Insight Focus

- Both raw and white sugar prices are drifting sideways-to-low.

- Raw sugar speculators have failed to maintain another short build

- White sugar speculators are slowly reducing the large long position as prices stall.

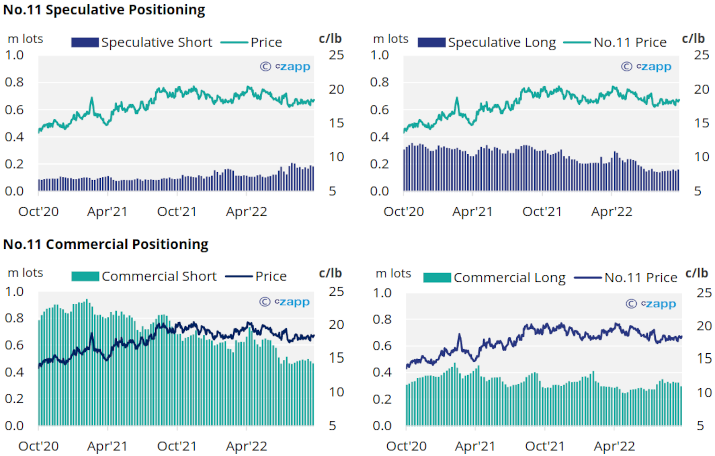

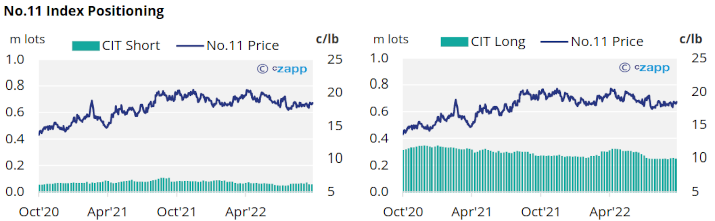

New York No.11 (Raw Sugar)

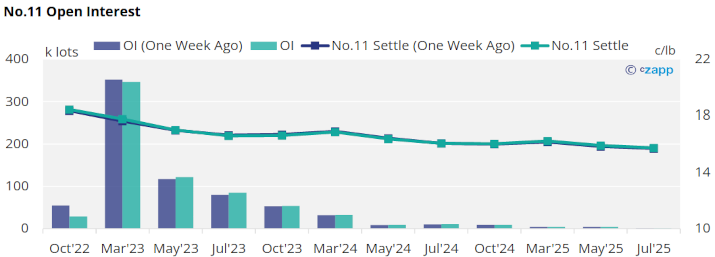

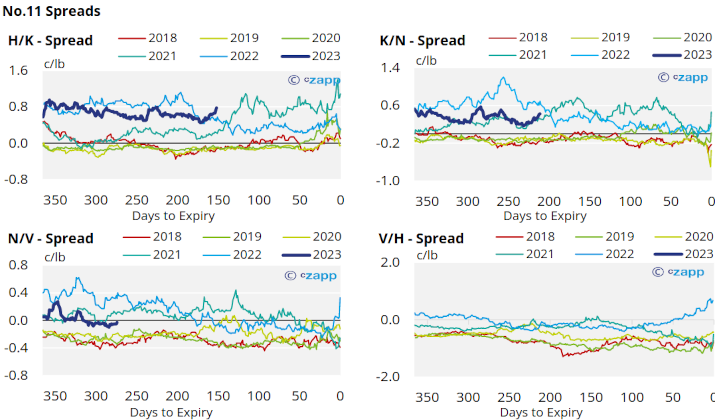

No.11 prices have drifted below 18c/lb following last week’s Oct’22 contract expiry. This continues the wider sideways-to-low trend followed over the last few months.

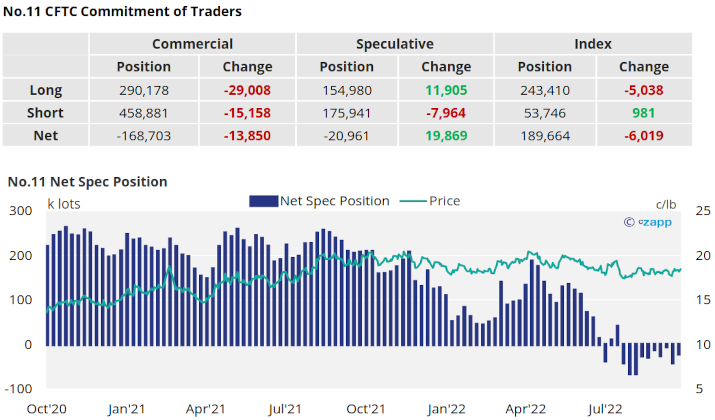

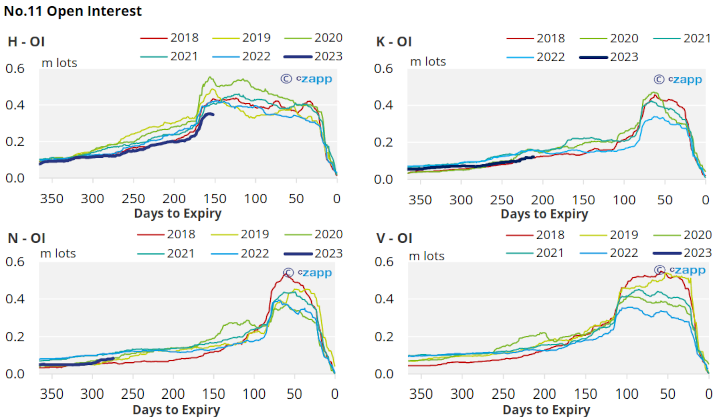

By the latest COT report from the 27th of September (prior to the expiry), commercial open interest fell by 50k with long positions making up the majority. This is reflective of consumers holding more hedges in the nearby contracts compared to producers who are happier to hold cover further down the board.

For speculators in raw sugar, almost 8k of newly added short positions have been closed, along with 12k new long positions added whilst the market was closer to 18.5c/lb. This has halved the new spec position, now back at 20k lots short and highlights the difficulty for speculators in trying to maintain a significant short position.

The No.11 forward curve remains backwardated toward the middle of next year, suggesting that the current tight supply could ease in coming months.

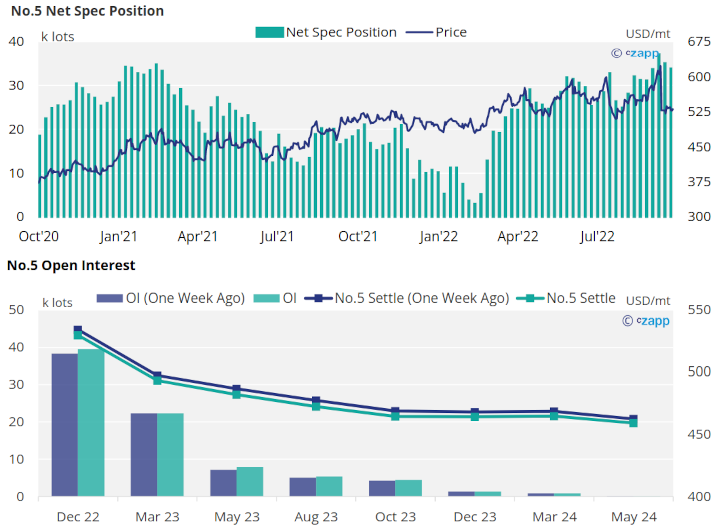

London No.5 (Refined Sugar)

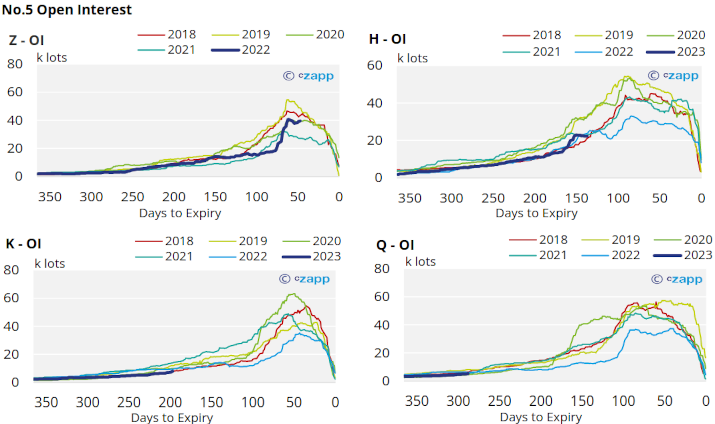

The Dec’22 No.5 contract continues to trade sideways between 520-540USD/mt.

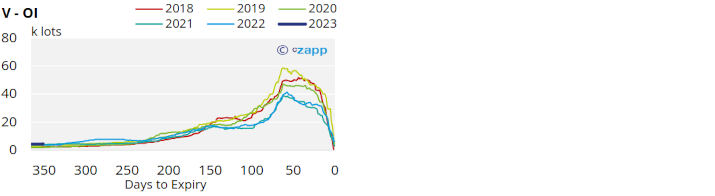

Now firmly out of the uptrend channel, refined sugar speculators continue to lift long positions now leaving the net spec position below 34k lots as of the 27th of September. This is still very high by recent standards and reflects the No.5 as one of the best performing agricultural commodities in previous months.

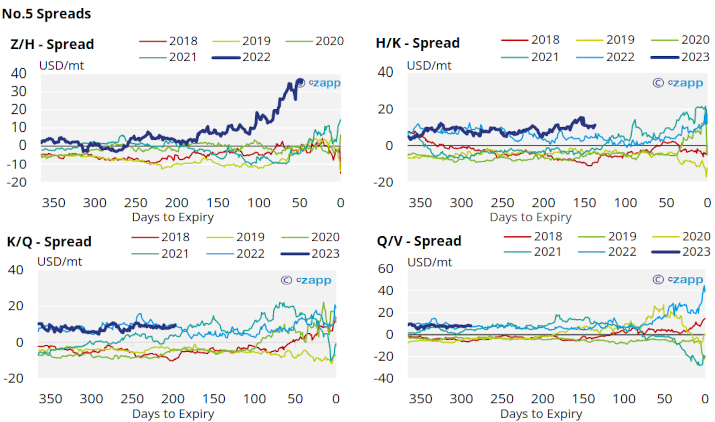

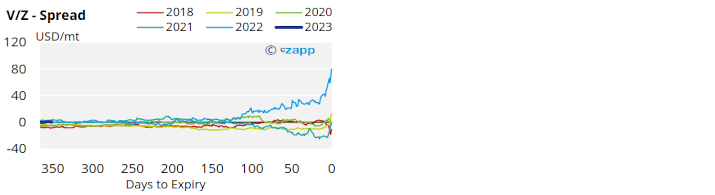

The No.5 forwards curve remains heavily backwardated for the next 12 months, highlighting the severe short-term tightness in the market.

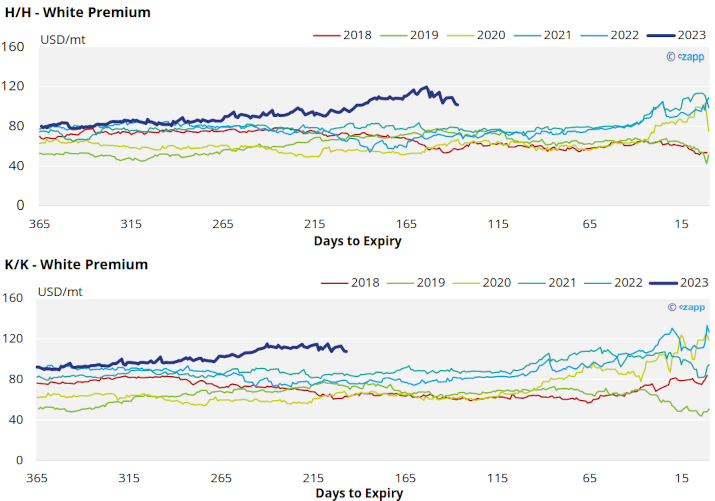

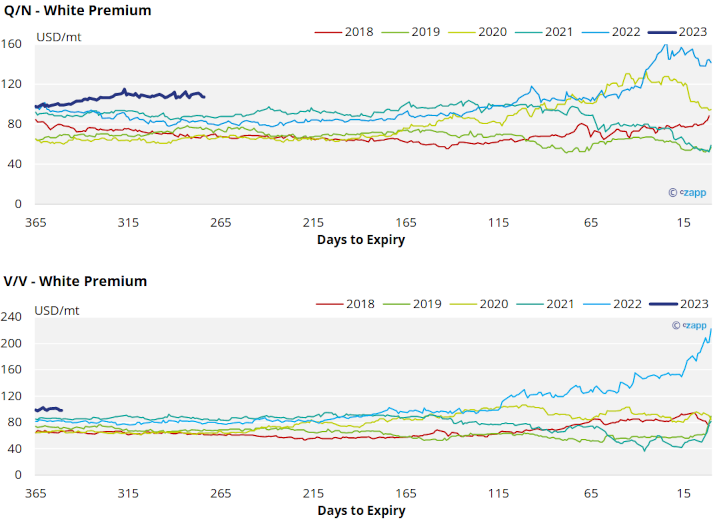

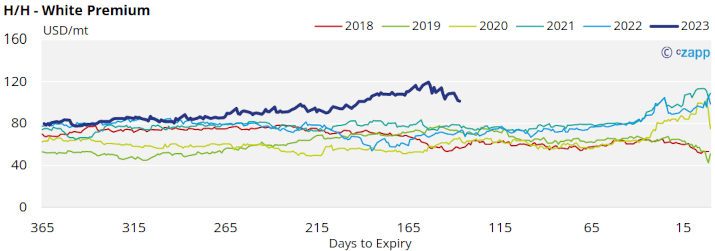

White Premium (Arbitrage)

The white premium has drifted lower and now threatens to break below 100USD/mt. At this level we think many re-export refiners will struggle to operate profitably.

The proceeding K/K and Q/N white premiums are both trading at a similar level, unusually high this far in advance of their expiries.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix