Insight Focus

- Raw and refined sugar futures have halted after a two-week rally.

- Speculators continue to extend their long positions in both No.11 and No.5

- Raw sugar producers continue to capitalise on higher prices adding new hedges.

New York No.11 (Raw Sugar)

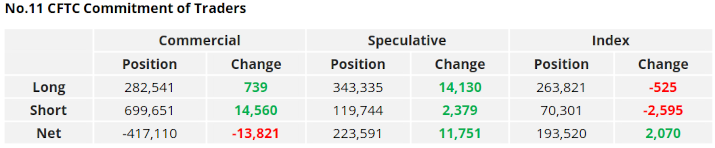

After two weeks of rally, No.11 futures have run out of momentum falling back to trading below 20.5c/lb during the last week of 2022.

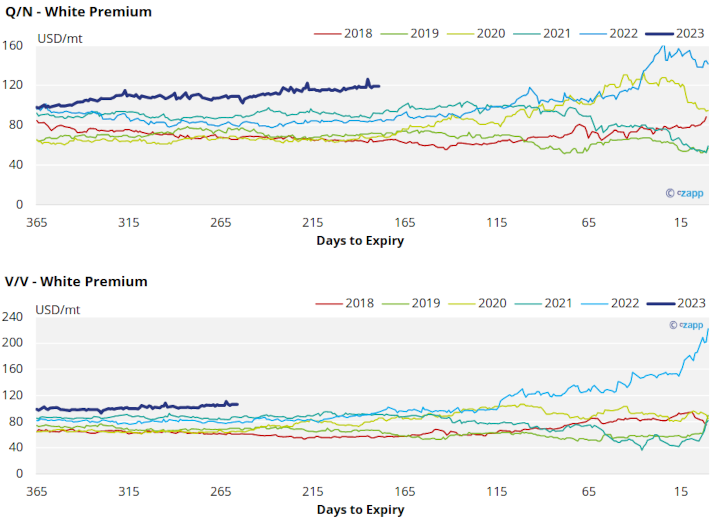

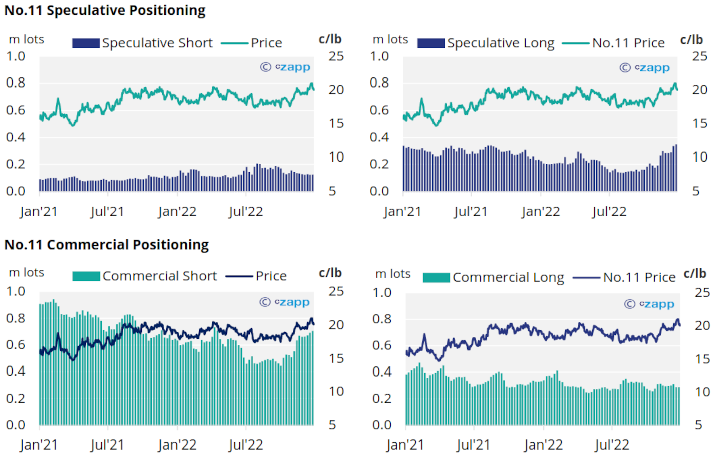

By the 27th of December (latest CoT CFTC), prior to the market fall, speculators added 14k lots of new long positions, in a failed attempt to maintain upwards momentum.

Alongside this, the net spec position continues to extend, now at over 223k lots long, its largest in over 12 months.

Raw sugar producers continue to add new hedges capitalising on the still higher prices (above 20c/lb), stretching the commercial short by 14k lots. For raw sugar consumers, the market is still above where buyers had been happy to hedge at, hence the slight change.

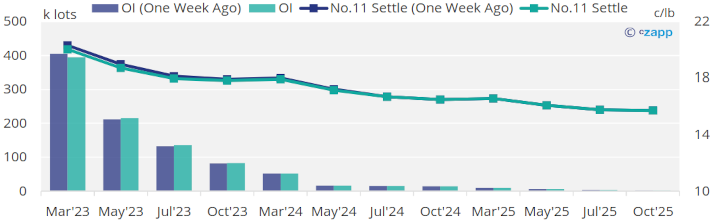

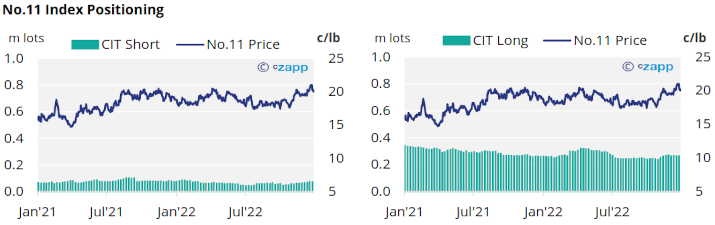

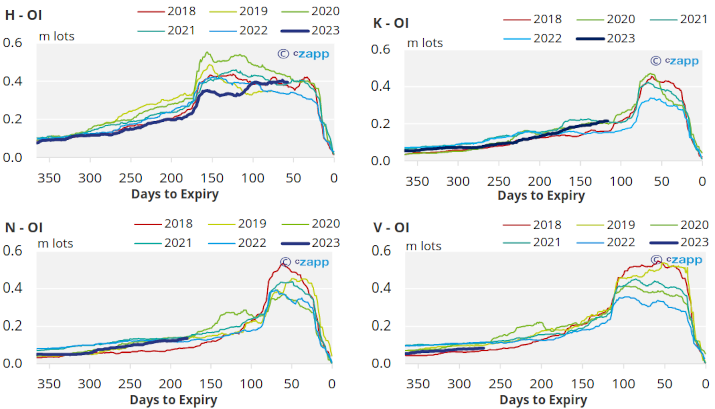

The No.11 forward curve remains inverted until Oct’23 moving into contango to Mar’24.

No.11 Open Interest

London No.5 (Refined Sugar)

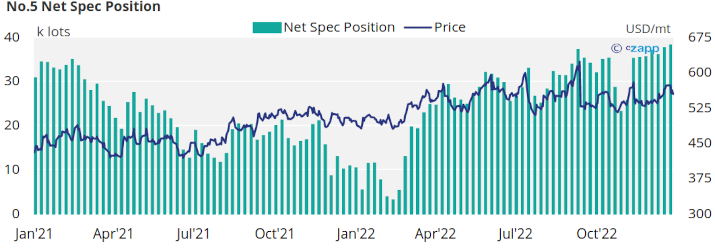

No.5 refined sugar futures also dropped back to trading sideways around the 560USD/mt during the last week of 2022.

By the 27th of December, before the drop, refined sugar speculators continued to extend the net spec position by 500 lots.

As such, the No.5 net spec position reaches close to 38k lots long, breaking a record high to end 2022.

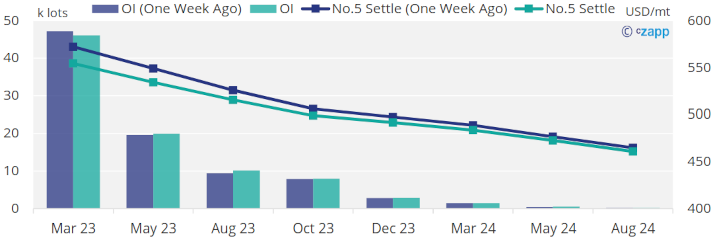

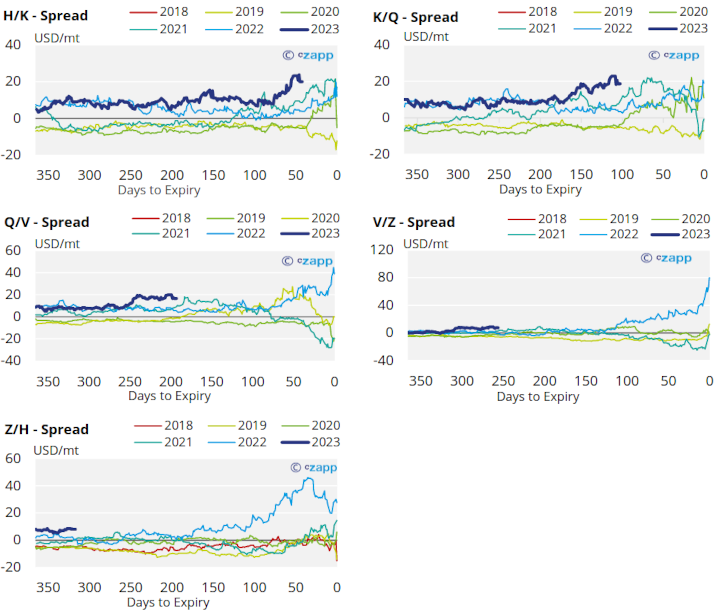

The No.5 forward curve (although heavily backwardated) has flattened particularly in the nearby contracts suggesting easing market tightness.

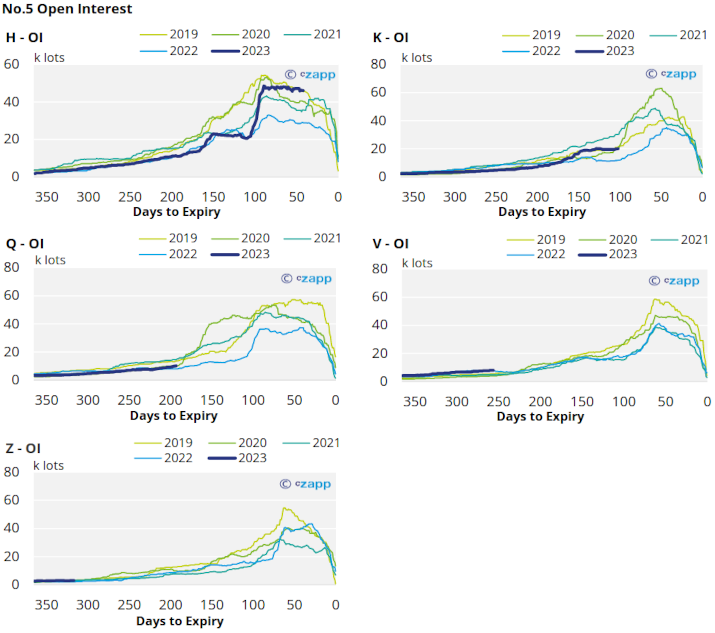

No.5 Open Interest

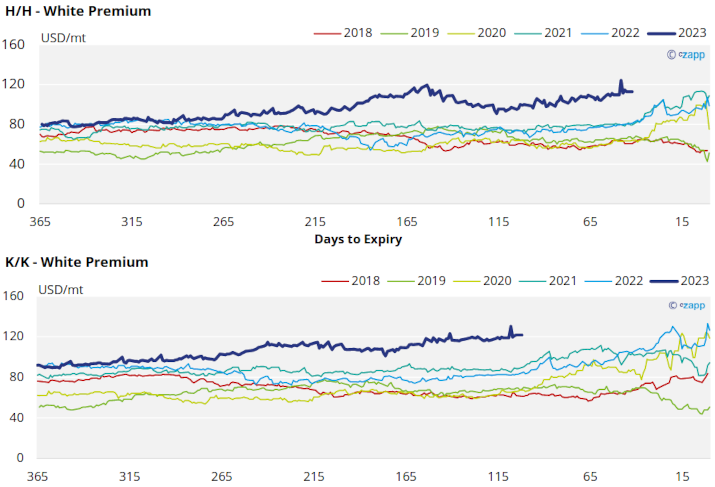

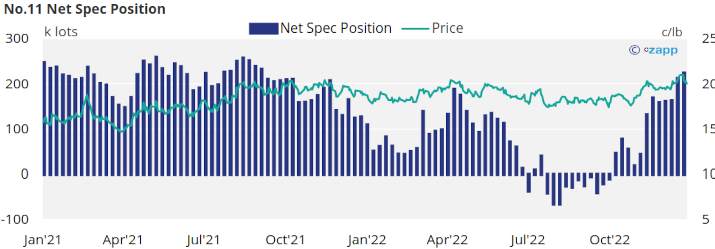

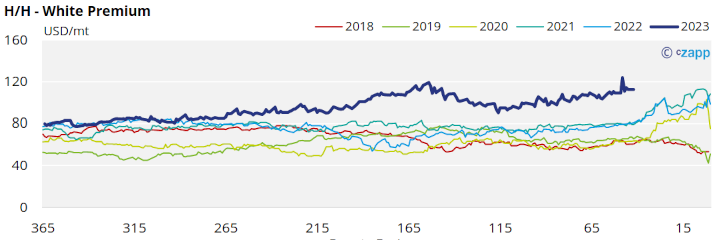

White Premium (Arbitrage)

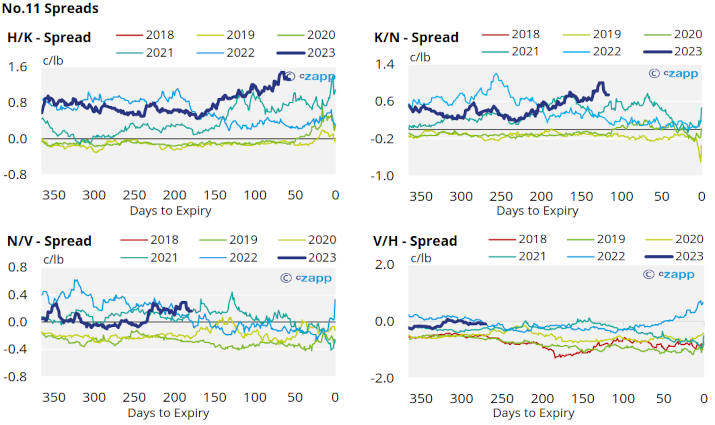

The H/H sugar white premium fell sharply below 113USD/mt by close of trading last week.

We think re-exports refiners need around 120-130USD/mt above the No.11 to profitably produce refined sugar without physical premiums, therefore the current white premium is not strong enough to incentivise this.

The refined sugar market is likely to be slightly undersupplied for the majority of 2023 and this is reflected in comparatively stronger K/K and Q/N white premiums which have moved back to 120USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.11 Open Interest

No.5 (White Sugar) Appendix

No.5 Spreads

White Premium Appendix