- The No.11 fell to near 18 c/lb over the last week.

- This could give consumers another good opportunity to buy.

- The white premium still looks positive despite a fall in the No.5.

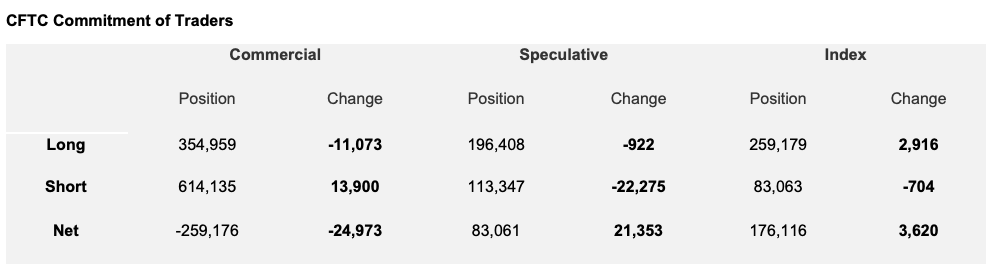

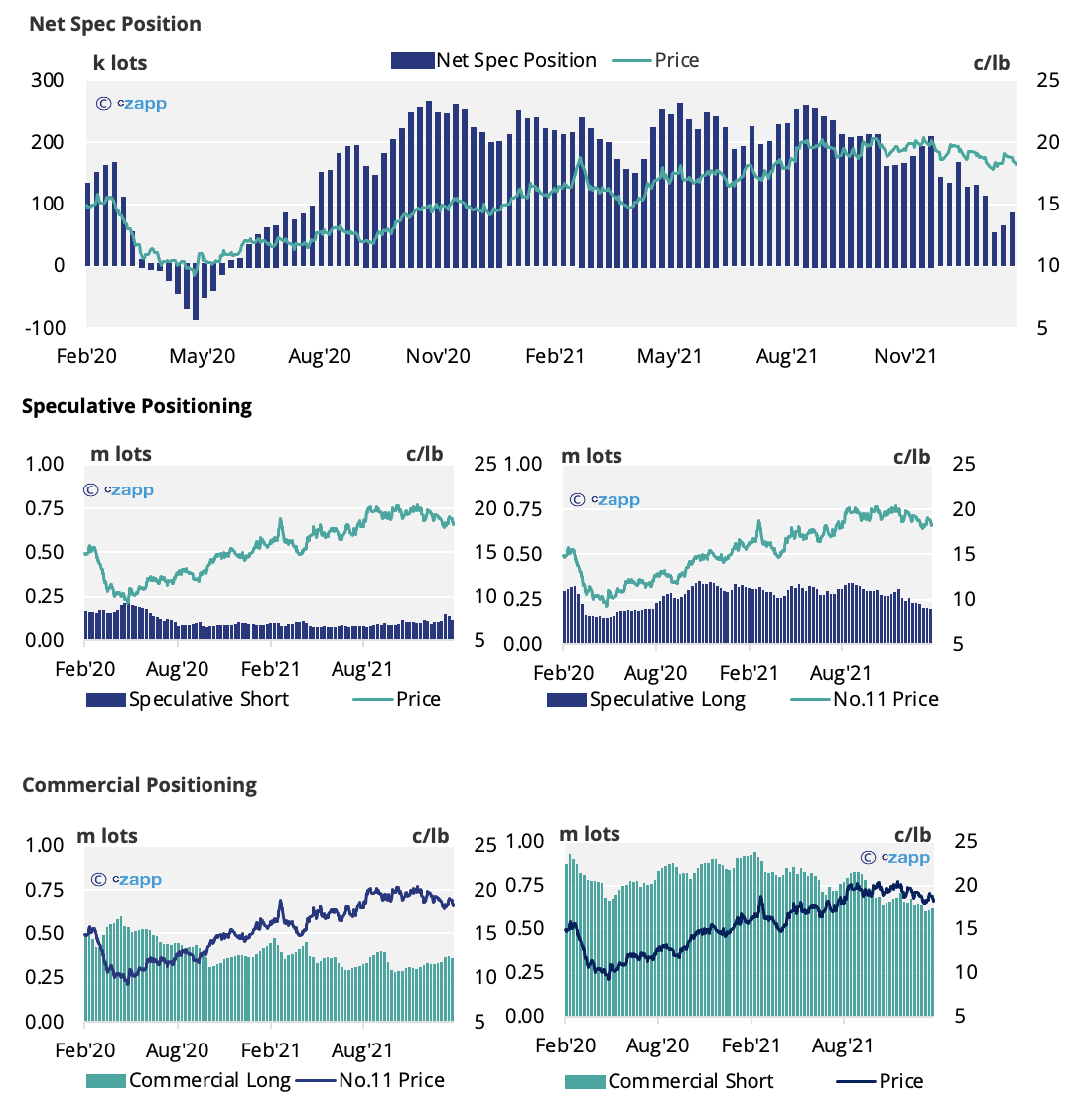

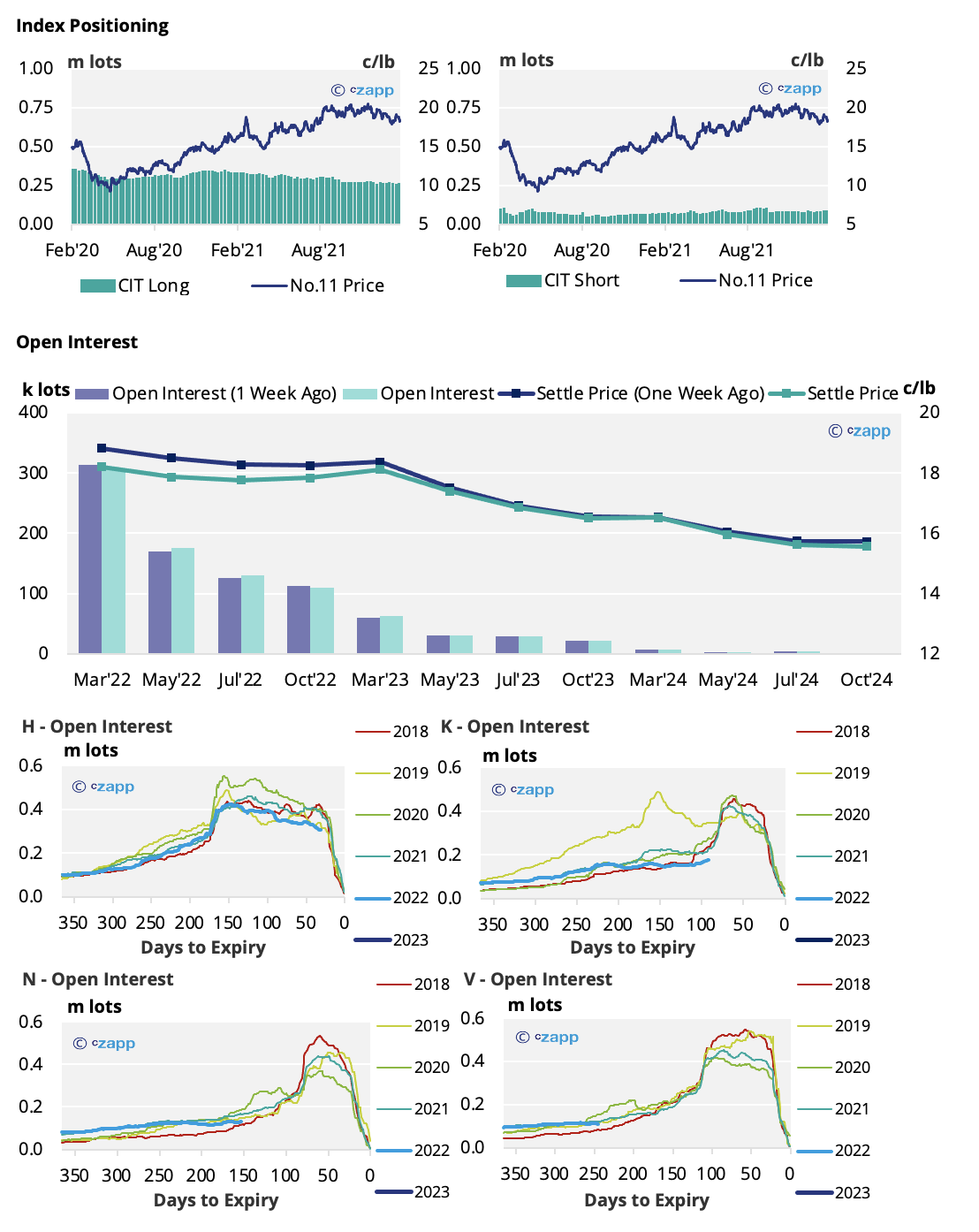

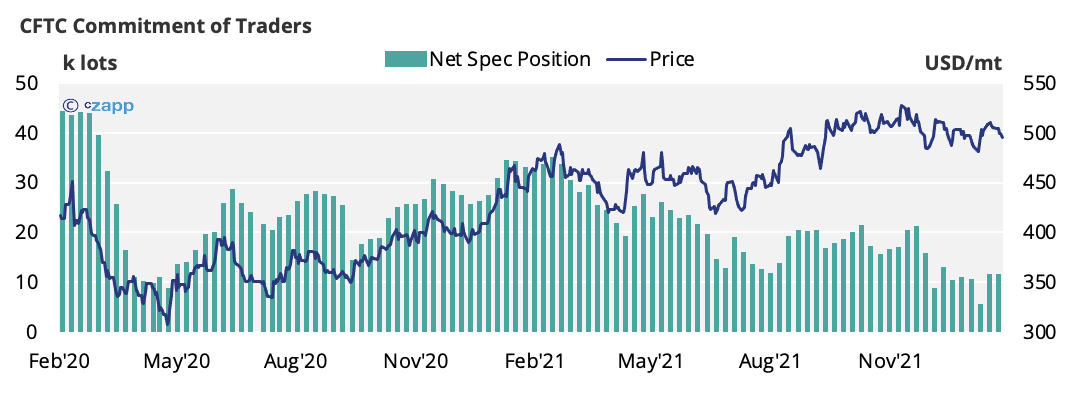

New York No.11 (Raw Sugar)

- The specs bought aggressively to close the new short positions that facilitated the price drop below 18 c/lb.

- The recent fluctuations between 18 and 19c/lb is indicative of a lack of clear direction in the market.

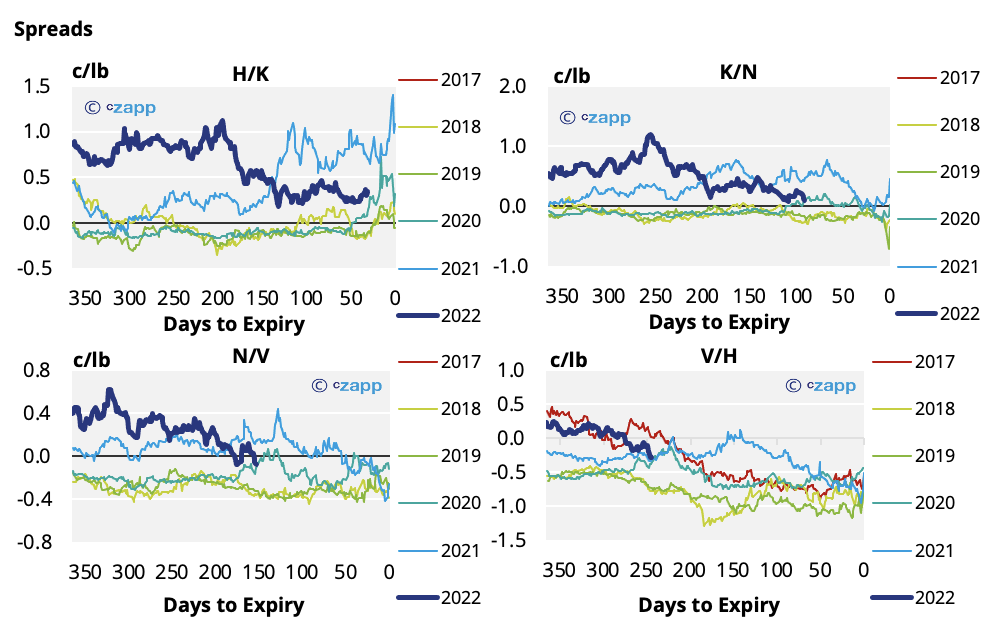

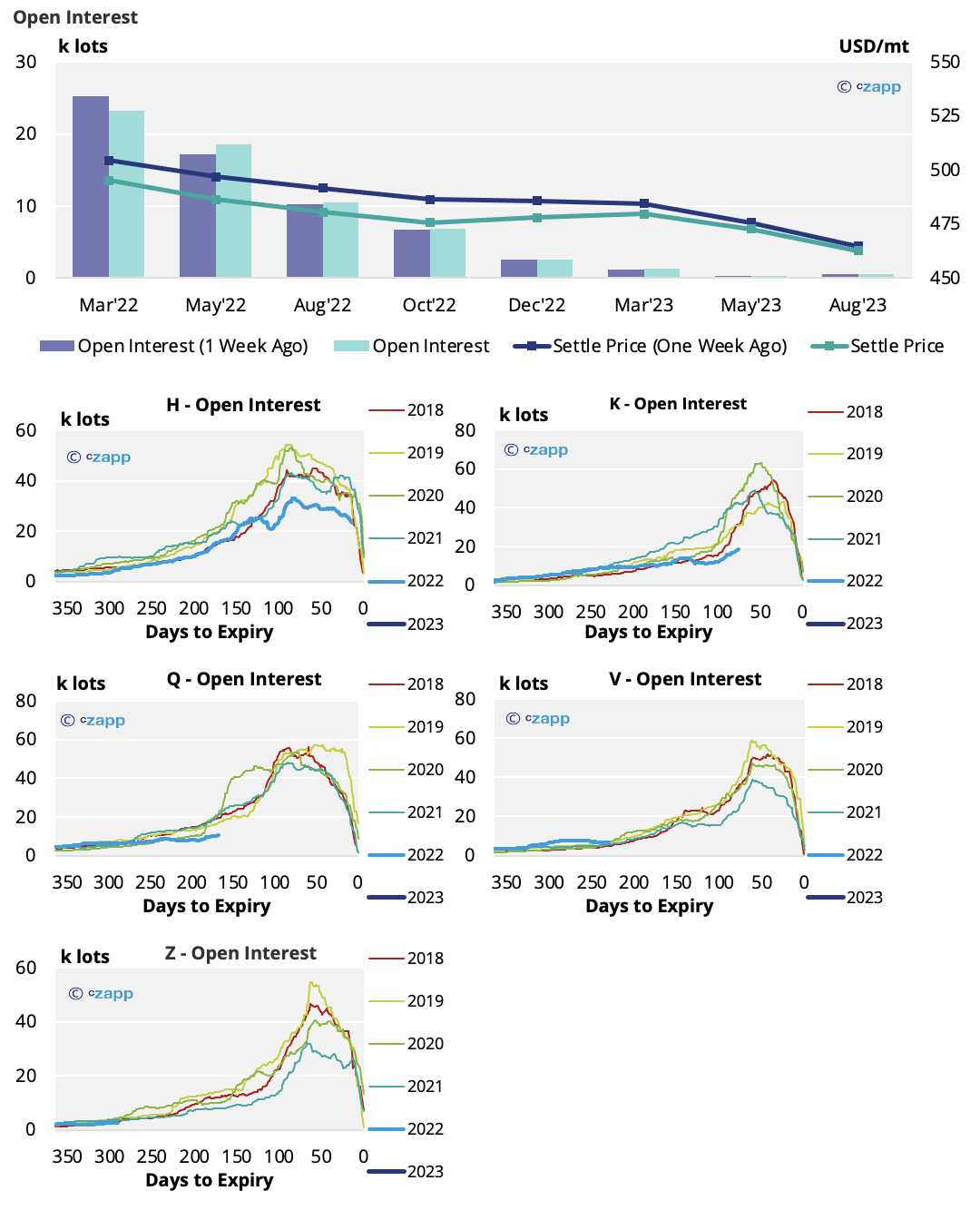

- The forward curve continues to flatten in 2022, increasing the attractiveness of forward buying.

- Jul’22 now trades at a discount to Oct’22, which is opportune for re-export refining.

No.5 London (White Sugar)

- Whilst the No.5 has seen pressure in the last week, the white premium has strengthened.

- There’s been little change in the net speculative position highlighting a lack of direction in the market.

- The K’22 and Q’22 open interest is below historic levels, which suggests physical demand for 2022 may be lacklustre.

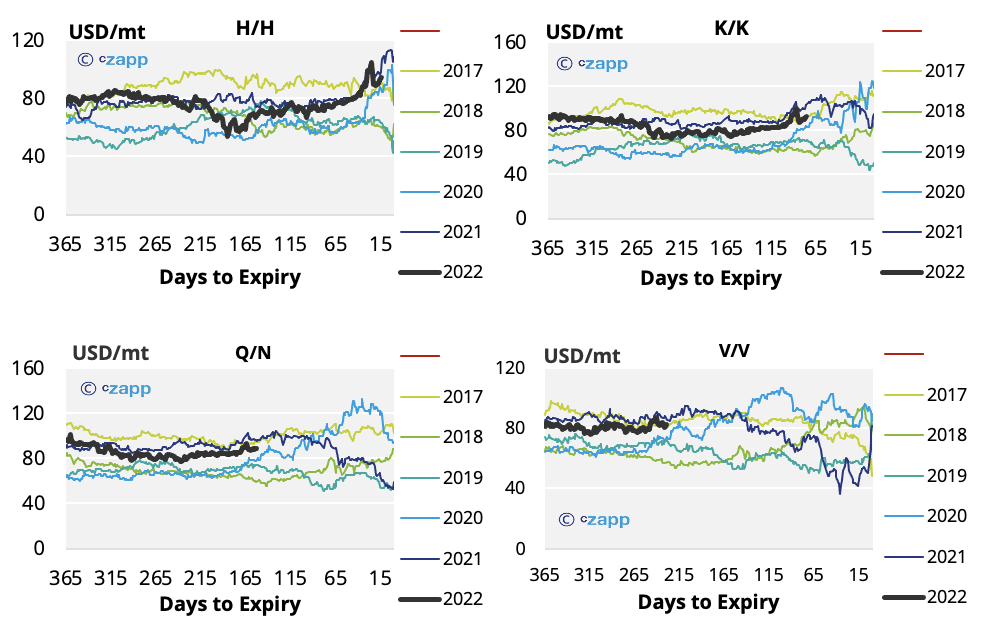

White Premium (Arbitrage)

- Both the H/H and K/K 2022 white premiums have recovered due to fresh pressure on the No.11 and remain at historically strong levels.

- Whilst this is slightly lower than the margin needed by many refiners, cash values or discounted raw spreads could help bridge this deficit.

Other Insights That May Be of Interest…