Insight Focus

- Raw and refined sugar price increases have stalled after an almost two-week rally.

- Speculators have recorded largest one week increase to net spec position in the last two years.

- Raw sugar producers have also reacted strongly to higher prices, adding plenty of new hedges.

New York No.11 (Raw Sugar)

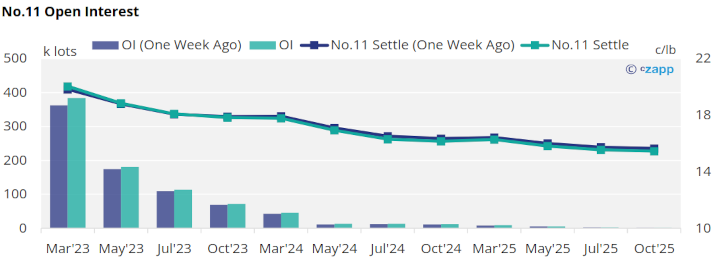

After a 12 day long rally, raw sugar futures prices appear to have run out of momentum trying to push above 20.5c/lb, falling back toward 20c/lb by the end of last week. This is still 200 points higher than at the start of November.

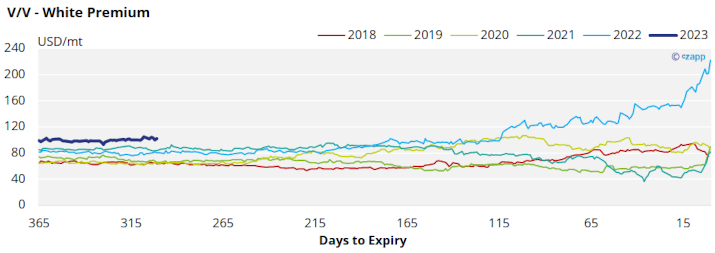

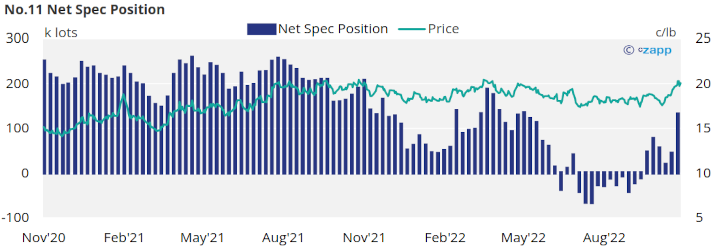

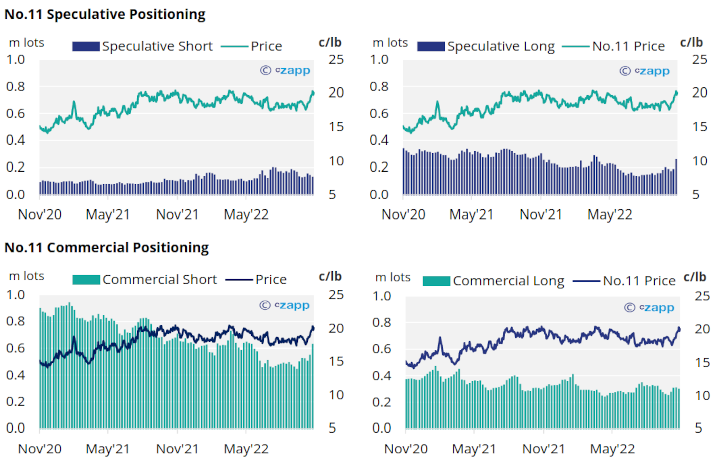

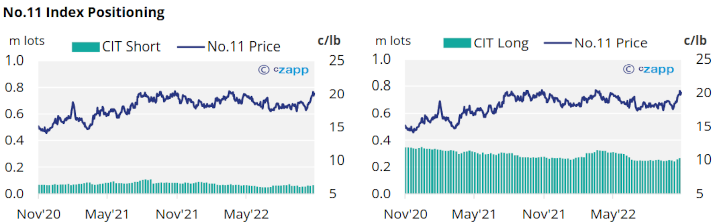

As of the middle of this rally (latest CoT report current to 15th November), raw sugar speculators aggressively bought into upwards price movement, opening over 75k lots of new long positions, and closing 12k lots of short positions.

This means that the net spec position has exploded upwards by almost 90k lots, the largest single week change in at least the last two years. At 130k lots long the net spec position is now at its highest since late May, the last time the market was at 20c/lb.

Raw sugar producers have acted equally aggressively, adding over 80k lots of new hedges as prices strengthened. Whilst consumers, likely unwilling to add any new cover at this level allowed 11k lots of existing hedges to roll off.

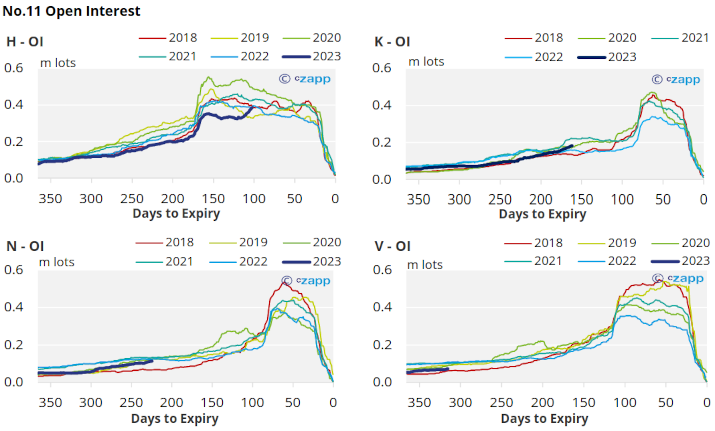

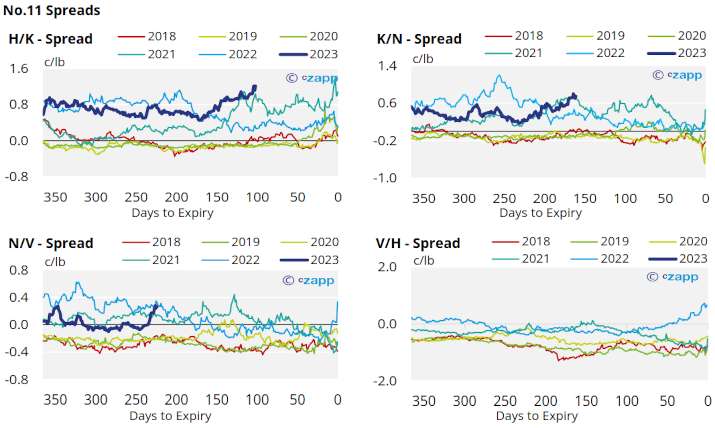

The No.11 forward curve is now backwardated all the way to October 2024.

London No.5 (Refined Sugar)

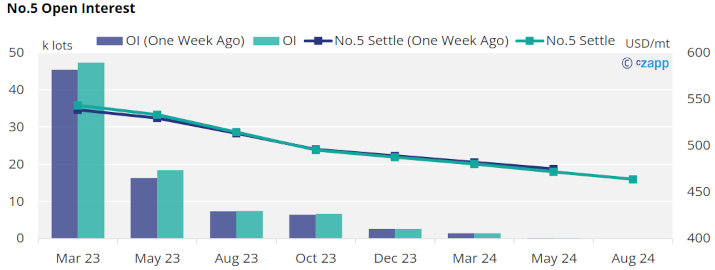

The Dec’22 contract expired last week at 579.2USD/mt, since then Mar’23 refined sugar futures have retreated toward 540USD/mt.

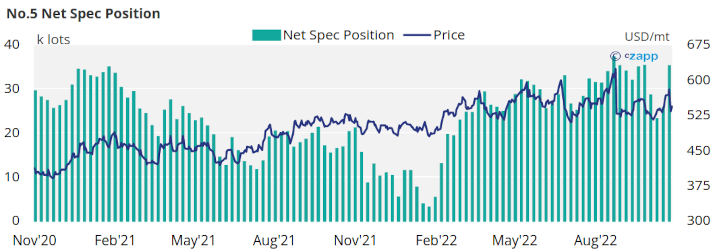

By the latest CoT report up to the 15th of November refined sugar speculators increased their long position by almost 10k lots. This is also the largest single week movement in at least the last two years, returning the net spec position close to 2022 highs.

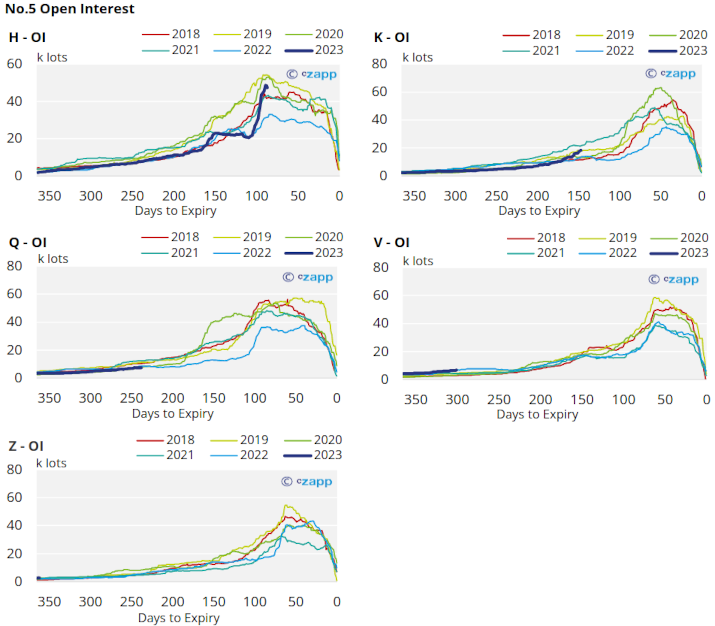

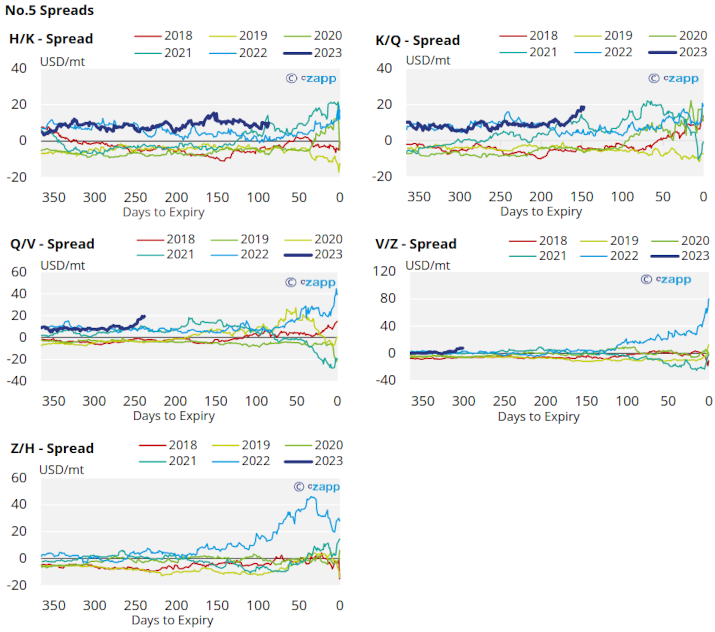

The No.5 forward curve remains strongly backwardated as far ahead as Aug’24, suggesting a slowly easing market tightness over the next few years.

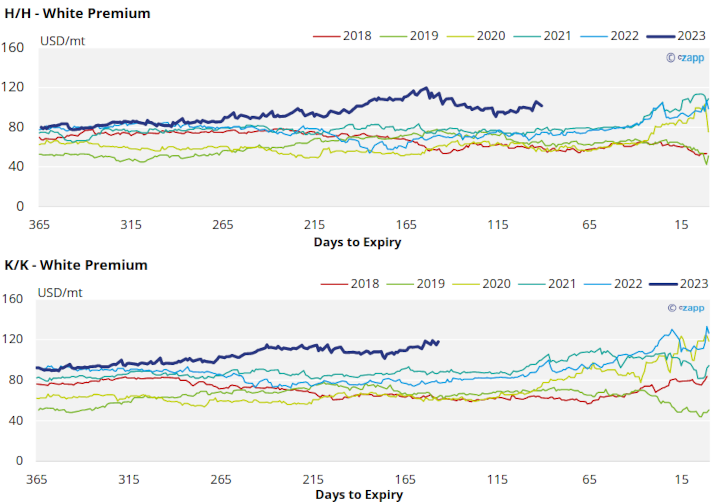

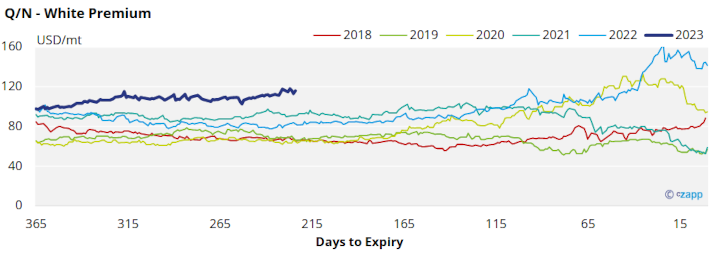

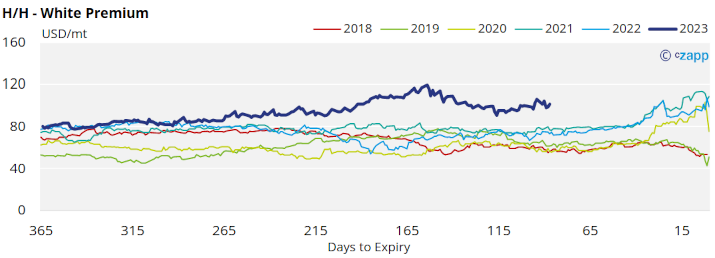

White Premium (Arbitrage)

The sugar white premium has broadly moved sideways over the last week, steady around 100USD/mt.

Many re-exports refiners need around 125-135USD/mt above the No.11 to produce refined sugar, therefore physical values are still necessary to bridge this gap.

The refined sugar market is a little undersupplied for the majority of 2023 and this is reflected in comparatively strong K/K and Q/N white premiums which are both pushing toward 120USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix