Insight Focus

- Both raw and refined sugar futures have traded sideways in the past week.

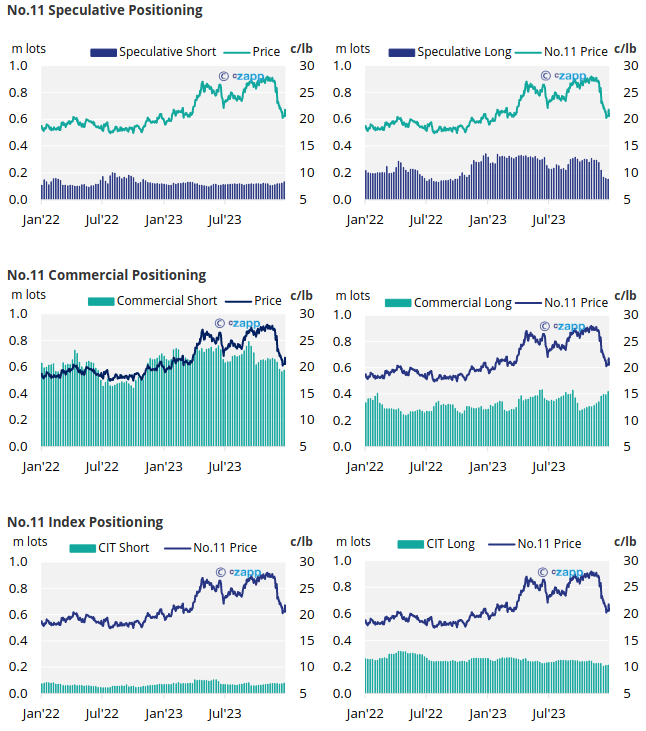

- Speculators continue are building their short positions in raw sugar.

- The H/H white premium has strengthened, now standing at 140USD/mt.

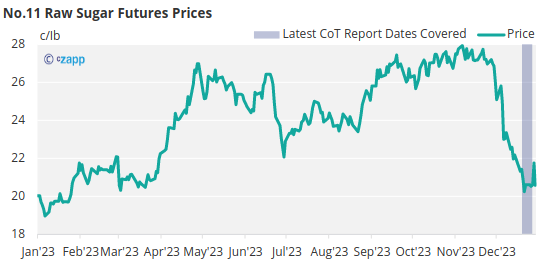

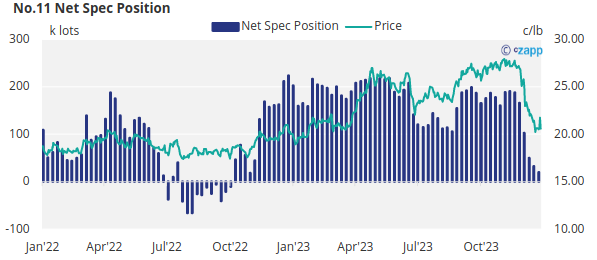

New York No.11 Raw Sugar Futures

The No.11 raw sugar futures gradually settled in the 20-22c range during the final days of the holiday season, and has been trading sideways since then.

Consumer hedging has increased significantly, with refineries and end-users taking advantage of the low prices and adding over 24.8k new hedges.

With producers also adding to their positions, the overall net commercial position has grown.

As a result of the recent price action, speculators have continued to sell their long positions while simultaneously opening new short positions.

The heavy speculative long liquidation, coupled with speculators taking short positions, has resulted in a significant decrease in the overall net spec position, which is currently standing at 19.9k lots – the lowest point since October 2022.

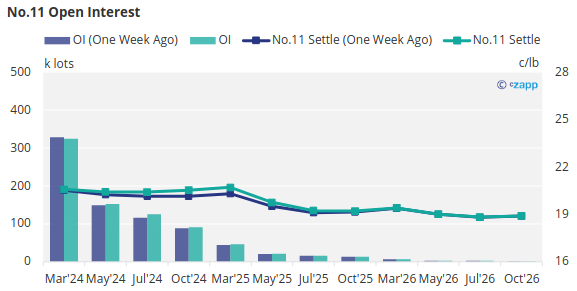

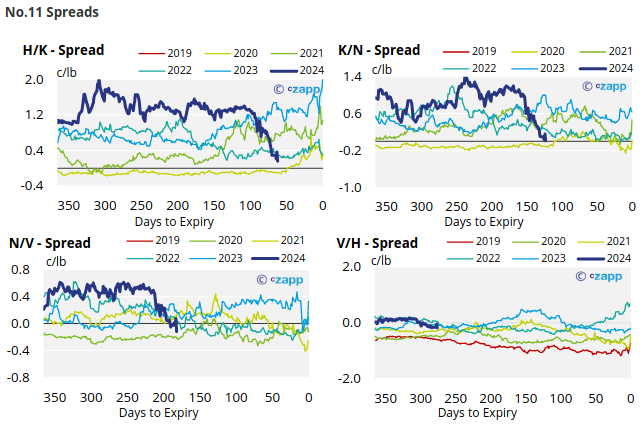

The No.11 forward curve has shifted slightly since our last update and is now broadly flat in 2024, while 2025 remains mildly backwardated.

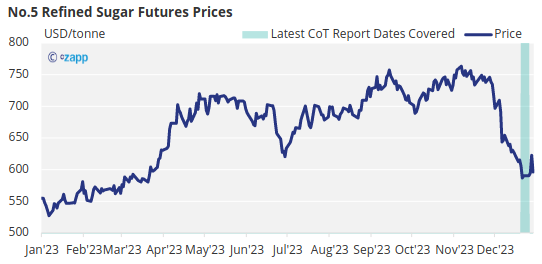

London No.5 Refined Sugar Futures

The No,5 refined sugar futures has also been trading sideways over the past week, before closing at 596USD/mt on Monday.

As a result, refined sugar speculators have closed out 1.9k lots of their long positions, bringing the overall net spec position to 11.4k lots.

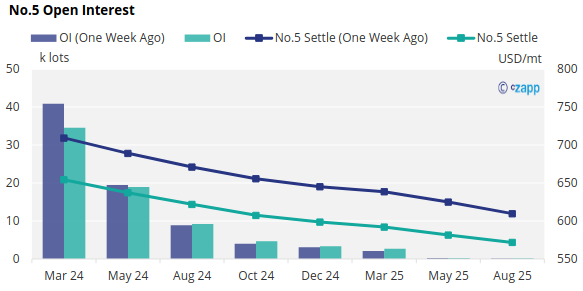

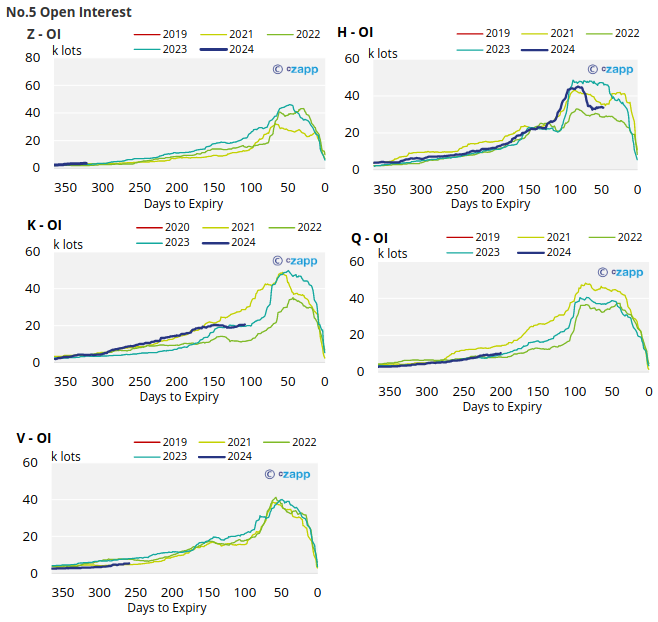

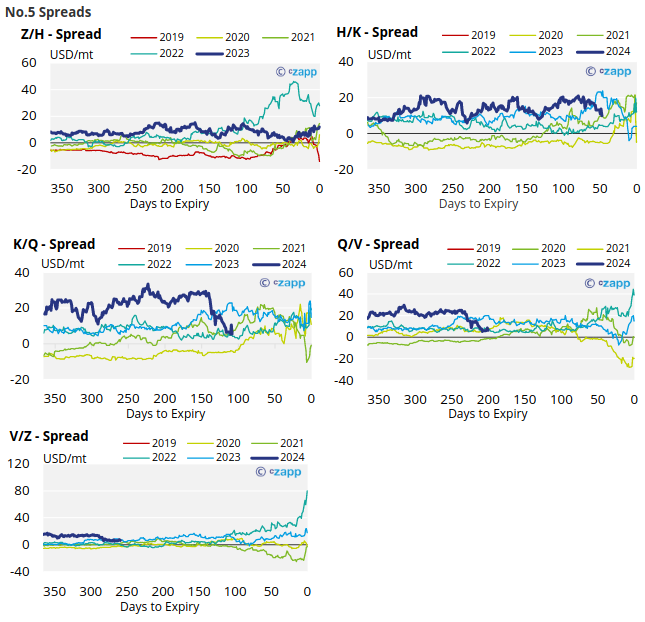

The refined sugar futures curve remains heavily backwardated.

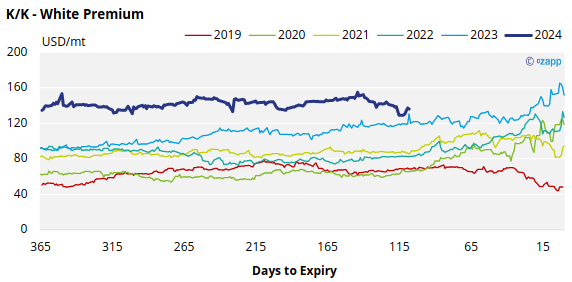

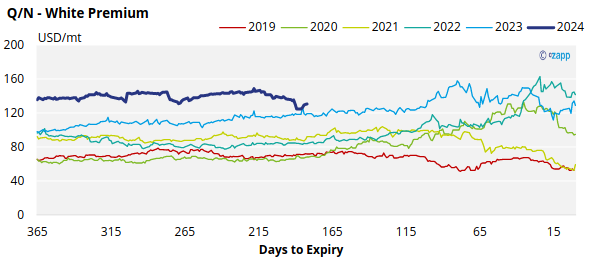

White Premium (Arbitrage)

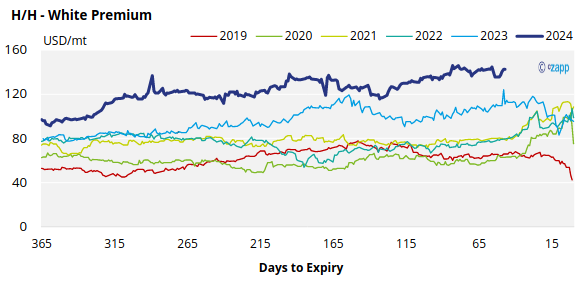

With the No.11 and No.5 sugar futures making similar moves in the past week, the H/H white premium has strengthened to 140USD/mt.

The 2024 white premiums remain strong. We’ve not seen this kind of strength in the H/H white premium at this stage in the cycle in at least 5 years.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix