Insight Focus

- Both raw and refined sugar futures strengthened over the last week.

- The sugar white premium has strengthened too, now standing at 137USD/mt.

- The CFTC has now fully recovered from a cyber-attack earlier in the year.

New York No.11 Raw Sugar Futures

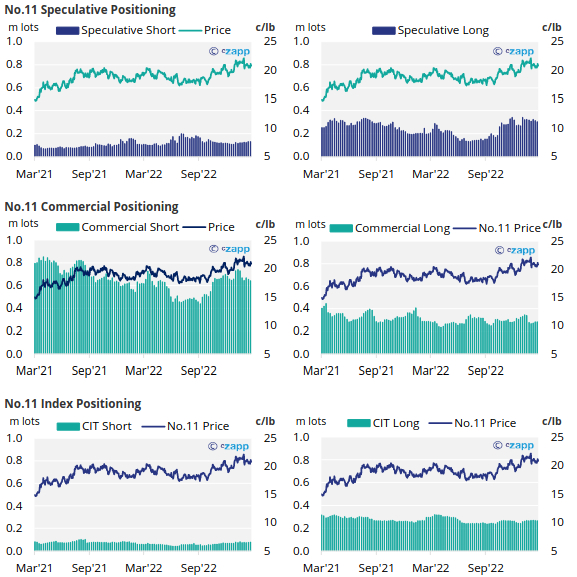

The No.11 raw sugar futures have broadly traded sideways over the past week, closing at 20.82c/Ib last Friday.

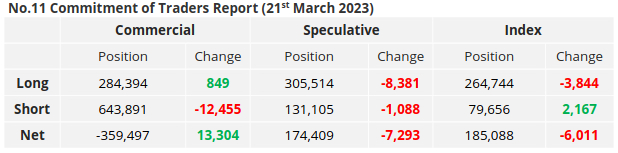

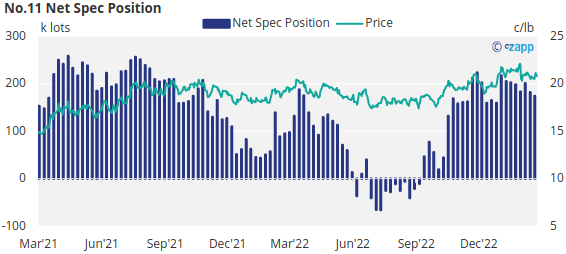

By the 21st of March (latest CoT CFTC report), when prices had weakened below 20.5c/lb, some recently opened spec long positions look to have come under pressure, with the speculative long position retreating by over 8k lots.

With some spec short positions closed too, the net spec position has fallen to just under 175k lots long, however this is still higher than throughout much of the last 12 months.

Looking at the commercial positions, raw sugar producers closed over 12k lots, by the 21st of March, whilst consumers extended the commercial long position by just under 1k lots over the same period.

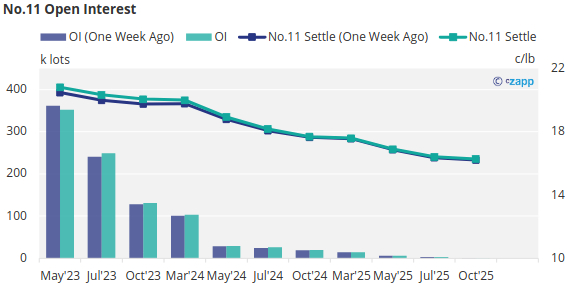

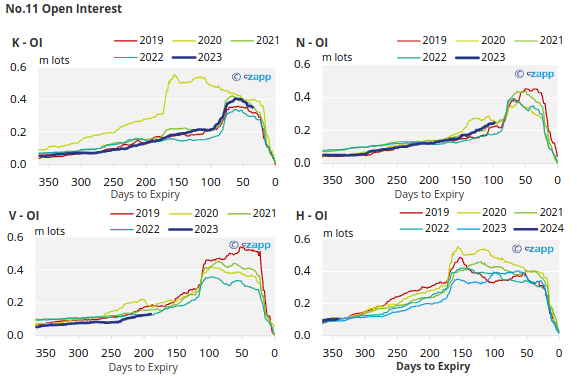

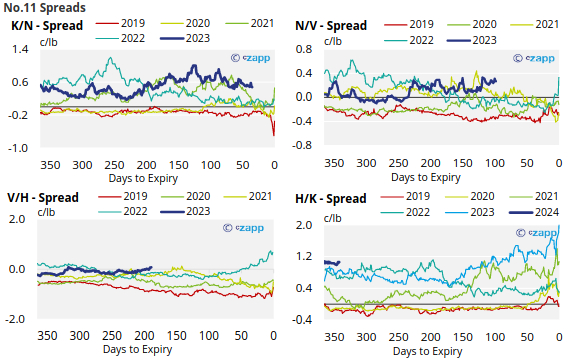

The No.11 forward curve remains inverted until the end of 2024.

London No.5 Refined Sugar Futures

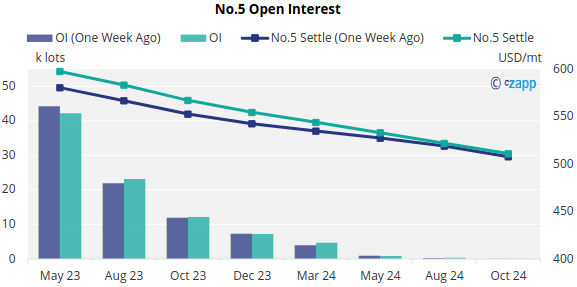

No.5 refined sugar futures have strengthened towards the end of last week, closing at 598USD/mt on Friday, up 13USD/mt since March 14th.

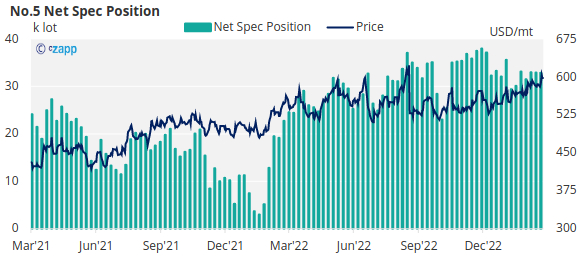

As of the 21st of March, the refined sugar net spec position has continued to remain stable, around 33k lots long.

This means the net spec position is still relatively large, as has been the case for the last 12 months.

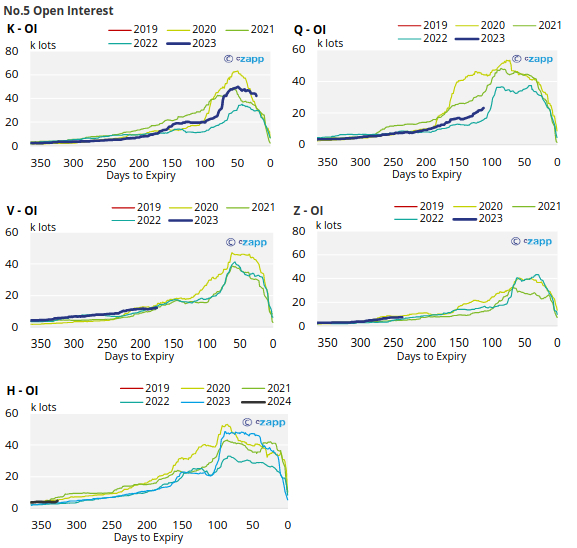

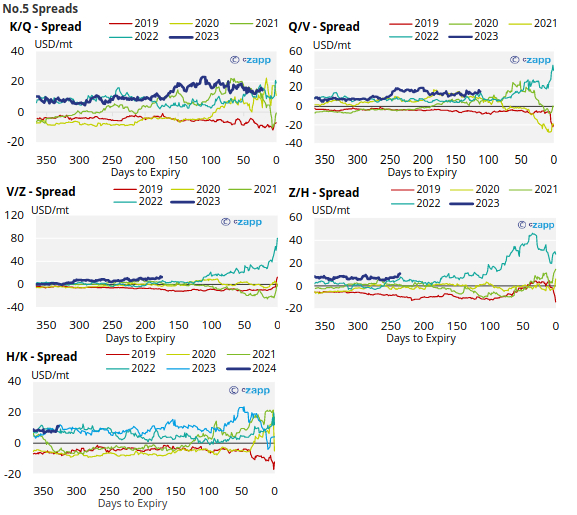

The No.5 forward curve is inverted and remains backwardated into 2024, with the nearby contracts lifting over the last week.

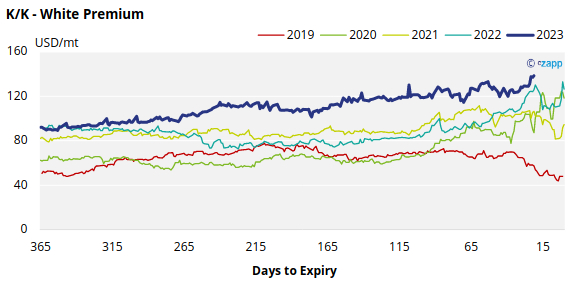

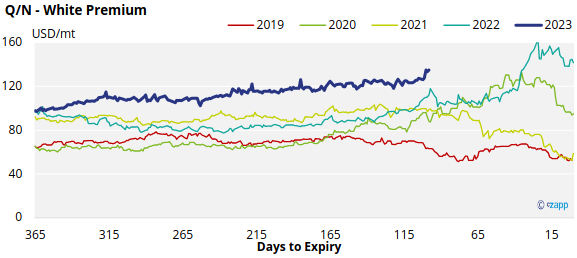

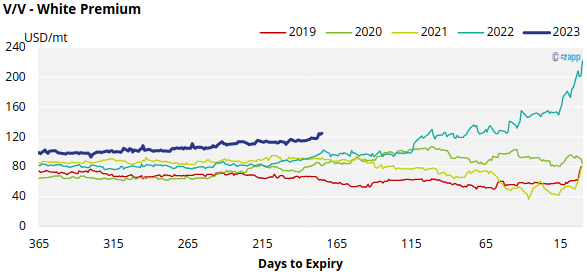

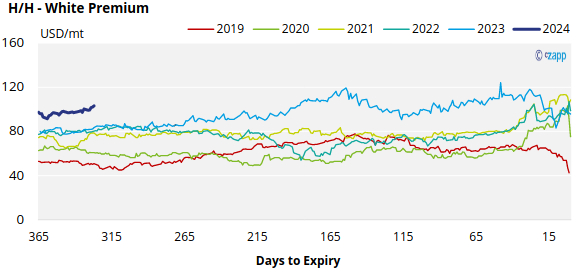

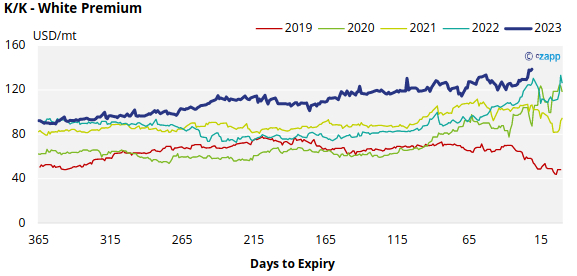

White Premium (Arbitrage)

The K/K sugar white premium increased by around 10USD/mt since last week, closing at 137USD/mt on Friday.

With world energy prices falling, we think re-exports refiners need around 125-140USD/mt above the No.11 to profitably produce refined sugar.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix