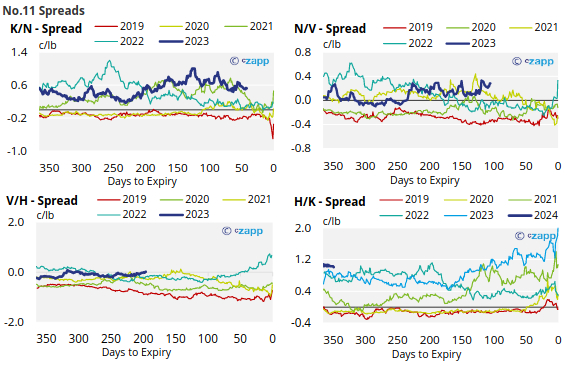

The No.11 forward curve remains inverted until the end of 2024.

London No.5 Refined Sugar Futures

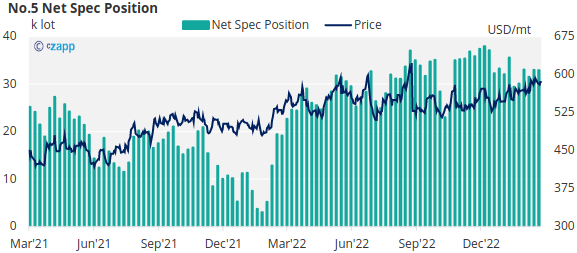

No.5 CoT data has been unaffected by the hack impacting CFTC. As such, data regarding No5. Net Spec Position is up to date.

No.5 refined sugar futures traded sideways over the last week, until Friday when the market rallied to close at 585USD/mt.

As of the 14th of March, the refined sugar net spec position has continued to remain around 33k lots long.

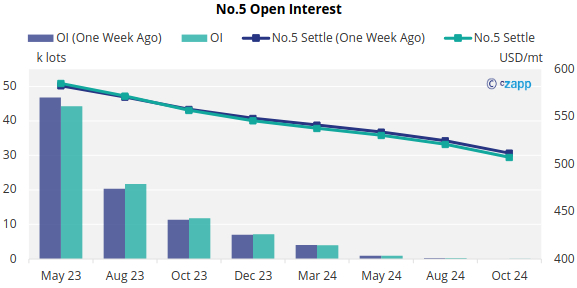

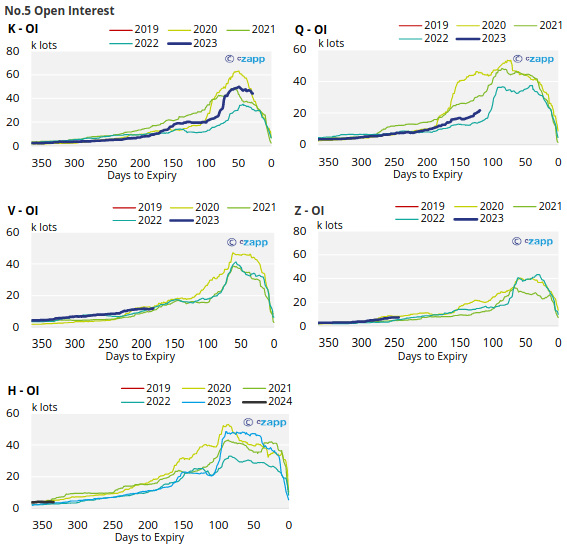

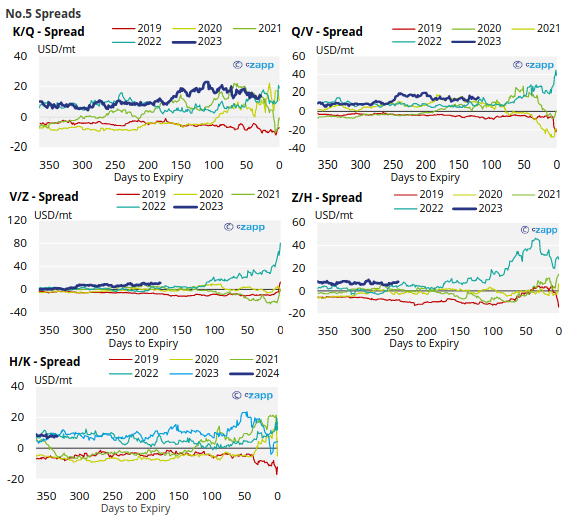

The No.5 forward curve remains strongly backwardated as far ahead as Oct’24. The May/July spread closed trading on Friday at 13.5USD/mt.

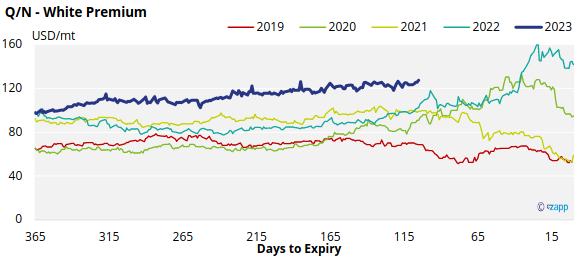

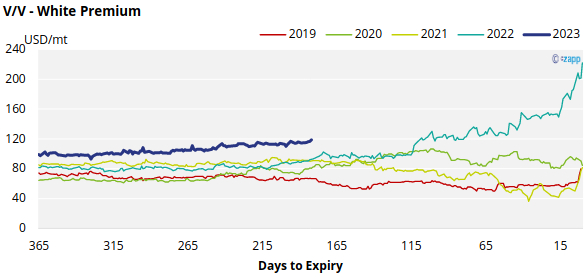

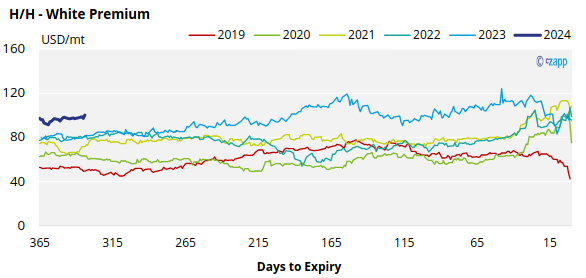

White Premium (Arbitrage)

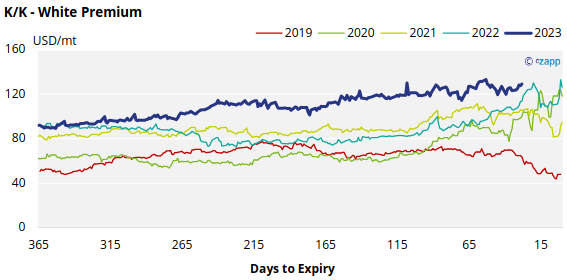

The K/K sugar white premium increased to 128USD/mt by the end of last week.

With world energy prices falling, we think re-exports refiners need around 125-140USD/mt above the No.11 to profitably produce refined sugar.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix