Insight Focus

- Both No.11 and No.5 sugar futures has strengthened in the past week.

- Speculators have been active in the market the past week.

- The K/K white premium has dipped slightly below 160 USD/mt.

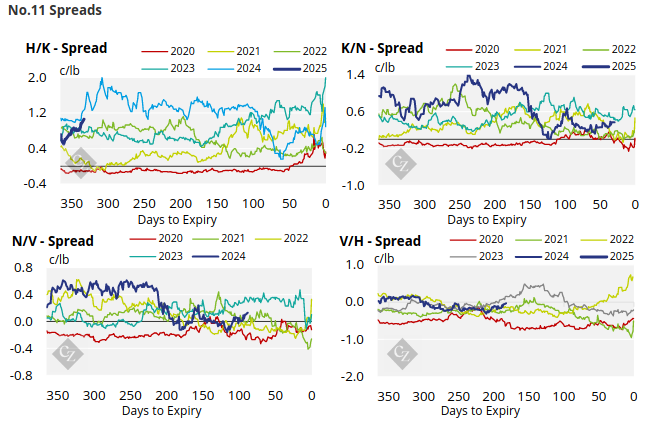

New York No.11 Raw Sugar Futures

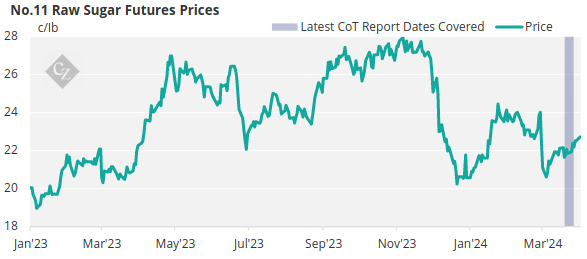

The No.11 raw sugar futures have strengthened over the past week, going from 21.9c/Ib at the start of the week to 22.5 c/lb by Friday’s close.

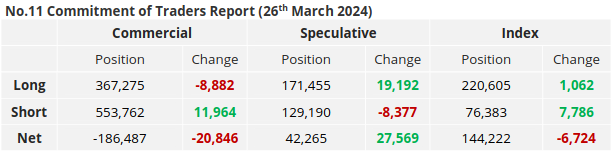

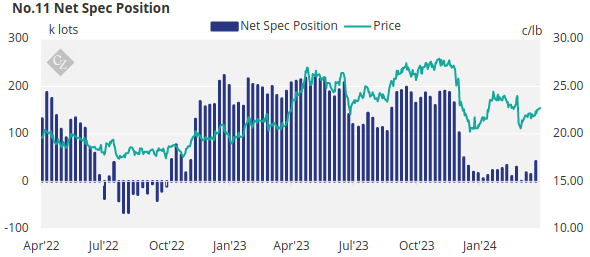

During this time frame, speculators opened 19.2k lots of new long positions and closed 8.4k lots of recently opened short positions. As a result, the net spec position has increased to 42.3k lots.

Looking at the commercial participants, producers have taken advantage of the slight price increase, adding 11.9k new hedges, while end-users have closed 8.9k hedges.

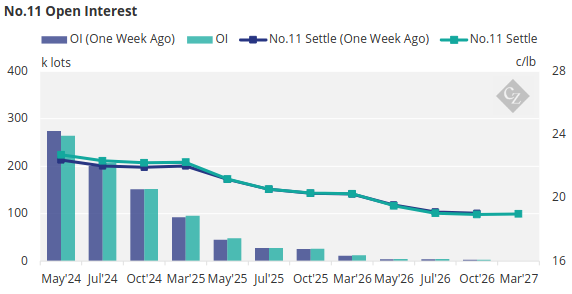

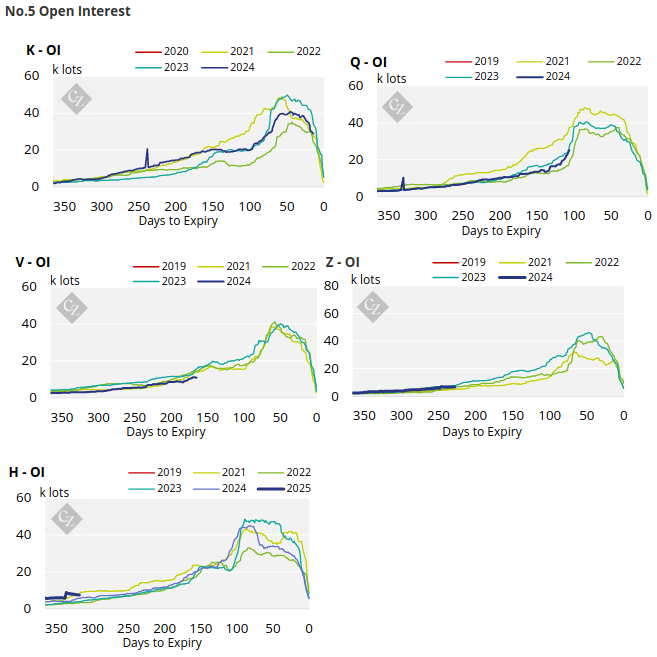

With contracts strengthening across the board, the No.11 futures curve remains backwardated through to Mar’27.

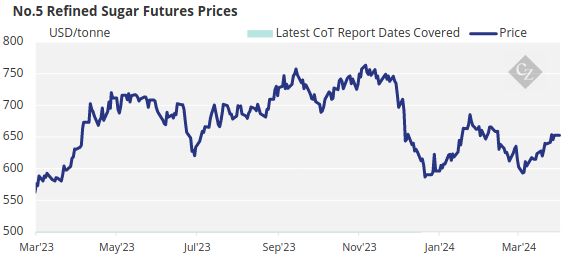

London No.5 Refined Sugar Futures

The No.5 refined sugar futures contract has continued to strengthen, closing at 652.5USD/mt last Friday.

This price movement may have been caused by the speculators who, in the past week, opened 12.4k lots of long positions bringing the net spec positions up to 21.3k lots – almost the same levels as the end of Jan’24.

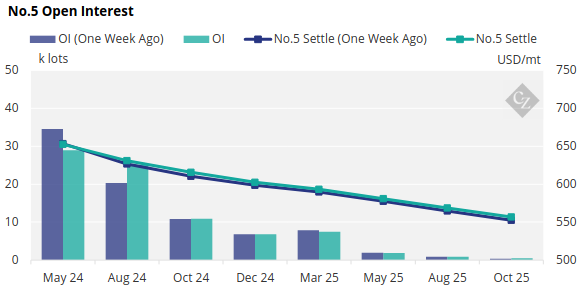

The refined sugar futures curve has also strengthened in the past week, with the curve in backwardation through to Oct’25.

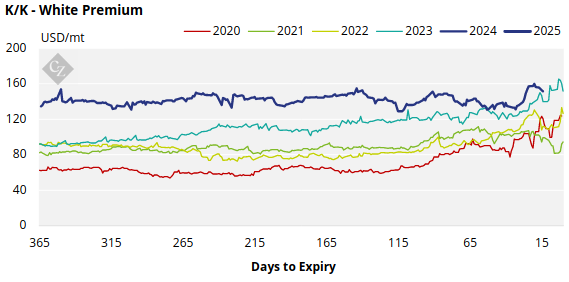

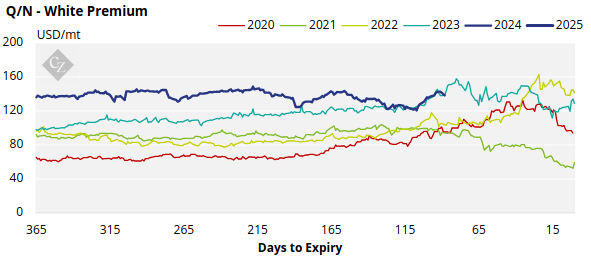

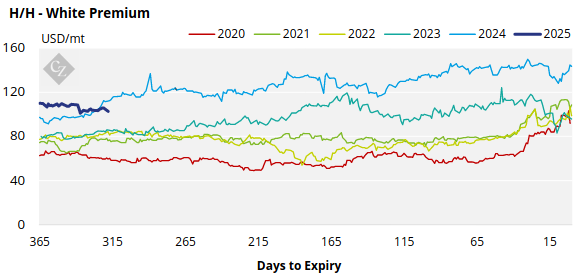

White Premium (Arbitrage)

The K/K White premium has weakened over the past week, trading at 151.6USD/mt.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix