Insight Focus

- Raw and refined sugar futures prices have traded sideways over the last week.

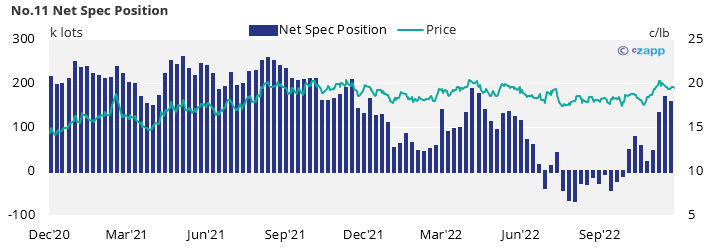

- As such speculators have largely maintained their long position for the time being.

- Raw sugar producers have paused their hedging regimes with the No.11 off November highs.

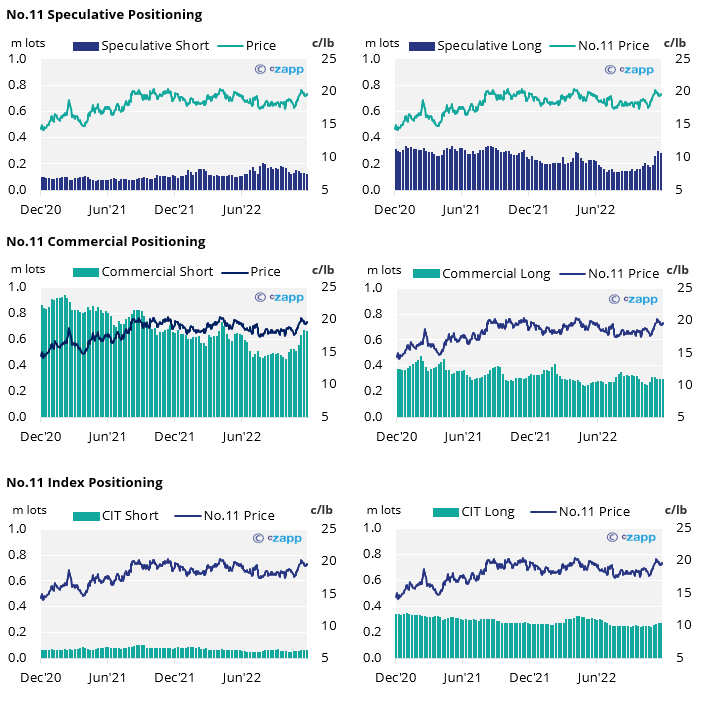

New York No.11 (Raw Sugar)

The No.11 raw sugar futures have broadly moved sideways over the last week, trading around the 19.5c/lb mark.

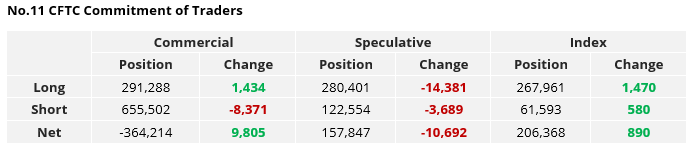

Despite falling 100 points from last month’s highs, with prices still elevated above pre-November levels (18-19c/lb) speculators appear willing to hold on to many

of their recently opened long positions for the time being.

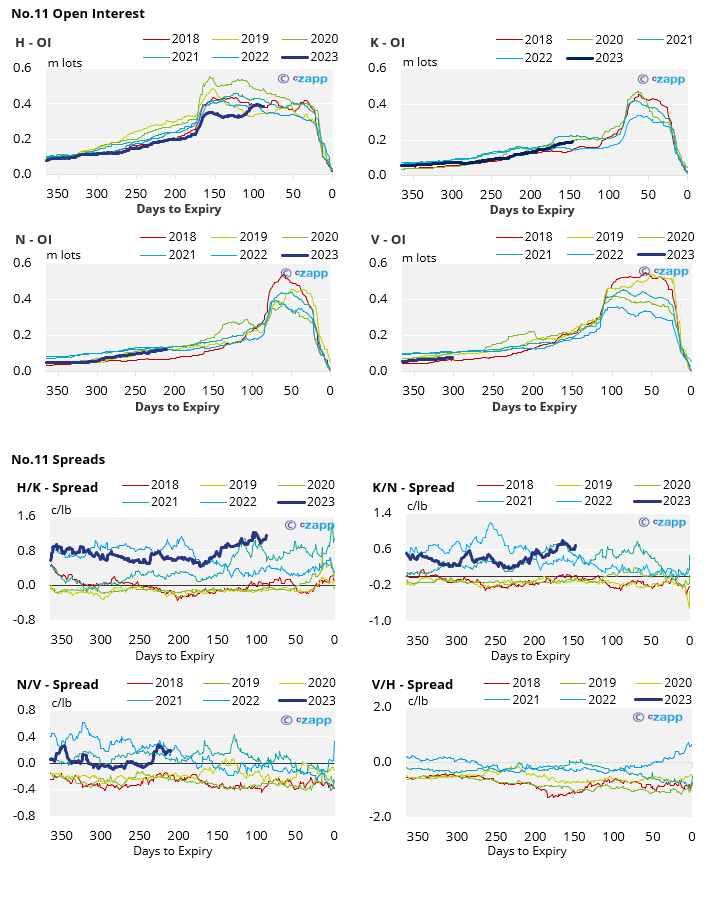

By the 29th of November (latest CoT CFTC report) the spec long position fell by 14k lots, less than 5% of the total number of long positions held last

week.

With some short positions also closed too, the net spec position has only fallen by 11k lots to 158k lots.

On the commercial side, raw sugar producers closed over 8k lots of short positions, whilst consumers were able to add 1.5k lots of new hedges.

This lower rate of hedging activity has been generally observed when the market is closer to 19c/lb, too high to see much consumer hedging, not high enough to see much producer hedging.

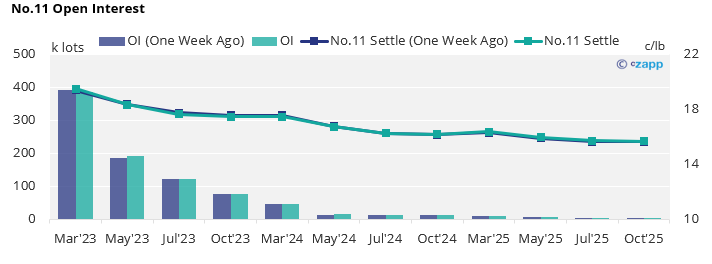

The No.11 forward curve remains inverted until the end of 2024.

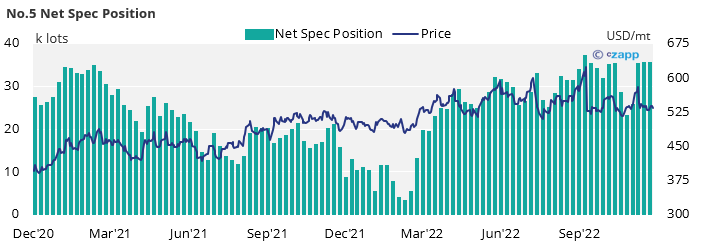

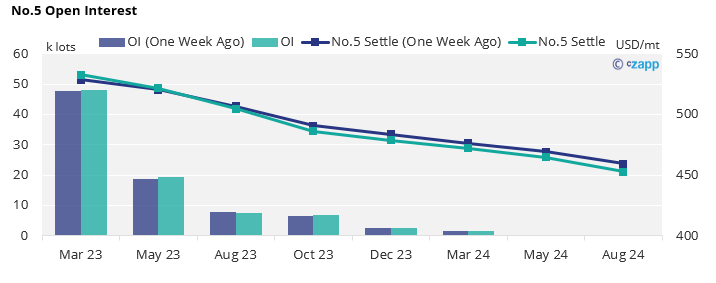

London No.5 (Refined Sugar)

The No.5 refined sugar futures also traded sideways last week, hovering around 540USD/mt.

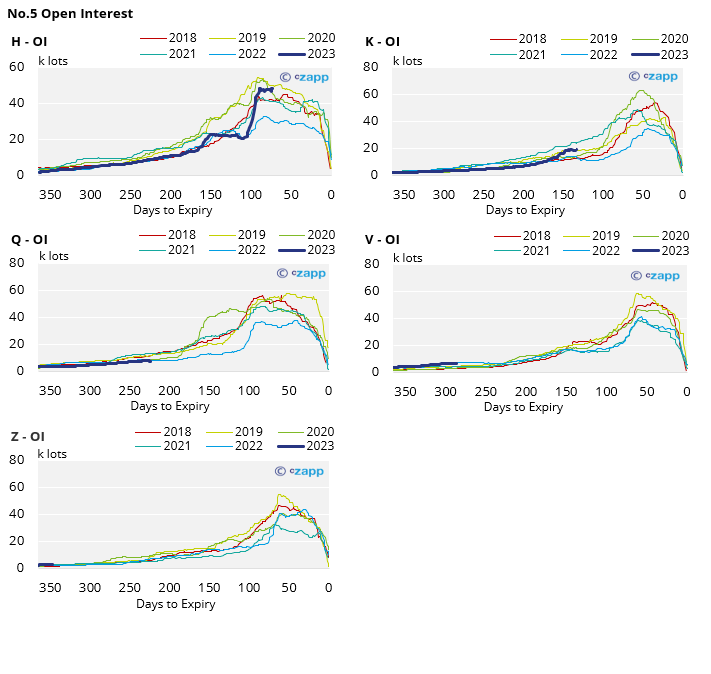

As of the 29th of November, speculators maintained their long position, with the net spec position extending

slightly by 137 lots.

This maintains the No.5 net spec position very close to 2022 highs.

The No.5 forward curve remains strongly backwardated as far ahead as Aug’24, suggesting a slowly easing market

tightness over the next few years.

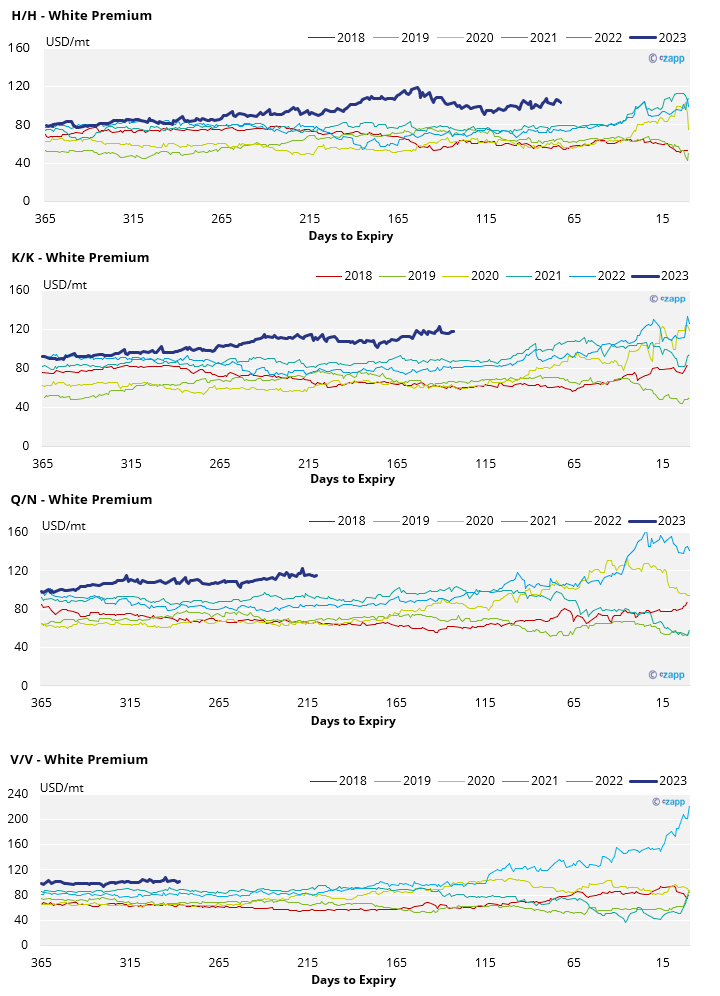

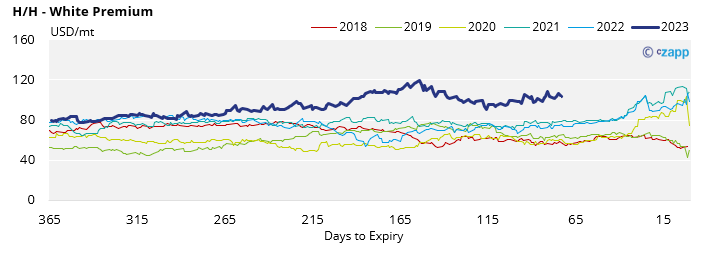

White Premium (Arbitrage)

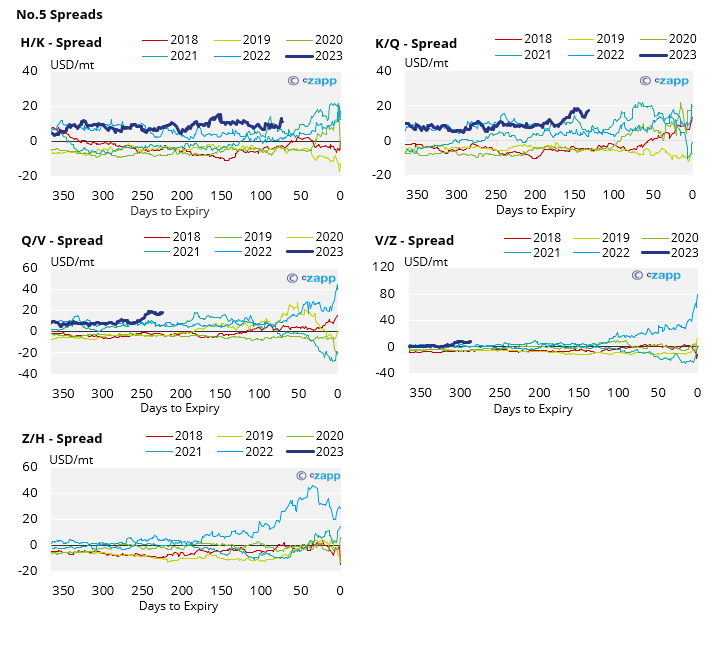

The H/H sugar white premium continues to sit slightly above the symbolic 100USD/mt threshold, growing slightly to 103USD/mt over the last week.

We think re-exports refiners need around 120-130USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

The refined sugar market is likely to be slightly undersupplied for the majority of 2023 and this is reflected in comparatively strong K/K and Q/N white premiums which are both sat above 115USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix