Insight Focus

- Both No.11 and No.5 prices have fallen over the last week.

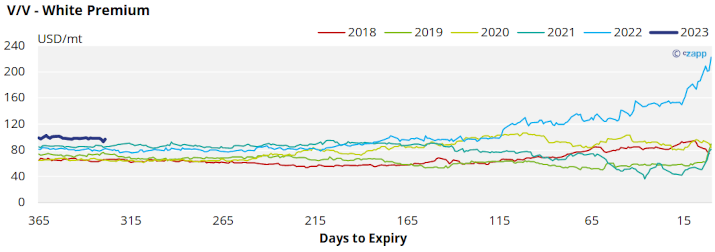

- This will not yet be reflected in the CFTC data which shows speculators furthering their long position.

- Likewise, raw sugar producers continued to capitalise when the market was rising.

New York No.11 (Raw Sugar)

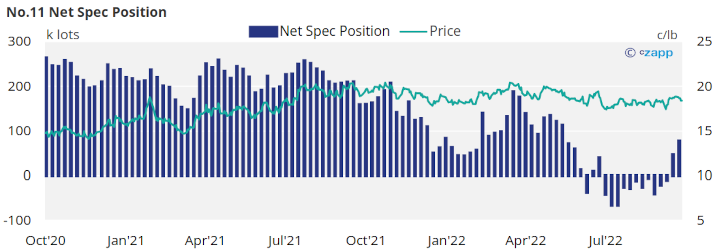

The No.11 was unable to fully move back into it’s yearlong sideways trend last week, instead falling back below 18.5c/lb by close of trading on Friday. This will not yet be reflected in the CFTC CoT data, which is only current to the 18th of October when the market was challenging 19c/lb.

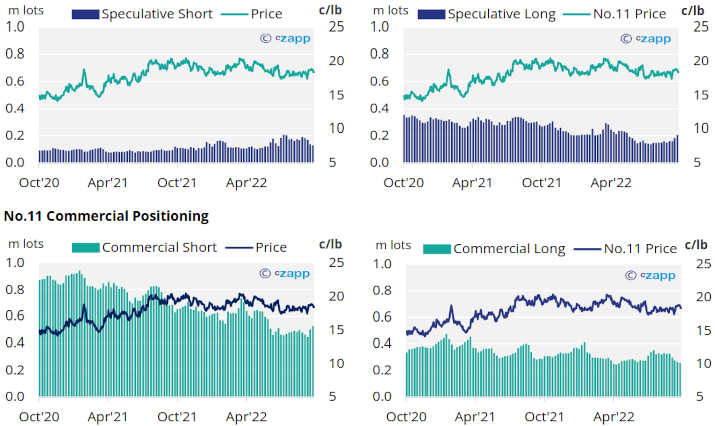

Raw sugar speculators, possibly trying to drive further upwards momentum added 23k lots of new long positions, and closed a further 8k lots of shorts.

Now at over 77k lots long, the net spec position moves to its highest point since the start of June, almost a 90k lot swing in just over two weeks.

Raw sugar producers also capitalised on a rising market to the 18th of October, adding 25k lots of additional hedges. With the No.11 having moved sideways-to-low (bad for producer hedging) for much of the last few months producers have moved quickly to lock in prices with the market closer to 19c/lb.

Consumer hedging has stalled with prices rising, with over 7k lots more hedges closing out than new positions being added.

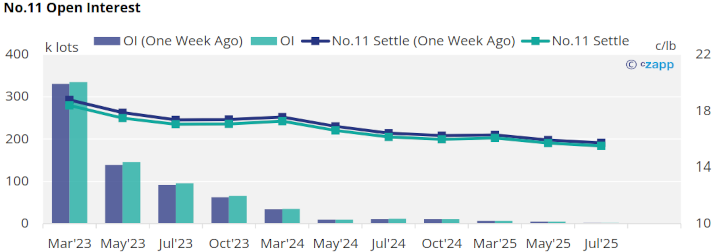

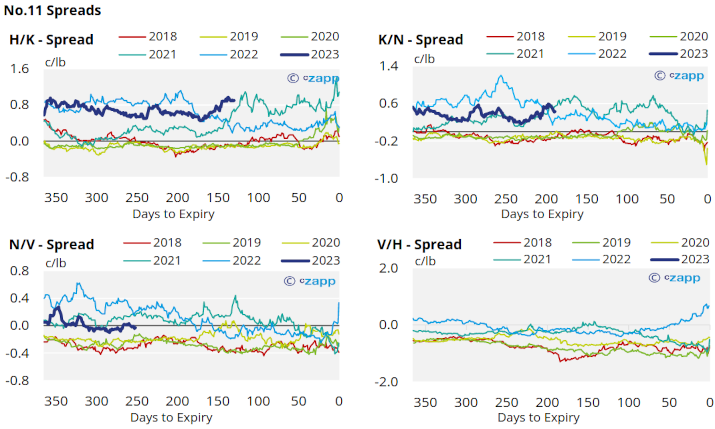

Now, with prices falling by Friday last week the forward curve moved lower across all active contracts. This means it remains in backwardation to Jul’23 before moving into a slight carry to Mar’24.

London No.5 (Refined Sugar)

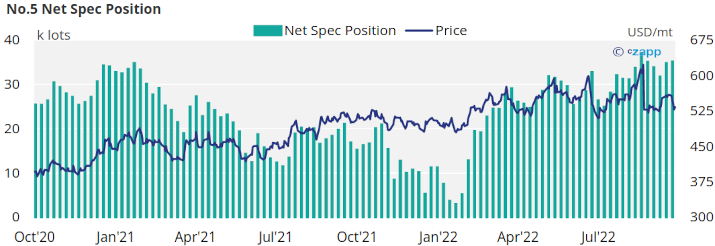

After briefly touching 560USD/mt, the No.5 has fallen sharply back towards 530USD/mt over the last week of trading.

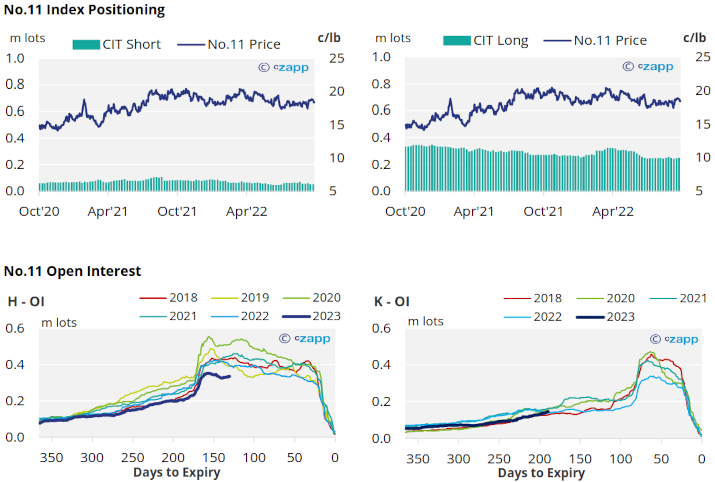

As of the 18th of October, refined sugar speculators slightly increased their net long position, moving the net spec position above 35k lots, the second highest in 2022.

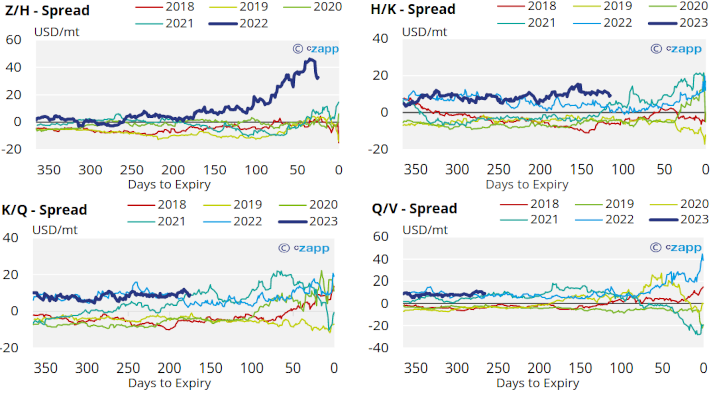

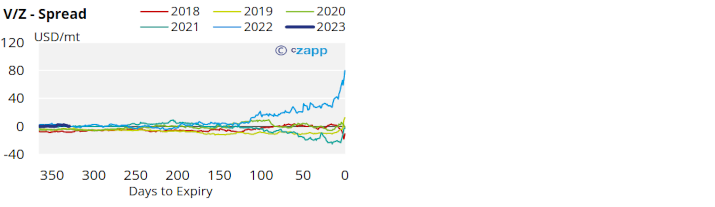

Whilst still heavily backwardated, a narrowing Z/H spread, now close to a 30USD/mt premium has allowed the No.5 forward curve to flatten over the last week.

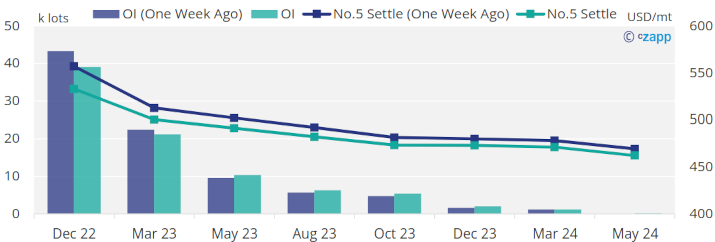

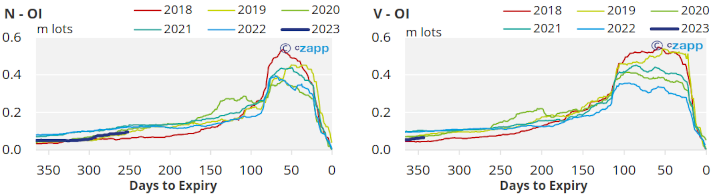

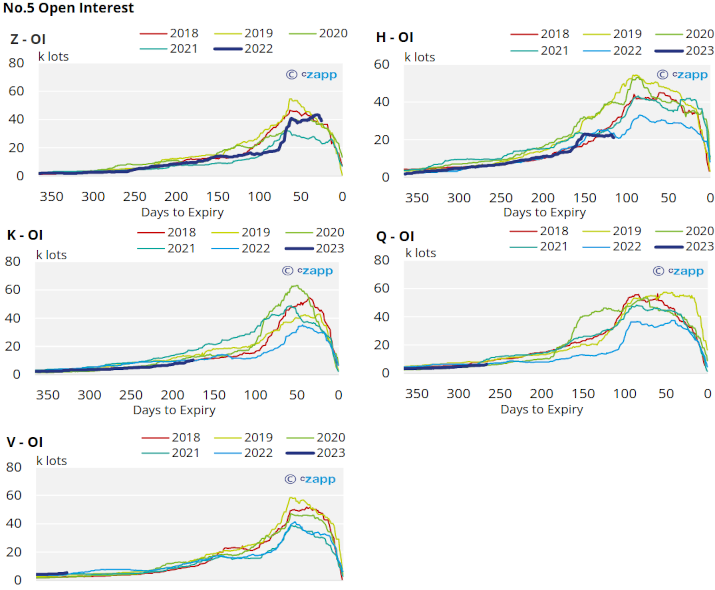

No.5 Open Interest

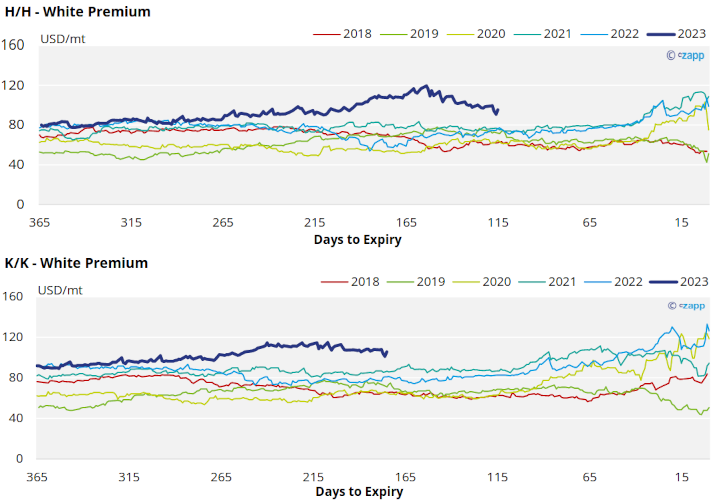

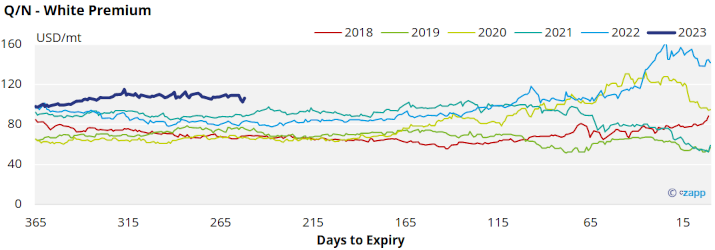

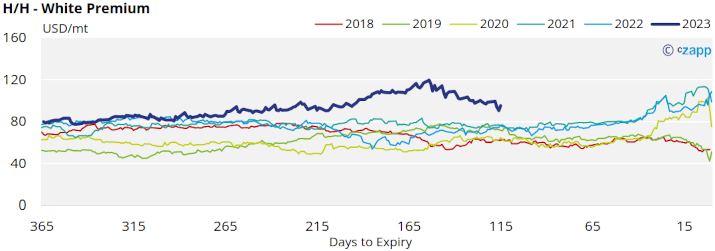

White Premium (Arbitrage)

Decline in the white premium looks to have slowed, with the arbitrage increasing slightly to 95USD/mt by Friday.

Whilst we think the recent narrowing has been partially driven by bearish macroeconomic factors, there is also a growing case that inflationary pressure on economies around the world could be causing a decline in usually robust sugar demand.

Many re-exports refiners need around 120-130USD/mt above the No.11 to produce refined sugar, therefore the current white premium is not strong enough to incentivise this.

The proceeding K/K and Q/N white premiums are more stable at the moment, still trading around 105USD/mt, unusually high this far in advance of their expiries.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.11 Speculative Positioning

No.5 (White Sugar) Appendix

No.5 Spreads

White Premium Appendix