Insight Focus

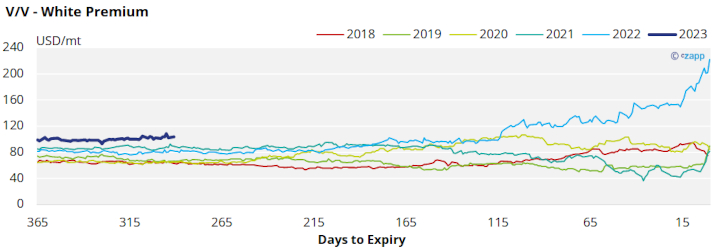

- Raw and refined sugar speculators extend their net long positions a third week in a row.

- However, with the respective futures prices weakening over the last week, it’s unlikely this will persist.

- The sugar white premium continues to move around the 100USD/mt threshold.

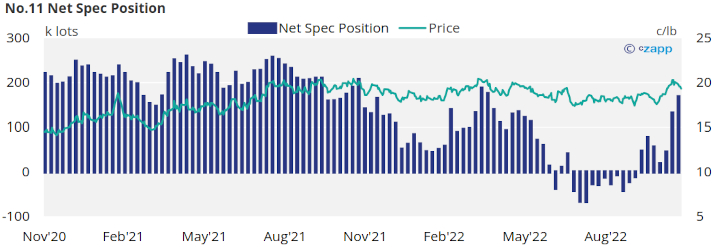

New York No.11 (Raw Sugar)

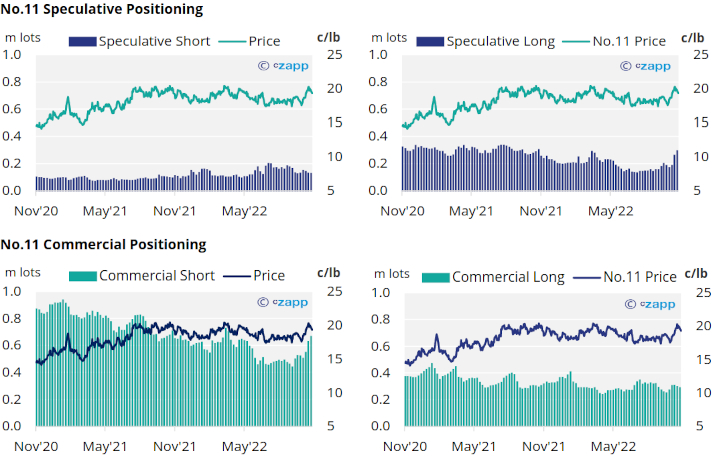

Raw sugar futures have drifted back toward 19c/lb over the last week following the rally at the beginning of the month.

In the week to the 22nd of November (latest CFTC CoT report) toward the end of this rally, raw sugar speculators opened a further 34k lots of new long positions, aiming to maintain upwards momentum. With prices in decline since then it is likely many of these new positions will now come under pressure.

For now, this means the net spec position reaches higher, now almost 170k lots long, it is now the highest since April and the 3rd highest point of 2022.

Raw sugar producers continued to take advantage of more attractive prices for hedging, adding a further 35k lots of new short positions. Consumers have recently tended to add new cover when the market is closer to 18c/lb, thus almost 6k lots of existing hedges have rolled off since the week before.

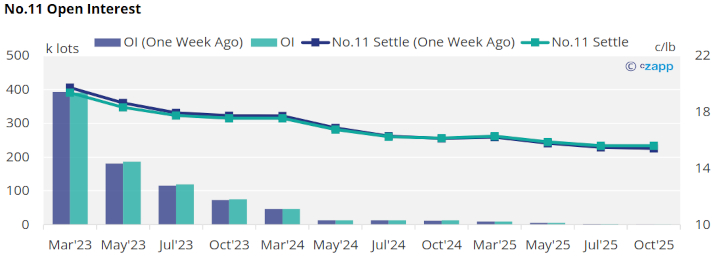

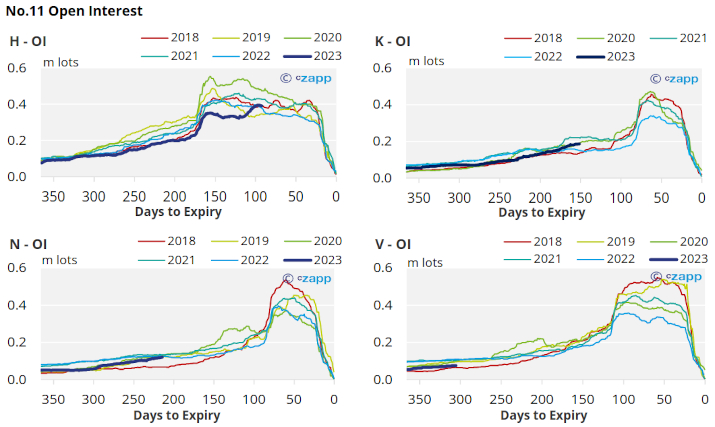

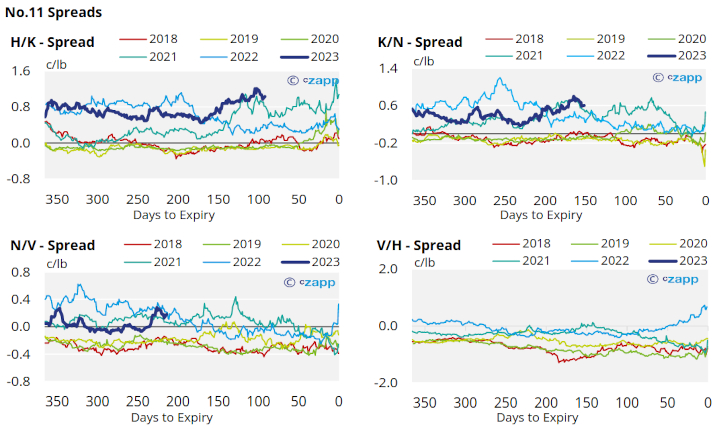

The No.11 forward curve remains inverted until the end of 2024.

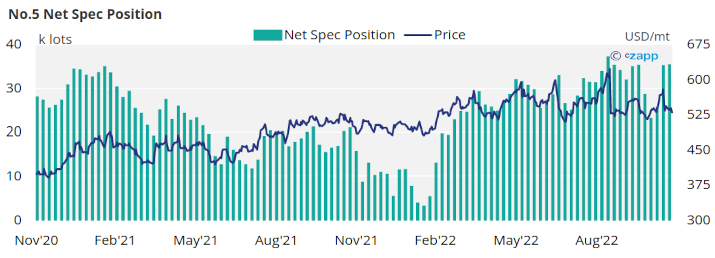

London No.5 (Refined Sugar)

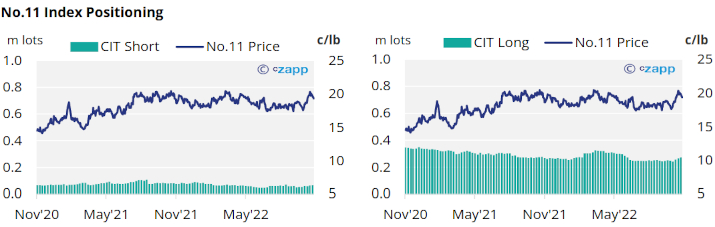

Refined sugar futures prices have also declined over the last week, drifting back through 530USD/mt by the end of last week.

As of the 22nd of November, when prices appeared to be trading sideways, refined sugar speculators held on to the large volume of long positions opened the week before, increasing the overall net spec position by fewer than 1k lots.

This maintains the No.5 net spec position very close to 2022 highs.

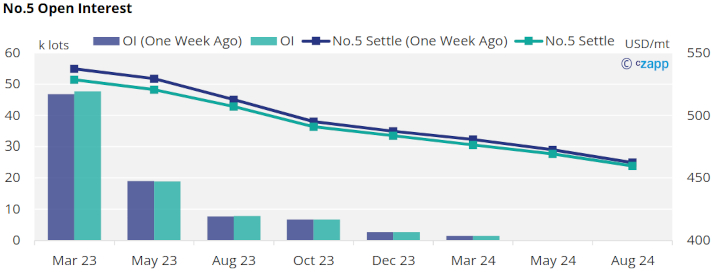

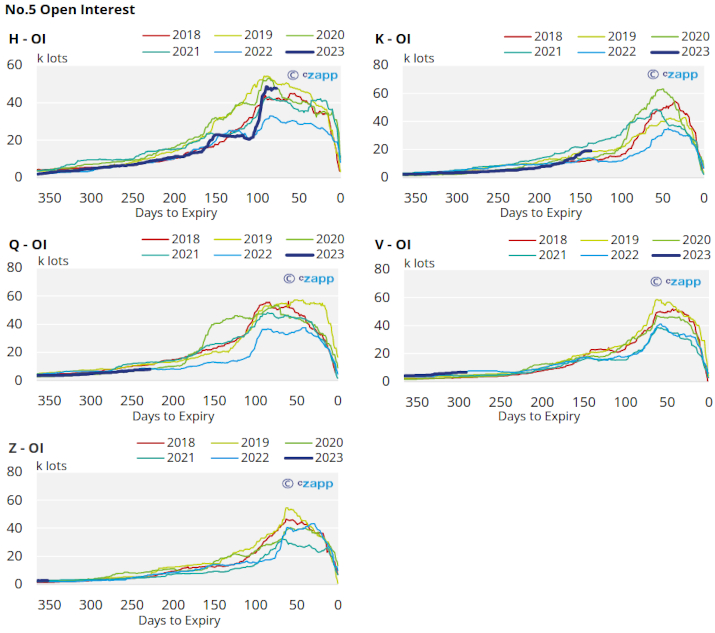

The No.5 forward curve remains strongly backwardated as far ahead as Aug’24, suggesting a slowly easing market tightness over the next few years.

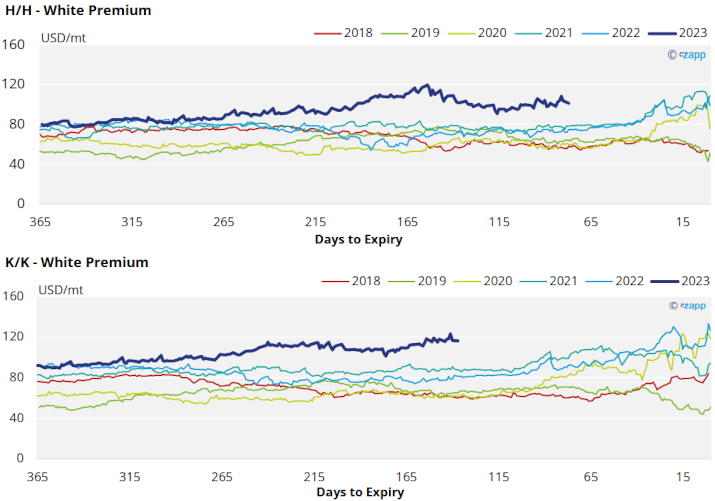

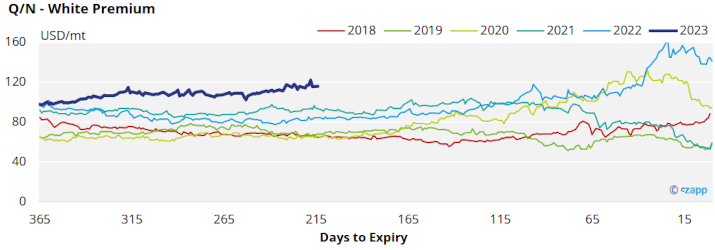

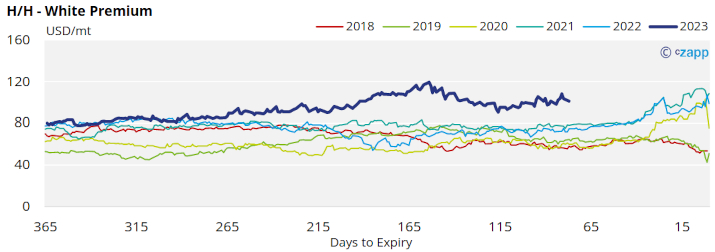

White Premium (Arbitrage)

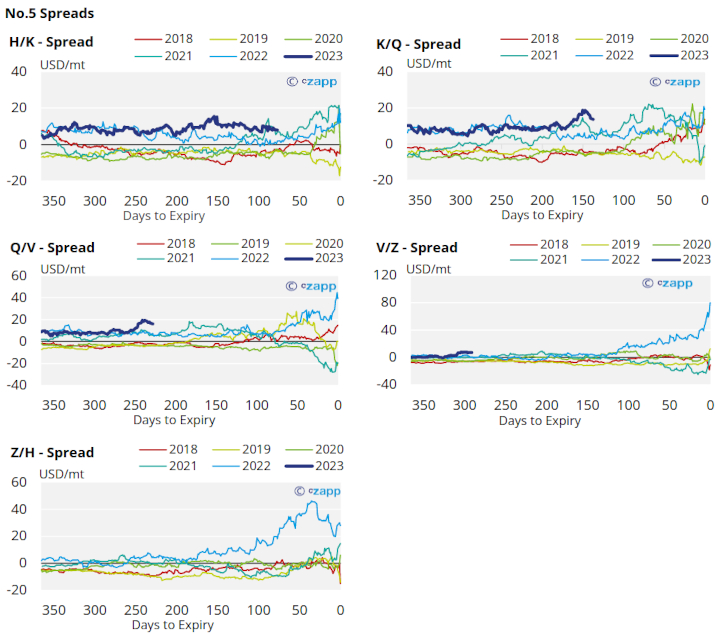

The sugar white premium has steadied around the symbolic 100USD/mt threshold over the last few weeks.

Many re-exports refiners need around 125-135USD/mt above the No.11 to produce refined sugar, therefore physical values are still necessary to bridge this gap.

The refined sugar market is slightly undersupplied for the majority of 2023 and this is reflected in comparatively strong K/K and Q/N white premiums which are both sat above 115USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix